NEWS

Setting Up For A Wild Wednesday

Source: Tenor.com

Today’s action was the inverse of yesterday's, with AI-related stocks in the green and everything else experiencing selling. A Fed cut is not expected tomorrow, but investors will closely analyze the commentary to identify how Powell and the FOMC attempt to handle Trump’s pressures for lower rates. Speaking of commentary, “Mag 7” earnings kick off tomorrow after the bell with Tesla, Meta, and Microsoft, and we’re all anxiously awaiting perspective on the DeepSeek AI development. 👀

Today's issue covers tomorrow’s Fed expectations, what Starbucks shares have brewing, a special “Trends With Friends” episode, and more from the day. 📰

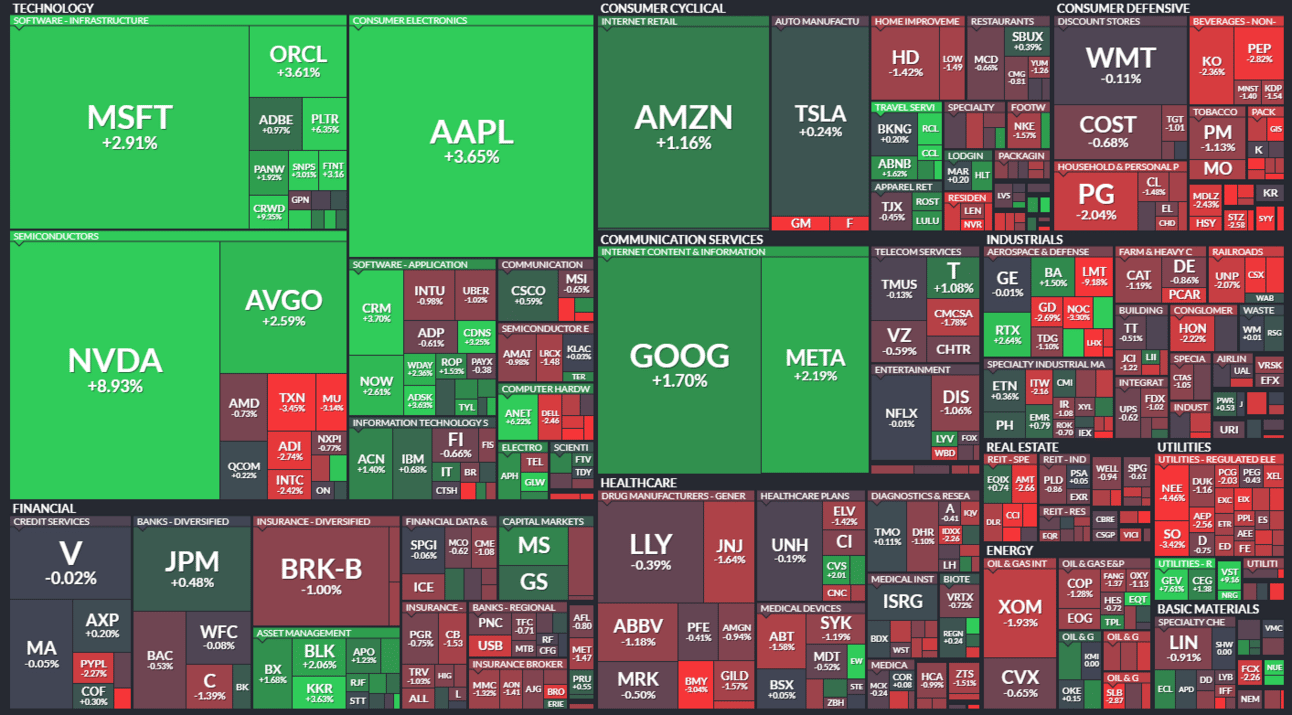

Here’s the S&P 500 heatmap. 3 of 11 sectors closed green, with technology (+2.67%) leading and consumer staples (-1.56%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,068 | +0.92% |

Nasdaq | 19,734 | +2.03% |

Russell 2000 | 2,289 | +0.21% |

Dow Jones | 44,850 | +0.31% |

EARNINGS

Retail’s Fed & Magnificent 7 Expectations 🌡

As noted in the intro, tomorrow is a big day for the markets, so let’s quickly review retail’s expectations for the Fed meeting and Mag 7 earnings. 👇

Starting with the Fed, futures markets indicate a 98% probability of rates staying where they are. And after the last set of economic projections, many aren’t expecting a cut until at least the second quarter.

While the actual rate decision is priced in, Jerome Powell’s commentary is not. Trump recently indicated he wanted interest rates in the U.S. to fall, signaling some potential pressure on the Fed to make a move. However, when Powell was asked about a potential clash with Trump in November, he indicated he would not resign nor bow to any pressures from the President. 😤

With Trump now officially in office, we’ll see if the Fed’s perspective has shifted at all and how they plan to navigate the many fiscal policies that will make managing the economy all that much more difficult.

Moving onto earnings, a Stocktwits poll indicates that more than half the 6,800 active investors who voted believe the “Magnificent Seven” is set to report strong growth and continue its dominance this earnings season. 🤔

With Meta trading near all-time highs and Microsoft and Tesla not far off theirs, expectations are certainly high for these stocks. We’ll have to wait and see if they can deliver the optimistic views Netflix, the banks, and others have. 🤷

Remember to tune into all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! Or, simply add a stock to your watchlist to be notified when the call is live! Either way, we’ll see you there. 👍

SPONSORED

JOIN THE "BEST BROKER FOR OPTIONS TRADING 2025" AS RANKED BY INVESTOPEDIA!

Old trading walks into a bar. New trading raises it.

It's time you got serious at tastytrade.

Tools and tech made for tough markets.

Pricing that fits the way you trade.

Stocks. Options. Futures and more. All in one place.

Up your trading game with order chains, backtesting, visualized analysis, and courses to help you trade smarter.

If you can see opportunity differently, then you can seize it differently.

We’re upgrading options trading. See it in action.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. tastytrade, Inc., and Stocktwits are separate and unaffiliated companies that are not responsible for each other’s services, products, and policies.

EARNINGS

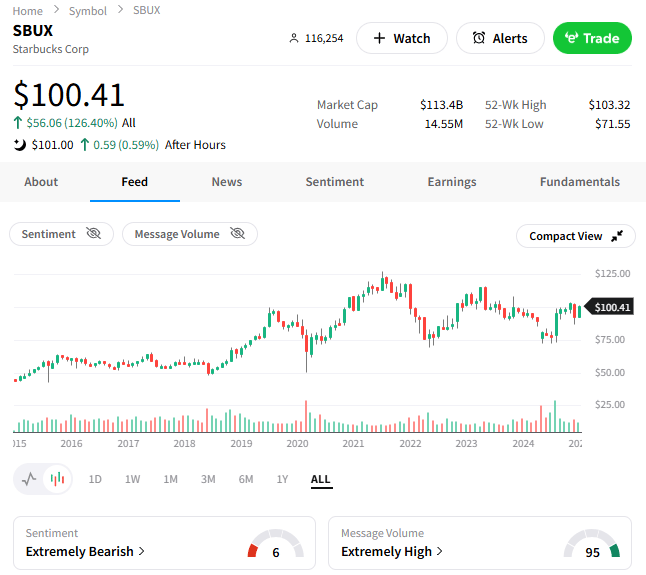

Starbucks Still Has Some Problems 🫠

New CEO Brian Niccol has only been in charge for three months, but after years of underperformance, investors are asking for a quick turnaround.

Earnings per share of $0.69 on revenues of $9.4 billion topped estimates of $0.67 and $9.31 billion. Same-store sales slid for the fourth consecutive quarter, as its turnaround plan remains in its early stages. Still, a decline of 4% was less than the 5.5% Wall Street anticipated, with U.S. and global locations topping estimates. 🔺

Niccol noted that the company has seen a “positive response” to its early steps, which included tweaks such as removing upcharges for nondairy milk options, overhauling its menu, focusing on marketing, and serving customers quickly.

The Chinese market remains a concern. Starbucks relies on discounts to remain competitive with lower-priced chains like Luckin Coffee. Same-store sales in its second-largest market fell 6%, with its average ticket falling by 4%. 🔻

Shares initially popped a few percent after hours but flatlined as investors took time to digest the report and guidance. Stocktwits community sentiment is currently in ‘extremely bearish’ territory as investors impatiently await progress. 😡

STOCKS

Other Noteworthy Pops & Drops 📋

Oracle ($ORCL +4%): Rebounded after Jefferies called Monday’s 14% DeepSeek-driven drop “overdone,” maintaining a ‘Buy’ rating and noting that AI demand remains robust despite potential efficiency gains from the new Chinese AI model.

AMD ($AMD -1%): Hit a 52-week low after Melius Research downgraded the stock on concerns of rising competition in the x86 server and PC chip markets, further weighed down by broader tech sell-off worries linked to Chinese AI startup DeepSeek.

Qorvo ($QRVO -2%): Slipped ahead of its Q3 earnings release amid forecasts of a sharp profit drop, but Piper Sandler’s upgrade and activist investor Starboard Value’s involvement have stoked hopes for operational improvements and potential upside.

Mind Medicine ($MNMD +8%): Evercore initiated coverage with an ‘Outperform’ rating and a $23 price target, citing the potential of its novel LSD formulation (MM120) for anxiety and depression, along with broader market acceptance of psychedelics.

Chevron ($CVX -1%): Chevron, Engine No. 1, and GE Vernova announced plans to develop up to four gigawatts of natural gas-generated power—potentially integrated with carbon capture—to support U.S. data centers, bolstered by favorable energy policies and rising retail optimism.

General Motors ($GM -9%): Posted better-than-expected Q4 results and bullish 2025 guidance, but shares tumbled after CEO Mary Barra warned of a looming 25% tariff under Trump, which could significantly impact GM’s North American supply chain.

BlackSky Technology ($BKSY +7%): Soared after securing a seven-year, $100 million-plus contract for its real-time space-based monitoring services.

Lockheed Martin ($LMT -9%): Issued a weaker-than-expected 2025 earnings forecast and missing Q4 sales estimates due to higher project costs, offsetting as adjusted earnings beat consensus.

Raytheon ($RTX +3%): Hit record highs after beating quarterly profit expectations on strong aerospace and defense demand; though retail sentiment was split amid concerns about Lockheed Martin’s results and near-term sector headwinds.

AT&T ($T +1%): Solid Q4 results and positive 2025 guidance led multiple analysts to raise price targets, citing healthy growth and margin prospects.

JetBlue ($JBLU -26%): Disappointing Q1 revenue and rising fuel cost projections overshadowed better-than-expected Q4 results, but investors remained optimistic.

American Airlines ($AAL -0.29%): Received a price target hike to $30 from TD Cowen based on optimism about corporate traffic recovery, credit card spend momentum, and stable domestic pricing, even as the airline’s Q4 revenue beat estimates but Q1 guidance implied a wider-than-anticipated loss.

PRESENTED BY STOCKTWITS

“Trends With Friends” With TWO Special Guests 🤩

Howard, Phil, and Michael are joined by Danny Frenkel and Alex Dajani of Punchup.live. Today’s discussion ranged a variety of topics, including DeepSeek’s AI innovation and geopolitical challenges, how open-source AI changes the game for startups, reimagining content ownership in a post-social media era, how Punchup is empowering creators in the live entertainment space, and a lot more!

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Retail/Wholesale Inventories (8:30 am ET), Bank of Canada Rate Decision (9:45 am ET), EIA Energy Inventories (10:30 am ET), Fed Interest Rate Decision (2:00 pm ET), and Fed Press Conference (2:30 pm ET). 📊

Pre-Market Earnings: Teva Pharmaceuticals ($TEVA), T-Mobile ($TMUS), ASML Holding ($ASML), Nasdaq ($NDAQ), Scotts Miracle-Gro ($SMG), Whirpool ($WHR). 🛏️

After-Hour Earnings: Tesla ($TSLA), Meta ($META), Microsoft ($MSFT), IBM ($IBM), ServiceNow ($NOW), Lam Research ($LCRX), Western Digital ($WDC), Wolfspeed ($WOLF), Las Vegas Sands ($LVS), Waste Management ($WM). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋