NEWS

Slow Bleed Turns Into A Gusher

Source: Tenor.com

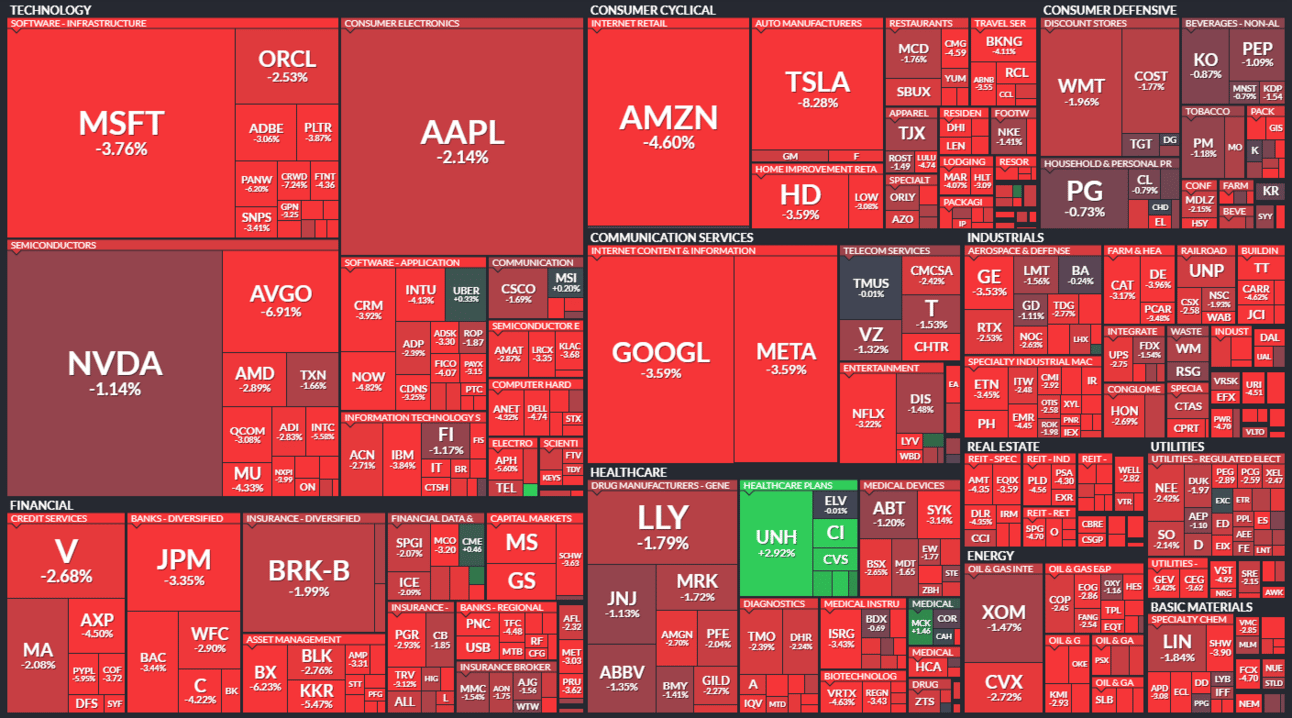

The slow and steady decline most stocks have been experiencing throughout December accelerated into a full-blown selloff after the Fed reduced its rate cut outlook amid rising inflation risks. The S&P 500 had its worst one-day decline since March 2020, as investors fear the Santa Claus rally will fail the bulls for the second year in a row. 👀

Today's issue covers what the Fed just happened, Micron earnings missing the mark, Hindenburg’s latest short target, and more from the day. 📰

Here’s the S&P 500 heatmap. 0 of 11 sectors closed green, with healthcare (-1.36%) leading and consumer discretionary (-4.51%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,872 | -2.95% |

Nasdaq | 19,393 | -3.56% |

Russell 2000 | 2,232 | -4.39% |

Dow Jones | 42,327 | -2.58% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $AEMD, $CURR, $QMCO, $GPCR, $WIMI 📉 $NVNI, $SEZL, $CARA, $VRTX, $XELA*

*If you’re a business and want to access this data via our API, email us.

POLICY

What The Fed Just Happened? 😨

Today’s Fed meeting was expected to be a major catalyst for the market, but investors weren’t sure whether it’d be bullish or bearish. Although the bulls had been in solid control most of the year, this specific event didn’t swing in their favor.

The Federal Reserve cut rates by another 25 basis points, as expected. However, the pre-prepared statement hinted at a slower pace of cuts by adding the phrase “the extent and timing” to modify potential adjustments. And the updated economic outlook is what ultimately sent the market into a tailspin. 📉

In the projections, members raised their inflation and GDP expectations for 2024 and 2025, reflecting resilient economic growth. As a result, their forecast is now for two rate cuts during 2025 (down from four) and another two in 2026. Higher rates are here to stay as long as the economy holds up and inflation remains sticky.

Speaking of sticky inflation, the committee sees more uncertainty about the path of inflation and now sees the risks “weighted to the upside" vs. broadly balanced in September. This is what drove their decision to significantly lower rate cut expectations and ultimately spooked the market. ⚠

Source: Federal Reserve

The market selling off because the economy is stronger than expected is an interesting paradox. But with stocks trading sharply higher this year, part of the thesis for paying higher valuations was that interest rates were set to fall more significantly. 🤔

The fiscal side of government didn’t help things either, with President-elect Donald Trump opposing a bipartisan government funding bill that would have kept the government open until March 14th. A shutdown will occur this Saturday at 12:01 am ET without any action from Congress, and there’s currently no fallback plan.

Between “Fart Coin” approaching a $1 billion value and people taking side bets on just about everything (including Jerome Powell saying “good afternoon” during his press conference. Spoiler alert, he did.), there was clearly a lot of hot air in this market. 🥵

We’ve been talking about it for a while, saying that bears lacked a clear catalyst to take control of the market. And today, Jerome Powell and the Fed delivered it.

With many stocks already down for most of the month, some traders and investors are looking for short-term signs of a “washout” before stepping in to buy the dip. The current poll on Stocktwits suggests the community is split 50/50 on whether there’s still potential for a Santa Rally. Time will tell. 🤷

SPONSORED

$11M Raised — 6 Days Left to Invest in the AI Company Everyone’s Buzzing About.

It’s not just another buzzword-filled startup… Meet Atombeam, the AI-driven disruptor aiming to change how data moves — faster, safer, and smarter. Investors are taking note, with over a $3M waitlist from their last round and $11M+ raised in this round — but the offering is closing soon.

Up to 4X Faster, $2.4M+ Defense Contracts. Atombeam’s patented AI software can send up to 4x more data over existing networks — without expensive hardware upgrades. That’s why names like the U.S. Space Force, U.S. Air Force are already customers. In 2023, Atombeam secured $2.4M in defense contracts.

Building industry relationships within a $200B market… Atombeam’s partnerships span NVIDIA, Intel, Ericsson, and HPE.1 Atombeam has a projected $200B global data center market by 2025. Now, you can invest in Atombeam.

$3M+ waitlist in last round, and only 6 Days to Invest…before Atombeam’s current funding round is closed. Over 7,500 investors have already invested across offerings, and one previous offering sold out. Invest now before the round closes on 12/18.**

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. **This is a paid advertisement for Atombeam’s Regulation A+ Offering. This Reg. A+ offering is made available through StartEngine Primary, LLC, member FINRA/SIPC. Please read the Offering Circular and related risks at Atombeam’s webpage on StartEngine before investing. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

EARNINGS

Micron Earnings Miss The Mark 👎

The chipmaker’s weak second-quarter guidance offset an earnings beat and revenue meeting expectations for the current quarter.

The cautious outlook was driven by weakness in consumer-oriented markets such as PCs, which is offsetting the strength in its data center business, which saw 46% YoY growth. ⚠

The lack of momentum in consumer-oriented segments of the chip market has been a major headwind for companies like Micron, Intel, AMD, and others, whose data center or AI-focused businesses still account for a smaller portion of their overall revenues.

While Micron expects consumer-focused markets to return to growth in the second half of its fiscal year, the market is not so sure. Industry leaders have made similar comments for several quarters, but the momentum has yet to develop. 🤔

Despite a cautious outlook sending prices down 14% after hours, Stocktwits sentiment remains ‘extremely bullish,’ suggesting some are buying the dip. 🐂

COMPANY NEWS

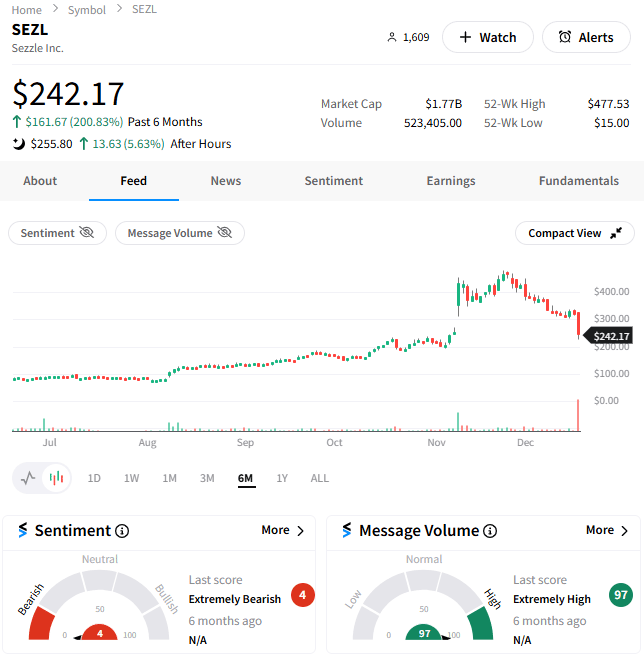

Sezzle Sizzles Out Following Short Report 😬

High-flying fintech firm Sezzle Inc. saw its momentum shattered after Hindenburg Research disclosed a short position. The firm cited risky and lower-quality loans, insider selling of its stock, merchants abandoning the platform, and more.

Fintech firms like this tend to be retail favorites, but sentiment on Stocktwits turned “extremely bearish” following today’s news as the fundamental and technical stories took a turn for the worst. 📉

PRESENTED BY STOCKTWITS

Brian Shannon (@alphatrends) Takes Chart Requests 👀

Pro trader, Stocktwits user, and pioneer of the Anchored Volume Weighted Average Price (AVWAP), Brian Shannon, breaks down the latest market trends and takes chart requests from the Stocktwits community. You don’t want to miss this!

STOCKS

Other Noteworthy Pops & Drops 📋

Advanced Micro Devices (-3%): The chipmaker invested in GPU cloud provider Vultr at a $3.5 billion valuation, helping fund its international expansion.

Polyrizon (+210%): The biotech announced a manufacturing agreement with Eurofins CDMO Amatsiaquitaine, a prominent European Good Manufacturing Practice (GMP) manufacturer.

Heico Corp. (-9%): The aerospace and industrial player’s earnings topped estimates; however, revenues fell slightly short.

Oklo (-3%): The Sam Altman-backed nuclear energy company announced plans to deploy 12 gigawatts of power over the next two decades through a framework agreement with data center operator Switch, lifting retail sentiment.

Viking Therapeutics (-18%): Shares fell on worries of increasing competition. Merck & Co. and China-based Hansoh Pharma announced that they have entered into an exclusive global license agreement for HS-10535, a preclinical oral small-molecule GLP-1 receptor agonist aimed at treating metabolic disorders, including obesity.

Jabil (+7%): The manufacturing services and solutions provider’s earnings beat was fueled by strong demand in its intelligent infrastructure and data center markets, lifting retail sentiment around the stock.

ParaZero Technologies (+39%): The drone safety technology company successfully avoided being delisted from the Nasdaq stock market.

Quantum Computing, Inc. (+45%): The company was awarded a prime contract by the National Aeronautics and Space Administration’s (NASA) Goddard Space Flight Center, sending shares surging.

CommScope Holdings (+9%): The provider of network connectivity solutions entered the refinancing deal with its “first-lien” secured lenders.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: England Interest Rate Decision (7:00 am ET), Q3 GDP Growth Rate Final (8:30 am ET), Initial/Continuing Jobless Claims (8:30 am ET), Philadelphia Fed Manufacturing Index (8:30 am ET), Existing Home Sales (10:00 am ET), Mexico Interest Rate Decision (2:00 pm ET). 📊

Pre-Market Earnings: Fuelcell Energy ($FCEL), Accenture ($ACN), CarMax ($KMX), Darden Restaurants ($DRI), ConAgra Brands ($CAG), Paychex ($PAYX), Cintas ($CTAS), Lamb Weston Holdings ($LW), FactSet Research Systems ($FDS). 🛏️

After-Hour Earnings: BlackBerry ($BB), Nike ($NKE), FedEx ($FDX), Scholastic ($SCHL). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋