NEWS

Small-Caps Are Back On The Menu

Rate-sensitive areas of the market, like utilities, real estate, and small/micro-caps, all rebounded sharply today as bonds caught a bid. With one day of trading left in the quarter, everyone’s rushing to “window dress” their portfolios for their letters to investors. Let’s see what you missed. 👀

Today's issue covers bonds quietly bouncing back, retail’s top picks in the small-cap space, and more from the day. 📰

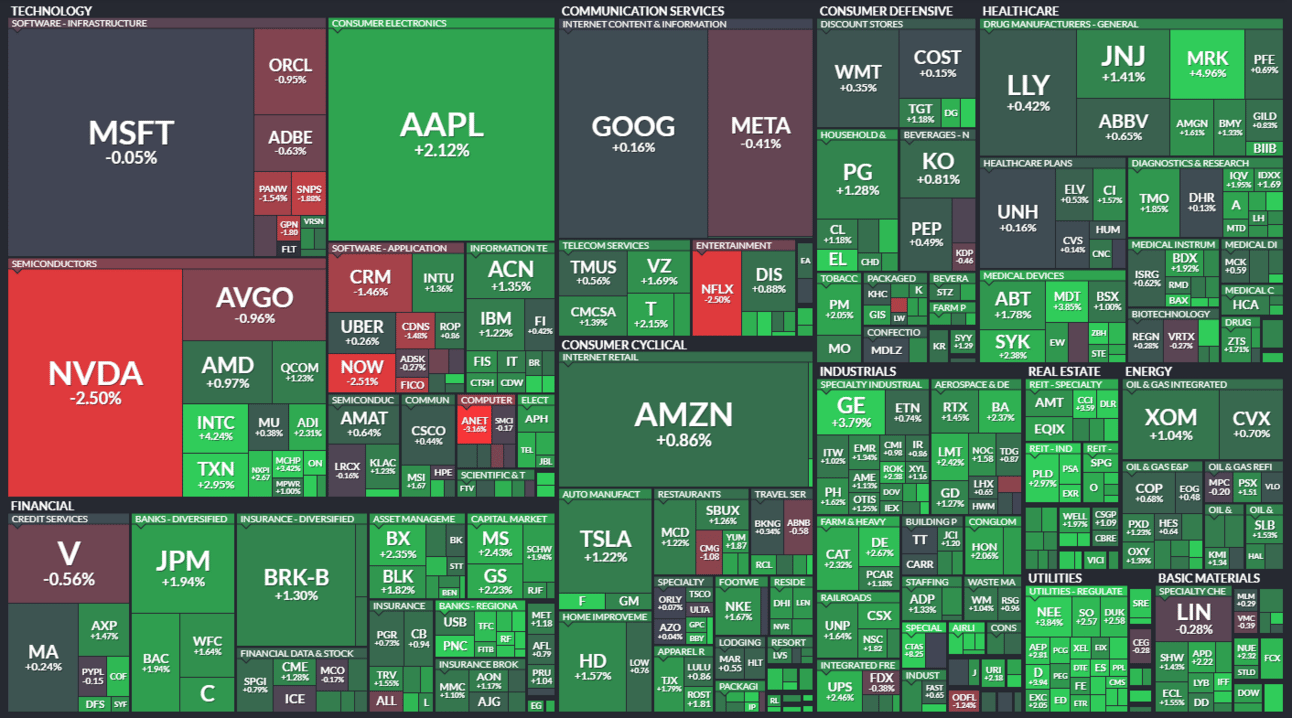

Here's today's heat map:

11 of 11 sectors closed green. Utilities (+2.79%) led, & technology (+0.51%) lagged. 💚

It was a tough day for meme stocks, new and old. GameStop fell 15% after an earnings and revenue loss caused it to cut an unspecified number of roles. Meanwhile, Reddit shares gave back after independent research firm Hedgeye Risk Management published a “short note” implying a 50% downside. 🫨

Carnival Cruise Lines experienced volatility after its first-quarter revenues came in below expectations, and its full-year guidance matched estimates. The company noted that the Baltimore Bridge Collapse would impact its profitability, given one of its ships sails year-round out of the city. ⚠️

Corporate apparel giant Cintas jumped 8% to new all-time highs after beating on earnings and revenues and raising its full-year guidance. 🧹

Cloud banking software company nCino jumped 19% after reporting a 13% YoY rise in revenue and better-than-expected earnings. ⛅

And electric vehicle maker Fisker slashed the sale prices of its remaining inventory in an effort to raise cash and avoid (or delay) bankruptcy. 🪫

Other active symbols: $RH (+11.85%), $CGC (+32.09%), $QS (+8.17%), $DNUT (-11.53%), $DJT (+14.19%), $GCTS (+568.69%), & $APAC (+20.53%). 🔥

Here are the closing prices:

S&P 500 | 5,248 | +0.86% |

Nasdaq | 16,400 | +0.51% |

Russell 2000 | 2,114 | +2.13% |

Dow Jones | 39,760 | +1.22% |

BONDS

Bonds Quietly Bounce Back

Alright, we know leading with a story about bonds is a good way to put everyone to sleep. But stick with us because the payoff is worth it in our second story, which covers how bonds may be driving an opportunity in small-cap stocks. 🙏

As we’ve discussed recently, the uptick in commodity prices and stickiness of core inflation have investors thinking that interest rates will need to stay higher for longer. But not too much longer, as the market (and Federal Reserve) still anticipate three rate cuts before the end of the year.

Despite all that, it’s interesting to note that interest rates have stopped going up and are sitting at the same levels they were about six weeks ago. 🤔

That brings us to the long-term treasury ETF ($TLT) that market participants often use as a trading vehicle to bet on the direction of rates. After all, the longer the duration, the more beta (volatility) these experience.

And right now, it’s interesting to note that the ETF has stabilized at a prior support/resistance level near $92 and is beginning to turn higher. So, despite all the hawkish rhetoric out there, bonds are holding a bid. 💵

The jump in bonds (and fall in rates) today helped boost rate-sensitive sectors, with utilities, real estate, and small-cap stocks all jumping dramatically.

Technical analysts say that as long as this chart remains above $92, then the path of least resistance is to the upside. And a break of that downtrend line near 95-96 would further confirm the shift to an uptrend. 📈

As a result, investors and traders are closely watching the direction of this chart for clues on which areas of the market they should be buying and selling as we head into the second quarter.

Now that you have the proper context let’s dig into the discussion of small-cap stocks as promised. 👇

STOCKS

Retail Gets Bulled Up On Small Stocks

With the big-picture “macro” thesis shifting in favor of small-caps, the excitement about them is beginning to spread in a noticeable way.

$IWM shares closed at roughly 2-year highs today, as Stocktwits community sentiment reached its highest level of the year. Message activity also jumped as traders and investors debated whether the move was the “real deal.” 📈

It’s understandable people are skeptical about this type of move, especially given how badly small-cap stocks have underperformed over the last 18 months. While the mid/large/mega-cap indexes celebrate new all-time highs on a daily basis, the popular Russell 2000 ETF is still 15% off its highs. 🙃

But the case for rotation into this segment of the market seems to have meaningful backing for the first time in a while. And it’s not just retail. Fundstrat’s Tom Lee continues to pound the table on his “50% upside” thesis for this segment of the market. 🤯

But with nearly 2,000 holdings in this index, it can be difficult to know where to start. So, we used our platform data to identify which names retail investors are focusing their attention on now. Let’s dive in. 🕵️

The following Russell 2000 holdings had the largest % increase in message activity on Stocktwits over the last 52 weeks:

1-5 | 6-10 |

|---|---|

The following Russell 2000 holdings had the most message activity yesterday:

1-5 | 6-10 |

|---|---|

The following Russell 2000 holdings had the largest % increase in watchers on Stocktwits over the last 52 weeks:

1-5 | 6-10 |

|---|---|

Hopefully, if you’re interested in exploring the small-cap space, this data can help get the ideas flowing. 💡

Lastly, if you like this type of data and insights, let us know, and we’ll try to incorporate more of it going forward. 👍

STOCKTWITS EDGE

Elevate Your Trading Game 👀

Unleash your trading potential with our new Edge subscription plan—featuring unique social data, an ad-free experience, and more!

Bullets From The Day

☢️ Biden administration to lend $1.5 billion to restart nuclear power plant. The federal government is backing plans to restart a nuclear power plant in southwestern Michigan by late 2025. The 800-megawatt plant’s current owner, Holtec International, will lead the effort toward what would be the first nuclear power plant to be reopened in the U.S. However, despite the funding, it still faces a number of hurdles, including inspections, testing, and the U.S. Nuclear Regulatory Commission’s approval. AP News has more.

💰 Amazon makes its largest venture investment yet. The tech giant has committed another $2.75 billion to back AI startup Anthropic, bringing its total investment to $4 billion. The deal took place at the AI startup’s last valuation ($18.40 billion), with Amazon maintaining a minority stake but not receiving a board seat. Anthropic has closed five different funding deals worth $7.30 billion over the past year as the generative AI race rages on. More from CNBC.

🧑⚖️ Judge rules SEC can sue Coinbase for offering unregistered securities. The question of who gets to regulate crypto has some answers after U.S. District Judge Katherine Polk Failla ruled that under federal securities laws, “The SEC has sufficiently pleaded that Coinbase operates as an exchange, as a broker, and as a clearing agency under the federal securities laws, and through its Staking Program, engages in the unregistered offer and sale of securities.” The judge also dismissed claims that existing laws are inadequate for the current environment and should be adapted. The Verge has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍