NEWS

Small-Caps Finally Make Their Move

Source: Tenor.com

The small-cap Russell 2000 closed at a new year-to-date high as investors and traders continue to bet on further breadth expansion. Earnings and individual company news continue to drive the most significant moves in stocks across sectors, market cap segments, etc. 👀

Today's issue covers United Airlines helping the sector gain altitude, the beauty industry’s latest blemish, big tech’s big beg on nuclear energy, and other noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with utilities (+1.98%) leading and consumer staples (-0.07%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,842 | +0.47% |

Nasdaq | 18,367 | +0.28% |

Russell 2000 | 2,287 | +1.64% |

Dow Jones | 43,078 | +0.79% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $QNRX, $ATNF, $SAIH, $SMR, $KRRO 📉 $JBHT, $ASML, $NVAX, $RENB, $LRN*

*If you’re a business and want to access this data via our API, email us.

STOCKS

Airline Stocks Finally Take Flight ✈️

Record travel numbers have occurred for much of the last two years as people globally turned their discretionary spending away from goods and toward experiences to make up for time lost during the pandemic.

Still…despite record prices and volumes, Airline stocks still traded poorly, with many of them sitting well below pre-pandemic levels. Today, however, United Airlines finally jumped to new heights, showing just how far investors and traders are going to take advantage of the bull market’s “catch-up” plays. 📈

The company led the S&P 500 today with a 13% gain, closing at its highest level since February 2020, just before COVID was declared a pandemic.

Management said domestic unit revenue turned higher during August and September than last year as the industry adjusted to the glut of flights weighing on fares. The airline expanded capacity by 4.1% in the third quarter, with corporate revenue rising 13%, premium revenue rising 5%, and basic economy revenue rising 20%. 💸

Overall, its 2.50% YoY revenue growth topped analyst estimates, even as net income of $965 million was down 15% YoY. It painted an optimistic picture of the future, saying Q1 yield strength will be possible due to significant schedule changes and business model changes implemented by low-margin competitors.

That helped boost its fourth-quarter earnings per share estimate well above the consensus estimate and fuel a strong rally that was further boosted by a $1.5 billion share buyback announcement. 💵

Hotels, cruises, and now airlines are all breaking out as investors and traders bet on the consumer continuing to spend at the strong clip they have been. With other airlines reporting in the coming weeks, we’ll have to wait and see if the sector’s momentum can continue. But for now, bulls are partying on. 🐂

SPONSORED

The AI Disruption Has Begun. Hospitality is Next.

Hospitality is about to change forever thanks to AI, and you can invest!

A $4.1T industry - is what Jurny is about to disrupt with award-winning vertical AI technology. By automating 70% of back-office tasks, Jurny is on track to save the industry billions.

Partnered with Airbnb, Vrbo, Expedia, and many other leaders in the industry, Jurny’s cutting-edge AI is already fully automating operations for thousands of properties worldwide.

In just six months, Jurny has doubled its SaaS revenue and is on pace to triple by year-end.

Recognized for its groundbreaking impact on hospitality, Jurny’s AI platform has been featured by CNBC, Forbes, Bloomberg, Fortune, Skift, and more.

Backed by over $12M in funding from top VCs and 2,000+ investors.

This is a rare chance to invest in a rapidly growing private AI company. Jurny’s round closes on Oct. 24, and is 90% full at this valuation!

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

The Beauty Industry’s Latest Blemish 😐

Yesterday, we highlighted Coty, the owner of several beauty brands, which fell to two-year lows on the back of weaker-than-expected guidance. In sharing its outlook, management cited U.S. mass market retailers taking a more cautious approach to building their inventories…even during the key holiday shopping season.

Today, both Jeffries and Deutsche Bank reduced their price targets on the stock. Still, they maintained a positive outlook, citing cost-cutting measures and the company’s longer-term positioning in the market. ✂️

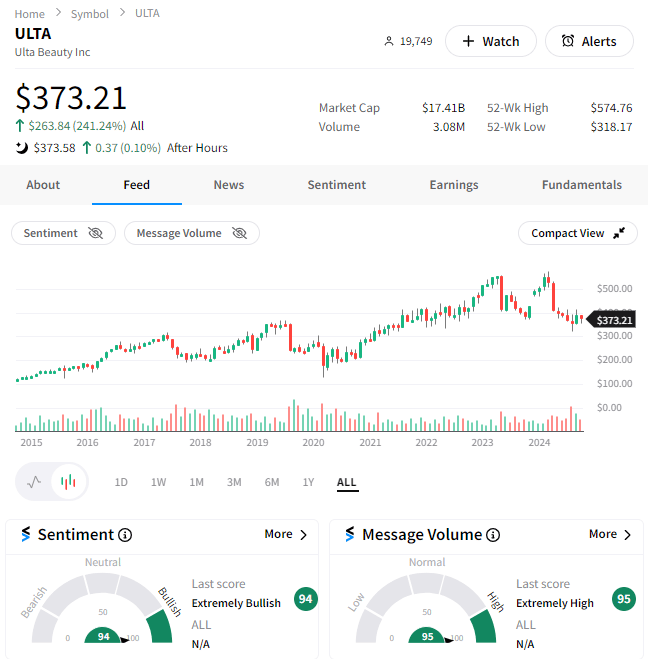

Adding insult to injury, competitor Ulta Beauty shared more cautious longer-term financial targets while sticking by its current-quarter forecast. At its hosted investor day, the specialty retailer cited “headwinds” and tougher competition in the beauty industry, which has normalized to more modest historical growth levels.

Despite the near-term headwinds and consumer uncertainty, management believes that partnerships with new brands, an expanded loyalty program, and personalized promotions will help drive long-term growth. Additionally, demographic trends remain a tailwind, with more men buying beauty products like fragrances and self-care items. 🪞

Essentially both companies are saying that the boom of the last few years is over and that the ‘easy money’ has been made. From here on out, they’ll have to differentiate their products and brands from competitors in order to capture and retain the more discerning U.S. consumer.

Ulta shares initially slumped on the news but battled back during the day to close green, with Stocktwits sentiment flipping into ‘extremely bullish’ territory. Investors seeing prices stabilize near the same levels as the last few years has seemingly empowered them to keep holding despite the near-term uncertainty. 👍

Source: Stocktwits.com

STOCKS

Big Tech’s Latest Big Bet Is Nuclear Energy ☢️

We can all agree that with technology advancing at the pace consensus estimates expect it to; we will need more clean energy to meet the demand…and quickly.

That’s why Microsoft signed a deal with U.S. energy firm Constellation Energy to resurrect a defunct reactor at Pennsylvania’s Three Mile Island. And why Google signed a contract to purchase nuclear energy from multiple small modular reactors that nuclear technology company Kairos Power plans to develop. 📝

Now…Amazon is getting in on the action, investing over $500 million with Virginian utility company Dominion Energy to explore the development of a small modular nuclear reactor near the company’s existing North Anna nuclear power station.

These developments have caused a sharp rebound in uranium-linked stocks like Nano Nuclear Energy, Nuscale Power Corp, and others who develop small modular reactors. 🔥

Additionally, uranium miners like Cameco have soared because more reactors mean more uranium mining is needed to run them. And finally, utility companies like Vistra Energy and Constellation Energy jumped because they’re the infrastructure players to deliver this energy once it’s created.

Popular uranium-focused ETFs like $URA approached their year-to-date highs on the back of investor’s optimism. Stocktwits sentiment is sitting in ‘bullish’ and ‘extremely bullish’ territory for many of these stocks and ETFs as investors bet on the longer-term potential of a nuclear energy revolution. 🐂

Still, bears say some risks are being overlooked…primarily on the regulatory side of things. While governments around the globe have aggressive clean energy plans, the execution risks and political pushback associated with nuclear energy may cause them to move more slowly than these companies and their investors might like.

We all know that sentiment and expectations drive prices in the short term. Hopefully, the underlying fundamentals can catch up quickly so that prices don’t “melt down” and return to lower levels like they have in prior cycles. 🤷

STOCKS

Other Noteworthy Pops & Drops 📋

Novavax shares plummeted 20% after U.S. regulators placed a hold on the company’s experimental vaccines because a study volunteer developed a serious nerve disorder. This applies to its stand-alone influenza shots and the influenza and COVID combination vaccine. While the company doesn’t feel causality has been established, its progress is halted as it (and regulators) investigate further. 💉

Lithium Americas Corp. soared 23% after GM agreed to establish a joint venture with the company, supplying $625 million in cash and credit. The venture will center on developing, constructing, and operating a lithium carbonate mining operation in Humboldt County, Nevada. 🔋

Alcoa shares jumped 10% after the aluminum giant reported better-than-expected third-quarter results, driven by its acquisition of Alumina and QoQ growth in several key financial metrics. Like its peers, it’s still seeing lower production and shipments due to a soft demand picture, but investors feel cost-cutting, and its acquisition has positioned it well going forward. 🏭

Victoria’s Secret & Co. rose 7% the day after bringing its famous “Fashion Show” back to life after six years, with investors cheering the brand's return to its roots in a way that still addresses its critics' concerns. 👙

Lucid Motors slumped another 10% after announcing an offering of 262,446,931 shares of common stock, granting the underwriter (Bank of America Securities) a 30-day option to purchase up to 39,367,040 additional shares. 💸

Additionally, the company’s majority stockholder, Ayar Third Investment Company, has announced its intention to purchase 374,717,927 shares from Lucid through a private placement concurrent with this public offering.

Beyond, Inc. is teaming up with The Container Store Group to help the struggling specialty retailer return to profitable comparable store growth over time by utilizing and benefitting from Beyond’s intellectual property, customer data, a network of brands, and affiliate relationships. 🏬

In other words, two struggling brands are looking to team up to stay relevant. Shares were mixed on the news, showing continued skepticism from retail investors and traders about their ability to pull it off.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Turkey Interest Rate Decision (7:00 am ET), European Central Bank Interest Rate Decision (8:15 am ET), Retail Sales (8:30 am ET), Initial/Continuing Jobless Claims (8:30 am ET), Philadelphia Fed Manufacturing (8:30 am ET), European Central Bank Press Conference (8:45 am ET), Industrial Porduction (9:15 am ET), Business Inventories (10:00 am ET), NAHB Housing Market Index (10:00 am ET), EIA Energy Inventories (11:00 am ET). 📊

Pre-Market Earnings: Taiwan Semiconductor ($TSM), Nokia ($NOK), Blackstone ($BX), KeyCorp ($KEY), Truist Financial (TFC), Travelers Companies ($TRV), Snap-On ($SNA). 🛏️

After-Hour Earnings: Netflix ($NFLX), Intuitive Surgical ($ISRG), Western Alliance ($WAL), WD-40 Co ($WDFC), Crown Holdings ($CCK). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋