NEWS

Smalls Take The Ball From Big Tech

Rotation remains the name of the game as rate-cut hopes push investors and traders into small-caps and other rate-sensitive areas of the market. Large caps were not totally left out, as sectors like financials made new all-time highs as major players reported earnings. Let’s see what else you missed. 👀

Today's issue covers M&A activity from the day, Goldman jumping as financials pump, and Celsius struggling amid demand concerns. 📰

Here's today's heat map:

6 of 11 sectors closed green. Energy (+1.51%) led, & utilities (-2.43%) lagged. 💚

Fed Chairman Jerome Powell indicated that the Fed won’t wait until inflation hits 2% before cutting interest rates, saying that would mean the Fed has “probably waited too long.” He reiterated that he’s looking for “greater confidence” that inflation will return to the 2% level before acting. 🔻

Trump-related stocks like Trump Media & Technology, Phunware, Rumble, and more jumped following this weekend’s failed assassination attempt. Additionally, he officially announced J.D. Vance as his VP running mate. 📈

Cryptocurrencies and their related stocks surged as the market continues to increase its odds of a pro-crypto candidate (Trump) winning the election. Firearm manufacturers like Sturm, Ruger & Company, and Smith & Wesson also rose. ₿

Tesla popped and dropped after CEO Elon Musk signaled that the automaker’s August robotaxi event would need to be delayed, with Bloomberg suggesting October as the next probable date. 🗓️

SolarEdge Technologies fell another 16% after announcing plans to lay off 400 employees amid declining revenues, pulling the sector lower too. 🪫

Apple shares rose again after Loop Capital upgraded the consumer tech giant to a buy rating, citing upcoming and future artificial intelligence integrations. Reports also indicated sales in India grew 33% YoY during the March quarter. 🍏

Other active symbols: $DJT (+31.37%), $PHUN (+0.94%), $GME (+3.65%), $MAXN (-4.42%), $SOFI (+5.17%), and $BTC.X (+5.90%). 🔥

Here are the closing prices:

S&P 500 | 5,631 | +0.28% |

Nasdaq | 18,473 | +0.40% |

Russell 2000 | 2,187 | +1.80% |

Dow Jones | 40,212 | +0.53% |

M&A

Just Another M&A Monday

The deal news of the day starts with a deal that’s NOT happening. 🙃

Struggling retailer Macy’s shares plummeted 12% after ending takeover talks with Arkhouse and Brigade, citing financing concerns and a low valuation.

Management said that the investment firms delivered a “check-in” letter one day after the June 25th deadline to express interest in acquiring the entire company for $24.80 per share in cash. That valuation was within a range the board had previously indicated was “not compelling” and their proposal offered no long-term vision. 👎

Instead, the investment firms are looking to monetize Macy’s real estate assets, leaving its core business in shambles and threatening its ability to survive as a retail operation.

Macy’s has decided instead to focus on its turnaround plan, which includes closing 150 Macy’s stores and upgrading its remaining 350 locations. It’ll pivot to more luxury sales, add more salespeople to stores to help drive demand, and keep costs low by focusing on small-format locations.

Investors remain skeptical about management’s ability to execute this vision, so shares plunged as the “easy money” was removed from the table. 😐

Meanwhile, Alphabet is close to closing its largest startup acquisition ever, $23 billion for cybersecurity firm Wiz. The news comes shortly after reports that it was no longer considering a $25 billion acquisition of marketing software company Hubspot. 🤑

The deal would be double the size of Motorola Mobility's acquisition of $12.50 billion over a decade ago and add to its cybersecurity push just two years after it acquired Mandiant for $5.40 billion. The deal is weeks away from completion, with regulatory scrutiny also anticipated.

Lastly, mining stocks are making moves while the going is good. Cleveland Cliffs is buying Canada’s Stelco for $2.50 billion in cash and stock. The deal will expand Cliffs’ steelmaking footprint and double its exposure to the flat-rolled spot market. ⚒️

SPONSORED

The Dividend Kings | The Best-Of-The-Best Dividend Stocks

Thousands of publicly traded companies have a dividend – that means they pay you just for owning their stock.

However, only some are able to increase their dividend payments year-after-year.

Sure Dividend researches the best dividend growth stocks for investors looking to build rising passive income over time.

And the best-of-the-best are the elite Dividend Kings.

A stock must have 50+ consecutive years of dividend increases to be included on Sure Dividend’s Dividend King list.

Only 53 stocks qualify for the exclusive Dividend Kings list.

These are businesses that have increased their dividend every year since the 1970s, in spite of recessions, wars, pandemics, and changing technology.

Instantly get your free Dividend Kings spreadsheet, along with metrics that matter, by clicking the button below:

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Goldman Jumps As Financials Pump

Goldman Sachs continues to deliver the stacks to its investors, topping second-quarter profit and revenue estimates. 🤑

The bank’s adjusted earnings per share of $8.62 on $12.73 billion in revenues exceeded consensus expectations of $8.34 and $12.46 billion. That’s a 150% YoY profit increase as it shakes off the write-downs tied to commercial real estate and its failed consumer business.

Companywide revenue rose 17% YoY, with fixed income trading of $3.18 billion, beating expectations by $220 million and acting as a major bright spot in the report. Additionally, the firm’s shrinking consumer loan exposure caused its provision for credit losses to fall 54% YoY, coming in at $282 million vs. the $435.40 million expected. 🌞

Asset and wealth management was another bright spot, rising 27% YoY as equity market gains and rising management fees drove results.

Analysts were concerned that its investment banking business was soft compared to its rivals. Investment banking fees rose just 21% YoY, driven by weakness in advisory fees, which came in 10% below expectations. However, CEO David Solomon blamed high comps for the miss and reassured the street that Goldman is still the market leader in this space. 💪

Investors cheered the results, with shares rising another 3% to new all-time highs. Stocktwits sentiment remains in “extremely bullish” territory as money continues to rotate into financial stocks. 💵

STOCKS

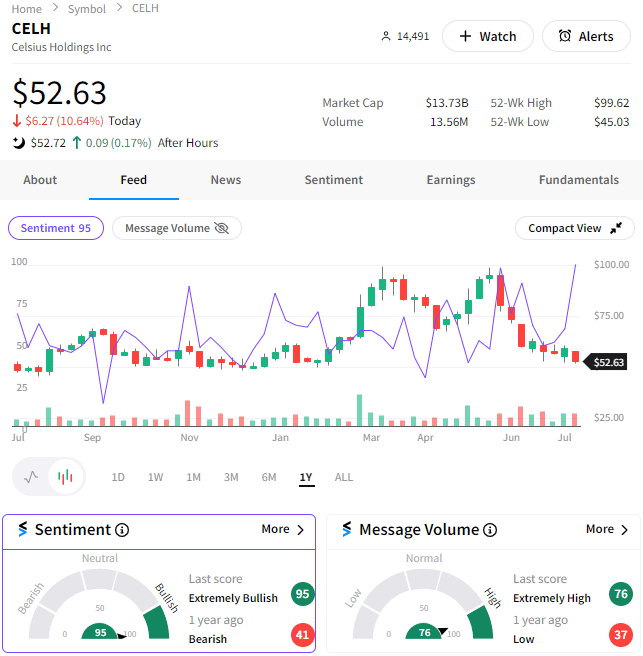

Celsius Struggles Amid Demand Concerns

Energy drink darling Celsius has recently become known as “sell-sius” among traders, as the stock’s struggles continue today. 😢

TD Cowen analyst Robert Moskow warned investors that expectations for the company are far too high, causing high to cut his price target by 20% to $68. Others pointed to a Wall Street Journal article that warned about people with eating disorders consuming energy drinks like Celsius in an unsafe manner.

Several analysts over the last few months have pointed to slowing growth and high expectations in the entire sector. Morgan Stanley analyst Eric Serotta said last week that Celsius’ YoY velocity fell by mid-teens during June. In other words, its products are being sold at a slower rate than before. 🔻

Despite the bearish views on Wall Street, retail investors view this pullback as a buying opportunity. Stocktwits sentiment is at one-year highs in “extremely bullish” territory, even as prices sit near one-year lows. 🐂

We’ll have to wait and see if they’re right. But for now, concerns about an economic and discretionary spending slowdown are hitting stocks like Celsius pretty hard despite the broader market’s continued strength. 😬

Bullets From The Day

🧑⚖️ Appeals court halts return of net neutrality. The Sixth Circuit’s temporary stay comes weeks after the Supreme Court weakened the Federal Communications Commission (FCC) and other federal regulators by overturning the Chevron deference. The delay until August 5th is the latest setback for net neutrality, which is the principle that internet service providers (ISPs) should not be able to block or throttle internet traffic in a discriminatory manner. The Verge has more.

🤑 Major Stripe investor Sequoia gives early investors a payday at a $70 billion valuation. The payments giant has delayed going public for years, causing Sequoia Capital to get creative to return capital to its limited partners. The firm offered LPs in funds raised between 2009 and 2011 to buy up to $861 million in shares at a $70 billion valuation. Last summer, it was valued at $50 billion when it raised $6.50 billion in Series I funding, a major haircut from its pandemic high of $95 billion. More from TechCrunch.

⚠️ Burberry CEO is out after issuing a profit warning. The British luxury brand is replacing its chief executive after another quarter of sales plunging more than 20%. The company is issuing a profit warning amid a global slowdown in spending on luxury goods. Its cost-cutting measures should deliver an earnings improvement in the second half of the year and into 2025, but the broader headwinds remain as the global economy weakens. CNN Business has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍