NEWS

Soft Landing Causes Late-Week Surge

Source: Tenor.com

Better-than-expected employment data fortified the “soft landing” calls and helped the U.S. major indexes recover into slightly positive territory for the week. Below the surface, the speculative activity continues, with companies like AMTD Digital, Phoenix Motor, and others dominating the streams alongside mega-cap tech which marched onwards. 👀

Today's issue covers September’s employment improvements, the surging small-cap building supply stock, and two troubled transport stocks. 📰

Here’s the S&P 500 heatmap. 9 of 11 sectors closed green, with financials (+1.69%) leading and real estate (-0.66%) lagging.

Source; Finviz.com

And here are the closing prices:

S&P 500 | 5,751 | +0.90% |

Nasdaq | 18,138 | +1.22% |

Russell 2000 | 2,213 | +1.50% |

Dow Jones | 42,353 | +0.81% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $KNTK, $ALTM, $APOG, $BQ, $NCNC 📉 $CALM, $RKT, $BLDR, $SAVE, $TRVN*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Today’s Labor Market Realization 💡

U.S. job creation was much better than anticipated during September. It rose 254,000, besting an upwardly revised 159,000 from August and the consensus estimate of 150,000. Unemployment ticked down to 4.10%, quelling fears that it could accelerate quickly after this summer’s uptick. 📊

Average hourly earnings rose 0.4% MoM and 4% YoY, topping estimates, while the average workweek ticked lower by 0.1 hour to 34.2 hours. The tight, but not too tight labor market is keeping wage growth above inflation, but not high enough to send prices into an upward spiral.

Job creation shifted strongly to full-time positions, with the hospitality industry adding 69,000 positions during the month after averaging just 14,000 over the last year. 🍽️

Overall, this week’s mix of employment data showed that companies are not rushing to lay people off or fire them. But they’re also not hiring at breakneck paces like during the pandemic.

As a result, the labor market may be in a “just right” place, allowing the economy to hum along without inflation ticking back up. At least, that’s the hope… 🙏

In today’s Chart Art newsletter, Stocktwits user @chessNwine posed an important question for this environment, so we’ve included an excerpt below. 👇

CHART OF THE DAY

What If Bonds Haven’t Bottomed For The Cycle… 🤔

With today’s nonfarm payrolls report showing a stronger-than-expected labor market in the U.S., some market participants are beginning to wonder whether the risk in bonds remains to the downside. 😬

That’s the question Stocktwits user @chessNwine posed to the community today, showing the 20+ year Treasury ETF $TLT with a potential “bear flag” pattern that may suggest further downside ahead.

With the Fed thinking that inflation has been tamed, continued strength in the economy and an uptick in inflation could cause a rush out of bonds right when everyone seemed to agree that rates were finished rising. Time will tell, but it’s a possibility (or risk) worth keeping an open mind towards. 👀

COMPANY NEWS

A Rough Day For Struggling Transportation Companies 🚗

Rivian shares fell another 3% after the luxury electric vehicle (EV) maker missed its third-quarter delivery expectations and slashed its full-year production forecast. ✂️

It produced 13,157 vehicles during the quarter but delivered just 10,018, potentially suggesting soft consumer demand. Meanwhile, management lowered its production target from 57,000 units to between 47,000 and 49,000, citing a “production disruption.”

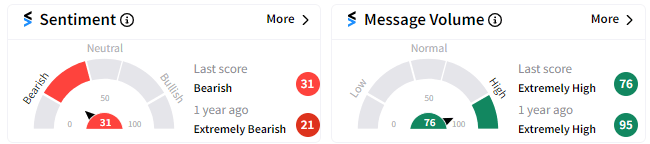

Stocktwits sentiment hit ‘bearish’ territory as prices approached their all-time lows set last year. 🪫

Source; Stocktwits.com

Meanwhile, Spirit Airlines fell 25% to a new all-time low after The WSJ reported the budget airline is considering Chapter 11 bankruptcy.

The company was betting big on JetBlue's acquisition, which was blocked earlier this year over antitrust concerns. Since then, it’s failed to identify a profitable path forward as a solo company, potentially considering restructuring as a last resort. ✈️

Other low-cost carriers like JetBlue and Frontier Group surged on the news as they’ll likely be able to capitalize on this and steal market share from Spirit.

The Stocktwits community is not hopeful about the company’s prospects, with sentiment pushing back into ‘extremely bearish’ territory. ☹️

Source: Stocktwits.com

STOCKTWITS “TRENDS WITH FRIENDS”

Why Investors Can No Longer Ignore Chinese Stocks 🤯

EARNINGS

Architectural Services Stock Soars 🏗️

Small-Cap building supply company Apogee Enterprises soared 20% to new all-time highs after boosting its adjusted earnings outlook and posting stronger-than-anticipated margins.

Improved pricing, a more favorable mix of projects in its architectural services unit, and lower material and insurance-related costs improved margins. 🔺

Sales growth is not something the company will deliver, expecting full-year sales to fall between 4 and 7%, though its ability to generate more earnings with less sales has investors cheering.

Shares made a new all-time high today in their best single-day gain since March 2020, bringing YTD gains to 55%. Still, the Stocktwits community appears to think these gains can “build” further, with sentiment in ‘extremely bullish’ territory. 🐂

Source: Stocktwits.com

COMMUNITY VIBES

One Tweet To Sum Up The Week 🥳

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋