NEWS

Spooky Season Strikes Stocks

Source: Tenor.com

It remains debatable whether Halloween spirits or lackluster earnings are causing the volatility. Regardless, stocks sold off sharply as investors anticipate volatility around tomorrow’s nonfarm payroll data and next week’s election and Fed decision. 👀

Today's issue covers Apple and Amazon’s earnings results, soaring auto insurance stocks, and the biggest earnings pops and drops. 📰

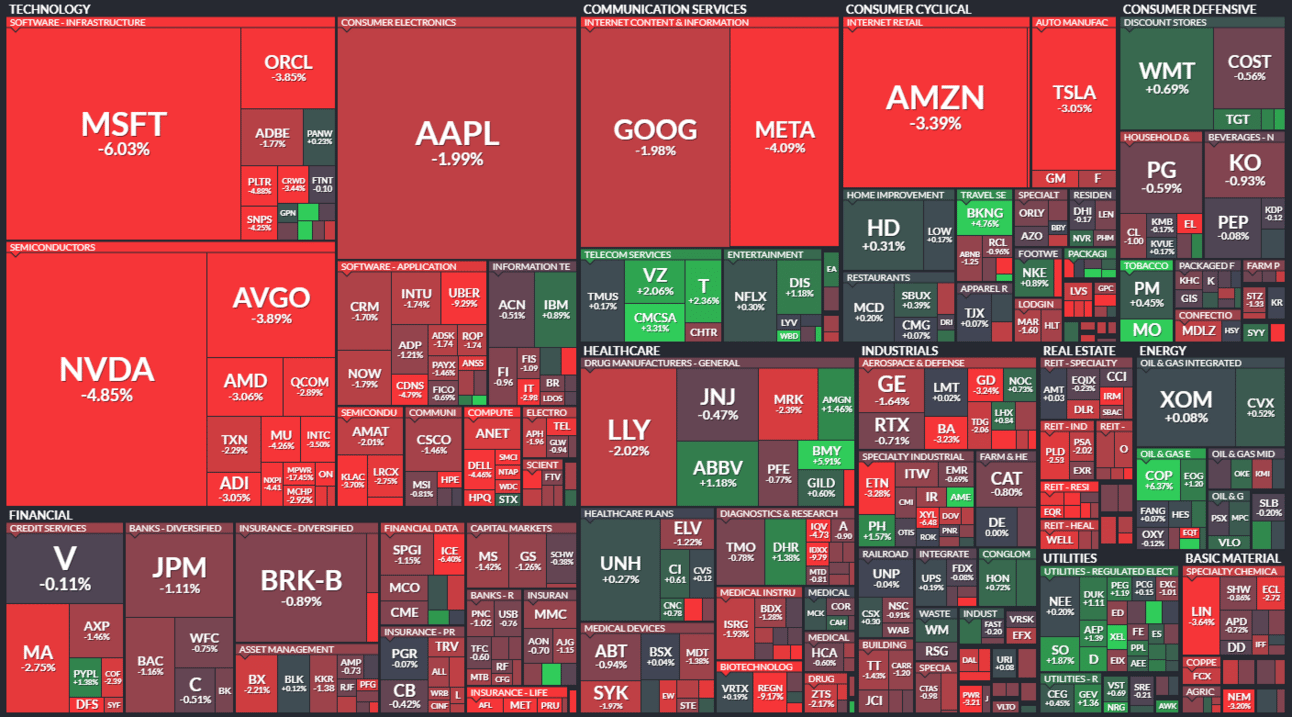

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with utilities (+1.06%) leading and technology (-3.14%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,705 | -1.86% |

Nasdaq | 18,095 | -2.76% |

Russell 2000 | 2,197 | -1.63% |

Dow Jones | 41,763 | -0.90% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $YCBD, $LMND, $APTV, $LICY, $MO 📉 $GPRE, $MPWR, $FND, $CPS, $CFLT*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

Apple & Amazon Add To The Earnings Mix 😵💫

With Microsoft and Meta failing to impress earnings, the next group of mega-cap tech stocks looked to take the baton. Let’s see how they did. 👇

Apple’s fourth-quarter results benefitted from strength in iPhone revenue, as every other category missed analyst estimates. Mac, iPad, other products, and services revenue missed, and gross margins were 0.2% better than anticipated.

This 6% iPhone revenue growth gave analysts the first look at how the iPhone 16 is fairing in the market after its September 20th release. Initial feedback has been positive, but some are unconvinced that the phone went far enough to drive the next major upgrade cycle. 😴

Analysts are still concerned about the company’s traction in China, a major market that has experienced weakness for many companies. That, combined with the mixed revenue numbers, has the stock trading marginally down on the day.

Amazon fared a bit better, with earnings and revenue topping expectations. Amazon Web Services (AWS) revenue of $27.4 billion missed estimates by $0.1 billion, though it’s growing faster than the same period last year (+19% vs. +12%). Still, analysts are concerned that AWS is growing slower than its top challengers like Azure and Google Cloud, whose revenues rose 33% and 35%, respectively. 🔻

Operating income grew 56% YoY as the company’s efficiency focus and cost-cutting helped boost the bottom line. From a technical perspective, traders and investors have been awaiting a catalyst for prices to break firmly above their 2021 highs near 200. Shares are up 5% after the bell, with many hoping this can spark more upside.

Surprisingly, one of the best earnings today came from Intel, which soared 10% after the bell. Revenues declined 6% YoY but still beat analyst expectations by $0.26 billion. Data Center and AI segment revenue stood out, growing 9% YoY, while its PC chip segment saw a 7% decline. 📊

Cost-cutting initiatives and AI division strength helped boost its third-quarter revenue and earnings forecast above expectations. Additionally, the company working with advisors to defend itself against activist investors is making investors more positive. 😅

So far, these results don’t look like they will be enough to reverse the market’s selloff tomorrow. But only time will tell!

SPONSORED

AI's Next Magnificent Seven

The Man Who Called Nvidia at $1.10 Says "AI's Next Magnificent Seven Could Do It Even Faster."

He says $1,000 in these seven stocks could turn into $1 million+ in less than six years.

He breaks down the seven stocks you should own.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Fintech Auto Insurance Stocks Boom 🚘

Carvana and fintech insurance stocks were demolished during late 2021 and 2022, with many writing them off as zeros. Now, they’re back in the limelight for the epic rebound they’ve experienced (and are still experiencing).

Below is a chart of the one-year returns showing Carvana, Root, and Lemonade all soaring triple-digits. But to contextualize these moves, we need the returns since January 2021, which are still deeply in the red (following ~99% drawdowns). 🙃

So, what is the driver of these massive moves? During the pandemic-era drawdown, investors and traders bet heavily against these businesses because rising costs of capital, a tight used car market, and reduced consumer spending on discretionary goods weighed on their actual operations.

And they were right…for a while. 🥳

However, somehow, these businesses survived the tough years long enough to reach the other side of these conditions, and their fundamentals improved. Now, that’s not to say they’re 100% fixed. But they’re far better than expected…so we’ve seen massive short squeezes in these stocks.

And those squeezes continued today, with earnings from all these stocks sending them soaring even further. Carvana raised its 2024 earnings guidance, Root surprised investors with its first profitable quarter, and Lemonade smashed its revenue forecast. 🤩

With price momentum clearly in the bulls’ favor, these stocks will likely remain on traders’ radars for the foreseeable future. But beware, volatility cuts both ways…so invest and speculate responsibly in these “back-from-the-dead” stocks. 🧟

EARNINGS

Today’s Top Earnings Movers 📊

Uber: Shares rode 10% lower after revenue rose 20% YoY and topped expectations alongside earnings. However, slowing bookings growth remains a concern for investors, with mobility gross bookings up 17% YoY and delivery up 16% YoY. 🚘

MGM Resorts: Shares fell 12% after missing third-quarter earnings and revenue expectations. Revenue from its Las Vegas casino operations fell 13% YoY, while winnings from the business’ tables games fell 19% YoY. 🃏

Peloton: Shares soared 26% after raising its full-year profit guidance and tempering expectations for the upcoming holiday quarter. More importantly, it announced Ford subscriptions executive Peter Stern as its new CEO, giving investors hope for a continued turnaround. 🚴

Comcast: Shares jumped 3% on news that it’s exploring the separation of its cable networks business, excluding its broadcast network NBC and streaming platform Peacock. Third-quarter revenue for its media segment rose 37% YoY, including the Olympics, and 5% YoY without it. Overall, the idea of a spinoff is enough to perk investors’ ears up after years of lackluster returns. 🎬

Starbucks: Shares were flat after the CEO promised a return to its core principles, including Sharpie pens, condiment stations, free non-milk options, and more, along with its disappointing fourth-quarter results. ☕

Merck: Shares fell 2% despite strong demand for Keytruda driving a third-quarter revenue and adjusted earnings beat. However, its vaccine that prevents cancer from HPV posted another quarter of lighter-than-expected sales, raising investor concerns about its product pipeline and future growth. 💉

Roku: Shares plummeted 20% as another wider-than-expected loss overshadowed the company’s first quarterly revenue of over $1 billion. Management also raised concerns by saying it would no longer report quarterly updates on streaming households beginning in fiscal Q1 2025. 📺

Roblox: Shares rose 20% after the company’s third-quarter bookings rose 34% YoY and topped analyst expectations. That offset the weakness in overall revenue, which rose 29% YoY and missed estimates by a wide margin. Management touted record daily active users (DAUs) of 88.9 million and record engaged hours of 20.7 billion. 🎮

Estee Lauder: Shares cracked 22% after the cosmetics giant reported another revenue miss and withdrew its fiscal 2025 outlook, citing challenges in China and travel retail. Organic net sales fell 5% YoY, with management noting “incremental uncertainty on the timing of stabilization in Mainland China market and Asia travel retail as well as in the context of leadership changes.” It will now only provide quarterly guidance. 🤡

Norwegian Cruise Lines: Shares moved 7% higher after the company's earnings and revenue both beat expectations. Resilient demand drove pricing and booking strength well into the company’s next fiscal year. 🛳

STOCKTWITS “TRENDS WITH FRIENDS”

Big Tech Earnings & The Future Of Crypto 💡

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Nonfarm Payrolls & Unemployment Rate (8:30 am ET), S&P Global Manufacturing (9:45 am ET), ISM Manufacturing PMI (10:00 am ET). 📊

Pre-Market Earnings: Exxon Mobil ($XOM), Chevron ($CVX), Enbridge ($ENB), Dominion Energy ($D), FuboTV ($FUBO), Charter Communications ($CHTR), Wayfair ($W), CBOE Global Markets ($CBOE). 🛏️

After-Hour Earnings: None — enjoy your weekend. 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋