NEWS

Stock Market Bear Cries Uncle

It was a mixed day in the stock market, with one of Wall Street’s biggest bears finally throwing in the towel. Morgan Stanley’s Mike Wilson raised his 12-month S&P 500 price target from 4,500 to 5,400, dropping his bet against U.S. stocks. Let’s see what you missed. 👀

Today's issue covers Wix shares coming back online, crypto cruising higher on spot Ethereum ETF rumors, and the oil and gas stock setups traders are taking advantage of this week. 📰

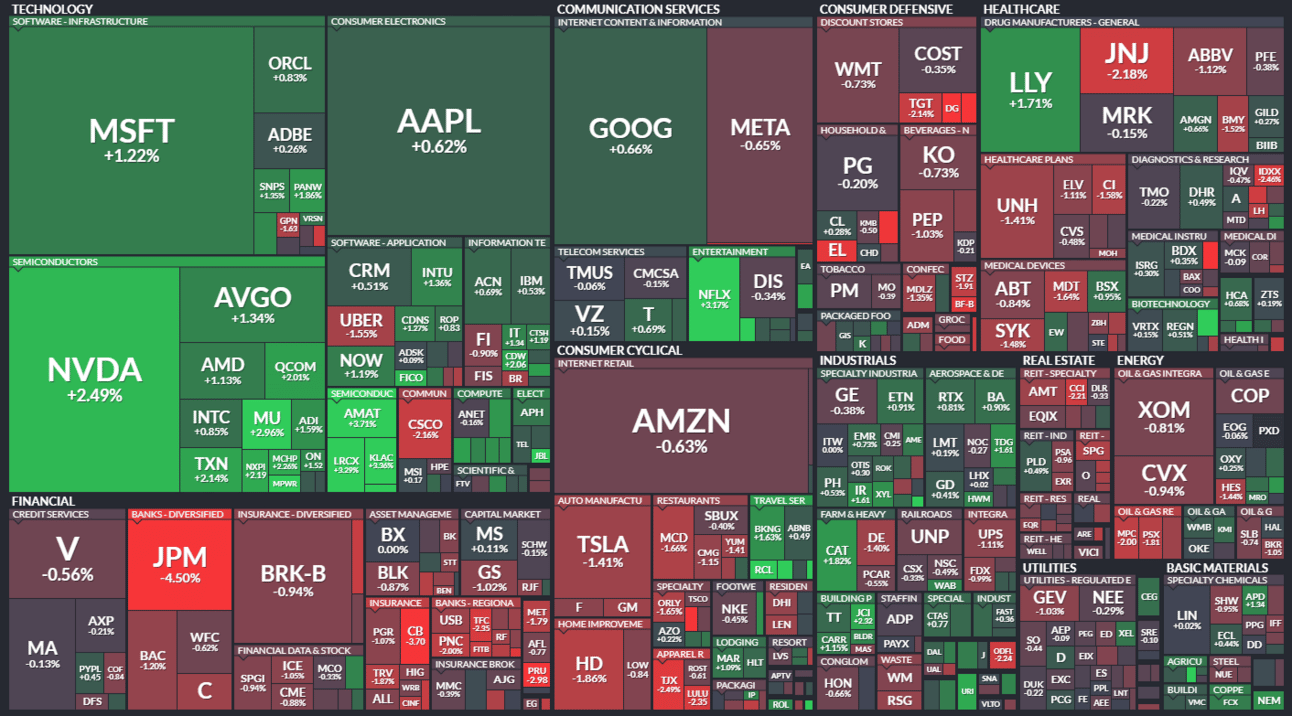

Here's today's heat map:

4 of 11 sectors closed green. Technology (+1.18%) led, & financials (-1.37%) lagged. 💚

JPMorgan Chase shares fell 4.50% from all-time highs after CEO Jamie Dimon signaled that his retirement is closer than ever, saying, “We’re on the way; we’re moving people around.” 👨💼

Budget airline Ryanair fell 2% after reporting record annual profit, with passenger numbers eclipsing pre-pandemic levels. However, executives said that a “recessionary feel” could be weighing on future demand and tried to offset that concern with a 700 million euro share buyback program. ✈️

Chinese electric vehicle maker Li Auto saw profits plunge on higher operating expenses, causing shares to fall 12%. It also issued weaker-than-expected vehicle second-quarter revenue and delivery guidance, citing the industry’s continued demand headwinds. 🪫

Trump Media & Technology Group fell 5% after the Truth Social parent reported a net loss of $327.60 million and total revenue of $770,500 during its fiscal first quarter. Notably, it signed contracts with a data center partner and hardware center to launch its planned TV streaming platform. 📱

Energy stocks remained in focus, with NextDecade popping 15% on news that the UAE’s state-owned oil company secured an 11.70% stake in its LNG export project. Meanwhile, NuScale Power also jumped 15% alongside other uranium stocks after the signing of a bill that bans imports of Russian uranium. ☢️

Hims and Hers Health shares jumped 28% after the company debuted $199 weight-loss shots, which are an 85% discount to competitor Wegovy. 💉

Peloton shares fell after the company announced a $275 million private offering of convertible senior notes as part of a “global refinancing” plan to buy back its debt and extend loan maturities. 💸

Other active symbols: $MTC (-85.02%), $FFIE (+74.76%), $GME (+4.19%), $GWAV (+2.53%), $AMC (+9.77%), & $MMV (+125.12%). 🔥

Here are the closing prices:

S&P 500 | 5,308 | +0.09% |

Nasdaq | 16,785 | +0.65% |

Russell 2000 | 2,103 | +0.32% |

Dow Jones | 39,807 | -0.49% |

POLICY

Crypto Pops On Ethereum ETF Approval Rumors

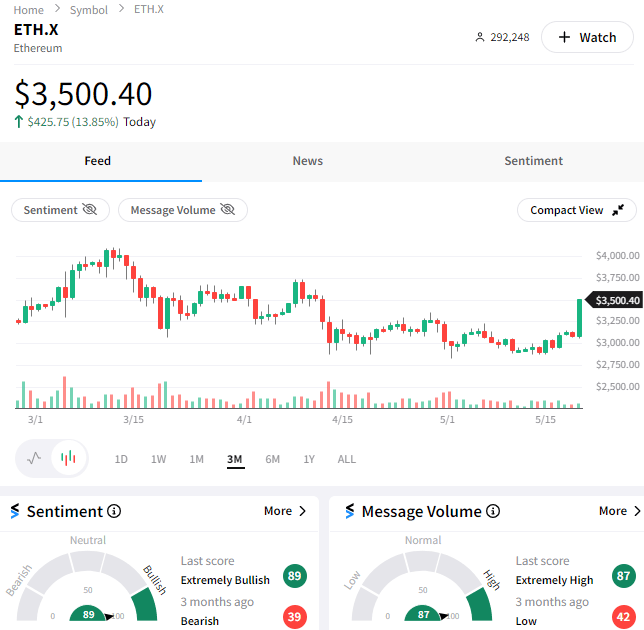

It was a ‘normal’ Monday for crypto until around 3:20 to 3:30 pm EST when the market went haywire due to the following tweet:

When two of Bloomberg’s ETF and crypto experts chime in saying there’s a 75% chance the SEC will approve Ethereum ETFs this week, you can bet your bottom dollar the market listens.

While it’s only a forecast for now, that’s not stopping the Stocktwits community from pushing sentiment into “extremely bullish” territory as prices soared to their highest level since early April. 👀

Time will tell if the approval actually comes, but for now, crypto-related stocks are back on the menu with the momentum crowd. 📈

EARNINGS

Is Wix Coming Back Online?

Website builder Wix is back on investors’ radars after reporting better-than-expected results. 💪

The company earned 41 cents per share, up from last year’s 18-cent loss. Its adjusted earnings of $1.29 were higher than the $1.03 expected by analysts.

Revenue rose 12% YoY to $419.80 million, narrowly beating estimates, with the company raising its second-half bookings forecast from 15% to 16%. 🔺

Executives pointed to the company’s artificial intelligence product suite as a potential growth driver and improving momentum among self-creators and commercial partners.

Wix shares rose 24% on the day, with Stocktwits sentiment surging into “extremely bullish” territory as shares hit 2-year highs. 🐂

STOCKTWITS “CHART ART”

Offshore Drilling Stock Set Up For Imminent Breakout 🛢️

Last week, it was metals and mining stocks popping off, and this week it’s energy catching traders’ attention. Below is one of the energy sector’s several trade setups highlighted by the Stocktwits community in today’s “Chart Art” newsletter.

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Bullets From The Day

✂️ Target is cutting prices of 5,000 items to lure back shoppers. The big box retailer made the announcement ahead of Wednesday’s pre-market earnings report. The price cuts will mostly impact grocery and household staples, where it’s made a larger push to private label products and cater to inflation-pinched shoppers across income segments. NBC News has more.

🤖 CyberArk acquires Venafi to ramp up its machine-to-machine security. Consolidation in the cybersecurity space continues, with bigger players picking up startups that have struggled to scale independently. CyberArk is paying $1 billion in cash and approximately $540 million in shares for Venafi, a specialist in machine identity. More from TechCrunch.

🛬 Saudi Arabia’s biggest-ever plane order goes to Boeing's rival Airbus. The country’s national airline has ordered 105 more Airbus airplanes, the first of which will be delivered in the first quarter of 2026. While its current fleet comprises 93 Airbus and 51 Boeing aircraft, the latest deal adds to the group’s existing backlog of Airbus orders of 39 aircraft. It’s yet another major setback for Boeing. CNN Business has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍