NEWS

The Stock Market Boom Goes Global

Source: Tenor.com

It was a turnaround Tuesday for Chinese equities after the country unveiled stimulus measures to help it keep pace with the rest of the world’s growth. In the U.S., several big tech stocks buoyed the major indexes to new record highs after an early-day selloff. 👀

Today's issue covers China unveiling a major stimulus package, Visa becoming the DOJ’s next victim, and StitchFix still needing fixing. 📰

Here’s the S&P 500 heatmap. 6 of 11 sectors closed green, with materials (+1.37%) leading and financials (-0.84%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,733 | +0.25% |

Nasdaq | 18,075 | +0.56% |

Russell 2000 | 2,224 | +0.17% |

Dow Jones | 42,208 | +0.20% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $VBFC, $XHG, $PRGS, $LNW, $WVE 📉 $SFIX, $THO, $PTN, $HRTX, $AMGN*

*If you’re a business and want to access this data via our API, email us.

STOCKS

China Says It Won’t Be Left Behind 😠

The world’s second-largest economy and its stock market have failed to keep pace with the rest of the world since the pandemic ended, with its government finally deciding “enough is enough.”

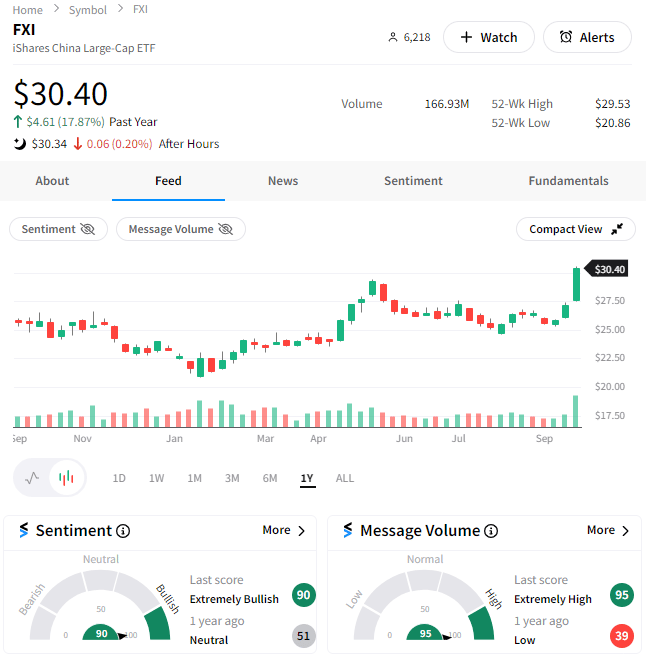

China’s central bank unveiled its largest stimulus plan since the pandemic to renew growth and avoid a deflationary spiral. The package offers more funding via interest rate cuts, lower capital requirements for banks, and special funds to buy stocks and facilitate stock buybacks. And officials signaled more could be coming if the economy doesn’t respond. 💰

Chinese stocks, which the Stocktwits community has been quietly bullish on, caught a major bid on today’s news. Individual stocks like Alibaba jumped, while broad-based China ETFs like $FXI soared to more than one-year highs as sentiment pushed into ‘extremely bullish’ territory. 😮

Source: Stocktwits.com

Despite the strong initial reaction, some analysts cautioned investors to temper their expectations. They warned that monetary stimulus cannot fix the economy’s issues on its own, suggesting that fiscal support will also be needed to reverse weak credit demand from businesses and consumers.

Time will tell if these measures can reinvigorate the economy. But in the short term, the stimulus is viewed as a major positive for stocks and is likely to remain on traders’ radars in the days and weeks ahead. 👀

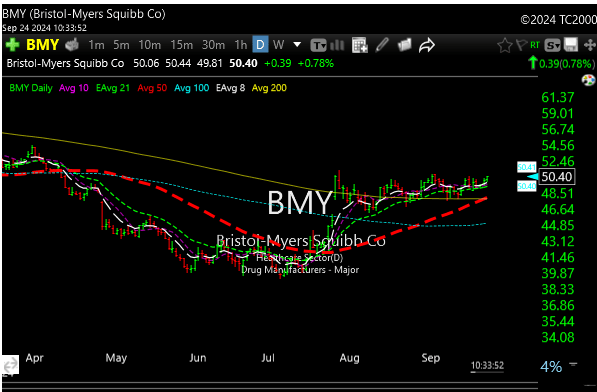

STOCKTWITS “CHART ART”

Bristol Myers Gets A Boost Amid Turnaround Story 💉

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

COMPANY NEWS

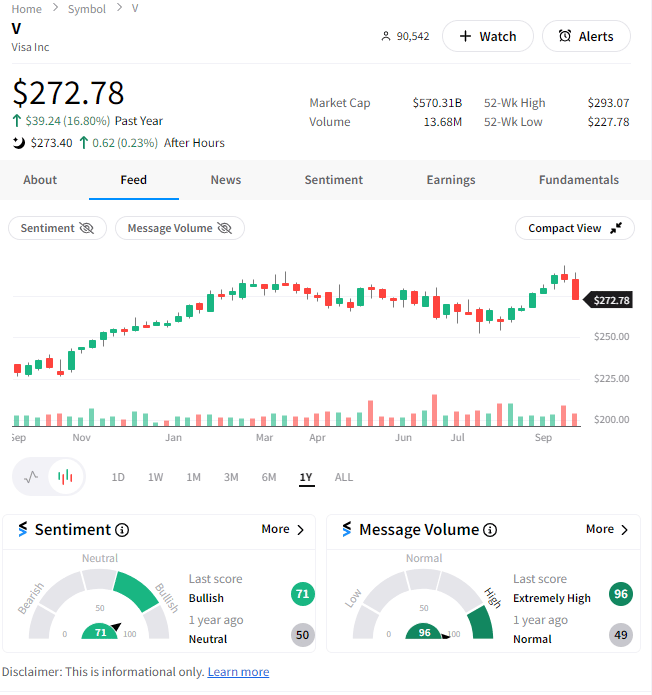

Visa Is The DOJ’s Latest Victim 💳

U.S. antitrust regulators have found their next target, with the Justice Department (DOJ) accusing Visa of a debit network monopoly that affects the price of ‘nearly everything.’ 🔺

The accusation's core assertion is that the world’s biggest payments network propped up an illegal monopoly over debit payments through its ‘exclusionary’ agreements on partners, which smothered upstart firms. The result? The DOJ says these moves have caused American consumers and merchants to pay billions of dollars in additional fees.

Visa’s general counsel fired back, essentially saying that there’s an ever-expanding universe of companies offering new payment options and that competition in the debit space is growing, too. 📊

Still, with more than 60% of debit transactions in the U.S. running over Visa’s rails and generating over $7 billion in processing fees, the company will face an uphill battle. Visa lost its last major case against the DOJ in 2020 when it was blocked from acquiring fintech company Plaid for $5.30 billion.

The stock fell about 5.50% today on the news, pulling back from all-time highs as investors digested it. Stocktwits community sentiment is still in ‘bullish’ territory, suggesting many see this as a near-term risk that won’t impact the company’s long-term profitability and position in the space. 🐂

Source; Stocktwits.com

EARNINGS

StitchFix Still Needs A Lot Of Fixing 🧵

Online personal styling services company StitchFix is falling again after posting disappointing earnings results. Let’s take a look. 👇

The company’s fourth-quarter revenues of $319.60 million were at the upper end of its guidance and just above analyst estimates. However, its forecast for first-quarter and full-year revenues were well below analysts’ forecasts.

Additionaly, investors focused on the company’s eroding active client base. It now sits at 2.50 million active clients, down 4.70% QoQ and 20% YoY. 😬

Still, management believes it’s on the right path to return to revenue growth by the end of its next fiscal year, focusing on improving the product offering and keeping costs low.

The Stocktwits community is not feeling that same optimism, with sentiment sitting at ‘extremely bearish’ levels as the stock falls 23% after hours. 🐻

Source: Stocktwits.com

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: New Home Sales (10:00 am ET) and EIA Energy Inventories (10:30 am ET). 📊

Pre-Market Earnings: Cintas ($CTAS) and Huize Holding ($HUIZ). 🛏️

After-Hour Earnings: Micron Technology ($MU), Jeffries Financial ($JEF), Worthington Steel ($WS), Inventiva ($IVA), and Concentrix ($CNXC). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋