NEWS

Stock Market Exuberance Goes International

While the U.S. stock and crypto market rally gets all the media attention, it was reported that nearly 80% of the world’s stock options volume was traded in India last year. Speculation knows no bounds as everyone fights to grab their piece of the action before the music stops. Let’s see what you missed. 👀

Today's issue covers Boeing breaking down, Indian stocks coming back on investors’ radars, and the communication sector’s next move. 📰

P.S. We’ve officially completed our newsletter platform transition to Beehiiv. To help ensure you receive our emails and receive the best content, please follow the steps in the first section below!

Here's today's heat map:

7 of 11 sectors closed green. Technology (+2.05%) led, & utilities (-0.97%) lagged. 💚

February’s consumer price index (CPI) data came in slightly hotter than anticipated, but the initial selloff was quickly bought up by bulls who pushed the market to fresh all-time highs. 🎉

Driving the uptick was a more than 20% surge in frozen noncarbonated juices and drinks (+27.20%) and motor vehicle insurance (+20.60%), with many categories rising in the mid-to-high single digits. 🔺

ON Holding shares dipped 9% after the shoemaker posted disappointing revenue and earnings results. Asana shares also fell 13% after the work management platform issued weak full-year revenue guidance. 📉

Acadia Pharmaceuticals plummeted 17% after the company said it was halting trials of its antipsychotic drug due to its failure to improve schizophrenia symptoms. Meanwhile, Ventyx Biosciences jumped 5% after Wall Street analysts upgraded the stock due to its latest clinical update. 💊

And YouTube's rival platform, Rumble, launched “Rumble Cloud,” a new infrastructure-as-a-service offering that champions the free and open internet. How much this will actually impact the business’ fundamentals remains to be seen, but the Stocktwits community isn’t waiting around to find out. Message activity and sentiment surged alongside prices, which jumped 18%. 📈

Other symbols active on the streams: $FSR (-8.92%), $SIGA (+125.75%), $SNCR (+10.41%), $CLRO (-5.25%), $MINM (+18.79%), $PACK (+51.72%), $ICU (+11.00%), $CRBU (-30.47%), and $RGLS (-12.10%). 🔥

Here are the closing prices:

S&P 500 | 5,175 | +1.12% |

Nasdaq | 16,266 | +1.54% |

Russell 2000 | 2,065 | -0.02% |

Dow Jones | 39,005 | +0.61% |

HELP US HELP YOU

Help Us Deliver Great Content 🙏

Please follow the steps below to ensure you receive all our emails. This will let your email provider know that our messages are welcome in your inbox.

Your inbox settings: 📬

Gmail users: Move us to your primary inbox.

On your phone? Hit the 3 dots at the top right corner, click “Move to” then “Primary”

On desktop? Back out of this email, then drag and drop this email into the “Primary” tab near the top left of your screen

Apple mail users: Tap on our email address at the top of this email (next to “From:” on mobile) and click “Add to VIPs.”

For everyone else: Follow these instructions.

Tell us about yourself: 🙋

The more we know about you, the better, more tailored content experience we can deliver. Please complete this brief survey to help us deliver you the best content possible.

Testimonials: 💌

Do you love these emails? We’d love to hear from you. Simply reply to this email with why you love our newsletter. (P.S. It also lets your inbox know to keep us front and center)

COMPANY NEWS

Boeing Breaks Down

If you haven’t been following the Boeing story closely, you may have missed a shocking update that has almost ever Boeing stakeholder and onlooker scratching their heads. 📰

First off, the aerospace and defense manufacturer failed 33 out of 89 product tests performed by the Federal Aviation Administration (FAA) on its MAX airplanes. The New York Times reported on that six-week audit, placing additional scrutiny on Boeing and its key supplier, Spirit AeroSystems, as their airplanes continue to run into issues almost daily. 🕵️

And if that wasn’t enough, the situation has turned into a conspiracy theory you’d expect to see in the movies but not in real life.

Today, it emerged that the former Boeing quality inspector who filed a whistleblower complaint over alleged plane safety flaws was "found dead” in an apparent suicide. John Barnett had spent more than three decades at the aircraft manufacturing giant and sounded the alarm in 2017 and was set to give deposition testimony in his federal legal action against Boeing this week.

The timing and circumstances around his death rightfully have his attorneys and those who knew him calling on law enforcement to do a full-scale investigation into what happened.

The news threw investors and traders for a major loop, adding another very hairy detail to an already tricky situation.

Message volume on Stocktwits surged as investors and traders discussed the stock’s future. The overall community is leaning bearish as Boeing shares fell to nearly six-month lows. 📉

Meanwhile, airlines remain an absolute mess of an asset to own, with Southwest Airlines dropping 15% after saying that Boeing delivery delays are causing it to “reevaluate all prior full year 2024 guidance, including the expectation for capital spending.” United Airlines also told Boeing to stop making its long-delayed Max 10s as concerns over quality escalated further. ❌

One would think that airlines would be a key beneficiary of a booming global travel industry. But unfortunately there are a lot of moving parts when it comes to these businesses, and they’ve yet to all align in one direction. 👎

STOCKTWITS AD-FREE

Enjoy An Ad-Free Stocktwits Experience 👀

Stay focused on your trading with Stocktwits Ad-Free. The streamlined experience fully immerses you in real-time discussions, breaking news, and expert insights.

EARNINGS

India Back On Map For Several Reasons…

We’ve spoken about India extensively over the last year, specifically as geopolitical tensions between the West and China escalate and companies look to diversify their operations away from the country. There’s no doubt the largest beneficiary of the deglobalization trend has been India, but it’s now on people’s radars because of its stock market’s ragingly bullish behavior. 🐂

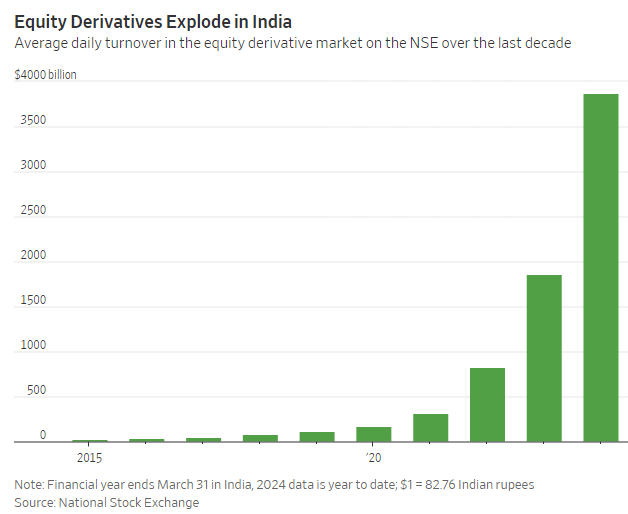

The Wall Street Journal shared a wild stat today showing that eighty percent of the world’s stock options were traded in India during 2023. The number of stock index options traded in the country rose 153% YoY to 84.30 billion, with nearly $4 trillion in notional value trading daily so far in 2024. 🤯

As far as emerging market equities go, China has been investors’ favorite place to invest for much of the last few decades. But with its economy experiencing issues and demographics not as strong as they used to be, some investors have begun to rethink how they allocate funds to each country. And that thinking has really accelerated in the post-pandemic world. 🤔

The sharp divergence in the countries’ performance can be shown by two popular U.S.-based ETFs that track large-cap stocks in each country. As the chart below shows, the two typically traded in tandem but separated in 2021, with China wiping out its gains and India adding to them.

Clearly, India is on fire, and global businesses and investors are betting big on that trend continuing well into the future. Whether or not it can live up to the short-term hype remains to be seen. But for now, many who live in India see the current stock market cycle as their opportunity to advance up the socioeconomic ladder, even if it means risking what they currently have. 💰

As for China, sentiment around the country’s economy and stock market remains very bearish. With that said, we’ve discussed for several weeks that signs of a short-term bottom have been growing, and that continues today.

Stocktwits user AnchorsAweigh shared a chart of the popular China ETF $KWEB trying to break out as investors look to beaten-down areas of the market to play catch up. 📈

As always, we’ll have to see how this all plays out in the coming months and quarters. But for now, stock market exuberance has gone international, and countries like India and Japan are some of the biggest beneficiaries. 💸

STOCKTWITS CONTENT

Follow Us On YouTube! 👀

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and chart wizard Ivanhoff every week on our flagship show "Momentum Monday."

Watch the latest episode now and subscribe to catch new episodes every Sunday!

Stocktwits Spotlight

With the market continuing its press to new all-time highs, traders and investors are looking for the next hunting ground for big winners. 🕵️

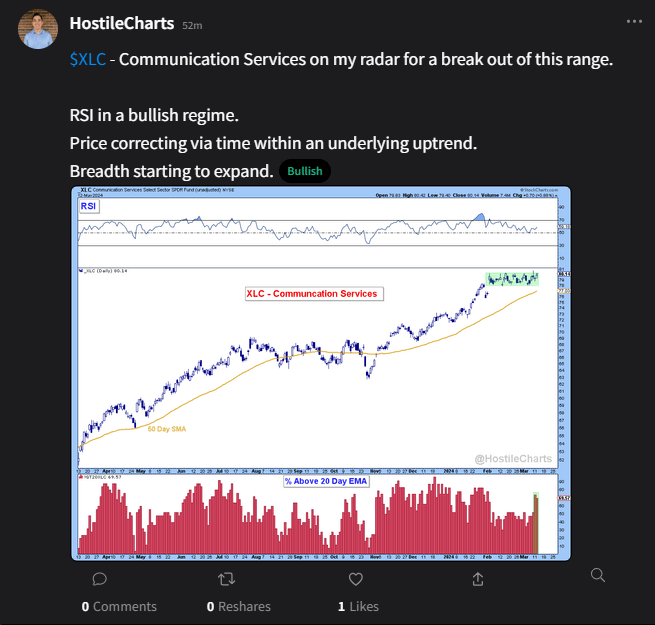

Stocktwits user Larry Thompson shared a chart today that suggests the communication services sector could be that place. 📍

His chart outlined above shows prices of the communication services ETF ($XLC) consolidating tightly for the last six weeks or so as its 50-day moving average plays catch up. He also pointed out that momentum (as measured by the relative strength index “RSI”) is in a bullish range and that more stocks in the sector are beginning to pick up steam.

It’s important to note that Meta and Alphabet make up 50% of this index’s weighting, so you’re betting big on them working. But, even if you’re not looking to buy the ETF, this chart shows the sector’s component list might be a good place to look for long opportunities in the days and weeks ahead. 🧺

Lastly, while the rest of the tech sector has already hit new highs, this ETF is still about 10% below its 2021 peak. So, those looking for “catch-up” type plays as the market rallies will certainly be watching this setup.

If you want to see how this chart develops and more analysis like this, follow HostileCharts on Stocktwits! 👀

Bullets From The Day

🏬Kohl’s is partnering with other retailers to lure shoppers in because nobody wants its merchandise. The company said during its latest earnings release that it’s struck a deal with brand management firm WHP Global to bring Babies R Us shops to roughly 200 of its stores across the country. The struggling retailer is trying to add more merchandise to its stores that will drive foot traffic and attract younger shoppers. CNBC has more.

🏦 New York Community Bancorp closes financing deal and prepares for reverse split. The troubled regional bank received the $1 billion capital infusion deal it agreed to with an investor group last week, and it plans to submit a one-for-three reverse stock split to help boost its share price. While getting the stock price back above $5 will help to broaden the company’s investor base, critics fear that it could be a sign the bank will issue more equity capital at some point in the future. More from Reuters.

💾 Roku is the latest company to deal with a data breach. Access to roughly 15,400 streaming user accounts was obtained by “unauthorized individuals,” though the group responsible has not been identified. Perpetrators of the data theft were allegedly seeking to sell the stolen account credentials “for as little as $0.50 per account, allowing purchasers to use stored credit cards to make illegal purchases.” Variety has more.

Links That Don’t Suck

Get In Touch

Have feedback on The Daily Rip? Shoot me (Tom Bruni) an email at [email protected]; I’d love to hear from you.

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here.