NEWS

Stock Market Snaps 356-Day Streak

The S&P 500’s 356-day streak of avoiding a 2% decline has officially ended, with big tech earnings and Bill Dudley’s rate cut comments emboldening sellers to cause the markets’s worst day since Q4 2022. Let’s see what you missed. 👀

Today's issue covers where the pain could end, why burritos are in while potatoes are out, and CrowdStrike’s guide on how not to apologize. 📰

Here's today's heat map:

3 of 11 sectors closed green. Utilities (+1.12%) led, & technology (-4.14%) lagged. 💚

U.S. new home sales slid to a seven-month low, with new-home inventory hitting its highest since 2008. The median sales price of a new home was flat YoY at $417,300, but record prices and rates remain demand headwinds. 🏘️

KKR-backed financial software company OneStream popped another 34% in a $490 million IPO, even after pricing above $1 above its initial $17-$19 range. 🤑

Kering SA plummeted 9% after warning that its recurring operating income could fall by about 30% YoY as luxury demand cools and turnaround efforts at Gucci, which accounts for two-thirds of its profits, remain challenging. ⚠️

AMC Entertainment slumped another 8% after announcing preliminary results that missed expectations, with revenue down 23% YoY and a net loss instead of an expected net profit. In its usual fashion, it blamed external factors like last year’s actors and writers strike, which delayed theatrical releases. 🥱

IT infrastructure company Vertiv Holdings fell 13% despite an earnings beat and in-line revenues. Meanwhile, computer hardware company Seagate Technology rose 4% on speculation that the artificial intelligence (AI) boom will drive demand for its storage products. 🤖

Despite lackluster earnings and revenue results, Telecom giant AT&T rose 5%, with investors cheering its 419,000 new monthly wireless subscribers. 📱

Pfizer was a rare bright spot in today’s trading, rising 2% after its gene therapy for a rare genetic bleeding disorder succeeded in its late-stage trial. Viking Therapeutics also rose 19% after advancing its experimental obesity treatment to a phase 3 trial. 💉

Align Technology fell sharply after its revenues came in below expectations, and its guidance missed consensus views. Heart valve systems manufacturer Edwards Lifesciences also slid after revenue guidance fell short of estimates. 📉

Managed care company Molina Healthcare rebounded 13% after reaffirming full-year earnings guidance that topped estimates. 🔺

And Ford shares fell 12% after the automaker failed to deliver, with earnings missing expectations by a wide margin and automotive revenue narrowly topping estimates. Rising warranty costs were the main culprit. 🚗

Here are the closing prices:

S&P 500 | 5,427 | -2.31% |

Nasdaq | 17,342 | -3.64% |

Russell 2000 | 2,195 | -2.13% |

Dow Jones | 39,854 | -1.25% |

STOCKS

A Magnificent Decline

“Stocks take the escalator up and the elevator down” is a common phrase you’ll be hearing more of as volatility picks up and stocks experience their second major decline of the year. 😬

The S&P 500 snapped its 356-day streak of low volatility by falling more than 2% today, while the Nasdaq 100 recorded its worst day since the depth of the 2022 correction by falling 3.59%.

From a technical perspective, this pullback has been recently sharp but otherwise pretty ordinary. 🤷

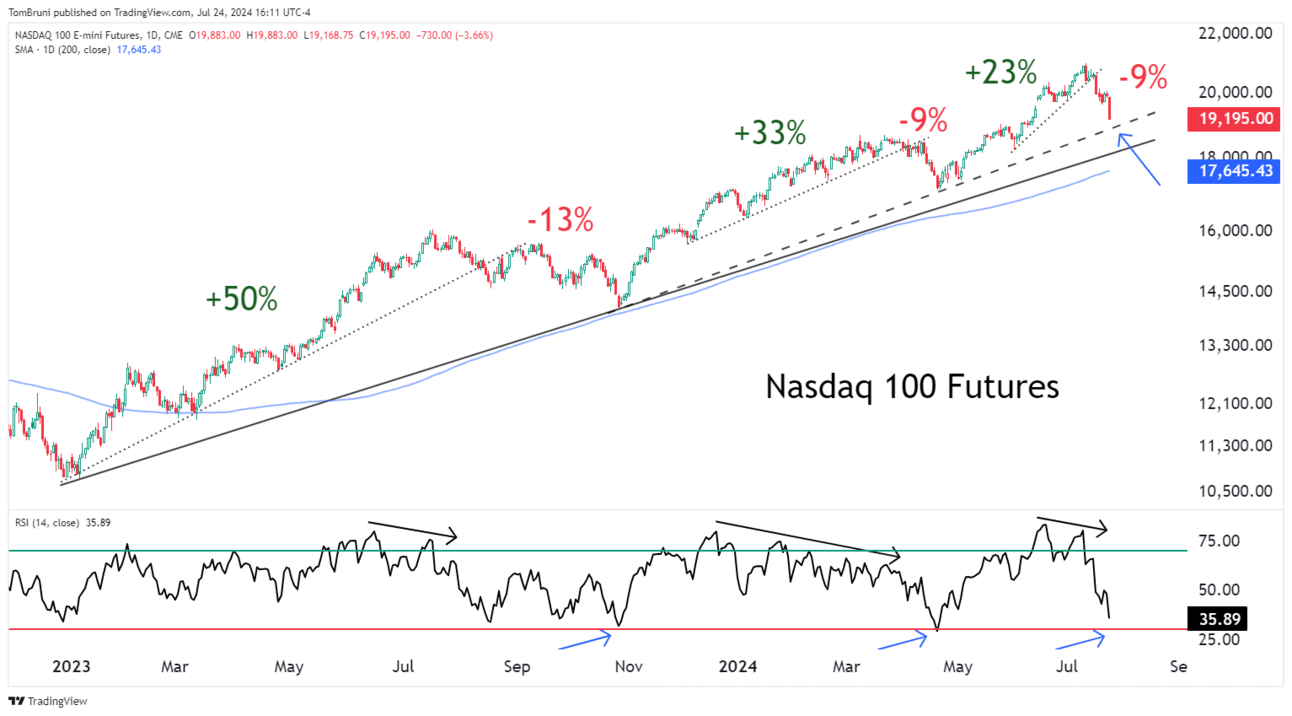

The chart below shows a couple of things. The first is the various trendlines that have acted as a guide for the market’s trend since it bottomed in late 2022. The dotted trendlines show accelerated trendlines that were too steep to be sustainable, while the solid trendline shows the longer-term trend that remains intact.

Additionally, it's worth noting that each correction we’ve had so far started with the combination of a bearish momentum divergence and prices breaking their accelerated trendline. This time was no different. 👀

So, what are technical analysts watching with this roadmap as their guide? Well, they can see that prices are approaching two potential trendlines of support, and the momentum indicator (RSI) is nearing “oversold” levels where it has previously bottomed. 🎯

Now, it’s important to remember these are “potential” levels where buyers may step back in. There are no guarantees in markets. But the point is that multiple trendlines, prior price highs, and a 200-day moving average in the range of 3%- 8% below current levels could offer some support.

As for what caused this? Tech earnings were the main culprit. But another was that the U.S. remains behind its international peers in the rate-cut cycle. 😨

The Bank of Canada cut its rates for the second consecutive meeting today, along with China and the European Central Bank (ECB) over the last week. Notably, Canada’s central bank’s tone was decisively dovish, with members flagging downside risks to the economy.

That, combined with a Bloomberg Opinion column from former New York Fed President Bill Dudley, raised the market’s fears that the Fed is once again behind the curve and risking a recession by reacting too slowly.

It’s a great read, but the title and lede summarize his commentary well… 😳

STOCKTWITS & 11thESTATE PARTNERSHIP

Final Day To Secure Your Alphabet Payout! 🚨

$GOOG has agreed to a $350 million settlement with shareholders to resolve claims related to the security issues of Google+.

Back in 2018, Alphabet was accused of hiding a major security flaw in its Google+ social network. This exposed users' private data to third parties between 2015 and March 2018. Following this news, $GOOG fell significantly, and Alphabet faced a lawsuit from shareholders.

Now, Alphabet has decided to pay the affected shareholders to avoid further litigation.

EARNINGS

Potato Giant Gets Mashed While Burritos Blast Off

While a lot of stocks in the S&P 500 were down today, Lamb Weston was the worst of them…after the frozen potato product manufacturer got cooked. 🥵

The restaurant potato supplier posted earnings per share well below analyst estimates and revenue that also fell short of expectations.

Management noted that global restaurant traffic and demand for its products weakened due to menu price inflation, which we’ve heard about from many restaurants over the last few quarters. 📉

Inflation and economic uncertainty has consumers pinching pennies and looking for deals when eating out, hence the $5 meal deals rolled out by McDonald’s, Burger King, and others.

The weakened demand has caused a major supply-and-demand imbalance in North America (too many spuds). Management expects the challenging environment to continue for “much, if not all” of fiscal 2025. ⚠️

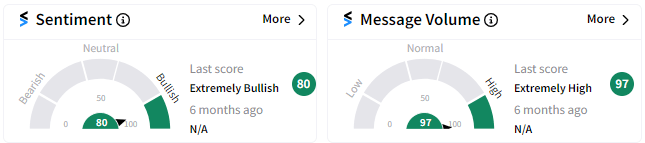

Sellers mashed Lamb Weston shares, sending them down 28% to more than 2-year lows. Surprisingly, Stocktwits sentiment remained in “extremely bullish” territory, suggesting some investors are betting on a comeback. 🤔

While potatoes are out of favor, Chipotle’s latest results suggest that burritos remain on consumers’ menus. 🌯

The fast-casual restaurant’s earnings and revenue both topped estimates, with same-store sales rising 11.10% YoY vs. expectations of 9.20%. Net sales rose 18.20%, while restaurant traffic increased 8.70% despite social media backlash over the company’s inconsistent portion sizes.

Notably, restaurant transactions grew across every income level, bucking the weakening trends that McDonald’s, PepsiCo, etc. have seen in their business. 🤑

As a result, management is pushing forward with its expansion plans, anticipating 285 to 315 new restaurant openings this year. It also reiterated its outlook that sales will grow by a mid-to-high single-digit percentage for the full fiscal year.

Stocktwits sentiment is back in “extremely bullish” territory as Chipotle’s shares jump 4% after hours. 🐂

COMPANY NEWS

CrowdStrike’s Crazy Apology Gift…

If someone has ever slighted you, you know how annoying bad apologies can be. Well, trigger warning: CrowdStrike may have just issued one of the worst apologies we’ve seen from a company in crisis. 🤦

After triggering a global IT outage that’s caused an estimated $5.40 billion in damages for Fortune 500 companies and left many around the globe in shambles, the company has issued an apology…a $10 Uber Eats gift card. 🛒

What the actual f^($?

Yes it’s real. Here’s the email CrowdStrike sent to apologize to its partners for “the additional work that the July 19 incident has caused.” It continues…”And for that, we send out heartfelt thanks and apologies for the inconvenience. To express our gratitude, your next cup of coffee or late night snack is on us!”

If you’re thinking, “That doesn’t even cover the service charge or delivery fee for the food, let alone a meal…” We all feel the same way.

And if the joke couldn’t get any funnier, the code didn’t work for many because Uber Eats flagged it as fraudulent due to “high usage rates.” 😡

This is not exactly the type of response that current or potential holders of CrowdStrike stock want to see from management. If the press around this event wasn’t bad enough, they just voluntarily made it worse.

We’ll have to wait and see what happens, but right now, shares remain in freefall as buyers await a clear reason to step in and support the stock. 🫨

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍