NEWS

Stocks Fly On Tepid CPI

Source: Tenor.com

It was a wild day in the markets after inflation data turned rate cut expectations on their head. Bulls ultimately regained control and closed the market green. Semiconductor stocks were the major bright spot as investors finally found the courage to buy the dip in hyper-growth names. 👀

Today's issue covers why a 50 bp cut is off the table, a better place for meme stock traders, and palladium punching through resistance. 📰

Here’s the S&P 500 heatmap. 6 of 11 sectors closed green, with technology (+3.41%) leading and consumer staples (-0.93%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,554 | +1.07% |

Nasdaq | 17,396 | +2.17% |

Russell 2000 | 2,104 | +0.31% |

Dow Jones | 40,862 | +0.31% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $PLCE, $BQ, $PCT, $FSLR, $MOD 📉 $SIG, $OXM, $MANU, $PR, $DJT*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Traders Take 50bps Off The Table 😒

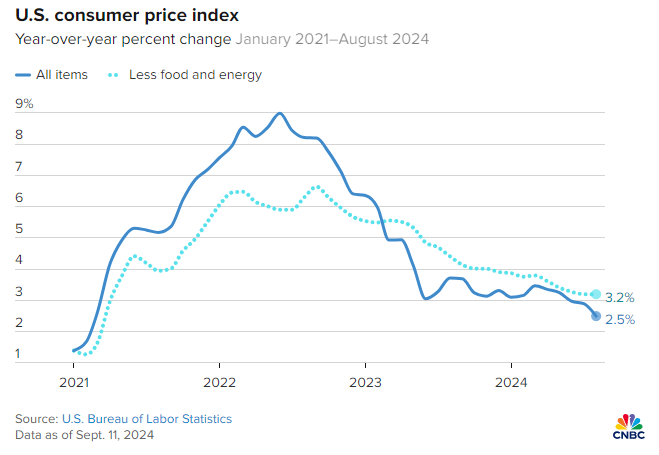

Consumer price growth came in at its lowest level since February 2021, with the headline reading rising 2.90% YoY, down from July’s 2.90%. The 0.20% MoM increase matched expectations. 👍

Meanwhile, core inflation rose 0.30% MoM and 3.20% YoY, as shelter prices reaccelerated after fifteen months of decline. The 5.20% YoY increase in shelter accounted for more than 70% of core CPI’s annual increase.

Source: CNBC.com

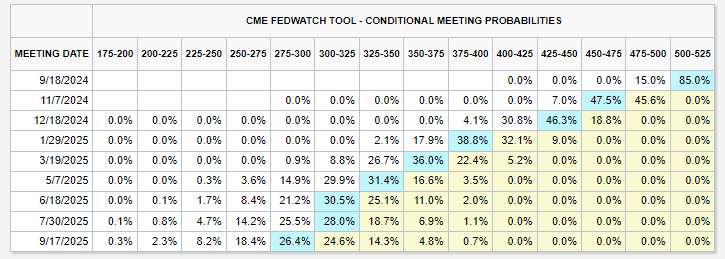

These readings are encouraging enough for the Fed to go through with its plan to cut rates next week. However, the market now expects a 25 bp cut instead of 50 bp, given that core inflation and shelter prices remain elevated (and a risk to the Fed’s 2% mandate). 🔻

Source: CME Fedwatch Website

As we discussed last week, the Fed was unlikely to cut 50 bps anyway because of the alarming message it could send to the market. With inflation continuing to move lower and the labor market cooling at moderate paces, the Fed’s path will remain slow and steady unless the data shifts dramatically toward the risk side of the equation. And so far, it hasn’t. 🤷

A MODERN INVESTOR CONFERENCE

Unlock The Latest Trends In Investing & Alternative Data 🔓

Stocktoberfest is back with an intimate event for executives, influencers, and the most active investors in financial markets on October 20-22. 🤝

Network with industry thought leaders like Howard Lindzon, Michael Batnick, Brian Shannon, Michael Parekh, and many more during the 2-day palooza.

Less than 40 tickets remain, so grab your seat now, and we'll see you in beautiful Coronado, CA! 😎

MEME STOCKS

A Better $PLCE For Meme Traders 🏬

While other ‘meme stocks’ like GameStop and Trump Media & Technology tumbled on weak fundamentals, the momentum has shifted to another beaten-down retailer. 👀

Children's Place was mulling bankruptcy earlier this year but was able to shore up its liquidity to mount a turnaround story. Unlike many other ‘meme stocks, ’ the company is actually making some improvements.

The company’s second-quarter results saw gross profit margins rise to 35%, with selling, general, and administrative (SGA) expenses hitting 15-year lows. That helped offset a 7.50% YoY decline in sales, which remains the key challenge. 🔺

Additionally, the company posted positive comparable store sales for the first time in ten quarters, helping it generate $3.90 million in adjusted income (or $0.30 per diluted share).

The heavily shorted stock surged 86% on the day, and the Stocktwits community expects the momentum to continue as sentiment pushed into ‘extremely bullish’ territory. 🐂

Source: Stocktwits.com

Additionally, many other smaller market-cap (speculative) stocks experienced momentum, including Quhuo Ltd. ($QH), FTC Solar $(FTCI), Nano Nuclear Energy ($NNE), and more. For a full list of undercover names, check out the list of the most active and most watched stocks today. 🧐

STOCKTWITS “TRENDS WITH FRIENDS”

Can This Under-The-Radar Name Keep Running? 🤔

COMMODITIES

Palladium Punches Through The 200-Day 📈

Over the summer, we outlined the precious metal that was getting little love from the market but showing meaningful signs of improvement: palladium.

Below is the chart we shared back then, with prices stabilizing above long-term support and momentum improving. Since then, prices have continued to churn sideways but are now turning higher. 🔺

Technical analysts are now pointing to another improvement, this time on the daily chart, with prices breaking firmly above their 200-day moving average.

This long-term trend indicator has been declining for roughly three years, signaling continued selling pressure. Now, with prices treading water for the last nine months, that moving average has begun to flatten out and turn higher. The longer prices stay above this, the faster it will turn higher. 🤔

Overall, analysts say these signs point to the slow but gradual reversal of this market’s downtrend into a new uptrend. Palladium futures are one way to play it, but traders are also looking to leverage commodity ETFs like $PALL and mining stocks with exposure to the commodity. ⚒️

CHART OF THE DAY

The Gronk Market Rally 😂

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: European Central Bank Rate Decision (8:15 am ET), Producer Price Index - PPI (8:30 am ET), Initial/Continuing Jobless Claims (8:30 am ET), European Central Bank Press Conference (8:45 am ET), WASDE Report (12:00 pm ET), and Monthly Budget Statement (2:00 pm ET). 📊

Pre-Market Earnings: Big Lots ($BIG), Kroger ($KR), Signet Jewelers ($SIG), DouYu International Holdings ($DOYU), and Innate Pharma ($IPHA). 🛏️

After-Hour Earnings: Adobe ($ADBE), Restoration Hardware ($RH), Lovesac ($LOVE), Radiant Logistics ($RLGT), and Farmer Bros ($FARM). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋