NEWS

Stocks Fly To All-Time Highs*

If you want to split hairs, the major indexes were technically not at a new all-time closing high. But Meta is up 19 straight sessions, the equal-weight Nasdaq 100 ETF hit record levels, and the U.S. Dollar is selling off as investors put more risk back into their portfolios. We’ll see if the bulls press their bets with a long weekend ahead. 👀

Today's issue covers the trend staying the bulls’ friend, GameStop falling into temptation, Coinbase’s lack of a catalyst, and more from the day. 📰

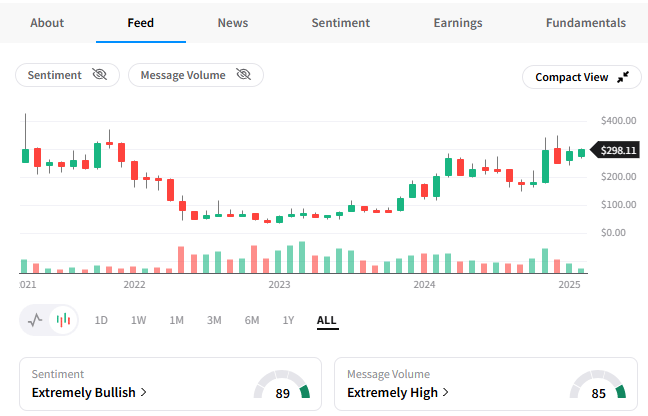

Here’s the S&P 500 heatmap. 11 of 11 sectors closed green, with materials (+1.74%) leading and industrials (+0.10%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,115 | +1.04% |

Nasdaq | 19,946 | +1.50% |

Russell 2000 | 2,282 | +1.17% |

Dow Jones | 44,711 | +0.77% |

EARNINGS

Coinbase Couldn’t Follow Robinhood Higher 😢

With Robinhood crushing its earnings report yesterday and singing the praises of crypto deregulation, many hoped Coinbase could follow suit. 🤞

The largest U.S. crypto marketplace reported after the bell, with earnings per share of $4.68 and revenues of $2.27 billion, topping estimates of $1.81 and $1.88 billion.

Total trading revenues were up 185% YoY, with consumer trading volume up 224% YoY and institutional volume up 176%. Higher levels of crypto volatility helped drive the activity, with management citing the launch of Bitcoin ETF products in and the election of a pro-crypto President and Congress as the two main tailwinds. 🪙

Still, Coinbase said it is trying to diversify its revenue streams away from trading, which made up roughly 68.5% of total revenue during the fourth quarter. Stablecoins are another opportunity, with USDC poised for growth in a post-stablecoin legislation world.

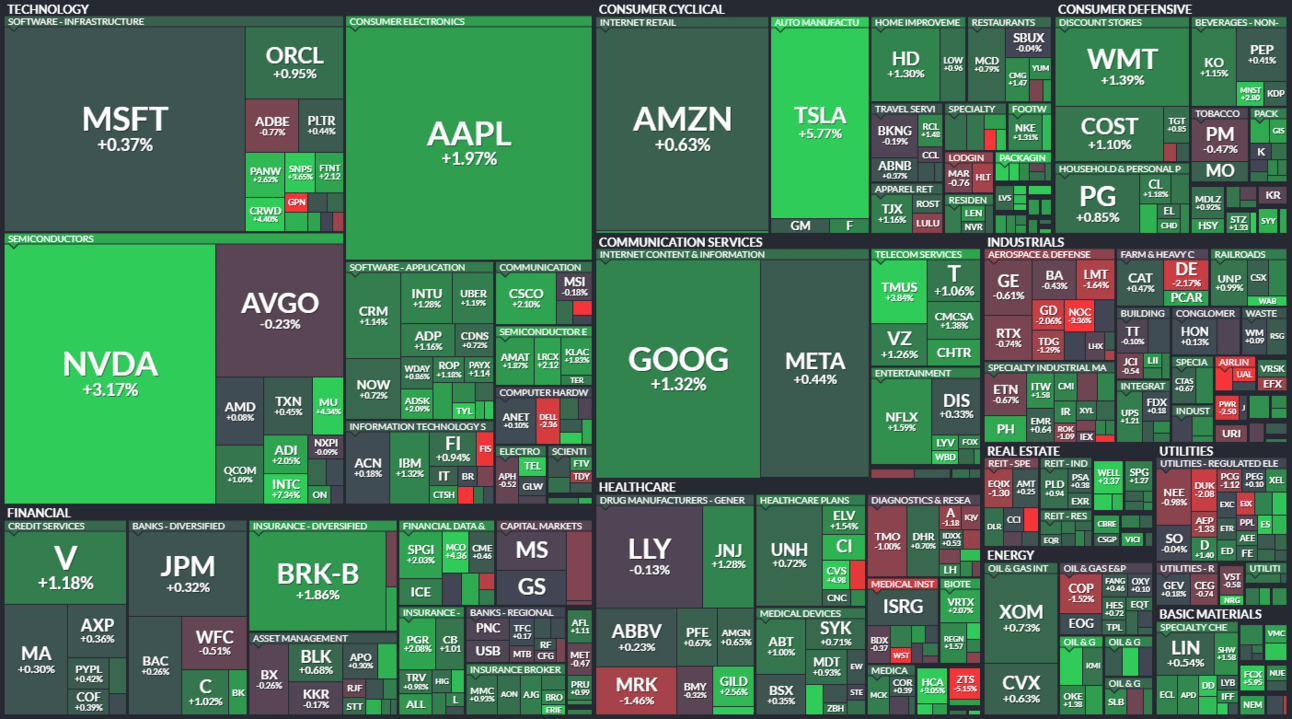

Stocktwits sentiment is ‘extremely bullish,’ but the 1% post-market decline indicates most investors were unimpressed. As prices flirt with their 2021-2022 highs, a more material catalyst is likely needed to keep the momentum going. 🤷

SPONSORED

Join Top Investors Before This “Unlisted” Stock Price Changes

When the team that created Zillow and grew it into a $16B real estate leader starts a new company, investors take note. That’s why top firms like SoftBank and Maveron already invested in Pacaso.

Pacaso’s disruptive co-ownership model took America by storm, earning $100M+ in gross profits in just four years. Now, they’re turning their focus to expanding internationally – which is why their share price is changing February 27.

Pacaso has already sold out two Paris homes in record time, with another on its way. In London, they just finalized the purchase of their most expensive European home yet. Meanwhile, in Cabo, they’ve added seven homes. And this is just the start. That’s why they formed a new partnership with a private UK lender to aid further growth.

Soon, Pacaso will become a globally known brand – which means the current $2.70/share price won’t last long. Lock in your stake before 2/27.*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com.

STOCKS

Other Noteworthy Pops & Drops 📋

Chevron ($CVX +1%): The oil and gas giant said it will lay off between 15% and 20% of its workforce as it attempts $2 to $3 billion in structural cost reductions by 2027.

PBF Energy ($PBF -12%): The refiner posted a wider-than-expected loss, with lukewarm fuel demand and a rise in global refining capacity hitting operations.

Deere ($DE -2%): The farm equipment maker’s net sales fell 30% YoY but topped Wall Street estimates. Higher rates and low crop prices continue to weigh on business.

Lincoln Electric Holding ($LECO +10%): Fourth-quarter earnings and revenue topped estimates, even as organic sales fell 7.5% amid lower activity and CAPEX levels.

CVS Health ($CVS +5%): Cantor Fitzgerald upgraded from ‘Neutral’ to ‘Overweight,’ raising its price target from $62 to $61, citing Medicare Advantage margin recovery.

Cisco ($CSCO +2%): Hit a 24-year high after its second-quarter results topped estimates. Barclays raised its price target from $56 to $61, keeping it ‘Equal Weight.’

WiSA Technologies ($WISA -7%): Announced a partnership with Dolby Laboratories to enhance its wireless audio integration on Android & Linux platforms.

Ascendis Pharma ($ASND +13%): The Danish biopharma’s revenue and earnings topped estimates, with its CEO providing an upbeat revenue growth outlook.

DataDog ($DDOG -9%): The company’s fourth-quarter earnings and revenue beat were overshadowed by weaker-than-expected guidance.

Blacksky Technology ($BKSY +8%): Won multi-year contracts, including assured access to subscription-based low-latency, high-cadence imagery, and AI-enabled analytics services, and have a combined eight-figure value.

Gorilla Technology ($GRRR +24%): Announced a partnership with British Telecom and the Port of Tyne to expand its AI video analytics department.

Pegasystems, Inc. ($PGEA -19%): The enterprise AI decisioning and workflow automation firm topped fourth-quarter estimates, but its total annual contract value (ACV) growth of 9% was a significant deceleration.

Aspen Aerogels ($ASPN): The sustainability and electrification solutions provider’s fourth-quarter earnings and revenue beat did not offset weak first-quarter guidance.

Himax Technologies ($HIMX +9%): The fabless semiconductor manufacturer’s fourth-quarter earnings topped estimates, driven by automotive and AI segments.

Hive Blockchain ($HIVE +4%): H.C. Wainwright and Canaccord analysts raised their price targets while maintaining their ‘Buy’ rating.

Moody’s ($MCO +4%): Moody’s Analytics (MA) revenue grew 8% YoY to $863 million, driven by 11% growth in Decision Solutions with notable contributions from Banking (11%), Insurance (9%) and Know Your Customer (15%).

COMPANY NEWS

GME Reportedly Gives Into Temptation 🙄

Traditional ‘meme stock’ GameStop has seen a material uptick in chatter this week on speculation that it would add Bitcoin and other digital assets to its balance sheet.

After the close, CNBC reported its sources indicated the company is still evaluating alternative asset classes, including crypto and Bitcoin. With significant cash on its balance sheet, no debt, and declining revenues, investors have patiently waited for management to devise a plan to reinvigorate the core business. 😐

However, after nearly four years of Ryan Cohen's involvement in the company, it seems the best he and his colleagues can come up with is more financial engineering.

The stock popped nearly 15% initially, setting down slightly with a 6% gain as of writing this. While Stocktwits sentiment is ‘bullish’ and many view this as another trading opportunity in the stock, long-term investors want to see a meaningful change to the business model. And buying Bitcoin is not that. 🙃

PRESENTED BY STOCKTWITS

Daily Rip Live: Shay Boloor’s 5 Stocks To Watch 🤩

Find out why Shay’s naming ARM Holdings, Meta, and three others as “much-watch” stocks in today’s market. Plus, the catalysts to take them higher. 🤔

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Retail Sales (8:30 am ET), Import/Export Prices (8:30 am ET), Industrial/Manufacturing Production (9:15 am ET), Business Inventories (10 am ET). 📊

Pre-Market Earnings: Moderna ($MRNA), Enbridge ($ENB), AMC Networks ($AMCX), Magna International ($MGA), Zoomcar Holdings ($ZCAR), TC Energy ($TRP). 🛏️

After-Hour Earnings: SolarBank ($SUUN). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋