NEWS

Stocks Hang In The Balance

Stocks and crypto recovered some of this week's losses but still hang in the balance, awaiting more testimony from Fed Chair Jerome Powell and labor market data. Let's see what else you missed. 👀

Today's issue covers JD joining the China party, March Madness continuing at NYCB, and Palantir punching through resistance. 📰

P.S. Over the next month, we’re transitioning our newsletter platform to Beehiiv. If you’re reading this, you’ve been switched over and may notice some changes as we tweak the formatting. To ensure our emails reach your inbox, please whitelist [email protected]

Here's today's heat map:

10 of 11 sectors closed green. Utilities (+0.96%) led, & consumer discretionary (-0.36%) lagged. 💚

The Bank of Canada kept interest rates steady and refused to establish a clear calendar for cuts, citing inflation's slow but steady downward progress. Fed Chairman Jerome Powell testified before Congress and laid out a similar theme, saying inflation's progress is "not assured." However, the market remained strong after he seemingly left a June cut on the table. 🗓️

The latest job openings and labor turnover summary (JOLTS) report changed little in January as the labor market settled into its pre-pandemic highs. Firms remain reluctant to let go of workers over fears they may be unable to fill positions with qualified people if needed. 🧑💼

The squeeze in beaten-down pandemic darlings like The Honest Company remains, with the stock's shares soaring 30% after reporting a rare double-beat. Meanwhile, red-hot stocks like Abercrombie & Fitch fell despite crushing estimates, as investors question if its historic streak can continue. 📊

Certain retailers continue to struggle in the current environment, with both Foot Locker and Victoria's Secret falling nearly 30% after reporting weak quarterly results. While they've been able to cut costs to juice earnings, their inability to grow sales remains a key concern for investors. 🏬

Other symbols active on the streams: $SWIN (+135.00%), $AQST (+20.05%), $MEDS (+107.20%), $RSI (+22.62%), $AISP (+39.80%), $JL (-16.92%), $IFBD (+45.89%), & $RNDR.X (+37.15%). 🔥

Here are the closing prices:

S&P 500 | 5,105 | +0.51% |

Nasdaq | 16,032 | +0.58% |

Russell 2000 | 2,068 | +0.70% |

Dow Jones | 38,661 | +0.20% |

COMPANY NEWS

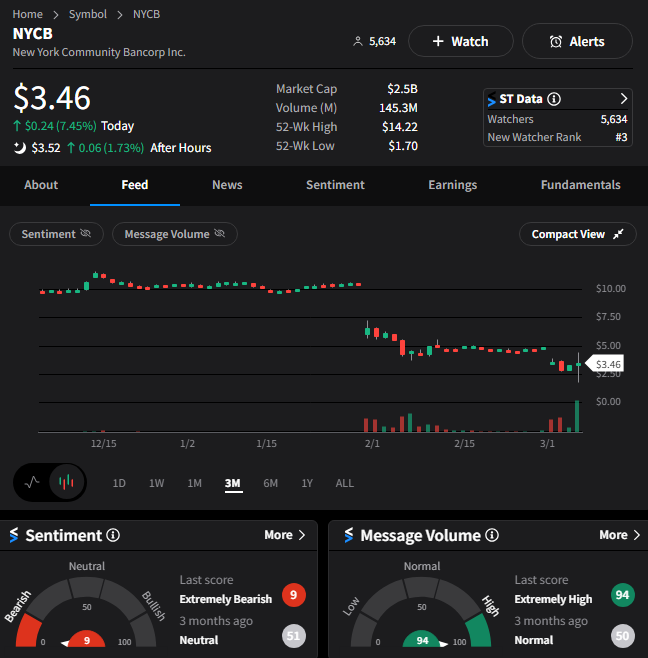

March Madness Continues At NYCB

When regular people talk about March Madness, they're referring to college basketball. But when traders and investors talk about March Madness, they're referring to a regional bank stock imploding.

We're about a year out from three regional banks failing and/or being rescued, and now the sharks are circling New York Community Bancorp. The long story short, until today, is that the regional lender has too much commercial real estate exposure, weak internal controls over financial reporting, and a new CEO trying to right the ship. 🗞️

This morning, the stock was halted and then plummeted on news that it had hired advisors to help it raise equity capital. In other words, it would sell stock and probably not at a price that the market liked. As a result, shares fell more than 40% to fresh lows.

But, by the end of the day, a cohort of investors (including former U.S. Treasury Secretary Steven Mnuchin's firm) stepped in to provide $1 billion of financing at $2 per share. That helped ease some of the short-term liquidity concerns and get the stock back into the green for the day. 💸

While it's clear that this bank's individual issues likely led it to this point, investors are worried about more structural headwinds that could impact the broader industry. Much like last year's crisis, this situation has caused investors to look into other regional banks that might be left vulnerable by their fundamentals. 🕵️

We'll have to wait and see how it develops throughout the month. But for now, the Stocktwits community remains extremely bearish on the stock and remains cautious on bank stocks. And we can't say we blame them, given what happened less than a year ago. 🤷

STOCKTWITS CONTENT

Follow Us On YouTube! 👀

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and our resident chart wizard Ivanhoff every week on our flagship show, "Momentum Monday."

EARNINGS

JD Joins The China Party

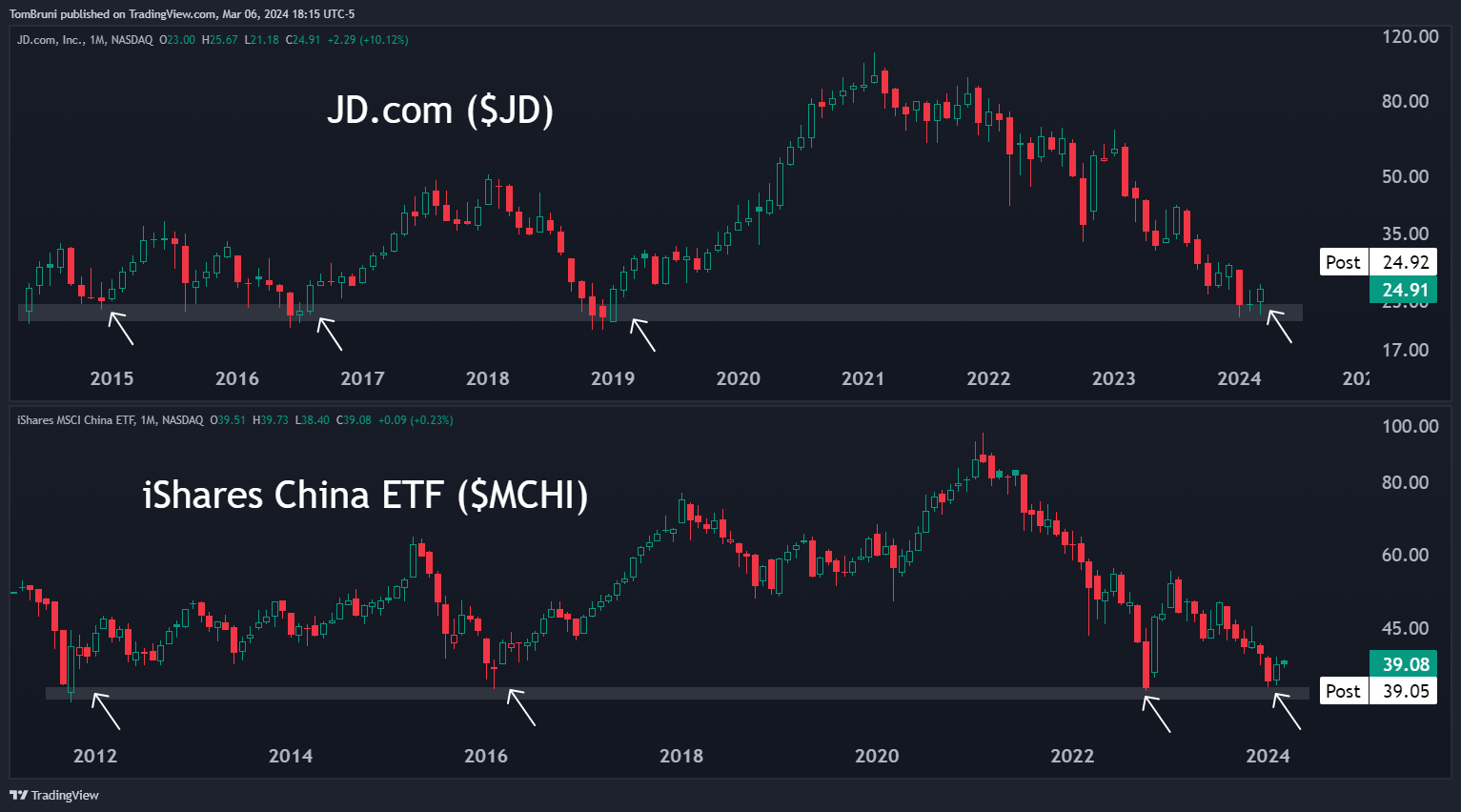

The China trade remains a controversial one, with bulls looking to nail an epic bottom and bears looking for the collapse of the country's stock market (and economy). However, despite all the crazy headlines about economic data, regulators banning short selling, and a whole lot more, some stocks are trying to stabilize. 📰

Today's example is eCommerce giant JD.com, which reported an earnings and revenue beat after a long string of disappointments. While growth remains well off its pandemic-era highs, investors are happy to see that the business is at least stabilizing and being forecasted properly by management.

$JD shares jumped 17% on the day, with sentiment hitting "extremely bullish" territory on the news. 🐂

Notably, technical analysts showed that the stock is finding support at a similar level and pattern as the broader China ETFs. Whether or not they're long-term bottoms remain to be seen, but the consensus view is that they've found some sort of short-term trough. 👍

Stocktwits Spotlight

Palantir Technologies is a data analytics software favorite in the retail community and is back on people's radar today. That's because the company won a new Army contract valued at $178.40 million. The contract covers 10 prototypes for the Army's Tactical Intelligence Targeting Access Node (Titan) ground station system. 📝

In addition to the fundamental improvements, Stocktwits user Thelonius_Stonk pointed out that the stock is also breaking out to its highest level since November 2021. The stock has been stuck in a range for a while, but maybe today's fundamental catalyst will help push it out of the muck and into a sustainable uptrend. 📈

Traders and investors are clearly watching her move, with this post getting over 50 likes today and the Palantir stream trending for much of the day. If you want to keep on top of this move and see more analysis like this, follow Thelonius_Stonk on Stocktwits. 👀

Bullets From The Day

🚨 Ex-Google engineer charged with stealing AI trade secrets. Linwei Ding has been charged with stealing AI technology secrets from the company and passing them on to two Chinese companies. It's a symptom of the broader escalation in the tensions between China and the U.S. as the deglobalization trend continues, especially in the technology sector. The Verge has more.

☣️ U.S. companies must start telling the public about their climate risks. New rules from the Securities and Exchange Commission (SEC) require sizable public companies to disclose their emissions and how a warming world could threaten their business. However, some climate advocates say the rules were watered down after pushback from the business community and lack the proper teeth to make an impact. More from NBC News.

🏦 U.S. regulators expected to reduce capital requirements significantly. They're considerably reducing the extra capital banks must hold under a proposed rule that has drawn aggressive pushback from Wall Street. The agencies said it would increase aggregate capital by around 16% for the roughly three dozen affected lenders with more than $100 billion in assets. With that said, the rules are anticipated to be watered down significantly as Wall Street warns that it could hurt lending and the economy. Reuters has more.

Links That Don’t Suck

Get In Touch

Have feedback on The Daily Rip? Shoot me (Tom Bruni) an email at [email protected]; I’d love to hear from you.

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here.