NEWS

Stocks Moderate As Buyers Tire

Buyers stormed out of the gate, with Nvidia briefly crossing the $2 trillion value mark before pulling back. Meanwhile, other stocks have begun participating as the list of new highs continues to expand. Let's see what you missed. 👀

Today's issue covers Intuitive Machines reaching a "tipping point," Carvana careening to new highs, Warner Bros. headlines facing reality, and more evidence of expanding breadth. 📰

P.S. Over the next month, we’re transitioning our newsletter platform to Beehiiv. If you’re reading this, you’ve been switched over and may notice some changes as we tweak the formatting. To ensure our emails reach your inbox, please whitelist [email protected]

Here's today's heat map:

7 of 11 sectors closed green. Utilities (+3.27%) led, & energy (-0.66%) lagged. 💚

Travel stocks continue to absolutely crush it, with Hyatt Hotels soaring to new all-time highs after smashing fourth-quarter earnings results. 🧳

Electric vehicle stocks continue to experience negative news, with Chinese EV maker Nio falling back towards all-time lows after being downgraded by JPMorgan. 🪫

Latin American eCommerce giant MercadoLibre fell 10% after posting flat YoY earnings growth for the fourth quarter, with operating income also missing estimates. 🛒

Hyperlocal social networking service Nextdoor Holdings rallied 16% after its preliminary fourth-quarter revenue topped expectations. It also announced co-founder Nirav Tolia will return as CEO and increase its share repurchase by $150 million. 🏡

Other symbols active on the streams: $ROOT (+27.61%), $SMCI (-11.84%), $SEM (+9.83%), $FI (+0.43%), $AAOI (-30.47%), $BKNG (-10.15%), $OCEA (+185.77%), & $UNI.X (+51.57%). 🔥

Here are the closing prices:

S&P 500 | 5,089 | +0.04% |

Nasdaq | 15,997 | -0.28% |

Russell 2000 | 2,017 | +0.14% |

Dow Jones | 39,132 | +0.16% |

COMPANY NEWS

$LUNR Reaches A “Tipping Point”

One of the top stories in the market over the last 24 hours has been Intuitive Machines', which trades under the ticker symbol $LUNR. 📻

The space exploration company's Nova-C cargo moon lander known as "Odysseus" became the first privately developed spacecraft to land on the lunar surface. It was also the first U.S. spacecraft to soft-land on the moon in over 50 years. 🌝

Shares had absolutely blasted off in anticipation of this success, rising from just over $2 at the start of the year to over $13 earlier this week. Despite experiencing some profit-taking, the stock rose sharply yesterday after the news broke and continued the momentum in today's trading session.

Investors celebrated, thinking the company had finally reached the "tipping point" in its history. But nobody could have predicted it would be a literal tipping point... 🤦

News broke after the bell that the moon lander had "tipped over sideways" but was "alive and well" on the lunar surface. CEO Stephen Altemus said the vehicle is believed to have caught one of its six landing feet during its final descent and tipped over "near or at our intended landing site."

Speculation around the mission's supposed success whirled today, given no photo images from the landing were circulated. And so far, their suspicions have been proven right. The company is still in contact with the lander and is working to obtain images soon, but much investor trust has already been lost in the process. 📡

$LUNR shares have begun a sharp descent in after hours, falling over 30% as investors and traders assess the situation. Once again, another promising investment opportunity has been unable to stick the landing. And in this case, we do mean a literal landing... 🦿

Message activity surged on the streams, pushing the stock to the second-most newly-watched stock on our platform today. That'll likely persist as this story develops, so be sure to add the stock to your watchlist to stay current on all the action. 👀

SPONSORED

Master Predictive Analysis: Watch This A.I. Live Training!

While Wall Street hangs on every word of the financial news cycle, the shrewd trader should be zeroing in on the insights offered by artificial intelligence in trading.

These tools aren’t just about crunching numbers; they’re about reading the market’s pulse, cutting through the noise of daily headlines, and zeroing in on what truly drives market movements.

In this session, you’ll learn what successful Stocks and Options traders are doing to find the best trade opportunities in the market each day.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Carvana Careens To New Highs

The return of "left for dead" stocks continues as investors look for opportunities in the market beyond the "magnificent seven." 🔍

Carvana is an excellent example of this turnaround story in action, with the stock posting its first-ever annual profit and catching several analyst upgrades. 💪

The online car retailer's $450 million in net income during 2023 compared to a $1.59 billion loss in 2022. Management's focus on cost-cutting is paying dividends, and it is currently working on step two of a three-step restructuring plan.

While management admitted the macroeconomic car-selling environment remains uncertain, it now expects to grow retail units sold in 2024. And with its total gross profit per unit more than doubling to $5,283 last quarter, improved unit economics should help it approach breakeven on an adjusted EBITDA basis. 🔺

Long story long, the stock was priced for bankruptcy, but the company actually turned things around. It's still got a long road ahead of it, but "not dead" is a big improvement from imminent bankruptcy... And that is certainly reflected in $CVNA shares, which made a new cycle high and are now up 2,100% from their lows. 📈

We'll see if it can continue, but the wild ride for Carvana bears certainly continued this week. 🤪

EARNINGS

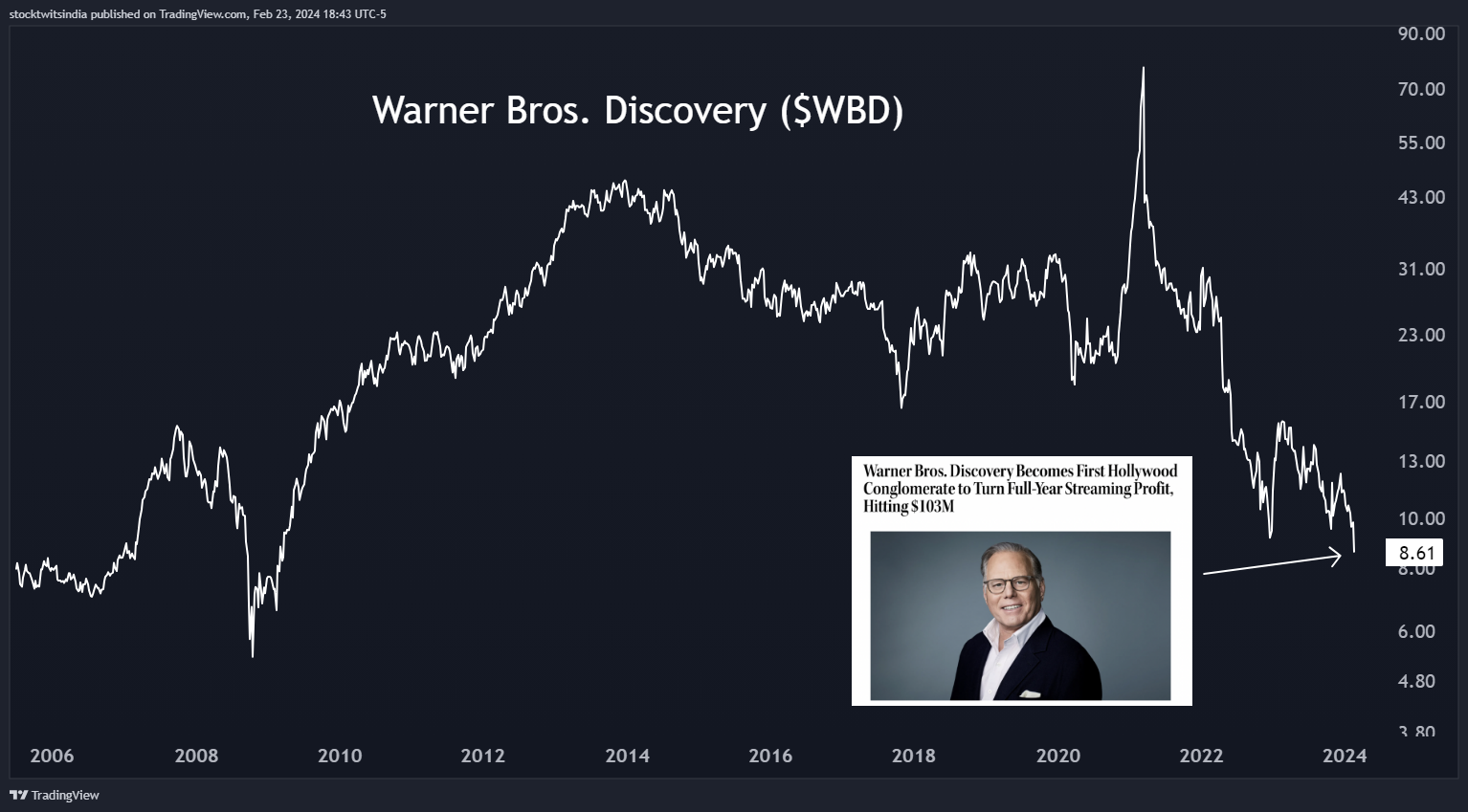

Headline Vs. Reality (Media Edition)

One of the perplexing things about markets is that sometimes headlines don't necessarily match the reaction in markets. And that was certainly the case today in struggling media giant Warner Bros. Discovery. 📰

The Hollywood Reporter wrote an article boasting that Warner Bros became the first Hollywood conglomerate to turn a full-year streaming profit ($103 million).

With a headline like that, you'd expect the stock to go gangbusters. Especially since major competitors like Disney have yet to reach that milestone, Warner Bros. must be doing something well, right??? 🤔

Well, not exactly. $WBD shares fell another 10% to their lowest level in about 15 years.

That's likely because the broader story is that the company missed revenue and earnings estimates, with advertising taking a significant hit in 2023. Management also said there will be free cash flow headwinds in 2024 as its content spending increases, declining to offer guidance for the year.

It is not exactly the picture-perfect situation that initial headlines indicated. The truth is that the media landscape remains incredibly challenged, and those conglomerates with other businesses to offset their media operations will continue to outperform.

So, while we commend Warner Bros. streaming service Max for its profitability, the company has much bigger problems to deal with. And that's why the market continues to sell its shares in the face of seemingly decent news. 😩

Stocktwits Spotlight

With the major stock market indexes sitting at all-time highs, the bears continue to say that just seven stocks are leading prices higher. However, many market watchers are pushing back on that notion, saying that the stock market's breadth is better than many give it credit for. 🤺

For example, yesterday's newsletter outlined Japan's Nikkei 225 Index hitting new all-time highs after 34 years, along with several other global stock market indexes.

Back on U.S. soil, Stocktwits users like HostileCharts are pointing out that yesterday, the S&P 500 recorded its most net new highs of 2024. As he stated above, that is literal breadth expansion.

It's hard to argue with that, folks. Despite all the worries, it's still a market environment that rewards market participants who buy the dip. Until that changes, it's hard to see why investors would change their current behavior. 🤑

If you enjoyed this perspective and want more technical-analysis-driven insights like this, follow HostileCharts on Stocktwits! 👀

Bullets From The Day

🧳 United follows other major carriers in raising checked bag fees. The company joins American, JetBlue, and Alaska, who have all raised fees this year, charging $5 more per checked bag beginning on February 24th. It last raised prices in 2020, with the company continuing to look for ways to grow profits amid waning domestic ticket prices while controlling costs. CNBC has more.

❌ Capital One won't pay a breakup fee if regulators block the Discover deal. With the financial giant revealing it will not pay a termination fee, analysts say it signals management lacks confidence in the deal being approved. However, an alternative take is that Discover was the much more eager party, going as far as to offer a $1.38 billion reverse termination fee were it to find another buyer. More from Axios.

🧑⚖️ The Supreme Court is about to decide the future of online speech. Social media companies have long made their own rules about the content they allow on their sites, but a pair of cases set to be argued before the Supreme Court next week will test those limits. Ultimately, the case will examine whether the platforms can be legally required to host users' speech. It's not just big social media platforms concerned about the law's effects, with Wikipedia and individual credit moderators worried they might have to fundamentally change how they operate. The Verge has more.

🗳️ Edtech giant's investors vote to remove founder. Byju has raised over $5 billion and was valued at $22 billion in early 2022, but has absolutely collapsed over the last year. Late last month, the troubled ed-tech platform launched a rights issue where it sought to raise about $200 million at a massively discounted rate, calling on existing investors to participate and maintain their ownership. While the deal is subscribed successfully, investors have forced its founder to resign over his recently poor stewardship. More from TechCrunch.

🚗 Used electric vehicle market could tempt EV-curious consumers. For the first time in years, consumers will have a vast pool of used vehicles available for purchase, with over twenty-thousand Teslas flooding the market from rental-car giant Hertz's inventory. The company's website shows hundreds of Teslas already listed for sale at a well below market rate, which will be a big test for U.S. consumer EV appetite. BBC News has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Have feedback on The Daily Rip? Shoot me (Tom Bruni) an email at [email protected]; I’d love to hear from you.

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here.