NEWS

Stocks Secure A Third Straight Weekly Gain

Source: Tenor.com

Stocks closed out another week in the green with mixed daily performance. What was up went down, and what was down went up as the energy sector led and technology lagged. All eyes turn to the jobs data next week as investors look to position their portfolios for what could be a volatile Q4 and election season. 👀

Today's issue covers progress in the Fed’s preferred inflation metric, Novo Nordisk’s potential downside reversal., and why Dish and DirecTV may end up together after all. 📰

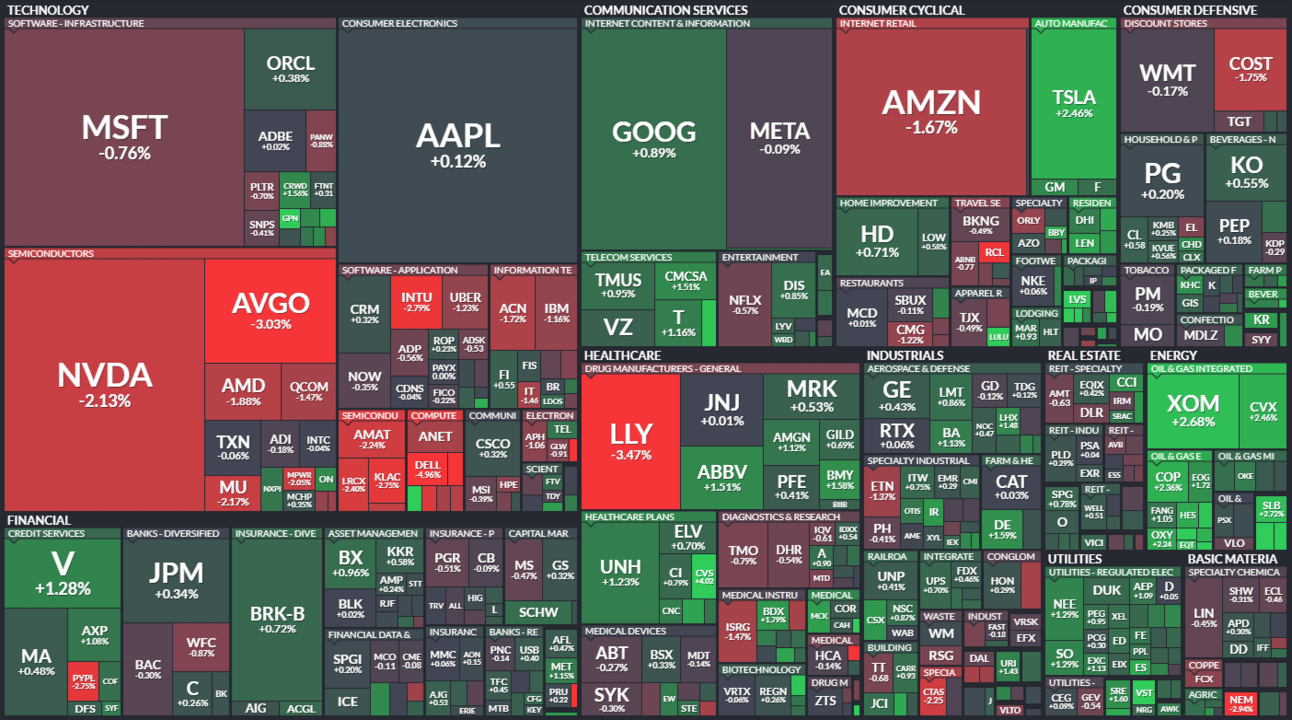

Here’s the S&P 500 heatmap. 8 of 11 sectors closed green, with energy (+2.04%) leading and technology (-0.93%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,738 | -0.13% |

Nasdaq | 18,120 | -0.39% |

Russell 2000 | 2,225 | +0.67% |

Dow Jones | 42,313 | +0.33% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $ZCMD, $TCTM, $IONQ, $CMCT, $ARDX 📉 $SCHL, $OCFT, $ACHC, $LVS, $CMTL*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Fed’s Preferred Inflation Measure Pushes Lower 😎

The personal consumption expenditures price index rose 0.1% MoM in August, with the annual rate falling to 2.2% from July’s 2.5% rate. That’s the lowest reading since February 2021

Excluding food and energy, core PCE rose 0.1% MoM and 2.7% YoY, essentially in line with expectations as some analysts say it remains “all quiet on the inflation front.” 🤫

Source: CNBC.com

Personal incomes and spending both rose 0.2% MoM, below their respective estimates of 0.4% and 0.3%. Still, investors care less on inflation and more about the labor market, eying next week’s labor market data to signal whether the Fed’s next cut will be 25 or 50 bps. 🔮

Meanwhile, Richmond Fed president Tom Barkin urges caution on interest rate cuts because inflation has not been defeated. He shares the more conservative outlook that the Fed should wait for further progress before aggressively easing.

Lastly, consumer confidence improved for the third straight month to its highest reading since April, as their outlook for the economy continued to tick higher while inflation expectations stayed flat.

Time will tell which view on inflation is correct. But for now, the downward progress continues, giving bulls the confidence to continue pressing equity market (and other risk asset) prices higher. 📈

STOCKTWITS “TRENDS WITH FRIENDS”

Tesla Turns Positive YTD: Where’s It Headed Next? 🤔

COMPANY NEWS

DirecTV May Get Its *Dish* After All 📡

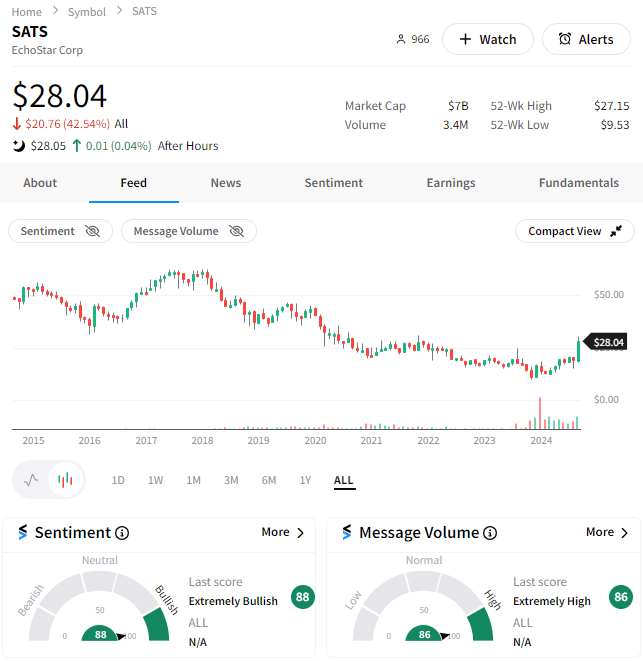

The combination of Dish and DirecTV has been rumored for years and was close to happening in 2002 until regulatory pressure killed the deal. Now, Charlie Egren is getting close to selling the pay-TV business he founded more than 40 years ago to its rival, DirecTV.

EchoStar is looking to sell the company for roughly $9 billion to DirecTV (which is owned by private equity firm TPG and telecom giant AT&T) in order to pay off $1.98 billion of debt that matures in November. 💸

As of June 30th, the company had just $521 million in cash and cash equivalents and forecasted negative cash flows through the end of the year, so an all-cash asset sale is seen as the easiest way of dealing with this debt.

Notably, no wireless spectrum assets are involved in the proposed deal, just Satellite TV, its digital business Sling, and any associated liabilities. 📵

Overall these remain structurally challenged businesses and consolidation seems inevitable, as legacy operators look to curtail costs and hang onto whatever market share they can in an environment full of alternatives.

EchoStar shares jumped 8% on the day to their highest level in about three years, with Stocktwits sentiment pushing into ‘extremely bullish’ territory. While asset sales are always a tough decision, investors seem to like the company's redirection and are betting on its continued turnaround. 🐂

Source: Stocktwits.com

STOCKTWITS “CHART ART”

Novo Nordisk Nears A Major Reversal 😬

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

COMMUNITY VIBES

One Tweet To Sum Up The Week 😬

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋