NEWS

Stocks Slip From Their Highs

Source: Tenor.com

Macro jitters from Trump’s tariff plans overshadowed positive earnings results this week, causing the major indexes to close marginally lower. Heading into next week, the market will be focused on U.S. labor market data and a fresh slate of earnings for many of the world’s largest companies. 👀

Today's issue covers Trump’s latest tariff moves, a recap of energy giant earnings, a fresh “Weekend Rip” with Ben & Emil, and what you missed on Stocktwits. 📰

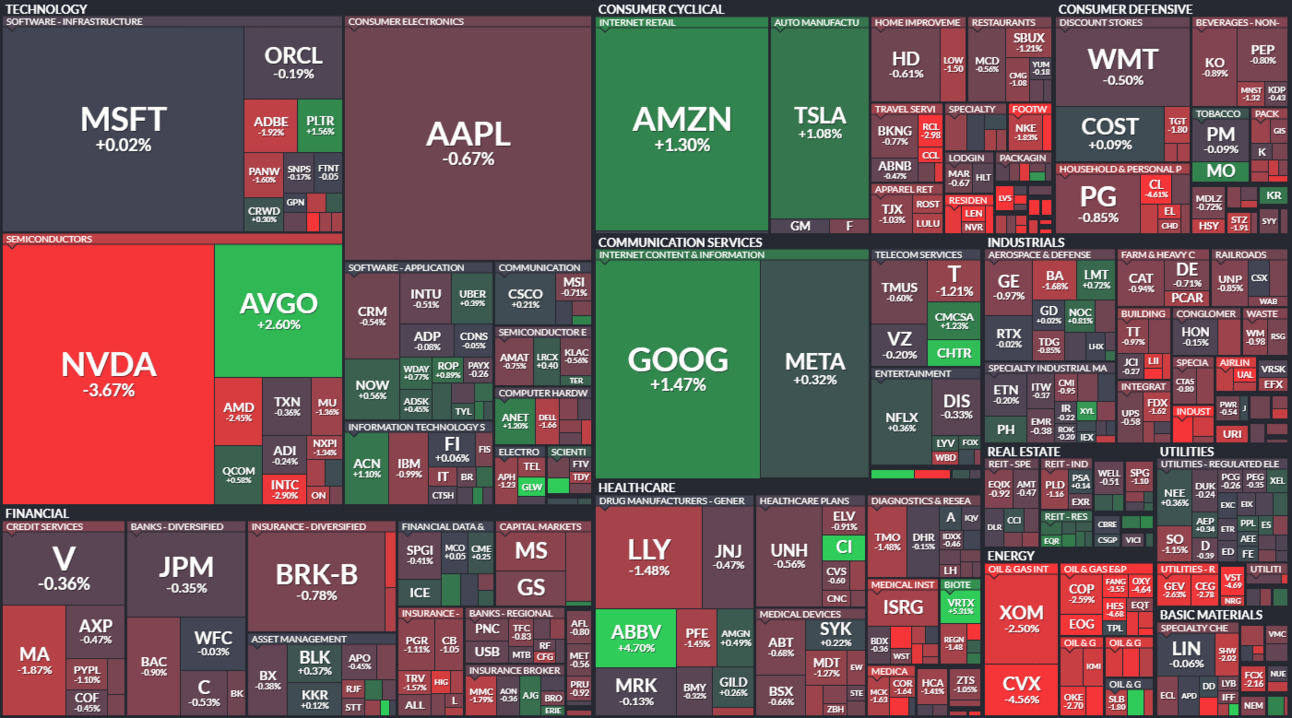

Here’s the S&P 500 heatmap. 1 of 11 sectors closed green, with communication services (+0.40%) leading and energy (-2.00%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,041 | -0.50% |

Nasdaq | 19,627 | -0.28% |

Russell 2000 | 2,288 | -0.86% |

Dow Jones | 44,545 | -0.75% |

STOCKS

Tariffs Cause Stocks To Turn Lower 📉

White House Press Secretary Karoline Leavitt briefed the press that Trump will implement 25% tariffs on Mexico and Canada and a 10% duty on China tomorrow, far quicker than the market's expectation of March 1st. 😱

Stocks slumped and turned deeply negative on the news as investors digested the news and adjusted their portfolios in anticipation of more weekend surprises.

With oil prices on the move, let’s recap how some of the biggest energy stocks fared after reporting earnings results. 👀

Exxon Mobil fell 2% after its fourth-quarter revenues of $83.42 billion missed analyst estimates. Oil and gas production rose by 20,000 barrels per day to 4.6 million, with yearly production jumping to its highest in a decade.

Weaker refining margins weighed on profitability, though adjusted earnings still beat expectations due to cost improvements. ⛽

Meanwhile, Chevron fell 5% after its revenue and earnings both missed analyst estimates. Its downstream (refining) unit posted a loss for the first time since the pandemic, driven by lower prices and a 3% decline in U.S. sales volumes.

Refining margins remain impacted by a rise in global production capacity and lackluster demand in major economies. It raised its quarterly dividend by 5% and expects a 6% to 8% rise in total production during 2025.

Phillips 66 was also hit hard by weakness in refining, as it remains the largest importer of Canadian crude in the U.S. 🚂

Overall, oil and gas majors remain in expansion mode, and their operations continue to generate meaningful cash flow. However, their earnings and revenue are well off their highs from 2023’s record year and will remain under pressure due to mixed global demand and rising capacity.

Trump’s regulatory decisions and global economic growth will set the tone for energy in 2025. They’re paying investors to hold tight and wait for further upside catalysts. Based on Stocktwits sentiment, retail investors remain selective in the oil and gas space as individual company performance bifurcates. 😐

PRESENTED BY STOCKTWITS

“The Weekend Rip” With Ben & Emil 🍿

Hosts Ben and Emil are back for another Weekend Rip, discussing the latest group of crypto grifters, DeepSeek ramping up the AI race, Trump demanding immediate rate cuts, and Elon Musk’s wild financial projections. Plus, the guy who launched 17,000 meme coins, Time Magazine getting rugpulled, and Michael Saylor’s Forbes cover.

STOCKS

Other Noteworthy Pops & Drops 📋

AbbVie ($ABBV +5%): The biopharma stock’s fourth-quarter earnings and revenue topped expectations, citing key regulatory approvals and strategic transactions.

RBC Bearings ($RBC +8%): The manufacturer of highly engineered precision bearings, components, and essential systems saw earnings and revenue top estimates.

Allegiant Travel Company ($ALGT -2%): Disclosed in an SEC filing that it will record a non-cash impairment charge worth $322 million during Q4 fiscal 2024.

KLA Corp. ($KLAC -1%): The semiconductor equipment maker’s fiscal second-quarter earnings and revenue topped analyst estimates.

Cipher Mining ($CIFR +20%): The Bitcoin miner secured a $50 million PIPE investment from SoftBank Group Corp. It will use the funds to support its push in the high-performance computing (HPC) data market.

Walgreens Boots Alliance ($WBA -10%): Suspended its cash dividend as it re-evaluated its capital allocation policy amid a broader turnaround effort.

Intel ($INTC -3%): Sentiment remains mixed as the chipmaker’s revenue and earnings topped estimates, but its first-quarter 2025 revenue guidance was weak.

Visa ($V -0.45%): The payment processor’s earnings and revenue topped estimates, driven by healthy spending during the holiday season.

Trump Coin ($TRUMP.X -6%): A recent Stocktwits poll reveals that 31% of retail investors feel that the creation of these meme coins is driving their dislike for the crypto market, among the 77% who are skeptical about Official Trump (TRUMP.X) and Melania Meme (MELANIA.X) tokens.

COMMUNITY VIBES

What You Missed On Stocktwits This Week💸

Yours truly appeared on Yahoo Finance to share Stocktwits’ insights on retail’s approach to earnings season and the DeepSeek AI selloff. 👇

We rolled out fresh branding across all Stocktwits properties this week. However, we need your help with the final piece of this rebrand, our StocktwitsCrypto logo!

See the options below and vote in our Stocktwits or X polls to have your voice heard. We’ll announce the community’s pick on Monday, so don’t delay! 🗳

Did you know we do giveaways each week on the @Stocktwits and @StocktwitsCrypto handles? Now you do! Congrats to some of last week’s winners for scoring free Stocktwits Edge. Watch these accounts tonight and over the weekend for the relaunch of our “Trading Competitions” with real cash prizes. 🤑

COMMUNITY VIBES

One Tweet To Sum Up The Week 🎯

Links That Don’t Suck 🌐

🧑🏫 Join a free 2-hour online workshop on 2/8 to learn investing strategies from IBD’s market experts*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋