NEWS

Stocks Snap Their 10-Day Win Streak

A rare red day interrupted the stock market’s all-time highs, with big tech giving back some of its gains. Still, some stocks continued their recent runs, with Walmart’s results helping put consumer staples back on the map. Let’s see what else you missed. 👀

Today's issue covers Walmart’s sales surprise leading to all-time highs, Alibaba’s latest buyer overshadowing Chinese tech earnings, and a recap of crypto miners’ Q1 results. 📰

Here's today's heat map:

2 of 11 sectors closed green. Consumer staples (+1.42%) led, & materials (-0.72%) lagged. 💚

U.S. new home construction rose less than anticipated in April, with permits for new activity dropping, as rising mortgage rates and record prices give builders pause about the ability to drive demand. 🏘️

The Philly Fed index and U.S. industrial production numbers remained weak in May and April, showing the continued volatility in manufacturing activity. On a related note, agricultural giant Deere fell today after slashing its full-year outlook as falling farm income weighs on customer demand. 🏭

Initial jobless claims fell again last week, as the labor market’s softening has yet to appear meaningfully in this leading indicator. 💼

It was a mixed morning for retailers, with Under Armour slumping following lower-than-expected full-year earnings guidance. Meanwhile, Canada Goose popped after beating Wall Street estimates for sales and earnings, saying one key profit margin metric will expand by 100 bps YoY. 🛍️

Meme stocks continued to meander around, waiting for their next catalyst and giving back significant gains during the process. However, Marijuana stocks moved higher after President Biden announced the Department of Justice (DOJ) is taking its next step to reclassify it as a Schedule III drug. 💸

And Corebridge Financial’s shares jumped on news that AIG will sell its 20% stake to Nippon Life in a $3.80 billion deal. 🏦

Other active symbols: $RENT (+60.63%), $GME (-30.04%), $FFIE (+134.04%), $AMC (-15.33%), $GNS (-8.38%), and $BSEM (-7.11%). 🔥

Here are the closing prices:

S&P 500 | 5,297 | -0.21% |

Nasdaq | 16,698 | -0.27% |

Russell 2000 | 2.096 | -0.63% |

Dow Jones | 39,869 | -0.10% |

EARNINGS

Sales Beat Sends Walmart Shares To All-Time Highs

An unexpected sales beat and e-commerce growth helped drive big-box retailer Walmart’s shares to fresh all-time highs. Let’s take a look at why. 👇

It’s no secret that low-to-middle-income consumers have been Walmart's core customers for some time, especially as inflation pushed spending away from discretionary goods and towards necessities.

However, it appears higher-income shoppers are also feeling the pinch, moving down the value chain and helping drive 22% YoY growth for Walmart’s U.S. e-commerce business. 🛒

The company’s CFO says the gap between the cost of eating out and cooking at home remains a major tailwind for Walmart’s grocery business, with shoppers searching for value and convenience in these areas. And with groceries making up 60% of the company’s U.S. sales in the most recent full fiscal year…it’s important for them to nail this segment. 😋

As a result of their efforts, the big-box retailers’ first-quarter adjusted earnings per share of $0.60 topped estimates of $0.52, while revenues of $161.50 beat the expected $159.50 billion.

The overall theme remained that wallets are still stretched, though the company is seeing continued signs of disinflation…”rolling back” prices on various items on its site and in stores.

To offset consumers’ reduced spending on higher-margin discretionary items, the company’s high-margin advertising and subscription-based membership program grew 24% YoY and 26% YoY, respectively.

Meanwhile, it’s cutting in other potential growth areas that have not delivered, like its Walmart health clinics, and reducing corporate headcount. ✂️

Investors cheered the quarter, with shares rising 7% to new all-time highs and Stocktwits community sentiment pushing into “extremely bullish” territory. We’ll have to wait and see in the days ahead if Walmart’s good fortune is seen in the rest of the sector or if its execution is just that far above the rest. 🐂

STOCKS

Baba Jumps While Other Chinese Stocks Flunk

With Chinese stocks remaining in focus, many thought that JD.com and Baidu earnings would be a major event today. However, their results were overshadowed by some news impacting Alibaba… 👀

Fund filings showed that billionaire investor David Tepper’s Appaloosa Management has been loading up on beaten-down Chinese stocks during the first quarter, looking to take advantage of the lower valuations relative to the U.S. and other foreign markets.

The filing showed the firm more than doubled its investment in Alibaba, making the e-commerce giant the biggest position in its $6.70 billion equity portfolio. It also raised stakes in PDD Holdings and Baidu and added JD.com and two Chinese ETFs as new buys. 💰

Needless to say, news of this high-profile manager’s activity in the sector helped boost its momentum further and put Alibaba amid today’s top gainers.

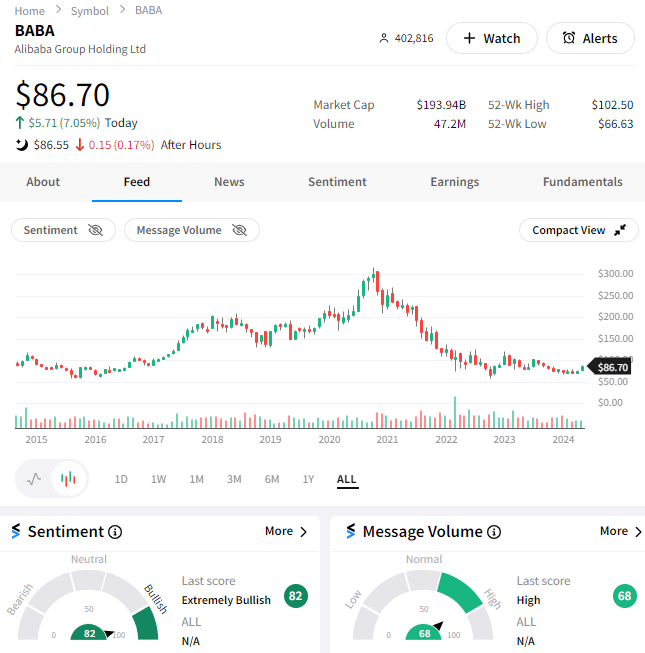

$BABA shares were boosted 7% to roughly 7-month highs, with Stocktwits sentiment pushing into “extremely bullish” territory for the first time since June of 2023! Clearly the stock has gotten retail’s attention once again. 🥳

SPONSORED

Maximize your options profits (and minimize your losses) at Public.com

Heads up, options traders: the investing platform Public.com has a rebate that allows you to buy contracts for less and sell contracts for more. As a member, you could earn up to $0.18 per options contract traded with no commissions or per-contract fees.

"My options trading platform is free, though. How is this better?" While some platforms seem to allow free trades, many charge fees of $1 or more per contract traded. On the other hand, Public offers rebates for trading options—and they can add up fast. In fact, if you trade 500 contracts each month, you can expect to clear almost $1,000 in rebates by the end of the year. In other words, you don't pay money to place options trades; you earn it.

Discover why NerdWallet awarded Public five stars for options trading, and earn up to $0.18 per contract traded with no commissions or per-contract fees.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

CRYPTO

Crypto Miners Cap Off An Exciting Q1

Today’s Litepaper breaks down the earnings for major crypto mining stocks, highlighting key themes and the “best of the best” and “worst of the worst.” ⚒️

Here are some key takeaways:

After the halving, the industry is focused on energy efficiency, developing sustainable operations, and integrating AI.

Industry consolidation will continue as it becomes tougher for smaller players to survive in a post-halving environment.

The “best of the best” was Marathon Digital Holdings, posting record revenues of $165.20 million and a 266% increase in adjusted EBITDA.

The “worst of the worst” was Bitfarms Ltd., which saw the lowest revenue growth among its peers (+67% YoY) and reported a $6 million net loss.

If you want more analysis and content on the latest crypto market trends delivered to your inbox daily, subscribe to The Litepaper.

SPONSORED BY OUR FRIENDS AT PUBLIC.COM

A Brand New “Trends With Friends” 🍿

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

Bullets From The Day

🗳️ Senate votes to repeal SEC’s crypto policy. The U.S. Senate, with bipartisan support, voted to repeal the SEC’s controversial crypto accounting policy, SAB 121. However, President Biden has threatened to veto the resolution, arguing it would disrupt efforts to protect crypto investors and the broader financial system. Senator Cynthia Lummis hailed the vote as a win for financial innovation, but the policy’s future remains uncertain. Coindesk has more.

💼 LSE CEO denies crisis as firms flee to the U.S. While big-name companies like ARM and Flutter pack their bags for the US, London Stock Exchange CEO Julia Hoggett claims there's no crisis and that the UK is still top-notch for investments. Apparently, the UK is "punching above its weight," even as more firms eye the exit. With a finance summit on the horizon, the UK government is scrambling to make the market attractive again. More from the BBC.

🔍 EU investigates Facebook and Instagram for addictiveness. The EU is going after Facebook and Instagram, accusing them of being so addictive they mess with kids' mental and physical health. Meta could get slapped with fines up to 6% of their global revenue if found guilty under the EU’s tough Digital Services Act. The probe will also dig into how well Meta checks users' ages and the rabbit holes their algorithms create. From TechCrunch.

📈 Copper short squeeze rocks Comex market. A historic short squeeze has driven copper prices on the Comex to record highs, with a premium over the London Metal Exchange price reaching $1,200 per ton. The squeeze, exacerbated by US and UK bans on Russian metals, has left traders scrambling for copper to fulfill expiring futures contracts. While signs of easing have appeared, the market remains volatile with significant shipping challenges. ZeroHedge has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: Paid endorsement for Public Investing, member FINRA/SIPC. Rebate rates vary from $0.06-$0.18 per contract depending on time of enrollment and number of referrals you make. Rates are subject to change. See terms & conditions of the Options Rebate Program. Investors must review the Options Disclosure Document (ODD). Options are risky and not suitable for everyone. See Fee Schedule and Options Rebate & Referral T&Cs: https://public.com/disclosures. Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.