NEWS

Stocks Snap Latest Winning Streak

Nvidia giveth, and Nvidia taketh away. The world’s most valuable stock pulled the broader market lower as the S&P 500 snapped its seven-day win streak. Notably, Stocktwits sentiment for all the major indexes closed in bearish or extremely bearish territory. Let’s see what you missed. 👀

Today's issue covers Darden’s current read on the consumer, Accenture’s AI revenue boost, and manufacturer Jabil’s latest warning. 📰

Here's today's heat map:

8 of 11 sectors closed green. Energy (+1.84%) led, & technology (-1.12%) lagged. 💚

Central bank actions continue to diverge. The Bank of England kept rates at 5.25% amid sticky inflation, aiming for an August cut. Meanwhile, Switzerland made its second 25 bp cut of the year, with inflation at 1.40%. ✂️

The NAHB housing market index fell to its lowest level of the year, as mortgage rates above 7% and elevated construction financing kept a lid on builder confidence. Building permits also fell to a nearly 4-year low during May, falling 3.80% MoM and 9.50% YoY. U.S. housing starts also fell 5.50% in May, their lowest since June 2020, on the back of weak multifamily starts. 🏘️

Homebuilder KB Home jumped 3% after its revenue and earnings topped expectations, noting that net orders rose 2% YoY. It’s continuing to focus on first-time homebuyers with lower-priced, affordable options. 🔺

The Philadelphia Fed manufacturing index was steady in June, marking its fifth straight month in positive territory. As economic activity holds up, crude oil and the energy complex continue to rise amid falling inventories. 🛢️

European political turmoil caused luxury sneaker maker Golden Goose to call off its roughly $2 billion initial public offering (IPO). It comes as 2024 is on pace to be the slowest year for European IPOs in the past decade. 🙃

Gilead Sciences rose 7% after its twice-yearly shot to prevent HIV succeeded in a late-stage trial of roughly 2,000 women. It must replicate the results before seeking FDA approval, but the treatment could hit shelves in late 2025. 👍

Sarepta Therapeutics soared 40% after receiving broad approval for its muscular dystrophy drug, expanding access to all patients who can walk. 💊

Honeywell shares popped on news it will buy aerospace and defense technology provider CAES Systems for $1.90 billion in cash. 🛡️

Electric vehicle maker Nikola plunged 31% after announcing a 1-for-30 reverse split, as fears remain high following Fisker’s bankruptcy. 🪫

Winnebago Industries fell to 18-month lows after earnings and revenue fell YoY and missed analyst expectations. Concerns are the slowing economy will weigh heavily on large discretionary purchases like RVs. 🚙

Penn Entertainment shares rose 10% on news that Boyd Gaming is exploring a potential acquisition. It would be the biggest merger among U.S. gambling companies since Eldorado Resort’s $17.30 billion purchase of Caesars. 🎰

Although the crypto market continues to melt lower, MicroStrategy completed the purchase of $786 million worth of Bitcoin using its convertible note proceeds. And crypto’s mainstream adoption continues, with Australia’s main stock market listing its first Bitcoin exchange-traded fund (ETF). ₿

Other active symbols: $DJT (-14.56%), $CMG (-6.22%), $AMD (+4.62%), $TPST (-29.47%), $HIMS (-9.68%), and $NNE (+31.21%). 🔥

Here are the closing prices:

S&P 500 | 5,473 | -0.25% |

Nasdaq | 17,722 | -0.79% |

Russell 2000 | 2,017 | -0.39% |

Dow Jones | 39,135 | +0.77% |

EARNINGS

Food Stocks Flag Latest Consumer Trends

Olive Garden parent Darden Industries is one of many restaurant stocks used as a proxy for the health of the U.S. consumer. Its diversified portfolio stretches across dining experiences and income levels, giving investors and traders a read into where people are spending their discretionary income. 🕵️

Today we heard a similar story from the company, which reported adjusted earnings per share that topped expectations, while revenues missed by a hair. Same-store sales were also flat YoY, with sales at Olive Garden and its fine-dining restaurants failing to keep pace with estimates.

Executives repeated a line we’ve heard for many quarters now: consumers are growing concerned about inflation. But these days, they’re also concerned about the job market, which continues thawing from historically hot levels. 😬

Despite the sales slowdown, Darden is opting not to play the “sales and promotions” game its competitors are. Instead, it’s betting its strong offerings will continue to lure consumers in, and full-priced items will buoy margins.

As for bright spots, LongHorn Steakhouse remains the key growth driver of the portfolio, seeing same-store sales rise 4% (the only property to grow). 🥩

However, looking ahead, its full-year earnings and sales forecast were on the lower end of analyst expectations, with its CFO projecting 3% inflation and same-store sales growth of 1%-2% in fiscal 2025.

Shares were up marginally on the day and continue consolidating about 10% below all-time highs. Stocktwits community sentiment seems to be in line with management’s upbeat outlook, sitting in extremely bullish territory. 🐂

SPONSORED

Earn rebates on every options contract traded at Public.com

Are you an options trader? At Public.com , you'll earn a rebate on every contract traded with no commissions or per-contract fees. That's because Public offers a rebate on every contract you buy or sell. Joining Public is easy, and your rebates can add up fast. If you trade 1,000 option contracts on Public, you'll earn $60 to $180 in rebates and avoid up to $1,000 in fees that other platforms charge.

So, don’t change your strategy; change your platform—and start earning rebates on every options contract traded. Plus, get up to $10,000 when you transfer your existing portfolio to Public.

Discover why NerdWallet recently awarded Public five stars for options trading (and 4.6/5 stars overall), and earn rebates on options trades with no commissions or per-contract fees.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Jabil Warns Of A Slowdown

Contract electronics manufacturer Jabil has been a major beneficiary of the pandemic-era tech boom and now the artificial intelligence (AI) cycle. However, shares slumped significantly today after executives told investors they may have to temper their expectations. 👎

The company’s $1.89 in adjusted earnings per share topped the $1.85 expected by analysts, as did revenues of $6.77 billion vs. the $6.53 consensus estimate. Investors took that as a positive read for Apple, since the consumer tech giant accounts for between 15% and 20% of the company’s revenue.

However, management said its March assumptions about automotive and transportation business growth have softened further. It cited the surplus of cars in China, where local demand remains suppressed. Additionally, its medical devices business is slowing and expected to remain a short-term headwind. ⚠️

Jabil maintained its full-year forecast of $8.40 per share in earnings on $28.50 billion in revenues, which matched Wall Street’s expectations. With that said, the concerns raised about several pivotal segments of its business put investors on edge and sent shares down 11% toward one-year lows. 📉

EARNINGS

Consulting Firm Accenture Forecasts AI Boost

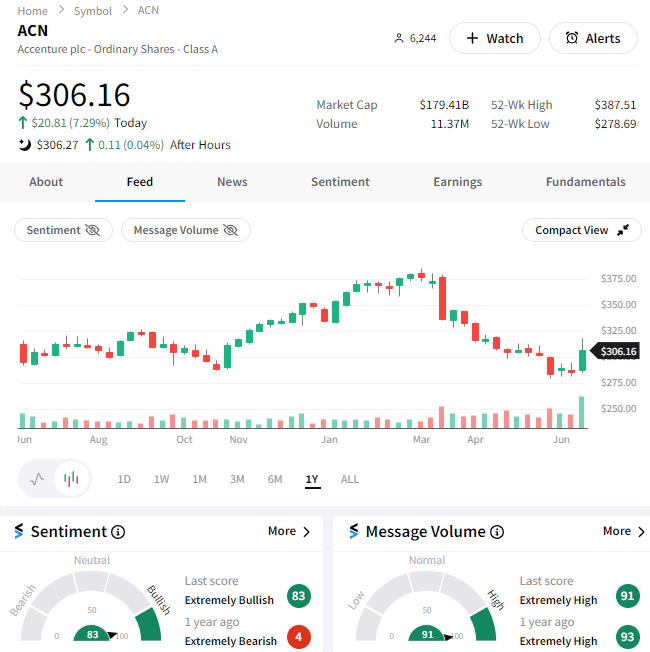

Tech consulting firm Accenture returned to the drawing board and has identified a new way to offset the broader slowdown in the tech sector. And to no one’s surprise, that plan involves artificial intelligence (AI). 👨💼

Accenture reported that third-quarter adjusted earnings of $3.13 per share were below the $3.16 anticipated by analysts. Revenues were also down marginally YoY and below expectations.

However, executives touted $900 million in generative AI new bookings, bringing the segment’s total for the fiscal year to $2 billion. Of that, roughly $500 million in revenue has been recognized year-to-date. 🦾

That statement and optimism around AI’s revenue potential were enough to offset weak results and a lackluster forecast. Full-year EPS and revenue guidance came in below Wall Street estimates, but nobody seemed to care.

Instead, investors see the stock 25% off its all-time highs and an opportunity to pick up shares ahead of their next potential run. As always, we’ll see if the Stocktwits community’s “extremely bullish” sentiment pays off as Accenture embraces the AI hype. 🥳

STOCKTWITS “TRENDS WITH FRIENDS”

Momentum Investing: Why The Hype? 🤔

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

This week, they’re joined by Carson Group’s Chief Market Strategist (and stat master), Ryan Detrick, to discuss the rise of momentum investing, breadth expansion & sector rotation, and the bull case for small caps!

Bullets From The Day

🚫 Biden administration bans Russian antivirus software. It will ban Kaspersky Lab’s antivirus software due to national security concerns over its close ties to the Russian government. Sources anticipate the ban will be announced on Thursday, preventing it from conducting new U.S. business 30 days after the restrictions are published (among other restrictions). The decision comes after a two-year probe by the Department of Commerce, which began investigating the company after Russia’s invasion of Ukraine. The Verge has more.

💸 Elok Musk tries to win back X advertisers. The billionaire has realized that telling advertisers to f— off wasn’t the smartest idea, as he went to the South of France this week to attend Cannes Lions, the world’s largest advertising festival. He’s striking a starkly different tone amid floundering X revenues, but his non-brand-friendly behavior and that of users on the platform are keeping many major advertisers on the sidelines. More from CNN Business.

♻️ Amazon takes a major step towards sustainability. The consumer tech giant will remove roughly 15 billion plastic cushions annually from its shipping process and use 100% recycled paper materials by the end of the year. Roughly 95% of plastic air pillows have already been replaced in its North American shipments, but this year, it’s finally closing the gap. Axios has more.

Links That Don’t Suck

💪 Free access is over, but you can still power your portfolio with Leaderboard––6 weeks is just $59*

🥵 Fossil fuel use and emissions hit record highs as world struggles with deadly heat, storms and fires

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: Paid endorsement for Public Investing, member FINRA/SIPC. Rebate rates vary from $0.06-$0.18 per contract depending on time of enrollment and number of referrals you make. Rates are subject to change. See terms & conditions of the Options Rebate Program. Investors must review the Options Disclosure Document (ODD). Options are risky and not suitable for everyone. See Fee Schedule and Options Rebate & Referral T&Cs: https://public.com/disclosures. Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.