NEWS

Stocks Remain Sticky Ahead Of CPI

Bears are trying to keep U.S. stock market indexes down but have failed to see meaningful follow-through. With inflation data and FOMC Minutes on deck for tomorrow, traders anticipate that may be the catalyst to get stocks out of their non-directional slog. Let’s see what you missed. 👀

Today's issue covers Tilray topping out after earnings, Moderna’s potential comeback, and the Nasdaq 100’s “do or die” moment. 📰

Here's today's heat map:

9 of 11 sectors closed green. Real estate (+1.27%) led, & financials (-0.57%) lagged. 💚

The RealClearMarkets/TIPP economic optimism index fell 0.70% in April, remaining in negative territory for the 32nd month in a row. Confidence among non-investors, or those who don’t own as many assets, ticked down as inflation picked back up in the real economy. ☹️

U.S. small business optimism also hit an 11-year low, with a quarter of respondents citing inflation via higher input and labor costs as their most pressing issue. 🔺

Boeing closed near 52-week lows after its quarterly airplane deliveries (83) fell 47% QoQ and 36% YoY due to its recent safety crisis. Additionally, the Federal Aviation Administration (FAA) said it’s investigating new whistleblower warnings about the company’s 787 jets. ⚠️

Alphabet shares made new all-time highs after the company unveiled custom Arm-based chips meant to help it keep pace with rivals Amazon and Microsoft in the cloud computing space. 🌤️

BlackBerry shares rebounded 8% after announcing a partnership with Advanced Micro Devices on robotics systems. 🤖

And Lucid Motors’ shares latched onto its all-time lows as the company beat first-quarter delivery estimates. Price cuts helped boost demand, but that obviously raises concerns about margins and its path to profitability. 🚗

Other active symbols: $ALCC (-11.78%), $SOFI (+1.68%), $DXYZ (-35.87%), $ACRV (+62.77%), $BMR (+20.97%), $MDIA (+42.05%), & $LASE (+81.12%). 🔥

Here are the closing prices:

S&P 500 | 5,210 | +0.14% |

Nasdaq | 16,307 | +0.32% |

Russell 2000 | 2,081 | +0.34% |

Dow Jones | 38,884 | -0.02% |

EARNINGS

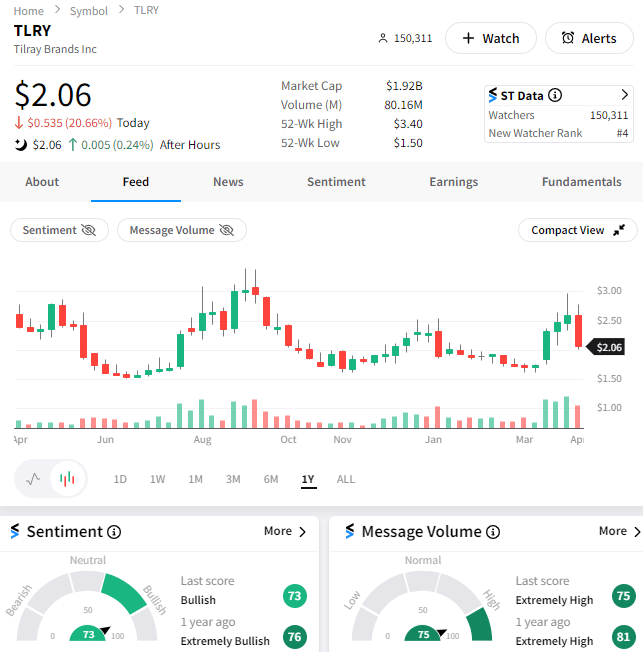

Fundamentals Trump Hype In Tilray

Marijuana stocks have been on a run recently in hopes that the U.S. could make changes to cannabis legislation at the federal level. 🥦

High short interest makes these stocks susceptible to short squeezes anytime good news (or rumors) hit the market. But that also makes them vulnerable to aggressive selling when the news isn’t so great, as Tilray shareholders were reminded of today. 😬

The cannabis producer released fiscal third-quarter earnings before the bell. A $0.12 per share loss was $0.05 wider than expected, while net revenues also fell short of expectations at $188.30 million vs. $198.30 million.

Its forward outlook wasn’t much better, lowering its earnings before interest, tax, depreciation, and amortization (EBITDA) guidance from $68-$78 million to $60-$63 million. 🔻

Additionally, the company no longer expects to generate positive adjusted free cash flow for the fiscal 2024 year due to the delayed timing of collecting cash on its asset sales.

Overall, Tilray has the largest share of recreational sales in Canada and operates in Germany, which recently allowed recreational cannabis sales. But Canadian producers don’t currently sell marijuana in the U.S., where it remains illegal under federal law. 🚫

As a result, Tilray and other players lack a clear growth driver in the near term and are leaving their long-term business prospects tied up in the U.S. legal system. It’s not a bet many investors are willing to continue making, especially with how poorly these stocks have performed.

Still, some investors are still holding onto their hopes. Stocktwits community sentiment ticked up into bullish territory today as message volume surged, showing continued conversation and debate around Tilray and its peers. 🤺

Only time will tell who is right. But for now, earnings season is proving to be a tough hurdle for cannabis stocks to maintain their “high” through. 😶🌫️

COMPANY NEWS

Can Moderna Make A Comeback?

Vaccine maker Moderna was back on traders’ and investors’ radars today on news that its cancer vaccine could treat more than just melanoma. 👀

The company’s presentation to the American Association for Cancer Research showed that its cancer vaccine exhibited a greater overall survival rate in a trial of patients with HNSCC when combined with Merck’s Keytruda vs. just taking Keytruda alone.

Fundamental analysts said that although the data compares favorably to the Keytruda monotherapy studies, the key debate remains whether Moderna can file for accelerated approval for adjuvant melanoma as it continues to enroll patients in Phase 3 confirmatory trial. 🧪

As for technical analysts, they’re paying close attention as the stock returns to the “scene of the crime” where shares originally broke down in July 2023. The 115-120 level has been a pivotal area for the stock, and with today’s 6% rally, shares are setting up for another test of this area. ⚔️

Retail investors are traders are certainly taking the news in a positive light, potentially expecting the recent run to continue. Stocktwits sentiment reached bullish territory while message volume and the breadth of users participating in the conversation surged. 🐂

We’ll have to wait and see if they’re right. But for now, there remain clear fundamental and technical reasons for bulls and bears to be watching Moderna.

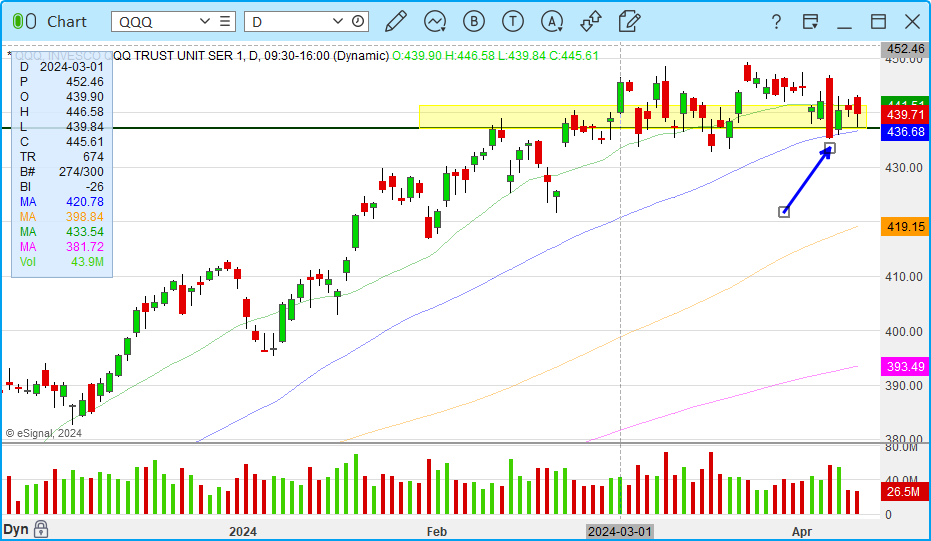

STOCKTWITS “CHART ART”

Nasdaq 100 Settles Into Its 50-Day Moving Average

If you liked this chart and commentary, you’ll love our new “Chart Art” newsletter, which officially launched today. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

To sweeten the deal for early subscribers, we’ve got two bonuses. 🎁

Receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Subscribe during April to be entered to win 1 of 5 Stocktwits Edge annual subscriptions.

Bullets From The Day

🤩 “Dude Perfect” is the latest influencer group to score a major investment. In the ever-reaching search for returns, billions of dollars are being deployed outside of the traditional media space with an unusual cast of characters leading the way. The popular YouTube group has secured a nine-figure investment of $100-$300 million from private investment firm Highmount Capital. The trick-shot team has dubbed its future “Dude Perfect 2.0,” which includes everything from opening a retail store and launching a streaming platform to a $100 million theme park. CNBC has more.

🕵️♂️ AI disinformation detection startup raises $20 million. The AI-powered social media monitoring platform Alethea Group has secured a Series B investment led by Google Ventures. It’s one of the few cybersecurity firms able to raise money in the current environment but sees an opportunity to play a critical role ahead of the 2024 U.S. elections. Founded in 2019, the company searches through online chatter to detect foreign influence operations launched against its clients. More from Axios.

🚕 GM relaunches Cruise robotaxis with a twist... Nearly five months after pausing operations and pulling its entire U.S.-based fleet, the automaker is redeploying robotaxis in Phoenix. However, this time, they’ll be accompanied by a human driver who will help their autonomous vehicles create maps and gather road information in certain cities. After last year’s incidents renewed regulator scrutiny on the company and the entire industry, it’s shifting away from its aggressive growth tactics and getting back to basics. TechCrunch has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍