NEWS

The Stream Watched Around The World

Roaring Kitty’s making his YouTube return tomorrow via live stream, with the news propelling GameStop higher and his position past the $500 million mark. Elsewhere, investors are awaiting tomorrow’s jobs data as they try to forecast when the U.S. will join the rate-cutting club. Let’s see what you missed. 👀

Today's issue covers the latest GameStop saga update, Big Lots’ big problems, and more from the day. 📰

Here's today's heat map:

7 of 11 sectors closed green. Consumer discretionary (+0.73%) led, & utilities (-1.04%) lagged. 💚

The European Central Bank (ECB) delivered on its promise and cut interest rates for the first time since 2019, even as ECB president Christine Lagarde warned inflation will likely remain above the 2% target “well into next year.” ✂️

Salesforce jumped 3% on news that board member and co-CEO of activist investor ValueAct, Mason Morfit, raised his stake to just under $1 billion. 💰

Instacart shares rose 9% after the company announced a $500 million share repurchase program, as prices remain well below their post-IPO highs. 🛒

Customer engagement platform provider Braze soared 14% after reporting a narrower-than-expected loss and revenues that beat expectations. 📲

Rivian shares jumped 3% after sharing its new all-electric R1 pickup and SUV redesign, which includes Nvidia chips and improved performance. 🔋

Other active symbols: $AMC (+12.43%), $NVAX (-6.75%), $FFIE (+2.35%), $LPA (+48.99%), $NIO (-6.83%), & $VNDA (+24.16%). 🔥

Here are the closing prices:

S&P 500 | 5,353 | -0.02% |

Nasdaq | 17,173 | -0.09% |

Russell 2000 | 2,049 | -0.70% |

Dow Jones | 38,886 | +0.20% |

STOCKS

“You Know What’s Cool…A Billion Dollars”

After leaving us hanging since Monday, Keith Gill (AKA Roaring Kitty) reemerged on the scene this afternoon by scheduling a YouTube live stream for tomorrow at 12:00 pm ET. 🍿

While it’s unclear exactly what will be discussed, the mere reappearance of his YouTube presence further ignited retail’s enthusiasm for GameStop and other “meme stocks.” Notably, the video’s description has a huge disclaimer stating clearly that his words/actions/etc. are not investment advice.

However, that’s simply a formality at this point because traders are not paying it any attention. GameStop shares were already up 47% on the day and continue to climb after hours, rising another 20% as of writing this.

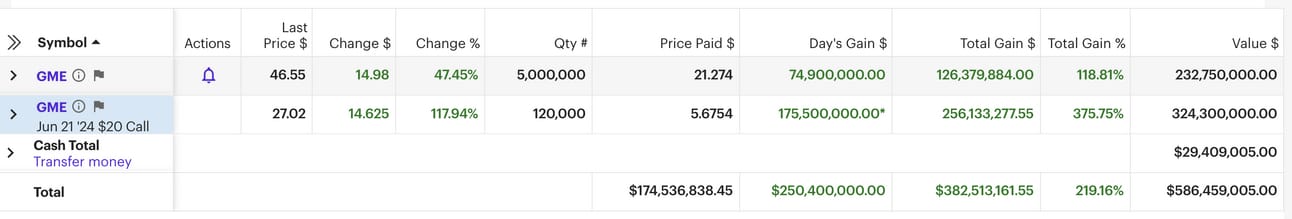

The massive rally has caused Roaring Kitty’s GameStop position to swell to nearly $600 million as of the close (and over $700 million after hours). 🤑

And according to some calculations, if the stock hits $69, his position will be worth a whopping $1 billion. We don’t know what could be more poetic…other than it happening on 06/09 (which is, unfortunately, a Sunday).

At this rate, the stock could hit that level by the time tomorrow’s livestream begins. We’ll have to wait and see what Roaring Kitty’s message is and if he reveals the real reason for his return to the GameStop scene. 🤷

And while we’re on the subject of meme stocks and retail traders, we should mention Robinhood’s $200 million acquisition of crypto exchange Bitstamp. ₿

The move comes as the brokerage looks to capitalize on the recent resurgence of crypto prices and trading volumes, further expanding its exposure to digital assets. With Bitstamp’s 50 active licenses and registrations globally, Robinhood will be better positioned to compete with Binance and Coinbase. ⚔️

While not quite at 2020/2021 levels, it’s clear the market’s animal spirits are alive and well, with market-related businesses looking to make hay while the sun is shining. Speculate responsibly, y’all… 🌞

EARNINGS

Big Lots’ Big Problems Remain

Big Lots’ investors continue to lose their shirts in the stock as the company struggles to attract customers in the current environment. ☹️

The discount home furnishings retailer reported an adjusted loss of $4.51 per share on revenues of $1.01 billion. That was materially worse than the $3.92 per share loss and $1.04 billion anticipated by Wall Street.

Comparable store sales aligned with expectations, falling 10% YoY, with its core customers continuing to pull back on discretionary goods spending. 🔻

We've heard the same story from the company for many quarters, and management has failed to offer a clear turnaround plan. Like other struggling retailers, it’s been cutting costs, but it needs to see its sales stabilize and begin growing if it has any hopes of survival.

Shares plunged to a 33-year low today, with the Stocktwits community remaining “extremely bullish” on the stock…probably on hopes that it can reach “meme stock” status and begin to squeeze. Other than that angle, it’s not clear why investors are still holding onto this company’s shares. 🤷

SPONSORED BY OUR FRIENDS AT PUBLIC.COM

A Brand New “Trends With Friends” 🍿

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

Bullets From The Day

🕵️ U.S. antitrust regulators go after Microsoft, OpenAI, Nvidia, and other artificial intelligence (AI) players. The Federal Trade Commission (FTC) and Department of Justice (DOJ) are preparing to open antitrust investigations into the three companies, assessing their influence on the AI industry. The investigations will reportedly focus on the companies’ conduct rather than mergers and acquisitions. CNBC has more.

◀️ FDA reverses its ban on Juul e-cigarettes. The Food and Drug Administration (FDA) announced a reversal of its ban on Juul e-cigarettes while reviewing new court decisions and considering updated information provided by the vape maker. While the FDA ordered the company to stop selling its products in 2022, they’ve stayed on shelves as it appealed, with Juul maintaining its status as the number 2 e-cigarette maker in the U.S. Still, the FDA’s latest review does not mean it will be fully cleared, only that it‘s being reconsidered. More from NBC News.

🚫 eBay drops American Express over its “unacceptably high” fees. The online auction platform will no longer accept AMEX payments beginning on August 17th, blaming elevated fees for AMEX credit card transactions as the core driver of the decision. In its notice to customers, eBay appealed to regulators, saying more needs to be done to drive greater competition in credit card networks and help reduce transaction processing costs. The Verge has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍