NEWS

Surprise…Nvidia Beat Estimates Again

Concerns about the path of rates put pressure on stocks going into Nvidia’s earnings, but prices bounced back after the tech giant’s results once again beat expectations. Notably, today was one of the first days I can recall where Stocktwits sentiment for the four major indexes was in bearish or extremely bearish territory. Let’s see what else you missed. 👀

Today's issue covers Nvidia topping $1,000 per share after earnings, a rough day for retailers like Target, and presidential candidates’ continued obsession with meme stocks. 📰

Here's today's heat map:

4 of 11 sectors closed green. Technology (+0.22%) led, & energy (-1.92%) lagged. 💚

The Federal Open Market Committee (FOMC) Minutes were released today and indicated concern among members about inflation’s lack of downward progress. While a rate hike is unlikely, it’s becoming increasingly likely that the “higher for longer” period of interest rates may be even longer than the market (or Fed) believed at the start of the year. 😱

U.S. existing home sales fell 1.90% MoM and YoY during April, even as inventories rose 9% MoM and 16% YoY to a 3.5-month supply. With that said, the median price was $407,600, which represents a 5.70% YoY increase. 🏘️

Meanwhile, homebuilder Toll Brothers fell 9% from all-time highs despite beating earnings and revenue expectations. It raised full-year guidance, though broader concerns about the housing market dragged the luxury builder lower. 🔻

Pfizer popped 4% after announcing a new cost-cutting program designed to save $1.50 billion by 2027. These new operational efficiencies are in addition to another $4 billion cost-cutting effort announced last year. ✂️

Software stock Snowflake rose 4% after reporting a current-quarter beat and full-year revenue outlook that topped analyst estimates. The top-line optimism was enough to offset its adjusted earnings per share miss. ❄️

Chipmaker Analog Devices jumped 11% after second-quarter earnings and revenues topped expectations. LiveRamp Holdings soared 16% after the ad-tech platform’s fourth-quarter revenues and guidance topped expectations. 📈

And solar stocks continued their surge, with First Solar catching another upgrade from UBS as investors became increasingly optimistic that artificial intelligence (AI) power demand will drive interest in renewable energy. 😎

Other active symbols: $AMC (+8.82%), $GME (-4.52%), $NVAX (+5.30%), $FFIE (-19.42%), $MGOL (-7.20%), & $BNED (+109.22%). 🔥

Here are the closing prices:

S&P 500 | 5,307 | -0.27% |

Nasdaq | 16,802 | -0.18% |

Russell 2000 | 2,082 | -0.79% |

Dow Jones | 39,671 | -0.51% |

EARNINGS

Nvidia’s Never Going Down Again

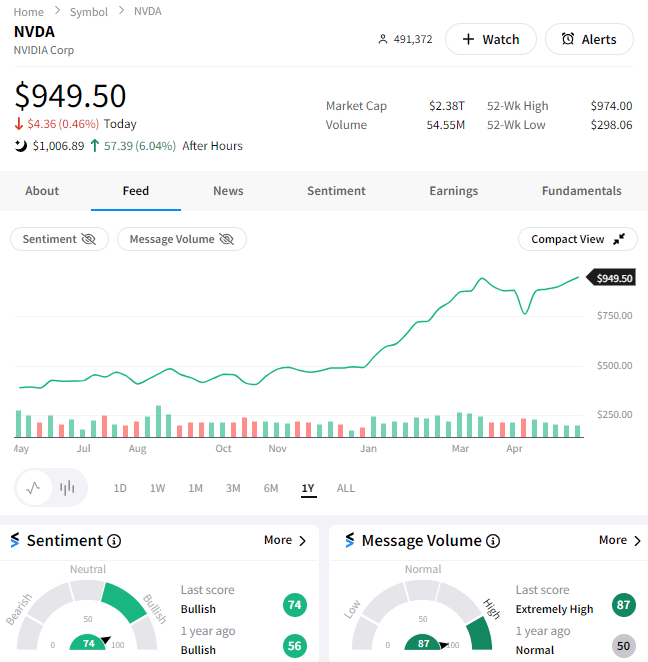

Or that’s certainly what the sentiment feels like right now as the stock eclipses $1,000 per share. Let’s see the key takeaways from today’s earnings report. 👀

The chipmaker’s adjusted earnings per share of $6.12 topped the $5.59 expected, while revenues of $26.04 billion were also ahead of the $24.65 billion consensus estimate.

Management is expecting $28 billion in current-quarter revenues, once again beating the $26.61 billion anticipated by Wall Street. 🔮

Data center revenues were up a whopping 427% YoY, with overall revenue rising 262% YoY and EPS jumping 560% YoY. Remember, this is a multi-trillion-dollar company we’re talking about. These types of growth rates are not supposed to be possible…and yet the company continues to deliver.

Additionally, the company announced a 10-for-1 stock split and will begin trading on a split-adjusted basis on June 10th. That, combined with a 150% increase to its (albeit very small) dividend, should be more than enough to continue broadening its investor base. 😮

At this point, the question many are asking is: Who doesn’t own Nvidia? And where will the incremental demand for the stock come from to support current prices?

Despite those being valid questions, the stock soared to new heights as celebrity CEO Jensen Huang began to speak on the conference call. 🤩

Some soundbites sure to make headlines are:

The industry is going through a major change; the next industrial revolution has begun.

We will see a lot of Blackwell revenue this year.

After Blackwell, there’s another chip. We’re working on a 1-year rhythm.

We’re not just making good looking powerpoints, we’re actually building stuff at scale

“AI factories” another buzzword investors and analysts are keeping on their radar nowadays. Nonetheless, Jensen’s words were enough to keep investors’ questions at bay and focus on an optimistic future. 🏭

Clearly, the company cannot continue this growth rate forever at its massive scale, but betting on when growth will slow remains a tough game to play. For now, the momentum remains in favor of the bulls. And until there’s a meaningful shift in stock (or business) momentum, many expect the path of least resistance to remain higher.

Nvidia shares are up 6% after the bell, trading at just over $1,000. Meanwhile, Stocktwits community sentiment remains in “extremely bullish” territory as we wait to see how shares trade tomorrow. 🐂

Lastly, a quick shout-out to everyone who joined us on the $NVDA stream today to test out our new “Live Earnings Call” feature, where you can listen to the call and chat with the rest of the Stocktwits community in real-time. 🎧

Our team is super excited about this feature and can’t wait to roll it out more broadly in the weeks and months ahead. Stay tuned! 👍

SPONSORED

Maximize your options profits (and minimize your losses) at Public.com

Heads up, options traders: the investing platform Public.com has a rebate that allows you to buy contracts for less and sell contracts for more. As a member, you could earn up to $0.18 per options contract traded with no commissions or per-contract fees.

"My options trading platform is free, though. How is this better?" While some platforms seem to allow free trades, many charge fees of $1 or more per contract traded. On the other hand, Public offers rebates for trading options—and they can add up fast. In fact, if you trade 500 contracts each month, you can expect to clear almost $1,000 in rebates by the end of the year. In other words, you don't pay money to place options trades; you earn it.

Discover why NerdWallet awarded Public five stars for options trading, and earn up to $0.18 per contract traded with no commissions or per-contract fees.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

A Rough Run For Popular Retailers

While Walmart has done a solid job of navigating the current environment, others in the retail space have not. Let’s see how Target and others fared in the market today after sharing fundamental updates. 👇

Big-box retailer Target’s earnings per share of $2.03 missed expectations by $0.03, while its revenues of $24.53 billion narrowly beat estimates. It’s the first time since November 2022 that the company missed earnings estimates.

Total revenues fell about 3% YoY, with customer traffic falling 1.90% and the average amount customers spent during those visits also falling 1.90%. Digital sales did grow 1.4%, its first YoY increase in over a year. 📊

With that said, same-store sales fell 3.70% as shoppers bought beauty items but less of other discretionary categories like apparel and home.

Unlike Walmart, the company failed to retain (or grow) customer spending on necessities. That’s a key market the company is trying to recapture by lowering prices across 5,000 items and increasing private labeling as it looks to lure shoppers back from discount retailers. ✂️

$TGT shares fell 8%, with Stocktwits sentiment pushing into “extremely bearish” territory on the news.

Athleisure retailer Lulelmon slumped to more than one-year lows after the company announced a restructuring of its product and brand teams. Its Chief Product Officer is also leaving the company later this month. 😱

The company faces increased competition in an already difficult environment for discretionary purchases, creating a double-whammy that management hopes to solve with its new team. The new group will assemble leaders from its Merchandising and Brand functions to scale global and regional go-to-market strategies.

$LULU shares fell 7% on the day, with Stocktwits sentiment pushing into “extremely bearish” territory again. 🐻

North Face owner VF Corp is falling 11% after the bell because its fourth-quarter earnings and revenues missed analyst expectations. Sales declined across its brand as it struggles with tepid demand for apparel and footwear.

Even retailers that are performing well are having a tough time. Williams-Sonoma reversed 11% from all-time highs despite its first-quarter earnings crushed estimates. ☹️

Like other retailers, demand concerns weighed on the stock. Same-store sales were down 4.90% YoY, while revenues fell about 5% YoY. The company reaffirmed its wide-ranged full-year guidance, reflecting management’s continued uncertainty about the current environment.

And lastly, it’s worth noting e.l.f. Beauty posted its first $1 billion year, growing sales 77% YoY. However, shares fell after management said growth would moderate and miss analyst expectations during the current fiscal quarter. 💄

Ulta Beauty CEO Dave Kimbell had already warned that the beauty category was slowing, so this wasn’t a major surprise. But when the stock is trading at all-time highs, hearing management acknowledge it themselves put pressure on the stock. 👎

STOCKS

Another Presidential Candidate Embraces The Meme Stock Movement

While Robert F. Kennedy Jr. wants to embrace the “meme stock” crowd to benefit his political race, former candidate Vivek Ramaswamy is simply looking to make a quick buck. 🤑

Ramaswamy’s Strive Asset Management has reportedly taken an 8% stake in beaten-down media brand BuzzFeed and is seeking to effect a “shift” in the media firm’s strategy.

His filing indicates that he’s “seeking to discuss every aspect of the company’s operations, up to and including an acquisition by a third party, with management.”

Buzzfeed shares, which have already been rising amid the meme stock comeback, soared as much as 85% today before closing up about 20%. The news excited some traders and investors, with Stocktwits community sentiment pushing into “extremely bullish” territory. 🐂

Meanwhile, Donald Trump’s presidential campaign is also looking to tap into the financial market’s—let’s call them…passionate—crowd. It’s vowing to build a “crypto army” by accepting cryptocurrency donations. ₿

It’s the former president’s latest move to court the crypto crowd by opposing “socialistic government control” over financial markets.

Funnily enough, while his campaign will accept any cryptocurrency, it’ll be processed through Coinbase. Using a centralized platform to court the decentralization crowd makes as much sense as anything these days… 🤷

Bullets From The Day

☹️ Synapse bankruptcy is a fintech nightmare. A dispute between fintech startup Synapse and its banking partners has left millions of Americans without access to their money for nearly two weeks. Synapse serves as a middleman between customer-facing fintech brands and FDIC-backed banks but has had disagreements with several partners about how much in customer balances it owes. The “banking as a service” provider has roughly 10 million ‘end users awaiting clarity on how this will be resolved. CNBC has more.

💳 U.S. regulator rules buy now, pay later (BNPL) firms must comply with credit card laws. The Consumer Financial Protection Bureau (CFPB) declared today that customers using the BNPL firms’ offerings have the same federal protections as users of credit cards. Its new “interpretive rule” deemed the decades-old Truth in Lending Act will apply to BNPL firms like Affirm, Klarna, and PayPal going forward. More from CNBC.

🤖 Amazon is giving Alexa an overhaul but also increasing its price. The tech giant is planning to unveil a newer version of its decade-old voice assistance this year and will charge a monthly fee that won’t be included in Amazon Prime subscriptions. The news comes as OpenAI reveals its own chatbot that can have two-way conversations, while Alexa is still widely used for simple tasks like setting timers, announcing the weather, etc. Amazon declined to answer, though the reports are interesting, given it cut several hundred jobs in its Alexa division about six months ago. CNBC has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: Paid endorsement for Public Investing, member FINRA/SIPC. Rebate rates vary from $0.06-$0.18 per contract depending on time of enrollment and number of referrals you make. Rates are subject to change. See terms & conditions of the Options Rebate Program. Investors must review the Options Disclosure Document (ODD). Options are risky and not suitable for everyone. See Fee Schedule and Options Rebate & Referral T&Cs: https://public.com/disclosures. Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.