Presented by

CLOSING BELL

Taco Turn-around 🌮

Happy Wednesday, markets climbed after tariff threats went out the window during U.S. talks in Davos, Switzerland.

President Trump made concessions on his Denmark takeover plan: he wouldn’t use force, he wouldn’t instate new punishing tariffs, and he told CNBC that he and NATO have laid out the concept of a framework plan. It sounded like a line we have heard before, but it was what the market needed to hear to come roaring back.

Today’s RIP: Earnings pile up, hot stocks and ones to watch, podcast hype, and more.

AFTER THE BELL

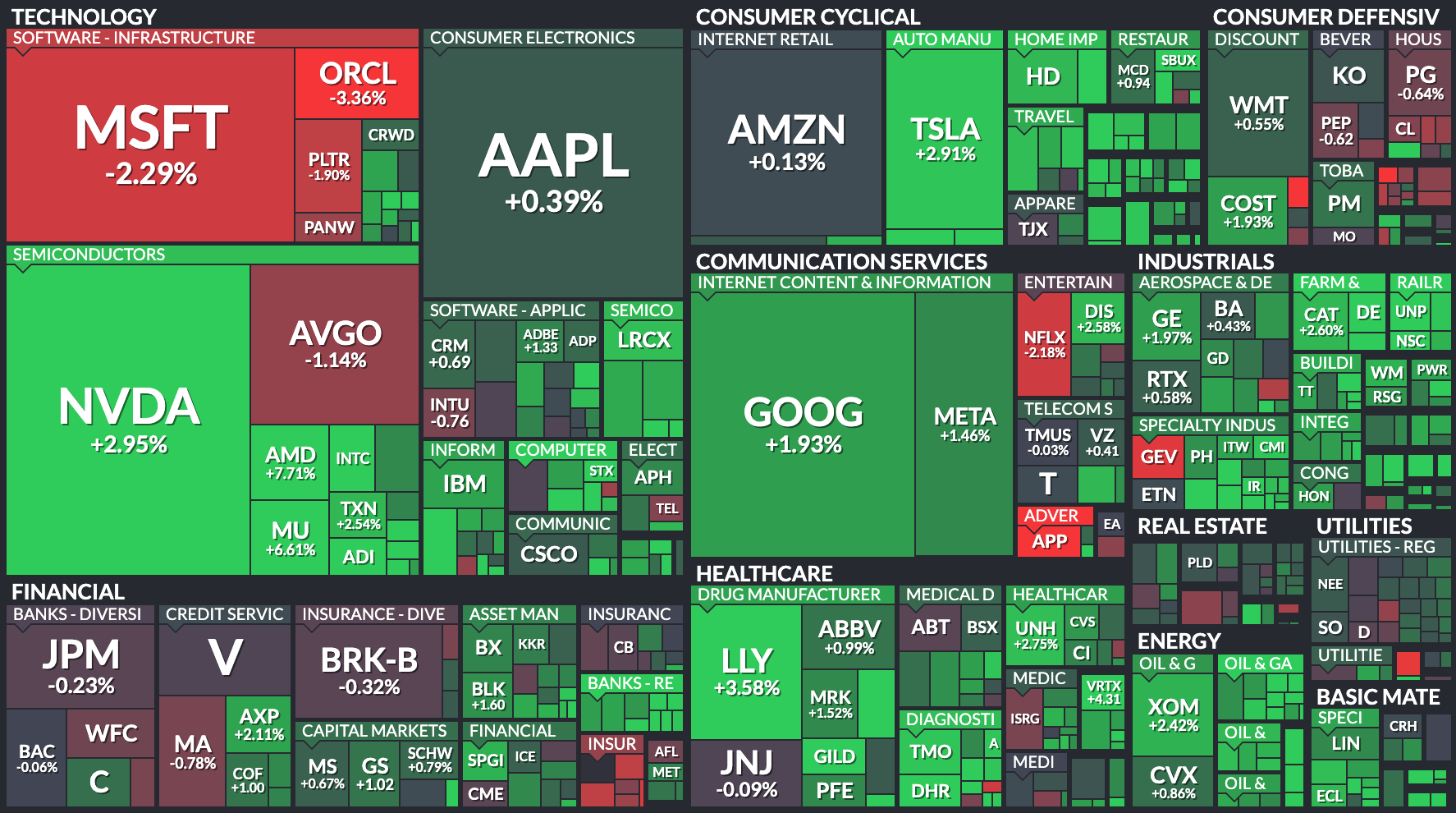

Davos Turned The Market Green 💚

Markets started the day red: Europeans, uncomfortably familiar with foreingers seazing land, said they would suspend the EU trade deal reached over the summer as tensions escalated. The “sell America” trade then turned into a “buy back in” trade Wednesday when Trump eased off the gas pedal toward trade war.

At home, earnings are churning out, with Netflix falling after missing forward-looking margin expectations. Intel flew as chips roared back, hitting a four-year high before its Thursday report.

Apple said it would finally join the AI chat world, updating Siri this year into a more modern chatbot, with back-and-forth conversation abilities like ChatGPT and Google’s Gemini. Two years after the announcement of Apple Intelligence, what was holding Apple back from updating such a core feature in its products?

Jamie Dimon of JPMorgan said the White House 10% APR cap that was supposed to launch yesterday was a terrible idea, better tested in Bernie Sanders and Elizibeth Warrens hometowns than on a national stage. Trump said he would push it in Congress, which can barely pass budgets. 🌮

Citadel’s Ken Griffin warned listeners at Davos that the Japanese bond sell-off is an ‘explicit warning’ of what will happen if the U.S. does not improve its finances.

The Supreme Court heard arguments on the possible firing of Fed Governor Cook, and even conservitive Justices seemed to poke holes in the idea. Brett Kavanaugh said it would all but guarantee the Fed chair’s change every four years, with each new president.

SPONSORED BY WIGWAM

Stop Storing Crypto on Exchanges — Take Control with Wigwam

Are you still storing crypto on exchanges, or planning to buy your first tokens? In both cases, Wigwam is the right solution.

Keeping tokens on exchanges comes with serious risks: account freezing, blocked withdrawals, penalties, or centralized decisions. Exchanges are also frequent hack targets — for example, in February 2025 Bybit lost over $1.4B in a hack, and Upbit previously lost millions.

Wigwam is a self-custodial wallet, which means only you control your funds. It uses advanced MPC security, where critical data is stored in several places and combined only when you sign in. Your private data is never stored in one location.

All assets and transactions are handled directly on the blockchain, without intermediaries. You can buy or withdraw crypto using cards, access decentralized exchanges, stake USDT for rewards, and earn points that can later be exchanged for crypto or USDT.

Wigwam is a self-custodial wallet. You are fully responsible for keeping access to your account safe and for understanding the risks of trading in Web3.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Reports Are Heating Up. Or, At Least The Frequency of Filings Is 🤷

Wednesday’s session featured a heavy slate of earnings from across the Dow and regional banking sectors. While several companies posted record profits, the "sell the news" sentiment lingered, as investors scrutinized 2026 guidance and credit quality.

Healthcare & Industrial Leaders

Johnson & Johnson $JNJ ( ▲ 0.71% ) Shares fell after a mixed Q4. While revenue beat expectations at $24.6 billion (up 9.1%), adjusted EPS of $2.46 missed the $2.53 consensus. Strong growth in Oncology (Darzalex) and MedTech was offset by a nearly 50% plunge in Stelara sales due to biosimilar competition, and 2026 guidance was viewed as conservative. 🏥

Travelers $TRV ( ▲ 0.01% ) The standout performer of the morning, TRV shares edged higher after a massive blowout. The insurer reported an EPS of $11.13, crushing the $8.74 estimate, on revenue of $12.43 billion. A 26% jump in core income and record underwriting results showcased the company's ability to stay ahead of inflationary pressures.

Financials & Real Estate

Charles Schwab $SCHW ( ▲ 0.4% ) Schwab shares fell at first after a revenue miss of $6.34 billion (vs. $6.38B expected). Despite the miss, the firm celebrated the completion of the TD Ameritrade integration and record assets of $11.9 trillion. Net interest margin (NIM) recovery to 2.90% suggests the "cash sorting" headwinds that plagued the stock for two years have finally stabilized. 📊

Ally Financial $ALLY ( ▲ 1.35% ) Shares initially tumbled despite an earnings beat of $1.09 EPS (vs. $1.03 estimate). The sell-off was driven by cautious 2026 guidance and ongoing concerns about auto-loan credit quality, overshadowing a new $2 billion share repurchase program and record consumer loan originations.

Energy & Services

Halliburton HAL $HAL ( ▲ 1.56% ) shares rose as the company delivered a "beat-and-raise" quarter. Adjusted EPS of $0.69 significantly outperformed the $0.54 forecast.

After the bell, Kinder Morgan $KMI ( ▼ 0.03% ) climbed slightly after delivering a decisive "beat-and-raise" fourth quarter. Driven by record-breaking performance in its natural gas pipeline business, the company posted an adjusted EPS of $0.39, comfortably topping the $0.36 analyst estimate.

HOT STOCKS

Stocktwits Watchlist & Hot Stocks

There are so many moving stocks today, we are splitting this section in two: top trending stocks on Stocktwits, and notable top stocks moving in the market:

Watchlist Winners

PAVmed $PAVM ( ▲ 8.82% ): Shares doubled after subsidiary Lucid Diagnostics secured a pivotal national VA contract for its EsoGuard DNA test, opening access to 9 million veterans. 🧬

Namib Minerals $NAMM ( ▼ 1.68% ): This penny stock leader skyrocketed on a technical short squeeze and renewed expansion plans for its Zimbabwe gold operations. ⛏️

Boxlight Corp $BOXL ( ▲ 12.25% ): Massive retail volume triggered a speculative rally as the stock attempted to reclaim key resistance following a recent reverse split. 🏫

ImmunityBio $IBRX ( ▲ 17.5% ) : Retail sentiment remains extremely bullish as the company nears full enrollment for its pivotal bladder cancer trial and an FDA filing. 📈

SanDisk $SNDK ( ▼ 4.2% ) : The stock hit nearly $500 as Citi raised its price target, citing insatiable data center demand for NAND flash memory. 💾

Gold +1%: Safe-haven demand pushed gold toward the $5,000 milestone today as investors hedged against global trade instability and tariff fears. 🪙

Top Gainers & Losers

$LCID ( ▲ 5.09% ) : Shares led the market higher as production for the Gravity SUV ramps up alongside a long-term robotaxi partnership with Uber. ⚡

$AMD ( ▲ 8.77% ) : The chipmaker surged after being named a "Top Pick for 2026" by KeyBanc due to a sell-out in server CPU capacity. 💾

$DDOG ( ▲ 1.77% ) : Strong customer retention and a favorable 2026 cloud-infrastructure outlook from Bernstein fueled a significant price rebound. 📊

$OXY ( ▼ 0.92% ) : Production growth and a beat in the midstream sector following the CrownRock integration supported a steady climb. 🛢️

$IONQ ( ▲ 2.73% ) : Shares suffered a sharp technical pullback as investors rotated out of high-growth quantum names following recent market volatility. 📉

POPS & DROPS

Top Stocktwits News Stories 🗞

Brand Engagement Network (BNAI) surged over 61% in pre-market trade after finalizing a strategic partnership with Valio Technologies to launch an AI licensing framework across Africa.

Nvidia rose as investors reacted to easing trade tensions and strong AI-related sentiment following the Davos forum.

Microsoft was in focus following reports of widespread service outages for Microsoft 365, including Teams and Outlook.

Dollar Tree fell 3% after BNP Paribas warned of slowing sales momentum and downgraded the stock.

Apple rose following reports that it plans to overhaul Siri into an AI chatbot, code-named "Campos," to be revealed this June.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Trump at Davos Sparks Safe-Haven Rush: Gold, Commodities, Tariffs & Fed Chair Watch

Welcome back to StocktwitsTV.

\Host Michele Steele is joined by Meghan King (live from London) as markets process a huge wave of “Trump at Davos” energy—tariff threats (10% rising to 25%), Europe’s reaction, and the use of Greenland diplomacy as an economic lever. Meghan explains how foreign policy uncertainty is pressuring equity benchmarks and driving sector rotation into commodities, while an Arctic freeze adds real-world demand pressure—especially in natural gas.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: GDP QoQ (Q3) (8:30 AM), Initial Jobless Claims (8:30 AM), PCE Price Index (10:00 AM), Personal Spending MoM (10:00 AM), Crude Oil Inventories (12:00 PM), 10-Year TIPS Auction (1:00 PM). 📊

Pre-Market Earnings: $GE, $FCX, $PG, $ABT, $MBLY, $NG, $HBAN, $MKC. ☀️

After-Market Earnings: $INTC, $ISRG, $AA, $ALK, $COF, $CSX. 🌙

Links That Don’t Suck 🌐

🏠 Trump pushes for lower rates and ban on investor home purchases in bid to make homes more affordable

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋