NEWS

Tech Sinks As Investors Rethink

It was another topsy-turvy day, with big tech continuing to break down while industrials, energy, asset managers, and other cyclical industries saw continued strength. Traders expect additional volatility with U.S. inflation data and consumer sentiment on deck tomorrow. Let’s see what you missed. 👀

Today's issue covers why airlines are getting no $LUV, Dexcom getting demolished on earnings, and regional bank troubles still rumbling. 📰

Here's today's heat map:

4 of 11 sectors closed green. Energy (+1.73%) led, & communications (-1.15%) lagged. 💚

U.S. durable goods orders plummeted by 6.60% MoM and 10% YoY in June, its sharpest drop since the pandemic. While the transportation sector pulled down the numbers, the “less volatile” nondefense orders fell 127%. 📉

U.S. second-quarter GDP estimates came in at 2.80%, topping the initial forecast of 1.90% and doubling the 1.40% logged during the first quarter. Consumer spending rebounded to 2.50%, along with a rise in inventories. 📦

The largest temperature-controlled warehouse real estate investment trust (REIT), Lineage) rose 3% in its Nasdaq debut, marking the largest IPO of 2024. 🤑

Aerospace and defense giant Raytheon soared 8% after earnings and revenue topped forecasts, while Northrop Grumman rose 6% after its beat and raise. 🛡️

Industrial giant Honeywell fell 5% after weak guidance overshadowed its second-quarter earnings beat. Dow Chemical dipped on a top and bottom-line miss. 🔻

Stellantis shares fell 8% after reporting a 48% decline in first-half net profit, citing weak U.S. sales. It says it’s ready to drop brands to fix its U.S. problems. 🚗

Nasdaq stock jumped 7% to 18-month highs after earnings and revenue topped expectations. Software stock ServiceNow also made new highs after raising its full-year outlook and soaring 13%. 💸

Lululemon shares lost another 9% after three Wall Street analysts downgraded the apparel firm, citing a category slowdown and management issues. 🧘

Online course provider Coursera surged 21% after a second-quarter revenue beat outweighed the $0.15 per share loss it posted. 🧑🏫

Bally stock rose 25% after hedge fund Standard General agreed to buy the casino company for $18.25 per share, valuing it at $4.60 billion. 🎰

And Deckers Outdoor rose 10% after its first-quarter earnings and revenues topped estimates due to continued strength in its Hoka and UGG brands. 👟

Here are the closing prices:

S&P 500 | 5,399 | -0.51% |

Nasdaq | 17,182 | -0.93% |

Russell 2000 | 2,223 | +1.26% |

Dow Jones | 39,935 | +0.20% |

EARNINGS

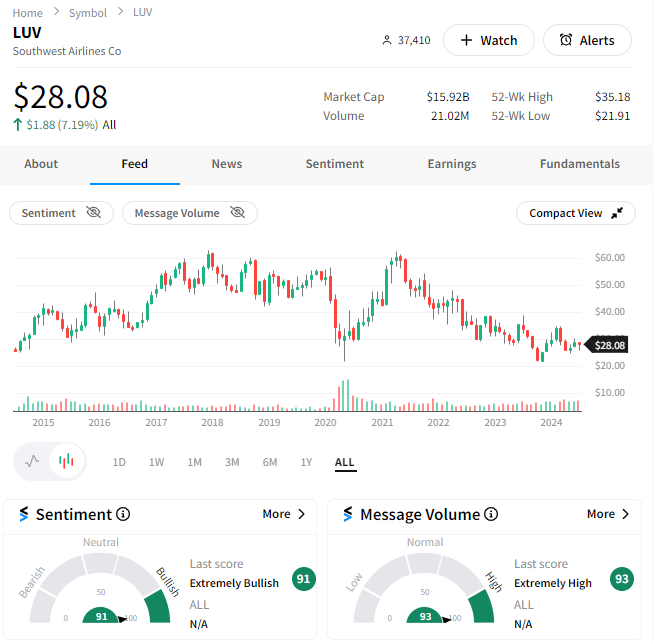

Investors Are Still Giving Airlines No $LUV

Despite record levels of U.S. and international travel, airlines have struggled to capitalize on the surge of customers…causing investors to punish their shares. The negative news continued today, but the stocks saw a brief bid, begging the question of whether a bounce is ahead. ✈️

American Airlines’ results were again weighed down by excess domestic flight capacity, which caused lower-than-expected ticket prices.

The company’s CEO said profits fell 46% YoY to $1.01 per share, with revenue ticking up 2% YoY to $14.33 billion. In addition to lower ticket prices and external factors, the company’s direct-to-consumer sales strategy, which it adopted in 2023, failed to generate the expected results. ⏪

That strategy mishap will cost the airline $1.50 billion in revenue this year, even as it works to reverse its decision quickly. It now expects third-quarter revenue to fall as much as 4.50% and adjusted earnings per share well below its own forecast and Wall Street’s expectations.

Notably, the shares rebounded today after an initial decline, but Stocktwits sentiment remains in “extremely bearish” territory as retail investors bet against the company’s turnaround. 🐻

Meanwhile, Southwest Airlines is abandoning 50 years of tradition by getting rid of its “open seating” policy, which surveys showed 80% of its customers despised. 😮

Beginning next year, it will offer extra legroom seats on its planes and plan overnight flights to better meet customer demand and boost revenues. With customers taking fewer short-haul trips, the importance of an assigned seat goes up…hence the growth in premium product growth across the industry.

With that said, it’s not changing its beloved “two free checked bags” policy, citing it as the number one reason customers choose Southwest over competitors (besides fares and schedule). 🧳

While the airline is fighting for relevance in a competitive market, its management is also trying to stave off activist investor Elliott Investment Management (and others) calling for leadership changes.

Shares fell and quickly reversed into the green to close higher today. And unlike American Airlines, retail investors appear interested in giving this turnaround story a shot as Stocktwits sentiment hit a one-year high. 🤔

A MODERN INVESTOR CONFERENCE

Unlock The Latest Trends In Investing & Alternative Data 🔓

Stocktoberfest is back with an intimate event for executives, influencers, and the most active investors in financial markets. 🤝

Network with industry thought leaders like Howard Lindzon, Michael Batnick, Brian Shannon, Michael Parekh, and many more during the 2-day palooza.

Space is going quickly so grab your seat now, and we'll see you in beautiful Coronado, CA! 😎

EARNINGS

Dexcom Demolished After Earnings

Diabetes management company Dexcom was demolished in after-hours trading, falling close to 40% after a revenue miss and weak guidance. 😱

Adjusted earnings per share of $0.43 topped the $0.39 expected, while revenue of $1 billion was $40 million shy of expectations. It also ratcheted down its revenue expectations to account for “certain unique items impacting 2024 seasonality.” ⚠️

Dexcom CEO Kevin Sayer attributed current challenges to a restructuring of the company’s sales team, fewer new customers, and lower revenue per user. A tough cocktail to stomach in an environment filled with uncertainty.

Analysts prodded for answers during the conference call, asking whether the surging popularity of GLP-1 weight-loss treatments was having an impact. Management said the company is short a large number of new patients and lost customers with the highest annual revenue per year. 🤔

Overall, management’s inability to clarify the current issues and its plans to fix them caused investors to run for the exits. Stocktwits sentiment is understandably in “extremely bearish” territory, with retail opting not to catch the falling knife just yet.

EARNINGS

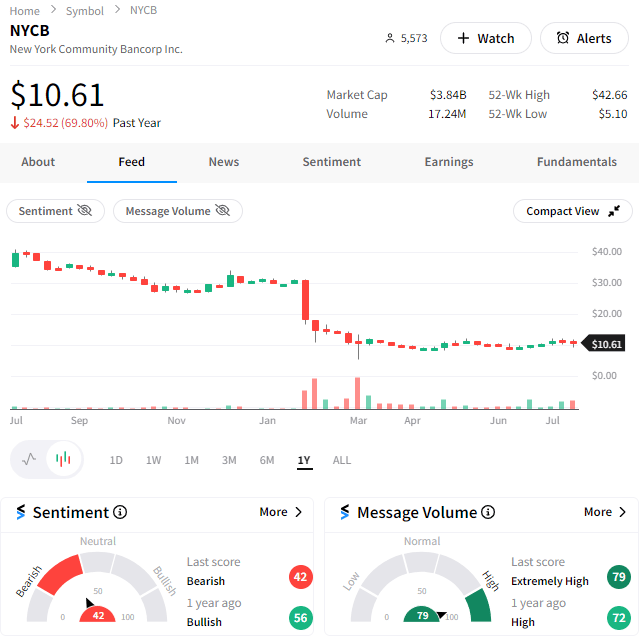

Regional Bank Troubles Rumble

New York Community Bancorp’s shares initially came under serious pressure after earnings but rebounded to close down just 3%. 🙃

The company’s second-quarter loan provision was $390 million, which was much above the consensus estimate of $193 million and raised further concerns about the health of its multifamily portfolio.

The company continues to make efforts to overhaul its balance sheet to address outsized exposure to commercial real estate in New York. CEO Joseph Otting said, “We are focused on transforming the bank into a leading, relationship-focused regional bank.”

Its Flagstar Bank unit will sell its residential mortgage-servicing business to Mr. Cooper Group for $1.40 billion, adding 60 basis points to its common equity tier 1 capital ratio (aka liquidity). 💰

Regional banks have enjoyed a solid rebound lately, hoping for a September rate cut. But once again, earnings season is bringing potential business issues to the forefront, especially at the banks that were most impacted by last year’s regional banking crisis. 🕵️

As for retail investors, Stocktwits sentiment shows investors are bullish on broad exposure to regional banks via ETFs like $KRE but bearish on NYCB and other individual banks viewed as “troubled” on Wall Street. 😵💫

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍