NEWS

Tech Stocks Lead Friday’s Rebound

Source: Tenor

The Trump administration chilled with its tariff talk today, allowing bulls to mount a comeback after three weeks of selling. Hard-hit technology stocks led the charge, with earnings from one quantum computing player boosting the industry. Last Friday was also a positive reversal for stocks, so traders hope no weekend surprises lead to a major selloff on Monday. 👀

Today's issue covers why quantum stocks leaped this week, BNPL giant Klarna’s plans to go public, and more from a busy day on Wall Street. 📰

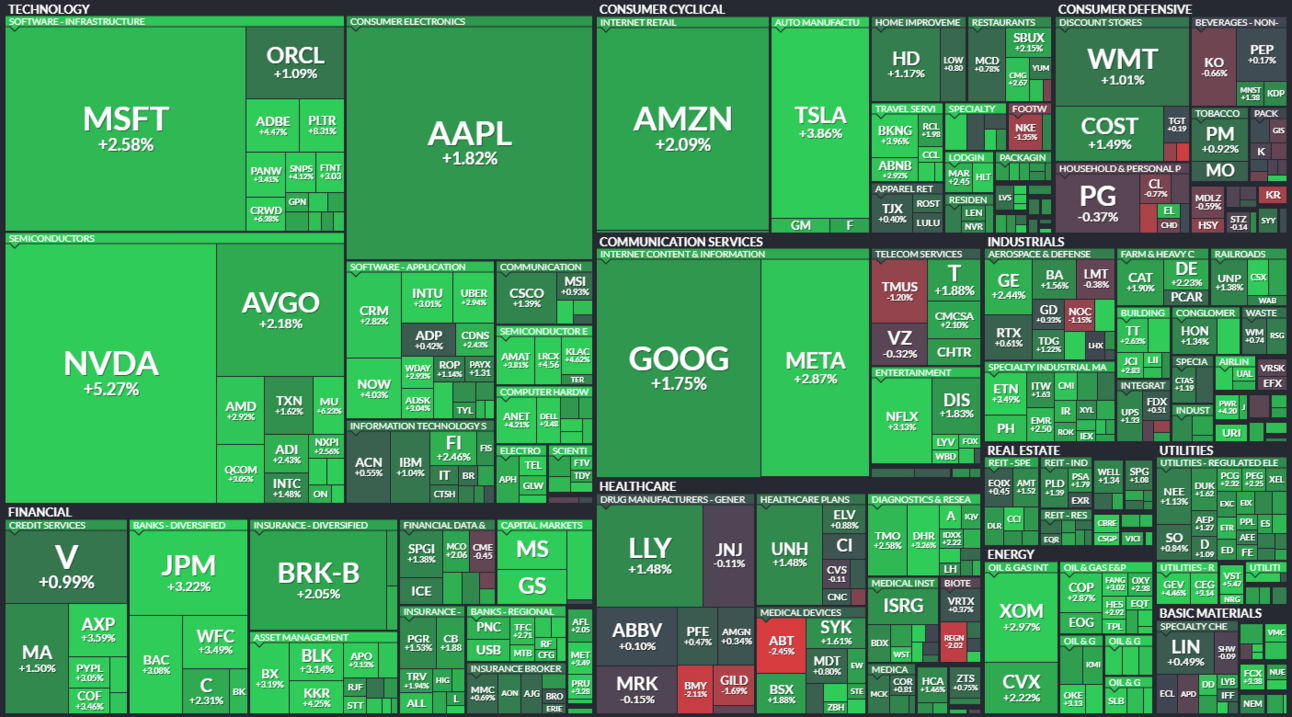

Here’s the S&P 500 heatmap. 11 of 11 sectors closed green, with technology (+3.02%) leading and consumer staples (+0.23%) lagging.

Source: Finviz

And here are the closing prices:

S&P 500 | 5,639 | +2.13% |

Nasdaq | 17,754 | +2.61% |

Russell 2000 | 2,044 | +2.53% |

Dow Jones | 41,488 | +1.65% |

STOCKS

Quantum Stocks Lead Amid Market Rebound 🤖

With Trump taking a break from the tariff talk today, stock market and crypto bulls were able to battle back and recoup some of this week’s losses.

One area that was beaten down during the tech selloff was the quantum computing industry. However, positive earnings results from D-Wave Systems helped its share price nearly double this week and lifted the entire sector with it. 📈

Bookings, a key metric, hit a record of $18.3 million and topped estimates. The company also ended 2024 with a cash position of $178 million, and management expects first-quarter revenue to be nearly 4x higher than the consensus estimate.

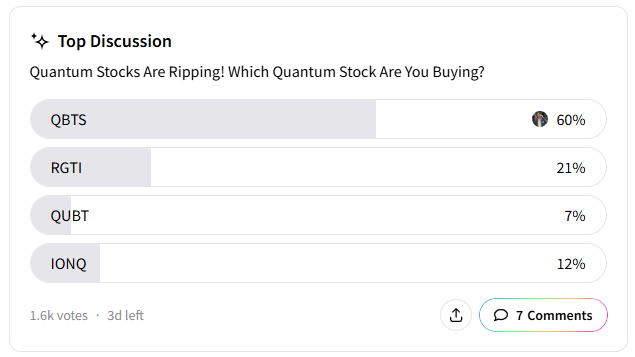

Stocktwits sentiment flipped into overdrive on the move, with investors looking for more upside ahead in the quantum computing space. $QBTS ( ▲ 4.5% ), $RGTI ( ▲ 6.19% ), $QUBT ( ▲ 7.65% ), $IONQ ( ▲ 7.12% ), and others all saw major momentum and are on the radar heading into next week. 🐂

Bitcoin prices bumped back into the mid-$80k range as traders held risk assets into the weekend. Strategy and other Bitcoin-related stocks also rebounded sharply. 🪙

SPONSORED

Big Tech Has Spent Billions Acquiring AI Smart Home Startups

The pattern is clear: when innovative companies successfully integrate AI into everyday products, tech giants pay billions to acquire them.

Google paid $3.2B for Nest.

Amazon spent $1.2B on Ring.

Generac spent $770M on EcoBee.

Now, a new AI-powered smart home company is following their exact path to acquisition—but is still available to everyday investors at just $1.90 per share.

With proprietary technology that connects window coverings to all major AI ecosystems, this startup has achieved what big tech wants most: seamless AI integration into daily home life.

Over 10 patents, 200% year-over-year growth, and a forecast to 5x revenue this year — this company is moving fast to seize the smart home opportunity.

The acquisition pattern is predictable. The opportunity to get in before it happens is not.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Buy Now, Pay Later Giant Plans To Go Public 🤑

Swedish BNPL giant Klarna has filed its IPO prospectus to go public on the New York Stock Exchange under the ticker symbol $KLAR. 💳

The decision reiterates a long-standing trend: European stock exchanges losing business to their U.S. counterparts. The primary drivers are better visibility, regulatory advantages, and higher activity levels. And that reasoning stands for Klarna.

However, it’ll attempt to go public in a market that’s been more or less frozen since 2022. More importantly, it’s doing so at a time when geopolitical and economic uncertainty is shaking consumer and investor confidence daily. 🥶

Its valuation will play a major role in determining how the market receives it. During the pandemic, it raised funds at $46 billion but saw its valuation fall to $6.7 billion in its most recent fundraising round. Given its return to profitability in 2023, analysts expect it to come public in the roughly $15 billion range.

Today’s Michigan Consumer Sentiment Survey showed a significant decline in sentiment, with expectations for business conditions in the coming year falling to their lowest level in the survey's nearly 50-year history. 😨

A consumer-focused fintech, especially in the highly competitive buy now, pay later space, faces many challenges in the current environment. Time will tell how investors embrace the company as it markets itself for a public debut. 🤷

STOCKS

Other Noteworthy Pops & Drops 📋

Semtech Corp. ($SMTC +21%): The semiconductor company posted a fourth-quarter earnings beat, with revenue rising 30% YoY and slightly topping estimates.

Charles Schwab ($SCHW +5%): Reported a 44% jump in core net new assets during February, with total client assets rising 16% YoY. It witnessed its 15th consecutive month of at least 300,000 new account openings, adding 362,000 in February.

Block Inc. ($XYZ +6%): The Federal Deposit Insurance Corporation (FDIC) approved the company’s industrial bank, Square Financial Services, Inc. (SFS), to begin offering the consumer loan product Cash App Borrow.

American Express ($AXP +4%): Baird analyst David George upgraded the stock from ‘Underperform’ to ‘Neutral,’ keeping its price target at $265.

JPMorgan Chase ($JPM +3%): Its asset management division launched the JPMorgan U.S. Research Enhanced Large Cap ETF ($JUSA) on the NYSE. It offers unique exposure through its proprietary research on well-established large-cap companies.

Nordic American Tankers ($NAT +3%): Expanded its fleet by purchasing a 2016-built vessel from a first-class owner, expanding its earnings and dividend capacity.

MRC Global Inc. ($MRC +4%): The energy and industrial parts supplier saw sales fall 10% YoY, missing Wall Street’s estimates of $726.90 million by a wide margin.

Intel ($INTC +1%): A Wall Street Journal report indicated that new CEO Lip-Bu Tan has no more than a year to turn things around and that buyouts are off the table.

Pepsi ($PEP +0.2%): The beverage and snack giant is reportedly in advanced talks to buy the healthier soda brand Poppi in a deal worth more than $1.5 billion.

Accenture ($ACN +1%): Several analysts tempered their expectations ahead of next week’s earnings report, saying it may be difficult for the company to deliver another beat-and-raise quarter in the current environment. With the Trump administration cutting waste, firms with significant exposure to government business may offer cautious comments until more clarity is provided.

STOCKTWITS COMMUNITY

Have Your Voice Heard 📣

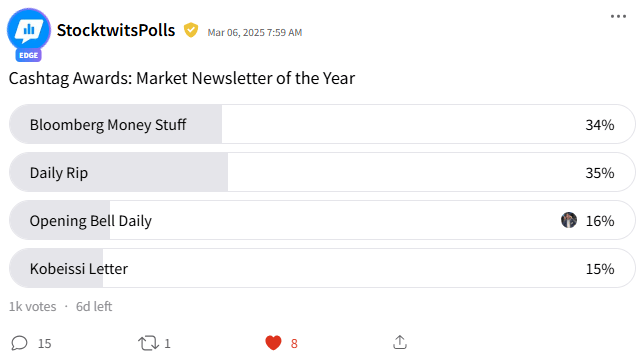

The Stocktwits Cashtag Awards are live, and voting has started! There are over a dozen categories, and we’ll be highlighting them daily until voting closes.

The Market Newsletter of the Year award recognizes the market newsletter that delivers the most insightful, timely, and engaging content to investors and traders. Vote now below or access every Cashtag Award here! 🗳

PRESENTED BY STOCKTWITS

“The Weekend Rip” With Ben & Emil 🍿

Markets in Turmoil: The S&P lost $1.15 trillion in four weeks, Tesla is in freefall, and recession fears are mounting. Just a dip or the start of something worse?

Beef Tallow & Meme Stocks: The internet's latest obsession is sending Steak 'n Shake’s stock soaring. Nothing pumps like unhinged social media.

Elon’s Bad Week: Tesla crashes 30%, a Cybertruck snaps in half, and Musk reportedly sobs in the White House.

Bitcoin Buyers Wiped Out: Rumble bought Bitcoin at the top, officially joining the “dumb money” club. Meanwhile, Ben is still buying.

CashTag Awards Are Coming: Vote for the best traders, hottest stocks, and (obviously) hottest guy of the year. Ben & Emil go live in NYC on April 30th!

COMMUNITY VIBES

One Tweet To Sum Up The Week 🤔

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋