NEWS

Tech's Cautious Tone Drags Market Lower

It was another mixed day for the market, with weakness in the semiconductor space and Fed officials’ hawkish comments continuing to weigh on stocks. Earnings remain at center stage as individual stock news sets the tone for the overall market. Let’s see what you missed. 👀

Today's issue covers Netflix’s lackluster showing, Taiwan Semi’s tepid outlook, and an interesting development in an under-followed stock. 📰

Here's today's heat map:

6 of 11 sectors closed green. Utilities (+0.56%) led, & technology (-1.14%) lagged. 💚

The U.S. labor market remains strong, with weekly jobless claims coming in unchanged. Meanwhile, existing home sales fell 4.30% in March due to higher interest rates. That said, the number of listings did pick up 14.40% YoY and the median selling price rose 4.80% YoY. 🏘️

Manufacturing activity continues to surprise to the upside, with the Philadelphia Fed Manufacturing index jumping from 3.20 in March to 15.50 in April. Economists anticipated a decline to 1.50. 🏭

Trump Media & Technology continued a two-day jump after telling shareholders how to block their shares from being loaned to short sellers. Again, not a business model but an attempt to keep the stock price up. 🛑

23andMe shares jumped 42% on news that the CEO is considering taking the DNA testing company private after three years as a public company. 🧬

Bitcoin miners rallied along with cryptocurrencies ahead of tomorrow’s Bitcoin “halving” event, which is a bit counterintuitive given the event will make it more difficult for these companies to mine going forward. But we’ll have to wait and see how the next few weeks play out. ₿

Other active symbols: $SERV (-41.32%), $SBFM (-12.63%), $CTXR (-1.31%), $HOLO (+31.70%), $AITX (-7.32%), & $WISA (-36.32%). 🔥

Here are the closing prices:

S&P 500 | 5,011 | -0.22% |

Nasdaq | 15,602 | -0.52% |

Russell 2000 | 1,943 | -0.26% |

Dow Jones | 37,775 | +0.06% |

EARNINGS

Netflix To Stop Reporting Membership Numbers

Streaming giant Netflix reported headline results that looked positive, but shares still dropped after the bell. Let’s take a look at why… 👇

The company’s earnings per share of $5.28 on revenues of $9.37 billion beat expectations of $4.52 and $9.28 billion. Total memberships of 269.60 million were also higher than the 264.20 million consensus estimate.

Ad-based memberships rose 65% QoQ and accounted for 40% of all signups in countries where the option is available for users. 🤔

Despite its recent strength, forward guidance left investors wanting more. It now sees second-quarter revenues of $9.49 billion vs. $9.52 billion expected and operating margins falling by 150 bps QoQ to 26.60%.

Netflix's full-year revenue growth guidance of 13% to 15% lagged the consensus view of 14.40%, though It did reiterate its free cash flow estimate of $6 billion.

In addition to the lackluster guidance, executives said they will stop providing quarterly membership data and average revenue generated per member beginning in Q1 2025. 😐

While they suggested these values have become less meaningful given the business model’s recent evolution, Wall Street is taking that as a sign that these numbers may not be good enough to keep sharing.

After all, if you’re absolutely crushing it, your inclination is to show off as much as possible. That doesn’t seem to be the case at Netflix. 🤷

Despite shares stalling out near their 2020-2022 peaks once again, the Stocktwits community remains bullish on the company’s outlook. Sentiment is currently in “extremely bullish” territory as users debate today’s results. ⚔️

SPONSORED

FinChat.io Is The Complete Stock Research Platform For Fundamental Investors

With comprehensive data on more than 100,000 stocks, FinChat has everything you need to track and manage your investments.

From standard financial metrics like revenue and EPS to company-specific measures like AWS Revenue and Tesla Deliveries, FinChat tracks everything so you don't have to.

Best of all, FinChat’s conversational AI assistant can quickly and accurately answer all your investing questions.

“Show me Microsoft’s Cloud Revenue over the last 10 years”

“Summarize Palantir’s latest earnings call”

“How many paying subscribers does Netflix have?”

Get started for free or use code “STOCKTWITS” at checkout for 15% off any paid plans.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Taiwan Semi Tells A Cautious Tale

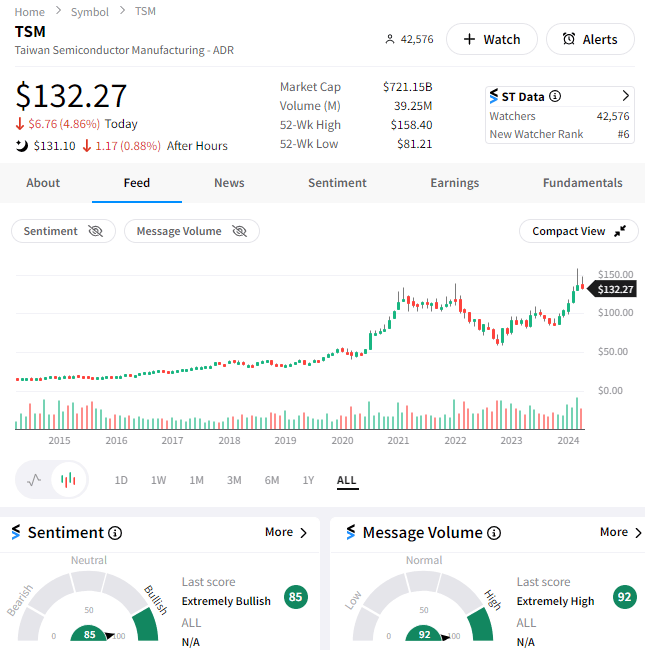

Yesterday, ASML Holding’s suspect earnings outlook pushed the chip space lower, with Taiwan Semiconductor adding insult to injury today. 🙁

The world’s largest chip-manufacturing company cut its full-year industry growth forecast from “more than 10%” to “just 10%,” adding to the tepid tone we’ve heard from its peers so far this earnings season. ⚠️

While demand for artificial intelligence (AI) chips will be more than 10% of its revenue and grow at a rapid clip, the rest of the space continues to face headwinds. Although consumer tech chip demand has likely troughed, the automotive sector’s expected demand is faltering.

Management had previously expected the auto segment to grow, but now it sees it declining in 2024 due to headwinds in the EV space. 🪫

While smartphone seasonality impacted first-quarter results, executives still anticipate YoY revenue growth will be at least double the overall market (20%).

Overall, it was a pretty solid report. But as we’ve seen with other high-flying tech stocks, “good results” are not going to be good enough to support elevated stock prices and valuations. 👎

These stocks are pricing in massive growth, which they’ll need to deliver on, especially given interest rates are set to stay higher for longer than anticipated.

Despite Wall Street pushing shares down 5% on the day, Stocktwits sentiment remains in “extremely bullish” territory as retail looks to buy the recent chip dip. Time will tell if their bet pays off. 🍪

STOCKTWITS CONTENT

New “Trends With Friends” 🍿

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

TECHNICAL ANALYSIS

Forestar Finds Potential Support

Forestar Group is a small-cap stock that was on the verge of becoming a mid-cap before its earnings drop pushed it back to a $1.70 billion valuation. 👎

With that said, the residential lot development company recently broke out of a 15-year trading range, catching some technical analysts’ attention.

With a major supply/demand imbalance in the housing market, one would think the lot development industry would have a major tailwind behind it.

If that’s the case, the weakness caused by its earnings report could present a buying opportunity for those who missed the initial move. 🛒

Currently, prices are testing their 200-day moving average near $31. But below that, technical analysts say the stock's former highs in the mid-20s could be tested without invalidating its long-term uptrend.

We’ll have to wait and see if investors step in here and buy the dip, but the few followers on Stocktwits seem like they will, as sentiment remains in “extremely bullish” territory. 🐂

Bullets From The Day

🚫 U.S. imposes new sanctions on Iran following its attack on Israel. New sanctions on 16 people and two entities associated with Iran’s drone program were hit with sanctions, also punishing five companies associated with Iran’s steel industry and three subsidiaries of an Iranian automaker. The efforts coordinated with European allies are an effort to cut off supplies to Iran’s missile and drone program and isolate the country from the global stage. CNN Business has more.

🤖 Meta rolls out its AI assistant across its platforms. The tech giant’s battle with ChatGPT has officially begun, with its new artificial intelligence (AI) assistance rolling out across Instagram, WhatsApp, and Facebook. Its next major AI model, Llama 3, has also arrived and outperforms competing models of its class on key benchmarks (according to Meta’s own reports). CEO Mark Zuckerberg says the goal for Meta AI is to be “the most intelligent AI assistant that people can freely use across the world." And with Llama, he feels the company is “basically there.” More from The Verge.

💸 Ibotta’s the latest tech company to test the U.S. IPO market. The tech platform that offers cash-back offers at most major retailers was the third major tech IPO of the year. Shares priced at $88, coming in above the $76 to $84 expected range, and popped to $117 at the open. That showcases a renewed optimism and appetite for tech stocks and will likely encourage other companies to consider testing the waters while the going is good. TechCrunch has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍