NEWS

Tesla Tops Expectations As Stocks Rebound

The U.S. and global stock market indexes were broadly in the green today, with the tech sector leading to the upside. It was a mixed day for earnings, but investors and traders remain focused on the biggest names like Tesla, Meta, and more who report this week. Let’s see what you missed. 👀

Today's issue covers Tesla’s affordable EV hopes toppling shorts, workers scoring two major wins, and Spotify surging following record profits. 📰

Here's today's heat map:

10 of 11 sectors closed green. Communications (+1.52%) led, & materials (-0.86%) lagged. 💚

U.S. new home sales rebounded to a six-month high in March. The persistently low inventory of existing homes continues to buoy demand despite the current high interest rate environment. 🏘️

The Richmond Fed Manufacturing index remained slow in April, marking its sixth consecutive negative reading. U.S. S&P Manufacturing PMI fell back into contraction territory during April, as factory activity data remains volatile. 🏭

GE Aerospace surged 8% to fresh highs after its earnings and revenues topped expectations in its first quarterly report since completing its spinoff. ✈️

Freemium software company HashiCorp shares jumped 20% on reports that IBM is in talks to buy the company as it looks to beef up its cloud offering. 🌤️

JetBlue shares bucked the recent trend in airline strength, falling 19% after lowering its 2024 revenue outlook. It remains focused on cost-cutting and pulling back from unprofitable routes. The stock has been stuck in no-man’s land since its multi-year merger attempt with Spirit Airlines failed. 🔻

Steel producer Cleveland-Cliffs fell 11% after its earnings and revenues missed analyst expectations, following similar results from its peer Nucor. 🏗️

Aftermarket auto parts distributor LKQ fell 15% after its earnings and revenue expectations. And the provider of investment indexes, MSCI, tumbled 13% after its revenues missed expectations. 📝

Other active symbols: $GL (+14.11%), $DJT (-8.25%), $ABEO (-53.67%), $AGBA (+18.80%), $IBRX (+11.13%), $POET (+26.40%), & $MARA (+10.77%). 🔥

Here are the closing prices:

S&P 500 | 5,071 | +1.20% |

Nasdaq | 15,697 | +1.59% |

Russell 2000 | 2,003 | +1.79% |

Dow Jones | 38,504 | +0.69% |

EARNINGS

Tesla Topples Shorts On Affordable EV News

One of the most widely-anticipated earnings reports this week was Tesla, which has been the worst performer of the “Magnificent Seven” stocks and S&P 500. And boy, it did not disappoint. 👀

The graphic from Stocktwits user @Stockmarketnerd sums up the results well, with the company missing most expectations outside of gross margins. 😬

Revenues were down 9% YoY, marking their biggest decline since 2012 as the company (and industry) battle faltering electric vehicle demand. We’ve heard time and time again of these macroeconomic headwinds that are weighing on demand, but the company has yet to offer a real solution. 🪫

Well, that seemingly changed today after Elon Musk announced on the conference call that Tesla plans to release an affordable new EV in “early 2025, if not late this year.” 🤯

This is a material change from previous estimates for the second half of 2025.

It’s also noteworthy that the company’s press release and investor deck leaned heavily into the narrative that it’s not just a car company. Instead, it focused investors’ attention on its software, autonomous vehicles, AI, and other big bets that will drive the company’s long-term value. 🤖

Honestly, given the state of the automotive business right now, it makes sense that they’d want to continue managing expectations on that front and talking up these bigger-picture ideas.

When low expectations meet “not as bad” results and promises of a light at the end of the tunnel, you get a relief rally. Shares were up 12% after hours. 📈

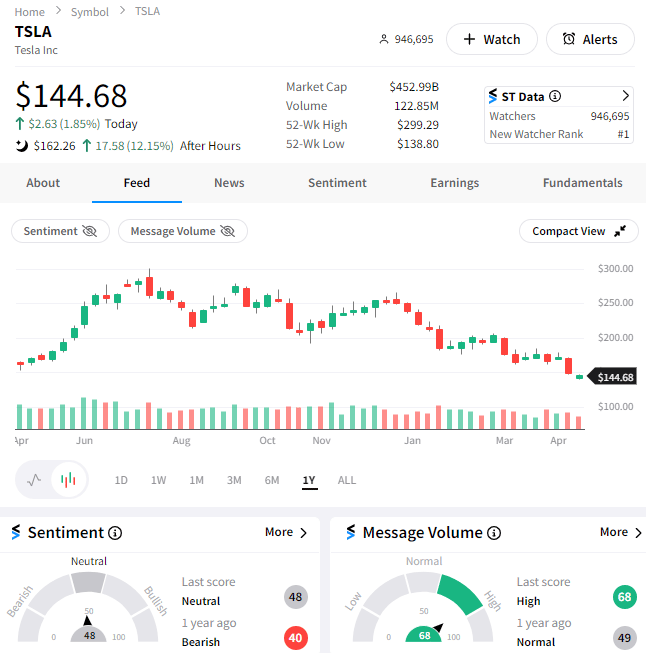

With that said the Stocktwits community remains skeptical about whether this affordable EV timeline is a reality or another one of Elon’s false promises. As a result, sentiment is sitting in neutral territory as investors and traders passionately debate the stock’s next move.

Whether you’re an investor in Tesla or not, we know you’ve got an opinion and would love to hear it. Share your prediction of where shares will open tomorrow, and if you’re right, we’ll send you some Stocktwits swag! 🎯

There are already over 600 comments on the post, and the number is climbing by the minute. Come show us what you’ve got! 😉

EARNINGS

Spotify Surges After Reporting Record Profits

Swedish streaming giant Spotify has seemingly found the “sweet spot” and continues to deliver results that are music to its shareholders’ ears. 😁

The company’s first-quarter adjusted earnings per share of 97 euro cents topped expectations of 65 euro cents by a wide margin. Revenues of 3.64 billion euros marginally beat, but monthly active users (MAUs) came in 3 million below estimates at 618 million.

Last year, the company took drastic measures to “right size” itself for the post-pandemic world, laying off more than a quarter of its headcount. It also doubled down on its podcasting business and expanded to audiobooks, looking to improve the value proposition of its premium offering. 📚

As a result, its gross margins improved significantly and management expects that to continue. It guided for second-quarter net new MAUs of 16 million and gross margins of 28.10%.

That said, its cost-cutting efforts have not come without a cost. Its “moderated marketing activity” results in more normalized user growth. If that’s anticipated to continue, the company will have to raise its premium service prices further to squeeze more profits out of its 239 million existing paid subscribers. 🤑

It announced earlier this month that it would roll out price increases to five major markets and the U.S. later this year. So far, users have absorbed its past price increases pretty well, so we’ll have to wait and see what impact this has over the mid to long term.

Ultimately, the company believes it will be a net positive. It’s continuing to invest heavily in content to improve its offering and allowing users to pay a lower price just for music if they don’t want audiobook access. 👍

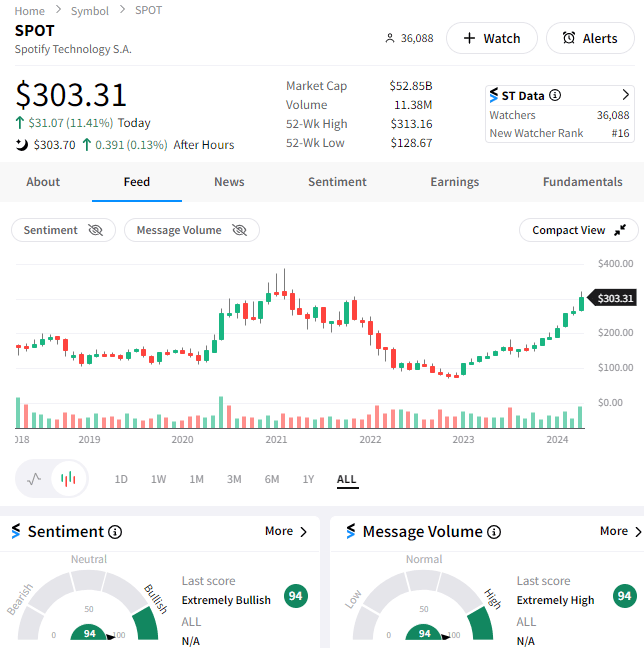

It seems that investors agree with that assessment, given $SPOT shares rose over 11% on the day. Stocktwits community sentiment also pushed into “extremely bullish” territory as message volume soared. 🐂

With prices continuing to rise, many investors and traders are expecting them to test their pandemic-era peak near $400. We’ll have to wait and see when the music stops. But for now, party on Spotify shareholders! 🕺💃

ECONOMY

Workers Score Two Major Wins

While Spotify and Tesla shareholders party it up, everyday workers were given a reason to join the celebrations. Two laws set to shake up the labor market were passed today, so let’s see what all the hubbub is about. 👇

The first bit of news was that the Federal Trade Commission (FTC) voted to enact a nationwide ban against noncompete agreements.

These agreements are provisions of employee contracts that prevent employees from going to work for competing companies for a set period of time after leaving their current role. 📝

Roughly 30 million workers, or roughly 18% of the American workforce, are currently subject to a noncompete, according to the FTC’s own estimates.

FTC Chair Lina Khan had this to say, “Noncompete clauses keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new startups that would be created a year once noncompetes are banned.”

The initial plans for this bill started in January 2023 and would go into effect 120 days after it’s officially published in the Federal Registrar. It would prohibit new noncompete clauses and scrap existing ones for all employees except senior executives earning more than $151,164 per year and who hold policy-making roles. ❌

However, it’s expected to be fiercely challenged by portions of the business community who claim noncompetes help preserve intellectual property and company secrets. The U.S. Chamber of Commerce has already pledged to sue the agency over the rule.

Time will tell how this plays out, but it is a major step for workers and another win for the current administration’s fight against corporations' anti-competitive practices. 👍

Next up, millions more salaried workers will soon qualify for overtime pay under a final rule released by the U.S. Department of Labor (DOL).

The new rule raises the salary threshold under which salaried employees are eligible for overtime in two stages, once on July 1st and again on January 1, 2025. The salary threshold will also be updated every three years to keep up with inflation’s impact. 💸

The agency estimates about 4 million more workers will qualify for overtime once the rule is fully implemented, providing a $1.50 billion boost to paychecks annually.

Lastly, investors may have a reason to rejoice as well. The U.S. Department of Labor (DOL) issued a final “fiduciary” rule that aims to raise investment-advice standards in retirement accounts, following an initial proposal from October 2023.

In legal terms, the rule expands the scope of when a broker, advisor, or other intermediary must act as a “fiduciary,” meaning they must give advice that puts the client first. What a novel f$@#ing idea that is. 🤦

Kidding aside, laws or no laws, there will always be a subset of people on Wall Street who don’t do right by their clients. At least now there will be additional legal ramifications to deter them or offer restitution to those impacted. 🧑⚖️

STOCKTWITS AD FREE

Go Ad Free Today 🧭

Dive into real-time discussions, breaking news, and expert insights without the distractions. Elevate your trading and investing experience with Stocktwits Ad Free today.

Bullets From The Day

📦 UPS continues to boost profits via cost cuts. The shipping giant remains cautious about the future, maintaining its balance sheet focus in a soft delivery demand environment. Revenues once again missed analyst expectations, with average daily volumes falling 3.20% YoY in the U.S. and 5.80% internationally. Adjusted operating margin fell from 11.10% to 8% YoY, but executives say this will be the lowest of 2024 because business conditions will improve in the second half of the year. CNBC has more.

🤑 Perplexity looks to raise $250 million for its AI search platform. A company taking on Google, Bing, and other major search engine platforms is reportedly raising at least $250 million more at a valuation ranging from $2.50 to $3.00 billion. The crazy part is how far its valuation has jumped in just a few short months. It raised roughly $74 million at a valuation of $540 million in January and first raised at a $121 million valuation in April 2023. Those are some big expectations to meet as it shoots for the literal and proverbial AI stars. More from TechCrunch.

🥤 Even Coca-Cola is getting in on the AI boom. The consumer goods giant has signed a five-year, $1.10 billion deal to use Microsoft’s cloud computing and artificial intelligence services. It follows a $250 million deal signed in 2020 to use Microsoft’s cloud and business software. Under the new agreement, the two companies will “jointly experiment” with Azure OpenAI as Coca-Cola tests Microsoft’s Copilot offerings and other tools aimed at improving productivity. Yahoo Finance has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍