NEWS

The Chase Is Totally On…

Source: Tenor.com

The S&P 500 closed above 6,000 for the first time ever, and Bitcoin blasted through $85,000 on its way to the actual moon. If you’re a longer-term investor or trader who feels like everyone is making easy money in this market besides you, we have some thoughts for you in the main story below. 👀

Today's issue covers a few thoughts on FOMO, some crazy crypto market stats, and several noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 6 of 11 sectors closed green, with consumer discretionary (+2.02%) leading and real estate (-0.87%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,001 | +0.10% |

Nasdaq | 19,299 | +0.06% |

Russell 2000 | 2,435 | +1.47% |

Dow Jones | 44,293 | +0.69% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $MFH, $BTM, $MMV, $CTOR, $LEDS 📉 $NGNE, $ZETA, $BTG, $ASRT, $SE*

*If you’re a business and want to access this data via our API, email us.

STOCKS

There’s Frankly A Lot Of FOMO Out There 😬

With the bull run continuing across risk assets, many market participants are feeling left behind, succumbing to “FOMO” and pushing prices even higher. During this time, technical analysis can offer a friendly reminder to always think about where an asset has come from and where it has the potential to go. 🤔

One way to measure this is by looking at a stock’s price relative to its 200-day simple moving average. That technical indicator measures a stock’s long-term trend, where prices eventually tend to revert if they get too stretched from it.

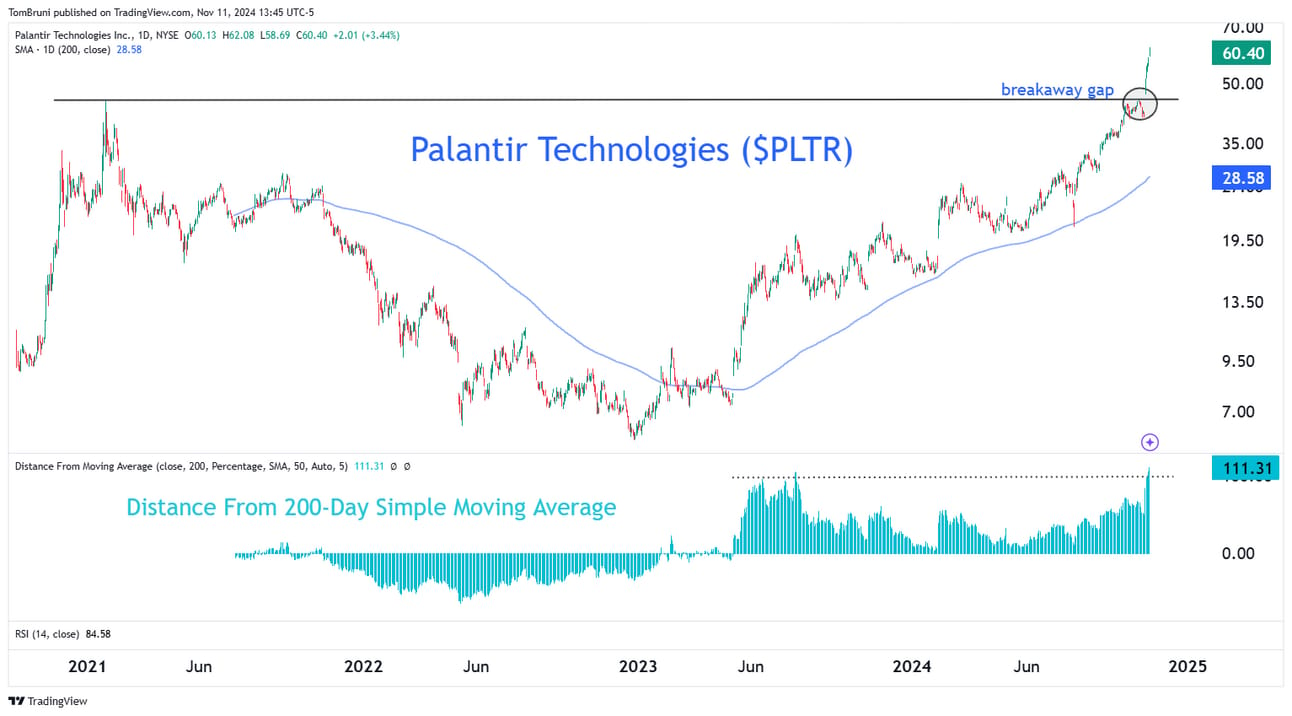

Below is a solid example of this using Palantir Technologies ($PLTR).

The stock recently broke out to new all-time highs via a “breakaway gap” through its 2021 highs, a very bullish sign. However, the stock is now more than 110% above its 200-day moving average, exhibiting how “stretched” it is relative to its longer-term trend. This represents a potentially higher-risk environment for shares, as prices could “mean revert” to their long-term trend. 😮

Source: TradingView.com

This “stretched” condition can resolve itself as a correction, where prices fall to the moving average, or over time, where price growth slows and allows the moving average to catch up. The bulls would prefer the latter outcome, but for now, they’re pushing through any potential downside risk and paying higher and higher prices for the red-hot stock. 🐂

And it’s not just happening in Palantir. Open your portfolio, and I’m sure you’ve got at least one stock that recently experienced a monster run. And it’s happening on the downside too…take a look at Moderna hitting fresh lows while being 60% below its 200-day moving average.

So, if it’s tough to press bets in extended stocks or assets, what is a trader or investor to do in these assets? The answer may be to wait for a more attractive risk-to-reward opportunity, even if it takes a while to present itself.

A great example of this is Bitcoin following its breakout in late 2021. It rallied over 400% in the year after its breakout, leaving many to believe they’d never be able to get in at lower prices again. So, they chased. Flash forward a little over a year and prices had corrected nearly 80%, bringing them back to the original breakout. 🙃

Source: TradingView.com

Now, that’s not to say that will happen again this time. But the point is that market opportunities present themselves regularly, but usually not in the timeframe we’d like them to. It’s important to remain patient and wait for a risk-to-reward opportunity that aligns with our long-term goals, risk tolerance, and overall investment objectives. Otherwise, emotional trading could lead us down a rough path.

This perspective is important to keep, especially in today’s environment where it feels like you’re missing the boat on the next greatest trade or investment. Maybe you will, but history tells us that the boat will either tend to make another pass…or another, better boat will emerge. You just need to be patient. 🤫

The recent trading environment can certainly get (and stay) crazier than it already is. But hopefully, this perspective can help investors and traders with longer-term horizons navigate an endless list of “amazing” opportunities right now.

Stay safe out there, folks. Enjoy the ride, and speculate responsibly! 🫡

SPONSORED

This Stock is Up 220% and Primed for the Next Breakout

Bank of America analysts predict gold will hit $3,000 by 2025 — and this hidden gold stock is set to benefit.

With gold's post-election dip, now could be a good opportunity to consider adding to your portfolio. Savvy investors understand the value of holding gold and gold stocks.

This stock has made impressive gains in recent years, and with insiders continuing to buy, it's one to keep on your watchlist.

P.S. The last gold stock we highlighted in this newsletter saw a strong rally, climbing over 60% just days after our feature. Be sure to keep this one on your watchlist!

This is a sponsored advertisement on behalf of Four Nines Gold. Past performance does not guarantee future results. Investing involves risk. View the full disclaimer here: https://shorturl.at/73AF8

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

Other Noteworthy Pops & Drops 📋

Monday.com: Shares fell 15% after the project management software provider reported better-than-expected earnings and revenue but failed to impress with its forward guidance. Its fourth-quarter revenue was in line with expectations, snapping a streak of “triple beats” that have been fueling its recent run. 💻

Grab Holdings: Shares rose 15% after management raised its annual revenue forecast. The Singapore-based food delivery and ride-hailing business still expects positive free cash flow for the full year, and management reiterated its bullishness on Southeast Asia's long-term growth outlook. 🚘

Radnet: Shares soared 19% after the radiology company reported better-than-expected third-quarter earnings and revenue. It also announced a new partnership with GE HealthCare, fueling optimism as prices hit new all-time highs. 🩻

Cigna: Shares jumped 7% after the company reiterated that it has not revived its efforts to merge with Humana after walking away late last year, dispelling reports by Bloomberg just last month. Humana shares fell roughly 3% on the news. ❌

AbbVie: Shares fell 12% after the company disclosed that its Schizophrenia drug trial failed to meet its primary endpoint. It adds to third-quarter results that saw revenues fall 4% YoY, as management looks for its next major growth driver. Bristol-Myers jumped 10% on the news. 💊

GameStop: Shares popped 14% as the ‘meme stocks’ come back into focus amid the return of influential trader Keith Gill, aka “roaring Kitty.” Stocktwits sentiment has pushed back into ‘extremely bullish’ territory as investors look for a repeat of the 2021 meme stock saga. AMC Entertainment also caught a late-day bid. 🤑

CRYPTO

Just How Crazy Is Crypto Getting? 🧑🚀

In case you’ve been living under a rock recently, let’s get you caught up on some of the crypto facts from the last couple of weeks. 🤯

Bitcoin’s market cap hit $1.736 trillion, overtaking silver as the world’s 8th largest asset.

BlackRock’s iShares Bitcoin ETF’s assets under management (AUM) surpassed its gold ETF, gathering $34 billion in just 10 months.

The total crypto market cap is about 3% from $3 trillion, and the altcoin market cap is now firmly above $1 trillion.

Solana became the fourth crypto to pass a $100 billion market cap, joining Bitcoin, Ethereum, and Tether USDT Stablecoins.

Dogecoin’s market cap is now $48 billion, making it the ~420th largest publicly traded company in the world (if it were a company). It’s larger than 94% of S&P 500 companies.

MicroStrategy shares hit their first all-time high in 24 years, and Coinbase shares have rallied 90% in six trading days.

Bitcoin and Dogecoin are today’s “most active” and “most newly watched” symbols on Stocktwits, with many other cryptos close behind.

We’ll have to wait and see if we go full-on 2020/2021 here in crypto land. But with the red-hot price action in risk assets, meme stocks picking up steam, and meme coins cruising into outer space…it certainly feels like a bull market. 🚀

If you want to understand what’s driving all this and stay on top of the crypto markets, subscribe to our Litepaper Newsletter. You’ll be in good hands with our resident crypto expert, Jonathan Morgan.

Lastly, shout out to Scottie Pippen for giving us some much-needed flare for the current crypto bull run. How much longer until we all have laser eyes again? 😂

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Fed Waller Speech (10:00 am ET), RCM/TIPP Economic Optimism Index (10:15 am ET), Fed Kashkari Speech (2:00 pm ET), Fed Harker Speech (5:00 pm ET), Fed Barkin Speech (5:30 pm ET). 📊

Pre-Market Earnings: Home Depot ($HD), Shopify ($SHOP), Sea Ltd. ($SE), Up Fintech Holdings ($TIGR), Tencent Music ($TME), Plug Power ($PLUG), Evgo ($EVGO), Cronos Group ($CRON), Novavax ($NVAX), On Holdings ($ONON). 🛏️

After-Hour Earnings: SoundHound AI ($SOUN), TeraWulf ($WULF), CXApp ($CXAI), Cava ($CAVA), Instacart ($CART), Spotify ($SPOT), Groupon ($GRPN), BuzzFeed ($BZFD), Blade Air Mobility ($BLDE), Rocket Companies ($RKT), Marathon Digital ($MARA). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

🧑🏫 Join IBD’s experts for a free webinar on Nov. 12 to learn strategies for holding stocks long-term*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋