NEWS

The DeepSeek Dive: What To Know

Source: Tenor.com

China is once again causing problems for U.S. markets, not because of its tepid economic growth but because of its artificial intelligence (AI) advancements. Fears that DeepSeek AI may have leveled the global playing field rocked U.S. tech giants as investors recalibrated their growth expectations to account for competition. Safe-haven stocks and bonds caught a bid as the market awaits a flurry of “Magnificent Seven” earnings and the Fed’s rate decision on Wednesday. 👀

Today's issue covers what we know about China’s DeepSeek AI, how retail is handling today’s wreckage, and other noteworthy pops & drops. 📰

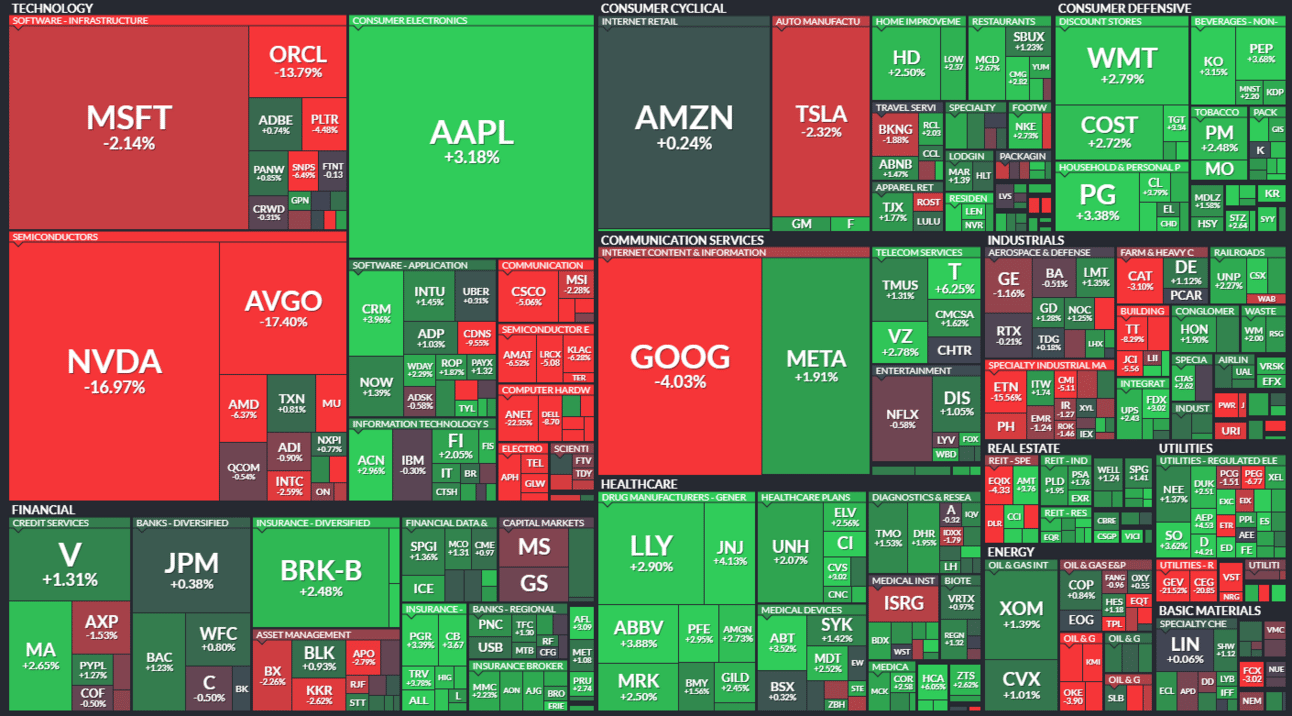

Here’s the S&P 500 heatmap. 7 of 11 sectors closed green, with consumer staples (+2.71%) leading and technology (-4.90%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,012 | -1.46% |

Nasdaq | 19,342 | -3.07% |

Russell 2000 | 2,284 | -1.03% |

Dow Jones | 44,714 | +0.65% |

STOCKS

AI Fervor Turns Into Fear 😱

While the U.S. was focused on banning TikTok over national security concerns, China was apparently building an artificial intelligence (AI) weapon of its own…DeepSeek AI.

The Chinese AI company DeepSeek launched its latest AI model last week, naming it R1 and stating that it’s particularly good at problem-solving. However, what blew investors' socks off was the claim that it performs on par with OpenAI’s o1 reasoning model but at a fraction of the cost per use.

That news sent the DeepSeek app to the top of the iPhone download rankings for the U.S. and spiraled the world into a frenzy about how this new entrant could turn the entire AI space upside down. 🙃

U.S. export controls had intended to hinder Chinese organizations from developing innovative AI by limiting their access to cutting-edge semiconductors. However, DeepSeek appears to have either circumnavigated rules to acquire enough chips…or, more scarily, achieved similar performance with worse tech. 🤯

Neither situation is a great one, but the latter is what sent semiconductor stocks plummeting. After all, much of their rally has been driven by a race to acquire the most technologically advanced chips at the largest volume…and at basically any price. If cheaper alternatives exist, then growth for these companies will suffer.

Additionally, DeepSeek’s R1 model is open-source, allowing others to adapt and use it for their own purposes. This could create other cheap AI alternatives, further reducing the U.S. chip supply/demand imbalance and pricing power. 📝

Still, others say that DeepSeek’s ability to cut AI training costs is only one piece of the puzzle. The AI infrastructure industry will continue to grow as tech companies require more computing power, elevating demand for years to come.

Whether DeepSeek will rebalance the world’s AI development playing field remains to be seen. However, many high-flying stocks in the space traded down today on fears that their lead may not be as great as initially thought.

The story below will break down the market action from the day and how the Stocktwits community is playing the dip. But here’s a sneak peak: 🚨

Nvidia shares shed $589 billion in market cap value, the largest single-day decline in history (over double its last $279 billion record).

The U.S. stock market lost $2 trillion in market cap.

Bitcoin (briefly) broke back below 100k.

Given its rise to prominence, DeepSeek has reportedly been hit with large-scale cyberattacks and other threats, causing it to temporarily limit registrations.

Isn’t it funny how we were all so worried about TikTok having our information but are perfectly fine feeding every living thought we have into a Chinese-owned AI model? Hey DeepSeek AI, what is the meaning of irony? 🤦

SPONSORED

JOIN THE "BEST BROKER FOR OPTIONS TRADING 2025" AS RANKED BY INVESTOPEDIA!

Old trading walks into a bar. New trading raises it.

It's time you got serious at tastytrade.

Tools and tech made for tough markets.

Pricing that fits the way you trade.

Stocks. Options. Futures and more. All in one place.

Up your trading game with order chains, backtesting, visualized analysis, and courses to help you trade smarter.

If you can see opportunity differently, then you can seize it differently.

We’re upgrading options trading. See it in action.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. tastytrade, Inc., and Stocktwits are separate and unaffiliated companies that are not responsible for each other’s services, products, and policies.

STOCKS

Today’s Wreckage & Retail’s Reaction 🕵

As we covered above, the stock market took quite the tumble today, with Nvidia’s record loss of $589 billion in market cap leading to the broader market’s roughly $2 trillion decline. 😨

The carnage hit all the major AI-growth areas of the market ranging from chipmakers, data centers, software, and energy and infrastructure stocks. Basically any company that tagged itself as an AI play became a target.

Since so many of these stocks are trading on momentum as much as on fundamentals, let’s simplify how to view them from a long-term timeframe. 🧭

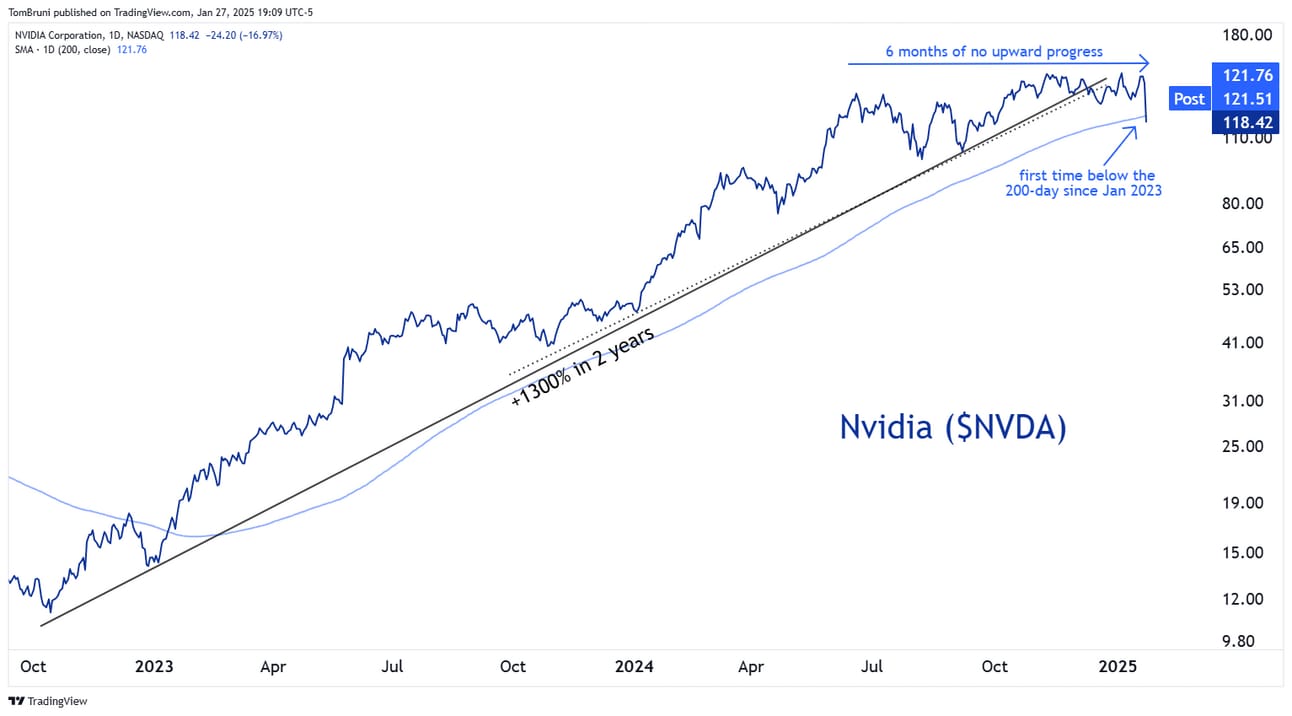

Nvidia is the prime example, given that it’s been the leader of this AI revolution. As the 2.5-year chart below indicates, the stock has soared roughly 1,300% since October 2022, reaching its first peak last June. Since then, the company has had two more “beat and raise” quarters and endless positive news but has failed to sustain a meaningful new high. It’s basically been flat for six months.

During that time, it broke the uptrend lines many technical analysts were using to judge the stock’s trend and is now at the next major level…its 200-day moving average. Investors use this indicator to gauge an asset's long-term trend, and it can often be viewed as a rough level of support or resistance. 🤔

Source: TradingView.com

In simple terms, it’s generally a positive sign when a stock is above its 200-day, and a negative thing when it’s below. Nvidia is back below it for the first time since January 2023, begging the question of whether its trend is officially broken.

Since we’re right on the cusp of a break, bulls have a chance to step in and save the stock. But the broader point is, if you look across the list of stocks slammed today, most traders and investors are looking to “buy the dip” in those that are still in uptrends (i.e. above their 200-day moving average).

As for the Stocktwits community, 72% of the 6,700 investors polled are using this weakness to buy Nvidia over its competitors. As you can see from my vote, I voted for something else, so go read the comments and compare notes. 👀

Notably, the rest of the market had a pretty good day. Apple was viewed as the “flight to safety” trade in the tech sector, but outside of that, the consumer staples, healthcare, and other “defensive” areas of the market had pretty good days. 💚

If this is a real market worry, analysts would expect these types of stocks to remain well bid as investors look to “hide out” and avoid the tech sector carnage. Time will tell. But with a busy economic and earnings calendar ahead, we can expect the heavy news flow to continue and keep volatility elevated. 😬

STOCKS

Other Noteworthy Pops & Drops 📋

Allakos, Inc. ($ALLK -71%): The biotech announced a significant setback for its lead drug candidate, AK006.

Intellia Therapeutics ($NTLA -4%): Morgan Stanley downgraded the stock to ‘Equal Weight’ from ‘Overweight,’ slashing its price target from $56 to $11.

Akero Therapeutics ($AKRO +98%): Had its best trading day since Sept. 2022, following the release of promising topline week 96 results from its SYMMETRY trial.

Oklo Inc. ($OKLO -19%): BMO Capital highlighted in its latest note that DeepSeek’s AI model could require between 50% to 75% less power than other large language models using Nvidia’s latest graphics processing units (GPU).

Talen Energy Corp. ($TLN -20%): Fell alongside other energy stocks despite a price target bump from Barclays ahead of its fourth-quarter earnings.

Diversified Energy ($DEC +6%): the company said it would buy Maverick Natural Resources from private equity firm EIG for $1.28 billion, nearly doubling its revenue.

Logility Supply Chain Solutions ($LGTY +25%): Clearlake Capital-backed Aptean agreed to buy the company for $14.30 per share in an all-cash deal.

Textron ($TXT +2%): Textron Aviation announced the first international sale of seven of its Beechcraft King Air 260 military multi-engine training aircraft to SkyAlyne and KF Aerospace.

SoFi Technologies ($SOFI -10%): CEO Anthony Noto said 2024 was SoFi’s “best year ever,” but the firm’s fiscal 2025 outlook failed to meet analyst estimates.

Bitdeer Technologies ($BTDR -19%): Bitcoin mining stocks continue to thrash around with the broader cryptocurrency market as investors await more clarity on Trump’s policy agenda and Federal Reserve’s interest rate path.

Ryanair ($RYAAY +0.19%): The airline grew its net profit 10x YoY, led by 9% traffic growth and marginally higher fares. That beat expectations, but management tempered its FY26 traffic target due to Boeing’s aircraft delivery delays.

COMMUNITY VIBES

Which Logo Should We Pick? 👀

Many of you noticed our brand-new Stocktwits look last week. However, we need your help with the final piece of this rebrand, our StocktwitsCrypto logo!

See the options below and vote in our Stocktwits or X polls to have your voice heard. We’ll announce the community’s pick next week, so don’t delay! 🗳

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Durable Goods Orders (8:30 am ET), S&P/Case-Shiller Home Prices (9:00 am ET), CB Consumer Confidence (10:00 am ET). 📊

Pre-Market Earnings: Boeing ($BA), General Motors ($GM), Lockheed Martin ($LMT), RTX Corp. ($RTX), Royal Caribbean ($RCL), JetBlue ($JBLU), Sysco ($SYY). 🛏️

After-Hour Earnings: Starbucks ($SBUX), LendingClub ($LC), Logitech International ($LOGI), Qorvo ($QRVO), Stryker ($SYK), F5 Inc. ($FFIV), Chubb ($CB). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

🧑🏫 Join a free 2-hour online workshop on 2/8 to learn investing strategies from IBD’s market experts*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋