NEWS

The Fed Finally Delivers…So What Gives?

Source: Tenor.com

The much-awaited Fed decision led to its normal dose of volatility, as stocks initially reacted higher but ended up closing in the red. Several other central banks are announcing their decisions in the days ahead as global investors look to judge growth prospects through year-end and into 2025. 👀

Today's issue covers the Fed’s 50 bp cut and updated forecast, Amazon adding perks for its warehouse workers, and 23andMe’s management mass exodus. 📰

Here’s the S&P 500 heatmap. 1 of 11 sectors closed green, with energy (+0.19%) leading and technology (-0.91%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,618 | -0.29% |

Nasdaq | 17,573 | -0.31% |

Russell 2000 | 2,206 | +0.04% |

Dow Jones | 41,503 | -0.25% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $VEEA, $NVVE, $OMEX, $APLT, $SPRC 📉 $SCS, $WTI, $MULN, $NWL, $MDAI*

*If you’re a business and want to access this data via our API, email us.

POLICY

Market Reads Into The Fed’s Forecast 🕵️

If you were living under a metaphorical or literal rock lately, today was the most consequential “Fed Day” in quite some time, so let’s review what happened and how the market reacted. 👇

First, off consensus expectations were for the Fed to cut 25 basis points (bps), though a minority of the market expected 50 bps because they viewed the move as needed to make up for not cutting at its July meeting.

And as usual, the masses were on the wrong side of the bet (myself included), as the Fed announced a 50 bp cut by an 11-1 vote. Notably, most Fed members were on the same page, but Fed Governor Miki Bowman dissented in favor of a smaller cut…the first dissent by a governor since 2005. 🗳️

Here’s a red-lined version from the WSJ’s Nick Timiraos, showing that the Federal Open Market Committee (FOMC) feels that inflation is moving sustainably toward 2% and that the risks to its employment and inflation goals are ‘roughly in balance.’ ⚖️

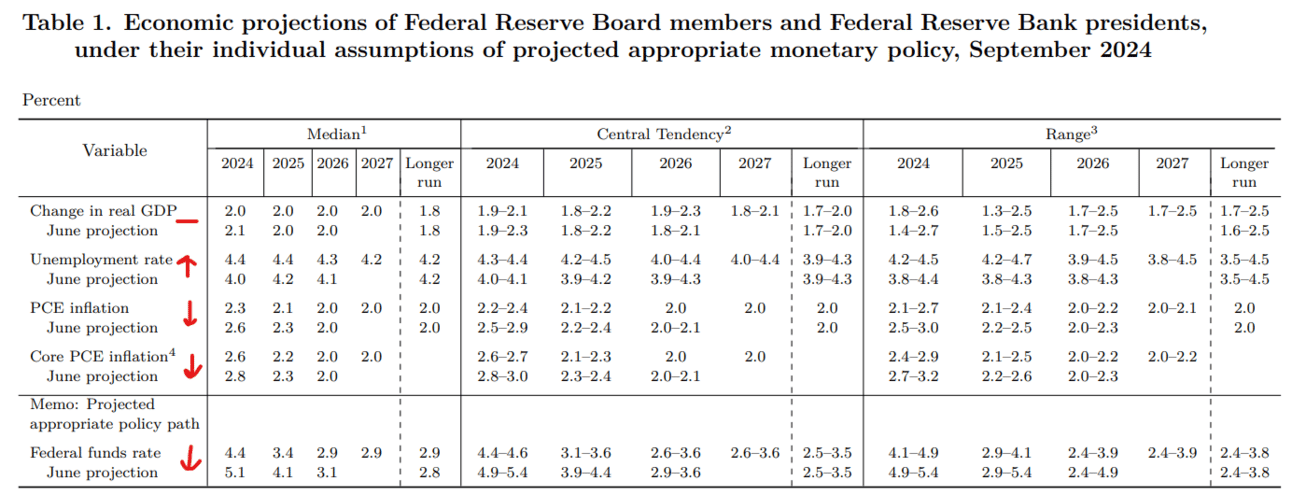

The Fed’s updated economic projections also provided some color on its latest move and forecast. Essentially, the new dot plot shows the Fed finally catching up to the expectations that the market has been pricing in since the July meeting.

The Fed funds rate saw the largest adjustment, coming down to 4.40% at the end of the year and 3.40% in 2025. That would mean 50 bps more in cuts before the end of the year and a full percentage point more in 2025. ✂️

Inflation expectations came down, while their economic growth forecast was notched down marginally in 2024 but flat through 2027. Unemployment expectations also rose, but not by a lot…showing that the Fed is continuing to bet on a “soft landing” in the economy.

Jerome Powell’s press conference leaned heavily into the “soft landing” narrative, with Nick Timiraos highlighting some of the key takeaways below. 🎙️

As for the market’s reaction, stocks initially soared alongside gold, bonds, etc., before reversing during Powell’s press conference. Some analysts are concerned that a 50 bp cut is a bad signal for the economy (and the market). 😬

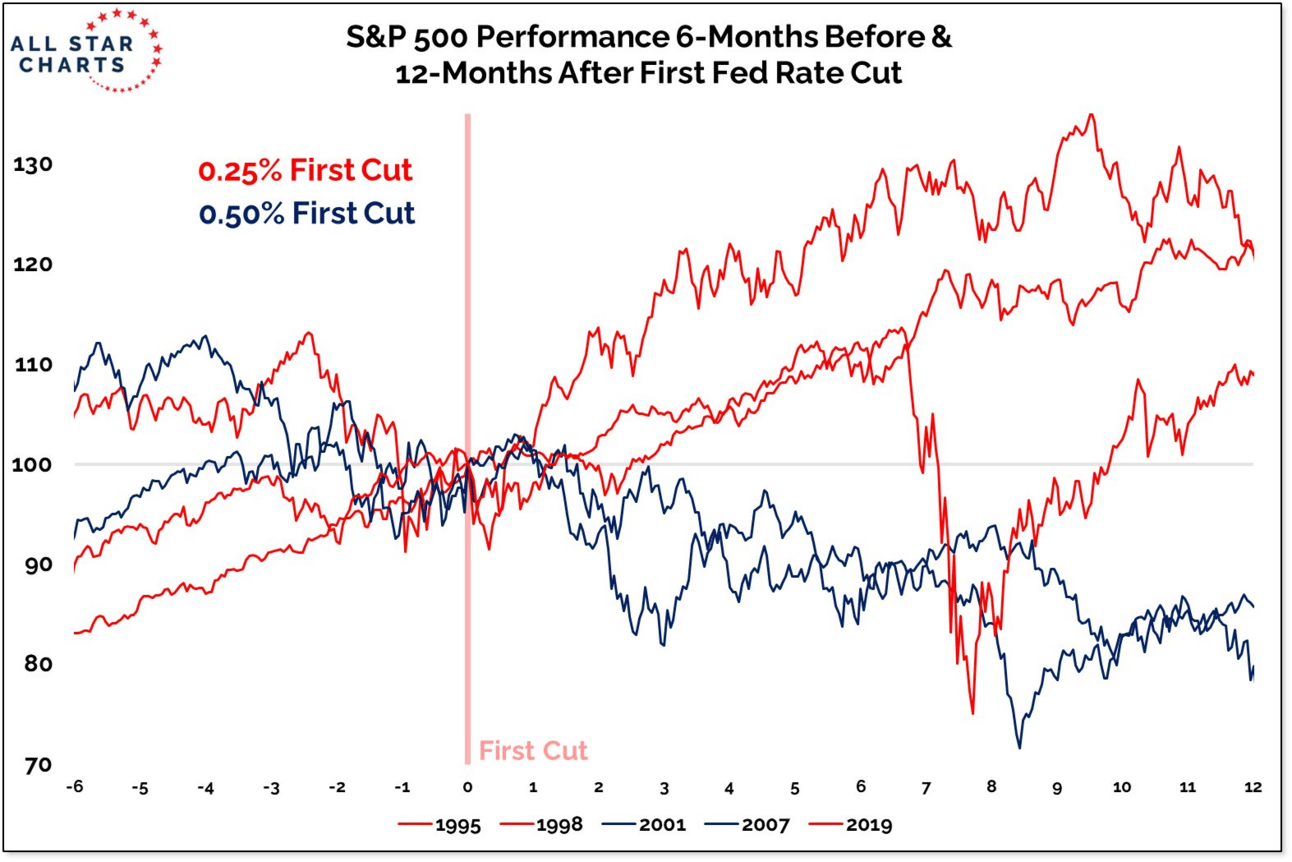

Many circulated a chart similar to @allstarcharts’ below, which shows the S&P 500’s performance after the initial rate cuts. As it shows, 25-bp cuts are generally positive, while performance after an initial 50-bp cut is often challenged.

Source: Stocktwits.com

With the Fed’s move out of the way, eyes turn to the Bank of England and Bank of Japan which are both announcing their latest moves tomorrow. But what’s clear is the world has shifted from higher rates and hikes to lower rates and cuts as inflation fades and countries look to support growth. 🔻

Traders and investors will be watching how the market settles over the coming days as the debate over whether to view this as a ‘successful soft landing’ or an ‘early warning signal’ rages on… 🤷

SPONSORED

The Crypto Minis from Grayscale: BTC & ETH.

Considering an investment in crypto but looking to start small?

How about starting with a mini. A Grayscale Crypto Mini.

Grayscale Bitcoin Mini Trust (ticker: BTC)

Grayscale Ethereum Mini Trust (ticker: ETH)

The Trusts are not funds registered under the Investment Company Act of 1940, as amended (“1940 Act”), and are not subject to regulation under the 1940 act, unlike most exchange traded products or ETFs. An investment in the Trusts are subject to a high degree of risk and heightened volatility. Digital assets are not suitable for an investor that cannot afford the loss of the entire investment.

The Grayscale Crypto Minis offer:

Mini fee: BTC and ETH have the lowest fees of all the Bitcoin and Ethereum funds on the market.

Mini share price: BTC and ETH both have very low share prices, allowing investors to get extremely precise with their exposure.

Mini commitment: You don’t need an entire Bitcoin or thousands of dollars' worth of Ethereum to get crypto exposure — investing in BTC or ETH allows you to allocate as much or as little as you want to crypto.

Turns out, a Mini gets you a lot.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Amazon Adds Perks For Workers 🎁

While we’re talking about the economy and labor market, it’s worth noting that some parts of the job landscape, especially in the services sector, are still facing challenges. As a result, major retailers like Amazon are having to ramp up their benefits in order to attract and retain workers ahead of the critical holiday shopping season.

Today, the company announced that its warehouse workers will receive a free Prime membership while they’re employed and a pay rise of at least $1.50 per hour beginning next month. This will bring the average base wage for these workers up to over $22 per hour. 💵

This is in addition to the $2.1 billion investment in its Delivery Service Partner program implemented last week to bring national drivers’ average wages to about the same $22 level.

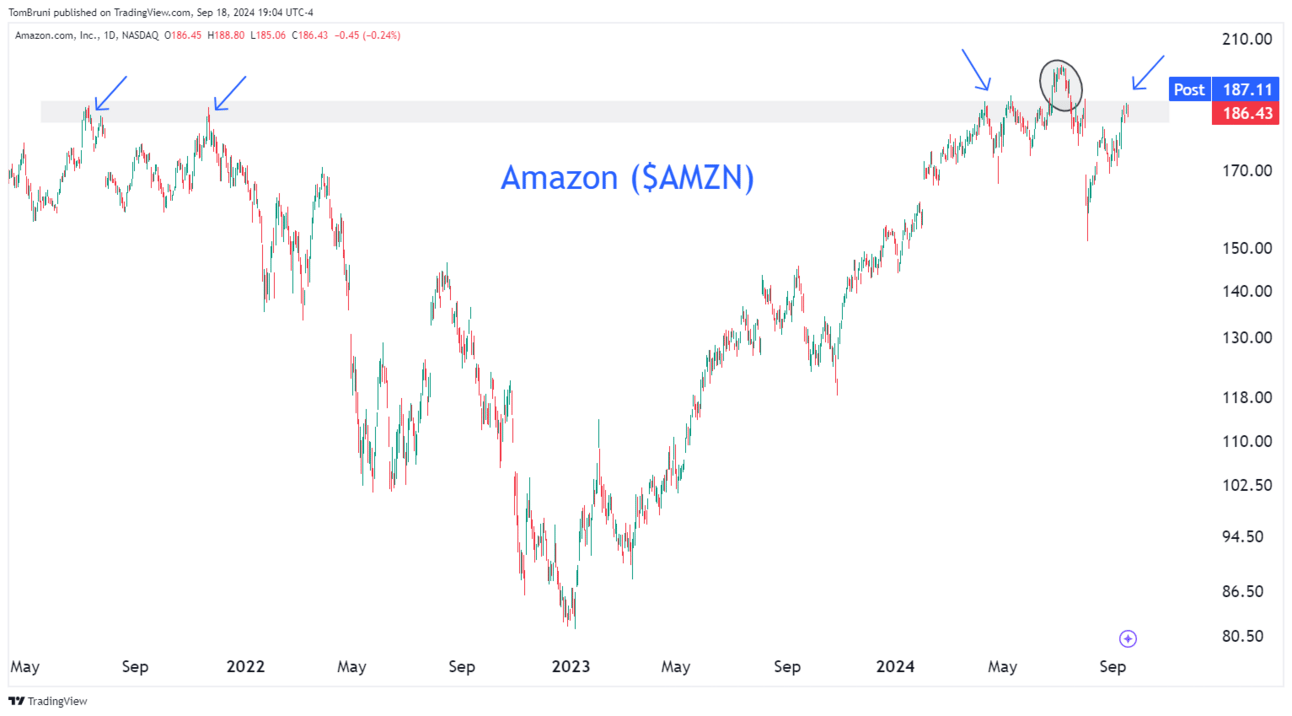

While the company gears up for its busy season with consumers, the stock is again flirting with its 2021/2022 highs, which it failed to break out above. With the Fed’s rate cut news and dovish outlook on the economy, Stocktwits sentiment in ‘bullish’ territory suggests some traders expect the stock to finally make new all-time highs. Time will tell. 🤷

Source: TradingView.com

COMPANY NEWS

23andMe’s Mass Exodus 😱

The struggling DNA testing company’s independent board of directors resigned yesterday, shocking employees, investors, and other stakeholders alike. 👨💼

These directors had formed a special committee in March to help find a new path forward for the spiraling company but were clearly unable to do so over the last six months as the stock bled to new lows.

CEO Anne Wojcicki told employees she was “surprised and disappointed by the decision” and said she remains committed to taking the company private.

The founder proposed taking the company private in July for $0.40 per share. However, the board rejected this proposal because it was not in the best interest of non-affiliated shareholders. ❌

Speaking of the non-affiliated shareholders, they’ve been absolutely toasted since the genetic testing company went public in 2021 through a special purpose acquisition company (SPAC).

Ultimately, the board of independent directors disagreed with Wojcicki on the company’s “strategic direction” and decided to resign instead of fighting the uphill battle further. 👋

The company will begin searching for new independent directors to join the board as the CEO continues her push to take the company private again for pennies on the dollar.

As for the Stocktwits community, retail investors and traders remain ‘bearish’ on the stock given the shares’ downside momentum and company’s lack of a turnaround plan. Ultimately, it remains a ‘hail-mary’ play that this founder can find the financing to take the company private and give public market investors the closure they need to move on. 👎

Source: Stocktwits.com

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Turkey Interest Rate Decision (7:00 am ET), England Interest Rate Decision (7:00 am ET), Initial/Continuing Jobless Claims (8:30 am ET), Philadelphia Fed Manufacturing Index (8:30 am ET), South Africa Interest Rate Decision (9:00 am ET), and Existing Home Sales (2:00 pm ET). 📊

Pre-Market Earnings: MoneyHero ($MNY), Darden Restaurants ($DRI), Cracker Barrel ($CBRL), and FactSet Research Systems ($FDS). 🛏️

After-Hour Earnings: FedEx ($FDX), LightPath Technologies ($LPTH), Lennar ($LEN), Genfit ($GNFT), Power ($IPW), and MillerKnoll ($MLKN). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: *BTC: Low cost based on gross expense ratio at 0.15%. Brokerage fees and other expenses may still apply. ETH: Low cost based on gross expense ratio at 0% for the first 6 months of trading for the first $2.0 billion. After the fund reaches $2.0 billion in assets or after 6-month waiver period, the fee will be 0.15%. Brokerage fees and other expenses may still apply. See prospectus for additional fee waiver information.

Please read the ETH and BTC prospectuses carefully before investing in the Trusts. Foreside Fund Services, LLC is the Marketing Agent for the Trusts. The Trusts holds Bitcoin or Ethereum; however, an investment in the Trusts is not a direct investment in Bitcoin or Ethereum. There is no guarantee that a market for the shares will be available which will adversely impact the liquidity of the Trusts.

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋