NEWS

The Fed’s Predicament (Dot Dot Dot)

The U.S. stock market surged to new all-time highs after the Fed met expectations by keeping rates unchanged and maintaining a dovish policy stance and outlook. Let’s see what else you missed. 👀

Today's issue covers the Fed’s dots saying a whole lot, Signet Jewelers signaling a slowdown in engagements, and the growing chatter ahead of tomorrow’s Reddit IPO. 📰

Here's today's heat map:

9 of 11 sectors closed green. Consumer discretionary (+1.49%) led, & healthcare (-0.22%) lagged. 💚

The Bank of Indonesia was the latest central bank to keep rates steady, as it looks to manage inflation while supporting growth and the Rupiah. ⏸️

Micron Technology soared to fresh all-time highs after the largest U.S. maker of computer memory chips forecasted third-quarter revenue and earnings well above expectations. Like other industry leaders, Micron has called for a rebound in the industry in 2024 and record sales levels in 2025, which we’re now starting to see play out in the numbers. 📈

Paramount Global shares jumped 12% on news that private equity giant Apollo Global Management has offered $11 billion for its Hollywood film and TV studio. It comes as the company’s board reviews another offer from Skydance Media to merge with all of Paramount. 🎬

Luxury stocks took a beating after Gucci owner Kerig warned of a sharp slowdown in demand for high-end goods, especially in China, the industry's largest growth market. After several bumper years, the industry is now facing weak demand in Asia as the U.S. and other developed markets wane. 👜

And data center firm Equinix fell sharply after short seller Hindenburg Research disclosed a position in the stock and alleged that the REIT was using an accounting trick to boost its adjusted funds from operations (AFFO). 📉

Other symbols active on the streams: $CMG (+3.48%), $CHWY (+6.36%), $DKNG (+5.69%), $FIVE (-13.04%), $DWAC (+17.79%), $ETAO (+91.76%), & $TGL (+38.13%). 🔥

Here are the closing prices:

S&P 500 | 5,225 | +0.89% |

Nasdaq | 16,369 | +1.25% |

Russell 2000 | 2,075 | +1.92% |

Dow Jones | 39,512 | +1.03% |

POLICY

The Dots Said A Lot (We Think)

As we’ve discussed regularly, the market has been projecting more rate cuts during 2024 than the Fed, fueling the recent optimism around asset prices. 🤑

That optimism comes despite stickier-than-expected inflation measures and an economy that’s held up better than most anticipated, which may lead to the Fed keeping rates higher for longer.

Today, the Federal Reserve’s rate decision went pretty much as planned, keeping rates unchanged. However, there was a significant change in the “dots” (or economic projections) that had the market moving. 🔍

In the table below, we can see that the Fed’s expectations for growth and the median Fed Funds rate in 2025 and 2026 both ticked up. That signals they expect growth to hold up better than their December projections, and therefore, rates may have to be slightly higher than they anticipated. 🔺

That said, Powell's projections and commentary suggest that three rate cuts are still on the table for 2024. For now, given the strength of employment and earnings, this seems to be enough for markets to rally.

Now, this isn’t exactly the reaction from markets the Fed would like to see, given that strong asset prices tend to place upward pressure on inflation. Yet that’s what’s happening, and only time will tell if the Fed or investors are wrong.

Regardless of what message the Fed intended to send today, here’s a solid summary of what the market actually heard. Party on, dot watchers. 😂

STOCKTWITS CONTENT

Join Us Live With Real Vision’s Raoul Pal 👀

We’re discussing all things crypto and markets with @RaoulGMI, this Thursday at 2 PM EST! Save your seat here, and we’ll see you then! 👍

EARNINGS

Signet Signals Slowdown In Engagements

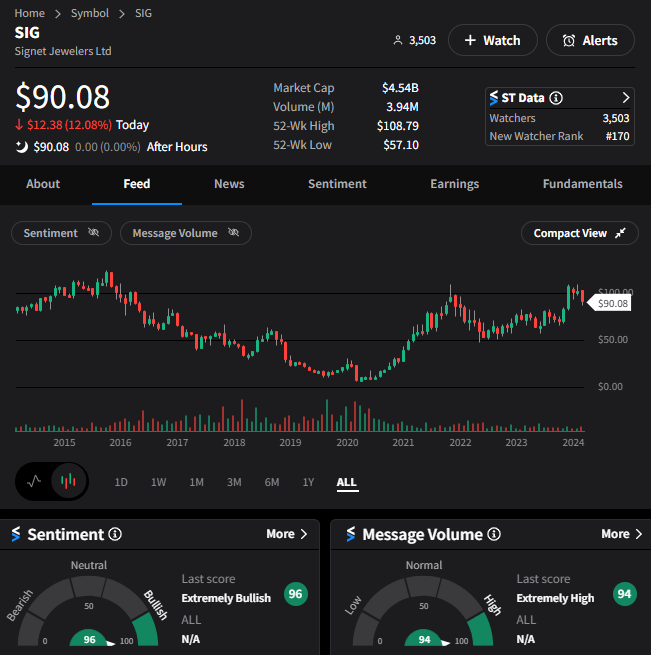

The U.S. jewelry retailer suffered its worst day in about two years after warning of a same-store sales decline in the current quarter, citing a drop-off in marriage engagements to start the year. It forecasted a 7% to 11% YoY decline in same-store sales, compared to a consensus estimate of +0.70%. ⚠️

Like other discretionary retailers struggling to spur demand, the company missed sales expectations but beat on profits due to cost-cutting efforts. It also boosted its dividend and share buyback program to try to appease investors in the short term. 💰

While this may seem like a one-off story, it ties into the broader challenges the country’s youth are facing in starting and advancing their adult lives in the current economic environment.

Everything is expensive, including relationships, marriage, buying a home, having children, and more. These struggles are trickling down through various industries, like jewelers, who depend on people going through the “traditional stages of life” in order to keep their businesses going. 💍

Executives said they expect sequential same-store sales improvement throughout fiscal 2025 as engagements gradually recover. But skeptics say the broader macroeconomic environment and socioeconomic challenges will continue to weigh on the engagement business.

Despite shares falling about 12% on the day, Stocktwits sentiment remained in “extremely bullish” territory, so we’ll have to wait and see if retail investor optimism pays off in the coming months and quarters. Maybe, just maybe, they’ve found a diamond in the rough? 🤔

IPO

Retail Readies For Reddit IPO

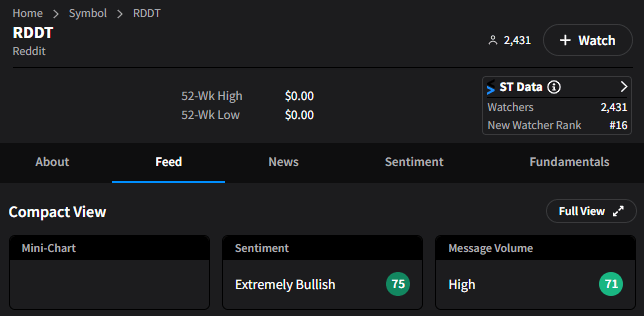

The Reddit IPO is finally upon us, and all the action is happening over on the $RDDT Stocktwits stream as the social media giant prices its IPO at $34 per share. 👀

Message volume is picking up heavily ahead of tomorrow’s first day of trading, with sentiment currently reading “extremely bullish” as the animal spirits continue to drive appetite for speculative (aka money-losing) companies.

The social media giant has notably set aside shares for users as it looks to reward its community for helping drive its business to this point. 💸

While some Reddit power users are jumping at the opportunity to participate in the IPO, others declined the offer, citing lingering tensions with management and concerns over the company’s ability to balance user experience and shareholder returns.

That said, there’s plenty of chatter about how the stock’s IPO is set to perform. If you have thoughts about how the stock will perform during its initial offering and afterward, come join the conversation and add the stock to your watchlist to stay on top of all the action. 💬

P.S. Be on the lookout for a giveaway happening on this stream in the next 24 hours; we’ll be handing out cool prizes as we discuss all the market action that’s bound to take place! 🎁

Bullets From The Day

💸 Intel awarded massive CHIPS Act grants as it eyes aggressive expansion. The chip giant will receive as much as $8.50 billion dollars in direct funding from the federal government, as well as up to $11 billion in loans tied to the legislation. The awards highlight the continued push to subsidize the onshoring of semiconductor manufacturing in the U.S. CNBC has more.

🚨 Google’s foray into generative AI hits another snag as French regulators impose a $270 million fine. France’s competition authority announced a new fine today, saying that the company disregarded some of its previous commitments with news publishers by using their content to train its generative AI model Bard/Gemini. The copyright issue remains a clear one for the artificial intelligence industry, and until clear regulatory approaches are established, we can expect more fines like this ahead. More from TechCrunch.

🔋 New, strict EPA emission rules poised to boost EV and hybrid demand. The Biden Administration finalized one of the most significant pieces of its ambitious climate agenda today, issuing the strongest new tailpipe rules for passenger cars and trucks. While electric vehicles (EVs) made up just 7.60% of new car sales in 2023, the new rule is targeting 35% to 56% for EVs in 2032 and 13% to 36% for plug-in hybrids. CNN Business has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍