NEWS

The Market Clock Strikes Midnight

Source: Tenor.com

And with that, the 2024 season comes to a close. The market ended another strong year on a weak note, with the major indexes continuing to feel the pressure of weakening breadth under the surface. With oddly-timed holidays breaking up the trading week, many are eying January 6th as the first major trading day of 2025. 👀

Today's issue covers how various assets did in 2024, the latest speculative small-caps surging, and an opportunity to share your top ideas heading into 2025. 📰

Here’s the S&P 500 heatmap. 6 of 11 sectors closed green, with energy (+1.31%) leading and technology (-0.83%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,882 | -0.43% |

Nasdaq | 19,311 | -0.90% |

Russell 2000 | 2,230 | +0.11% |

Dow Jones | 42,544 | -0.06% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $ONCO, $CMCT, $SEAT, $VSTM, $APM 📉 $GETY, $HE, $COIN, $SOS, $DNMR*

*If you’re a business and want to access this data via our API, email us.

STOCKS

A Quick Recap Of Winners & Losers 👀

We’ll do a full recap of how the market performed in 2024 once everyone’s back from the holidays. But for now, here are two charts that sum things up pretty well.

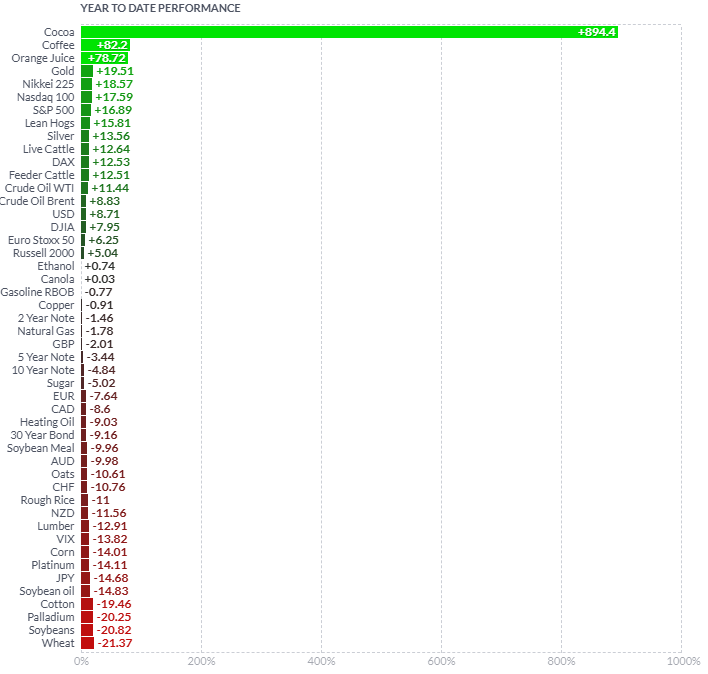

Starting with a breakdown of the major asset classes, cocoa blew everything away this year, soaring nearly 900% following a mix of bad weather patterns combined with speculators bidding up prices. Coffee and orange juice also posted massive gains due to similar market conditions, moving breakfast from “the most important meal of the day” to the “most important trade of the year.” 😅

Outside of that, it was a strong year for precious metals, with gold and silver topping the charts, inching out equities in the U.S. and globally. Japan’s Nikkei 225 was another big winner, with the large-cap U.S. indexes following closely behind. The true losers were foreign currencies, certain commodities, and bonds, to a lesser extent.

Source: Finviz.com

Moving into U.S. equities, “Magnificent Seven” stock performance was massive this year, with an ETF tracking those stocks up 64%. Every sector closed green, with the equal-weight S&P 500 also returning nearly 13% and showing a broadening of participation through most of the year, up until recently. 🤖

Cyclicals and more aggressive market sectors led, with the exception of utilities. Although utilities are typically viewed as a defensive, interest-rate-sensitive sector, they caught a bid this year as nuclear energy and the power needs of the tech and AI industries renewed interest in the space. ⚡

Source: Koyfin.com

Overall, it’s been a historically strong two years since the 2022 bear market ended, and investors are positioning for further gains into 2025. Notably, the S&P 500 posted back-to-back gains of over 20% for the first time since ‘97 and ‘98.

This year-end weakness is causing some to question what could potentially take the bull run off course next year, but for the majority of Wall Street and Main Street, dips continued to be viewed as buying opportunities. Time will tell if we’re all right. 🤷

SPONSORED

Gift THC edibles for fast-acting fun

Looking for an alcohol alternative to help you enjoy the holidays with family and friends? Cornbread Hemp has you covered with their 10mg THC Edibles. Formulated with a 1:1 ratio of THC to CBD (10mg of each), each gummy provides a balanced feeling of happiness without feeling overwhelmed or couch-locked. Customers have expressed their enjoyment solo or with friends, but either way, they’ll get you through the holidays with a smile on your face.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

Other Noteworthy Pops & Drops 📋

MicroAlgo Inc. (-6%): The company unveiled a FULL adder operation leveraging CPU registers within quantum gate computers, causing shares to surge more than 35% before reversing to close in the red.

Biohaven (+4%): The company’s director, John W. Childs, acquired shares worth $1.04 million on Monday, sparking a jump in retail sentiment.

Cemtrex Inc. (-8%): The company’s fourth-quarter revenue rose 9% to $18.1 million, surpassing analysts’ expectations of $16.39 million, driven by strength in its Advanced Industrial Services (AIS) segment.

Vacasa Inc. (+1%): The vacation rental management platform said it was merging with Casago, a vacation rental property management firm, rising 27% on Monday.

Precigen, Inc. (+22%): The clinical-stage biotech firm announced the completion of the rolling submission for a biologic license application (BLA) for PRGN-2012, a gene therapy being investigated as a treatment option for adult patients with recurrent respiratory papillomatosis (RRP).

Terreno Realty Corp. (+1%): The firm announced the acquisition of an industrial property located in Maspeth Queens, New York, for approximately $50.1 million.

STOCKTWITS COMMUNITY INSIGHTS

Share Your Top Trade Ideas For 2025! 🤩

We recently recapped an amazing 2024 on Stocktwits, but with the calendar now turning to 2025, we want to shift our focus to the future…and you can help!

We’re gathering the community’s top ideas for 2025 and giving out Stocktwits Edge to some of our favorites. Come share your highest conviction plays and see where the Stocktwits community is focusing in the new year. 🤑

STOCKS

The Latest Nano-Cap Stock To Go Nuclear 🤯

For the last few quarters, speculative activity has been running rampant in the stock and crypto markets, making it a major theme in this newsletter and our overall content. With the light-volume holiday trading sessions comes next-level funkiness, as we continue to see this week. 😵💫

Today’s example is Baird Medical Investment Holdings ($BDMD), which basically recovered all its post-SPAC decline in a single day. It came after the company, which specializes in minimally invasive microwave ablation (MWA) technology, showcased its innovations in endocrine care at the 2024 Southern Yue Forum in Guangzhou, China.

Shares were up roughly 630% at the closing bell but have continued to give back gains after hours…falling 35%. As usual, the volatility has attracted a lot of momentum traders who are just along for the ride, as investors remain skittish about the share price swings and unknown fundamental potential. 😬

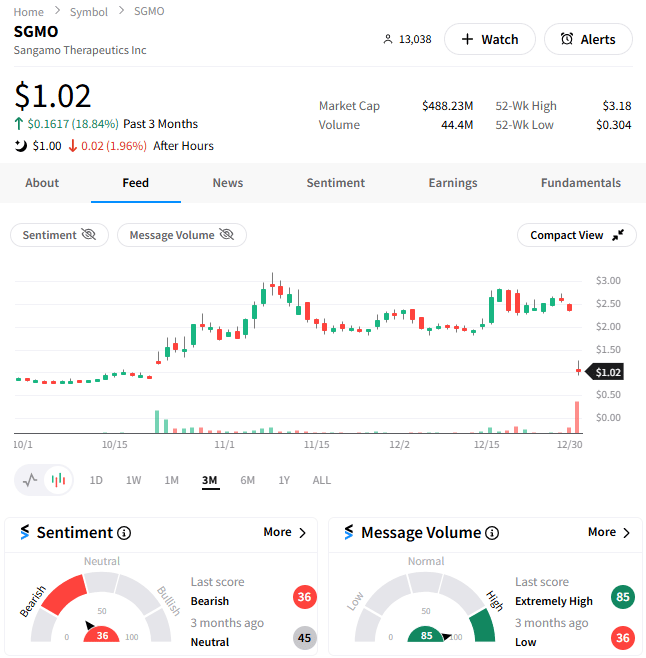

On the losing side biotech lottery today was Sangamo Therapeutics, which gave back three months of gains in about one session. The genomic medicine company said Pfizer had withdrawn from an agreement to develop a hemophilia drug.

Management “intends to explore all options to advance the program,” including seeking a new partner. However, investors are shooting first and asking questions later. Stocktwits sentiment flipped into ‘bearish’ territory as shares fell 56%. 📉

There are always winners and losers in this game of speculation. That’s why it’s important to have a game plan for your trades and only speculate (especially in highly volatile situations like these) with money you can afford to lose. 😐

PRESENTED BY STOCKTWITS

Daily Rip Live: The Final Trading Day Of 2024 ⌛

Daily Rip Live hosts Shay Boloor and Jordan Lee recap the market’s record year, discuss their current positioning, and chat about key themes like the emerging space economy, the future of natural gas, and their bold predictions for the year ahead. 👀

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋