NEWS

The Market Of Stocks Returns

Source: Tenor.com

Performance among indivdiual stocks continues to deviate, as the major indexes chop around in their recent ranges. With buyers and sellers lacking a clear catalyst to take control of the market, individual earnings and news is ruling the day as investors look for opportunities and traders cash in on the volatility. 👀

Today's issue covers Super Micro’s latest surprise, Upstart and others getting a Lyft after earnings, and other noteworthy pops and drops. 📰

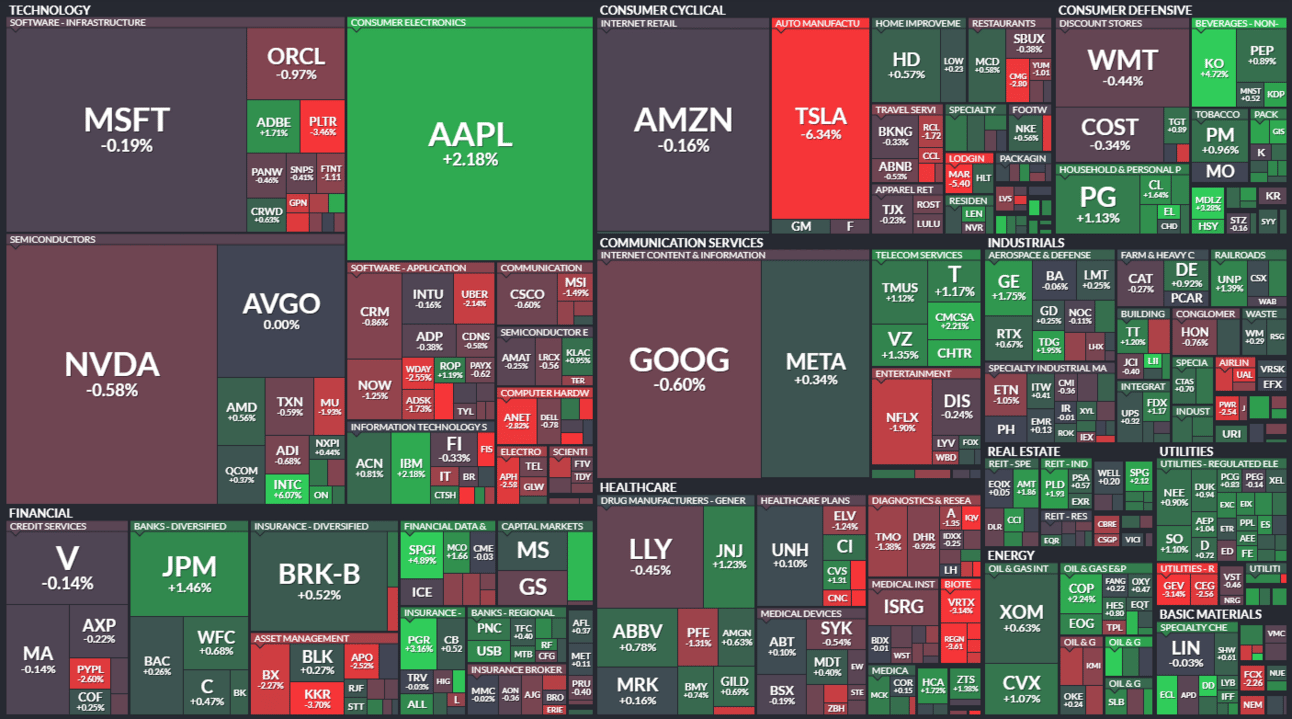

Here’s the S&P 500 heatmap. 9 of 11 sectors closed green, with consumer staples (+0.96%) leading and consumer discretionary (-1.14%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,069 | +0.03% |

Nasdaq | 19,644 | -0.36% |

Russell 2000 | 2,276 | -0.53% |

Dow Jones | 44,594 | +0.28% |

EARNINGS

Super Micro’s Latest Surprise 🤔

Super Micro Computer delivered a business update on its fiscal second-quarter, posting adjusted earnings per share of $0.58 to $0.60 per share on revenues of $5.6 to $5.7 billion. Those measures were below the consensus views of $0.61 and $5.77 billion.

Additionally, its revenue guidance of $5 to $6 billion for the current quarter is unlikely to meet the $5.92 billion Wall Street estimate. Notably, the company said it expects to file its 10-K for the year ended June 30, 2024 and 10-Q for the quarter ended September, 2024 by the Nasdaq’s February 25th deadline. 🗓

CEO Charles Liang said the company is paving the way for $40 billion in revenue during fiscal 2026 (well above the $29.2 billion consensus view), even though fiscal 2025’s revenue missed estimates by a wide margin. 🙃

Shares surged 8% after the bell on this optimistic outlook. However, a minority of users feel more cautious, waiting to see if the company can actually meet its deadlines to file audited financial statements.

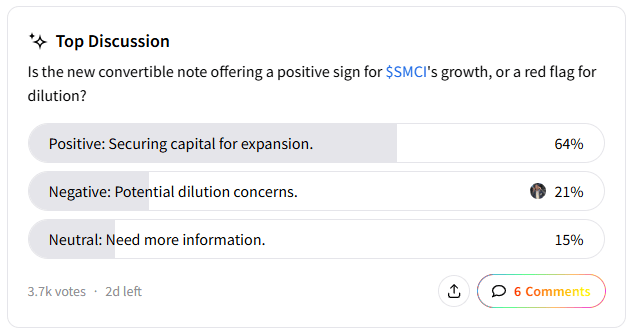

A Stocktwits poll indicates that two-thirds of the 3,700+ respondents view today’s $700 million convertible note offering as a positive. With the Nasdaq’s deadline approaching, time will tell if the optimism pays off! 🤷

By the way, have you seen the earnings recaps we’ve begun rolling out on Stocktwits? AI earnings summaries are coming soon for all major earnings events, making Stocktwits the premiere spot to listen to earnings calls, get a recap of the results, and discuss the trade with other active investors and traders. Check it out! 👇

SPONSORED

Final Hours to Invest in the Biggest Disruption to IP Since Disney

Tomorrow is the last day for investors to get a piece of some of the biggest names in entertainment.

Elf Labs won 100+ historic trademarks to characters like Cinderella, Snow White & The Little Mermaid. Now, they’re giving investors the opportunity to tap into the $2T entertainment & merchandising market.

Not only is Elf Labs signing major toy, apparel & food deals globally — they’re also using patented technology to bring their characters to life with AR/VR and AI — creating a first-of-its-kind, revolutionary entertainment platform.

But here’s the catch—only limited shares remain and their investment round closes tomorrow.

Cinderella’s magic ended at midnight—don’t let yours—Invest Now.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. This is a paid advertisement for Elf Labs’ Regulation CF offering. Please read the offering circular at elflabs.com.

STOCKS

Other Noteworthy Pops & Drops 📋

Lattice Semiconductor ($LSCC +9%): The chipmaker received several price target hikes after reporting slightly-above-consensus guidance and improved bookings.

GlobalFoundries ($GFS +6%): The chipmaker’s earnings and revenue barely topped estimates, with data center and automotive segments growing 18% and 30% YoY.

Redwire Corp ($RWD -6%): The space infrastructure firm announced that Orion Space Solutions has awarded an order to deliver a Mako spacecraft to support Tetra-6, a U.S. Space Force (USSF) Space Systems Command (SSC) mission.

Phillips 66 ($PSX +4%): Reports surfaced that activist investor Elliott Investment Management has built a stake in the oil refiner valued at more than $2.5 billion and plans to push the company to sell or spin off its midstream business.

DuPont de Nemours ($DD +7%): The chemical giant’s earnings and revenue topped estimates, with its electronics and industrial unit posting 10.6% YoY growth.

IonQ ($IONQ): The company announced a new collaboration with General Dynamics Corp. to gain further inroads into the federal government and defense sectors.

Cyngn ($CYN -25%): On Friday, the autonomous driving software maker disclosed stakes owned by New York-based hedge fund manager Michael Bigger and his funds in a Schedule 13G/A filing.

Astera Labs ($ALAB -10%): The AI connectivity solutions provider’s earnings and revenue topped estimates on “robust demand” for its Aries PCIe Retimer products.

Tesla ($TSLA -7%): Shares fell for a fifth straight session, as investors lose confidence in CEO Elon Musk’s ability to address declining sales across key regions.

Humana ($HUM -4%): The healthcare insuer giant’s fourth-quarter earnings missed estimates, as its benefits expense ratio rose from 90.7% last year to 91.5%.

Vertex Pharmaceuticals ($VRTX -3%): The biotech giant received multiple price target hikes after its earnings missed estimates, but revenue forecasts beating.

Travere Therapeutics ($TVTX +13%): Plans to seek full FDA approval for Filspari in treating focal segmental glomerulosclerosis (FSGS), a rare kidney disorder.

Paysafe ($PSFE -17%): The payments platform’s preliminary fourth-quarter earnings disappointed and it plans to sell its direct marketing payment processing business.

S&P Global Inc. ($SPGI +5%): THe ratings agency’s fourth-quarter earnings and revenue topped estimates, maintaining its target of returning 85% or more of adjusted free cash flow to shareholders through dividends and share repurchases.

Fidelity National Information Services ($FIS -11%): Fourth-quarter revenue fell short of estimates and its outlook disappointed investors.

Carlyle Group ($CG -4%): The alternative asset manager’s earnings missed estimates.

Cardano ($ADA.X +10%): The surge came after Grayscale Investments applied with the U.S. Securities and Exchange Commission (SEC) to list a Cardano exchange-traded fund (ETF) on the New York Stock Exchange (NYSE).

EARNINGS

Upstart Gets A Major Lyft After Earnings 🤩

Several popular stocks are popping on after-hours earnings, so let’s quickly recap!

Fintech lender Upstart Holdings is soaring 26% after the bell following better-than-expected earnings and revenues. Its first-quarter revenue guidance topped estimates, with analysts liking strong origination volumes and positive adjusted EBITDA. 🏦

Rideshare giant Lyft is falling 10% after its revenue and earnings topped estimates, but first-quarter guidance disappointed. Lower pricing and the loss of a key partnership are anticipated to weigh on bookings growth. 🚘

Doordash is dashing higher by 6% as higher-than-expected revenues offset an earnings miss. Management anticipates some deceleration in first-quarter 2025 due to marco factors and tough YoY comps, but signaled that new verticals like grocery and convenience exhibited strong growth. 🚴

Zillow is sinking 6% after its fourth-quarter revenue topped estimates, but earnings missed. Its outlook for a subdued housing market in 2025 weighed on the stock, as higher rates and record prices freeze activity in many key markets. 🏘

PRESENTED BY STOCKTWITS

“Trends With Friends” Discuss Golf’s Disruption 🏌

Howard, Phil, and Michael are joined by Jimmy Hoselton, founder of Grass Clippings. Today’s discussion breaks down the massive shift in golf, AI, and global tech power dynamics impacting the game and markets.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Consumer Price Index (8:30 am ET), Fed Chair Powell Testimony (10:00 am ET), EIA Energy Inventories (10:30 am ET), Fed Bostic Speech (12:00 pm ET), Monthly Budget Statement (2:00 pm ET), Fed Waller Speech (5:05 pm ET). 📊

Pre-Market Earnings: Barrick Gold ($GOLD), CVS Health ($CVS), Biogen ($BIIB), Anavex Life Sciences ($AVXL), Kraft Heinz ($KHC), Vertiv Holdings ($VRT). 🛏️

After-Hour Earnings: Robinhood ($HOOD), Reddit ($RDDT), QuantumScape ($QS), Cisco Systems ($CSCO), Fastly ($FSLY), Trade Desk ($TTD), Paycom Software ($PAYC), Upwrok ($UPWK), AppLovin ($APP), MGM Resorts ($MGM), Albermarle ($ALB). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋