NEWS

The Rest Of The Market Got Some Love

The DOW returned to 40k (the Emperor Protects) and then kept moving to hit new all-time highs. The S&P 500 also made new ATHs. And the Russell moved to levels not seen since mid-January 2022. However, all the indices gave up a good chunk of gains with strong selling into the close. Consequently, the NASDAQ was the only index to close in the red this week. Let’s see what you missed. 👀

Also, thank you for putting up with me (Jon Morgan, Litepaper author) this week! I now turn it back over to Tom! Have a great weekend everyone!

Today's issue covers JP Morgan, Citi, and Wells Fargo earnings, along with a possible future headwind about a NATO plan to seize China’s EU stuff, maybe. 📰

Here's today's heat map:

10 of 11 sectors closed green. Consumer discretionary (+0.96%) led, & communication services (-0.75%) lagged. 💚

June's Producer Price Index (PPI) rose 2.6% year-over-year, surpassing the 2.3% forecast, and marking the highest level since March 2023. The increase in final demand services prices was a key driver, while final demand goods saw a decline. Revised prior numbers and mixed signals leave the market uncertain about inflation trends. 📊

Fitch stated that the Federal Reserve needs to see similar CPI results in August and September before considering rate cuts. While some analysts predict a September cut, others argue the Fed might wait until November. The debate continues amid mixed economic signals and political considerations. 💵

Goldman Sachs warned of a potential "late summer equity market correction" if earnings disappoint and investors shift focus to autumn elections. Historical patterns and current market sentiment suggest downside risk after the best trading days of the year. Slow August flows, and full buyer positions add to the caution. 📉

The University of Michigan's July consumer sentiment fell to 66.0, below the expected 68.5 and down from 68.2 in June. Current conditions and expectations both declined, while 1-year and 5-year inflation expectations remained steady at 2.9%. The report indicates waning consumer confidence amidst economic uncertainties. 😟

The SEC concluded its three-year investigation into Hiro Systems, formerly Blockstack, which raised $70 million in token sales from 2017 to 2019, without recommending enforcement action. This follows the SEC's recent decision to drop an investigation into Paxos, marking another win for the crypto industry. 📝

Other active symbols: $MAXN (-1.37%), $TSLA (+3.64%), $NVDA (+3.15%), $DJT (+4.92%), $BTC (+0.94%), $LCID (+24.71%), and $QS (+17.56%). 🔥

Here are the closing prices:

S&P 500 | 5,615 | +0.55% |

Nasdaq | 18,398 | +0.63% |

Russell 2000 | 2,148 | +1.09% |

Dow Jones | 40,000 | +0.62% |

EARNINGS

JPMorgan Crushes Earnings, Stock Yawns 🥱

JPMorgan ($JPM) decided to show off this quarter thanks to a $7.9 billion net gain from Visa ($V) shares. Despite this, their stock dipped over 2% at the open. 📉

EPS: $4.40 vs. $4.14 expected

Net Income: $18.1 billion, up 25%

Revenue: $51 billion, up 20%

Provision for Credit Losses: $3.1 billion

Jamie Dimon, the CEO, is both boasting and warning. The guy’s juggling solid performance and economic doom. Their CET1 ratio is a comfy 15.3%, and they’re planning a dividend hike for the second time this year.

Investment banking fees skyrocketed 50%, equities trading revenue is up 21% to $3 billion, and fixed-income trading is up 5% to $4.8 billion. Yet, they set aside $3.05 billion for credit losses. Cautious much, Jamie? 🤔

Dimon also pointed out that while the company is in a strong position, they’re keeping a wary eye on the economic landscape. The provision for credit losses includes a net reserve build of $821 million, indicating they’re bracing for potential trouble ahead.

But hey, at least they’re increasing the dividend. 🚀

STOCKTWITS & 11thESTATE PARTNERSHIP

Effortlessly Find & Claim Shareholder Settlements 🕵️

In 2023, public companies settled a whopping $8.1 billion with investors. However, 75% of shareholders haven't claimed their payouts!

Even now, Apple, Alphabet, Zoom, and 50 other companies are distributing settlements to investors. Yet, most people either don’t know about these settlements or prefer not to spend time on the paperwork.

11thEstate identifies relevant settlements and recoveries, handles all the paperwork, and delivers the payouts to your account.

EARNINGS

Wells Fargo Wagon Breaks Down, Again 🛞

Wells Fargo ($WFC) posted Q2 earnings that beat expectations with an EPS of $1.33, but net investors weren’t thrilled. 😠

EPS: $1.33 vs. $1.29 expected

Revenue: $20.69 billion vs. $20.29 billion expected

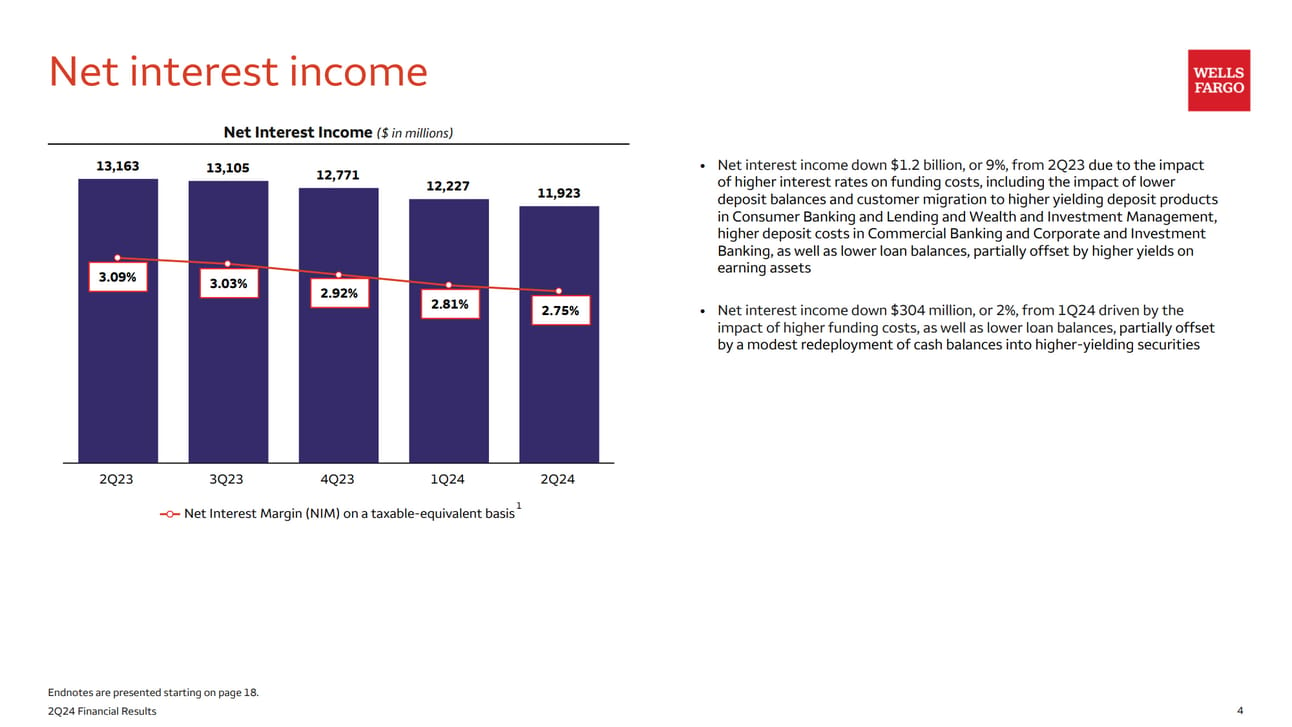

Net Interest Income: $11.92 billion, down 9%

CEO Charlie Scharf mentioned fee-based revenue was the silver lining in this cloud, but the bank’s provisions for credit losses hit $1.24 billion, hinting at stormy weather ahead.

Scharf’s economic outlook is basically: high inflation, high rates, and high chances of pain. On the bright side, noninterest income jumped 19% thanks to better trading revenue and investment banking fees. 😶

Net income dipped slightly to $4.91 billion from $4.94 billion a year ago. The bank also set aside $1.24 billion for credit losses, which includes a modest decrease in the allowance for those losses.

Meanwhile, their net interest margin fell to 2.75% from 3.09% a year ago, and average loans dropped 3% to $917 billion. The bank expects net interest income to be down 7% to 9% for the year. 🤦♂

Here’s the forecast: Mostly cloudy with a 100% chance of pain.

Scharf’s forecast is basically this: Mostly cloudy with a 100% chance of pain. ⛈

EARNINGS

Citigroup Beats, Then Gets Beaten 👊

Citigroup ($C) surprised everyone by topping expectations with an EPS of $1.52 and revenue of $20.14 billion, up 4%. Despite the strong results, their stock still managed to drop. 🔻

EPS: $1.52 vs. $1.39 expected

Revenue: $20.14 billion vs. $20.07 billion expected

Investment Banking Revenue: $853 million, up 60%

Equities trading revenue jumped 37% to $1.5 billion, thanks to derivatives and hedge funds. CEO Jane Fraser touted the progress in their strategy execution, but the regulatory slap they received this week adds a bitter note.

Citigroup’s net income jumped 10% to $3.22 billion from a year earlier. Fraser said, “Our results show the progress we are making in executing our strategy and the benefit of our diversified business model.” 🚀

NEWS

This Could Escalate Things A Little 🤌

Remember when Europe was desperately trying to climb out of the financial abyss around 2014ish? Chinese investments in Europe looked like a knight in shining armor back then. Fast forward to today, and those same investments are a glaring liability. 🗒

China's Infrastructure Investments: From Asset to Liability

With Europe now dealing with its biggest conflict since the 1940s, the idea of Beijing owning key infrastructure is making everyone squirm.

One U.S. official pointed out the obvious: if the conflict with Russia escalates, China could potentially use its European assets to lend a hand to its Russian buddies. 🤝

NATO's Plan: Nationalization and High-Tech Interests

NATO's newfound obsession with China was highlighted at the Washington summit, where 32 leaders collectively called out Beijing's cozy relationship with Moscow. The declaration didn't mince words, describing the China-Russia bromance as a "profound concern" that could upend the international order.

One NATO official suggested that if war breaks out, these assets would likely be nationalized or commandeered under emergency measures. China can take its grievances to court later—good luck with that. 🪖

Examples of Chinese Assets To Seize:

Rail lines connecting Eastern Europe to China

Ports in the North Sea and the Baltic Sea

Tens of billions of dollars in infrastructure investments since 2013

The U.S. sees a precedent here, referencing how European nations forced Russia to offload assets after the 2022 Ukraine invasion. The discussions aren't just about old-school infrastructure.

High-Tech Interests in the Discussions:

Quantum computing

Semiconductors

Telecom infrastructure

But, as usual, not everyone's on the same page. France, always the contrarian, wants to shift the discussion to the European Union, arguing that NATO isn't the best platform for tackling China. 🤼♂

STOCKTWITS “TRENDS WITH FRIENDS”

The European Union (EU) Takes On Big Tech ⚔️

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

This week, they’re joined by technology expert and investor Michael Parekh and the co-founder, chairman, and chief investment officer of Ritholtz Wealth Management, Barry Ritholtz. They discuss what scares them most as the market hits all-time highs, AI’s data ownership issues, and European regulators’ ongoing battle against U.S. tech giants.

Bullets From The Day

📈 BNY Surges to Record After ‘Cautiously Optimistic’ Forecast

Bank of New York Mellon ($BK) hit a record high after reporting better-than-expected net interest income and a “cautiously optimistic” forecast for the year. Net interest income was $1.03 billion for Q2, beating estimates by $20 million, despite a 6% year-over-year drop. Revenue edged up 2% to $4.6 billion, boosted by growth in investment services fees and foreign exchange sales. CEO Robin Vince highlighted their collaboration with BlackRock as a key driver of improved client experience and operational efficiency. From Bloomberg.

✂️ Unilever to Slash a Third of European Workforce

Unilever ($UL) plans to cut a third of its office-based roles in Europe by the end of 2025, affecting about 3,200 jobs. This move is part of a broader cost-cutting strategy announced in March, targeting 7,500 roles globally to revive growth under CEO Hein Schumacher. The company hopes to streamline operations, including splitting off its ice cream business to "do fewer things better." Hermann Soggeberg of Unilever’s European Works Council noted these are the biggest job cuts in decades. The BBC has more.

🌍 Marathon Oil Agrees to Record Penalty

Marathon Oil ($MRO) has agreed to a $241.5 million settlement for air quality violations at its operations on the Fort Berthold Indian Reservation. This includes a $64.5 million civil penalty, the largest ever for Clean Air Act violations at stationary sources. The settlement requires Marathon to implement extensive compliance measures, reducing over 2.3 million tons of pollution from more than 200 facilities in North Dakota. Attorney General Merrick B. Garland emphasized that this historic settlement will ensure cleaner air for the Fort Berthold community while holding Marathon accountable. More from CBS.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍