NEWS

The Stock Market Needs A Pardon

Source: Tenor

Since we’re handing out presidential pardons to those who’ve stolen investor funds, we should give one out to the broader stock market. That’s a Trevor Milton joke for you who aren’t filled in on that whole saga. Nevertheless, the market’s former tech giants are now leading stocks lower as investors worry about AI growth, Trump’s tariff impacts, and a potential economic recession. 👀

Today's issue covers why stocks are sliding into quarter-end, more signs the golden age of grift is upon us, and what drove the biggest market movers. 📰

Here’s the S&P 500 heatmap. 1 of 11 sectors closed green, with utilities (+0.74%) leading and consumer discretionary (-3.11%) lagging.

Source: Finviz

And here are the closing prices:

S&P 500 | 5,581 | -1.97% |

Nasdaq | 17,323 | -2.70% |

Russell 2000 | 2,023 | -2.05% |

Dow Jones | 41,584 | -1.69% |

STOCKS

Stocks Slide Into Quarter End 😬

The U.S. stock market is on pace to have its worst month since December 2022, and the S&P 500 is nearly back in “correction territory,” a 10% decline from its recent high. The Nasdaq 100 and Russell 2000 have already crossed this threshold.

Today’s catalysts included several things, starting with the core personal consumption expenditures (PCE) price index. This rose 0.4% MoM and 2.8% YoY, marking its biggest monthly gain since January 2024. A pickup in the Fed’s preferred inflation metric raises concerns about “stagflation,” where growth slows and inflation rises. 😨

On the tariff front, the mixed signals continue. Trump said he had a ‘very good’ call with Canada’s Carney ahead of the April 2nd reciprocal tariffs deadline. Still, he warned that the EU and Canada would face harsher tariffs if they collaborated “to do economic harm” to the U.S. Additionally, he noted that pharmaceutical tariffs would be incoming. ⚠

Lastly, CoreWeave’s lackluster public debut added to concerns about the AI industry’s growth potential. The Nvidia-backed “hyperscaler” reduced its offering price and number of shares, raising just $1.5 billion instead of $2.7 billion, with Nvidia anchoring the offering with a $250 million investment at $40 per share.

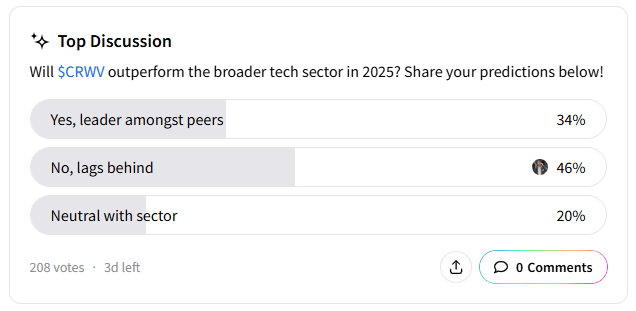

The weak first-day showing cast doubt on the sector and added pressure to an already falling tech sector. Looking ahead, the Stocktwits community remains mixed with the majority of poll respondents expecting it to underperform or match tech’s performance during 2025. 👎

Investors remain cautious with next week’s tariff deadline and U.S. employment data looming. Bears remain in control as bulls wait for more clarity on these key issues. 😬

SPONSORED

Apple’s Starlink Update Sparks Huge Earning Opportunity

Apple just secretly added Starlink satellite support to iPhones through iOS 18.3.

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone already reaches +45M users that have earned over $325M, and that’s before global satellite coverage. With SpaceX eliminating "dead zones" worldwide, Mode's earning technology can now reach billions more in unbanked and rural populations worldwide.

Their global expansion is perfectly timed, and you still have a chance to invest in their pre-IPO offering at just $0.26/share.

Mode’s recent 32,481% revenue growth and their newly reserved Nasdaq ticker $MODE puts them one step closer to a potential IPO.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur. The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period. Please read the offering circular at invest.modemobile.com. This is a paid advertisement for Mode Mobile’s Regulation A Offering.

STOCKS

Other Noteworthy Pops & Drops 📋

Honda ($HMC -5%): The National Highway Traffic Safety Administration (NHTSA) is opening an engineering analysis into over 2.2 million of the Japanese automaker’s vehicles, citing reports they failed to restart after coming to a complete stop.

Toyota Motor ($TM -2%): The Japanese automaker reported a 5.8% jump in sales of its Toyota and Lexus brand vehicles in February, marking the second straight month of growth. Vehicle sales in Japan rose 28.2% and outside the country rose 2.1%.

Tesla ($TSLA -4%): Deutsche Bank lowered its price target from $420 to $345, keeping its ‘Buy’ rating on the shares. It expects weaker first-quarter deliveries.

Katapult Holdings ($KPLT -20%): Revenue rose 9% YoY, but its fourth-quarter loss per share was larger than anticipated. For 2025, the company anticipates at least 20% growth in gross originations and revenue, but that was not enough for bulls.

Blackstone ($BX -4%): Announced that its infrastructure strategy for individual investors has agreed to acquire a minority stake of 22% in AGS Airports from AviAlliance for £235 million (approximately $304.17 million).

Humacyte ($HUMA -5%): The commercial-stage biotech platform reported a narrower-than-expected loss. However, investors are waiting for an update on its pipeline, given it has not generated revenues for two years.

Shell ($SHEL +1%): Activist investor Elliott Investment Management reportedly took a short position of £850 million ($1.1 billion) against the company.

Kyndryl Holdings ($KD -3%): Several brokerages reiterated their bullish stance on the stock, with management responding to short seller Gotham City Research’s allegations by calling the report “inaccurate and deliberately misleading.”

Milestone Pharmaceuticals ($MIST -60%): The Food and Drug Administration (FDA) did not approve its lead investigational product, Cardamyst. The FDA highlighted two key Chemistry, Manufacturing and Controls (CMC) issues and asked the company to submit additional information.

Wolfspeed ($WOLF -52%): Speculation mounted that the company had lost access to CHIPs Act funding and could face bankruptcy. The company has responded to the rumours, stating that it "continues to explore alternatives with regard to its convertible notes, in partnership with its advisors, and remains in a dialogue with lenders, including Apollo and Renesas."

SPONSORED

Technical Analysis, Market Strategy & Next-Gen Portfolio Insights: Monday, April 14th

Join CMT Association for a must-attend event for financial professionals seeking cutting-edge insights into technical analysis, market strategy, and next-gen portfolio management. Taking place at the stunning Hudson Yards, this summit promises to deliver valuable knowledge from industry leaders and thought-provoking discussions.

Kick off the Summit with networking and refreshments, then dive into an afternoon filled with engaging sessions. Learn how to go beyond traditional portfolio metrics with Mathew Verdouw’s exploration of Variability Weighted Return (VWR). Discover tactical strategies for protecting momentum portfolios with veteran hedge fund portfolio managers, and develop a tactical playbook for volatile, uncertain, and erratic markets, from a panel of seasoned experts, including Jay Woods, CMT, Frank Cappelleri, CMT, CFA, and Katie Stockton, CMT.

Wrap up the summit by connecting with peers during a relaxed cocktail hour. Don’t miss this unique opportunity to advance your technical analysis expertise and expand your professional network.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

One Fraud Released, Another Jailed 👮

Nikola founder Trevor Milton is officially free following a presidential pardon from Donald Trump. He was convicted in October 2022 of federal crimes related to defrauding investors with false claims about the success of the electric and hydrogen-powered truck maker. He was sentenced to four years in prison. 😐

The move raised many red flags if you want to go down a rabbit hole this weekend. But when asked by reporters about it, here’s how Trump responded. 🤦

The golden age of the grift is upon us. If you needed any more evidence of that, just see Haily Welch saying the SEC has closed its investigation into “Hawk Tuah Coin” and its 95% crash that wiped out people’s funds. Also, the Senate overturned a Consumer Financial Protection Bureau (CFPB) ruling to cap overdraft fees at $5. Glad we’re focused on the big issues as more pardons roll in. 🙃

Investors and consumers have been increasingly left to fend for themselves in this deregulated “wild wild west” environment, and it’s set to continue. So ensure you’re reading those terms and conditions closely, because we’re on our own. 🤷

For those needing a glimmer of hope, while one fraud is getting out of jail, another is headed in. Charlie Javice was found guilty of defrauding JPMorgan Chase in a $175 million deal by vastly overstating the customer list of her startup, Frank.

PRESENTED BY STOCKTWITS

“The Weekend Rip” With Ben & Emil 📺

A wild week—big wins, bigger losses, and plenty of market mayhem to unpack.

Highs & Lows: Ben went from options-trading king to bagholder in record time—trading really is like a punch from Mike Tyson.

Market Madness: NVIDIA stumbles, Lululemon blames foreigners, and Rivian tries to woo the Subaru crowd.

Betting Big: Booking.com puts, SPX heartbreaks, and why even Airbnb can't lure Canadians south.

Inflation Watch: Rick Santelli says it’s up, but honestly—bonds are just slow-motion paint drying.

Cashtag Awards Chaos: Trivia, Stocktwits giveaways, and Ben looking for someone (anyone) to blame for his week.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋