NEWS

“The Time Has Come” - Jerome Powell

Source: Tenor.com

Jerome Powell, the destroyer of puts, delivered dovish remarks at Jackson Hole today, sending pretty much every asset except the U.S. Dollar higher. Small-caps led the way as firms like regional banks benefit significantly from a lower-rate environment. Let’s see what you missed. 👀

Today's issue covers the market’s reaction to Powell’s speech, broadening stock market participation, and why cyber stocks are in focus going into next week. 📰

Here’s the S&P 500 heatmap. 11 of 11 sectors closed green, with consumer discretionary (+1.93%) leading and utilities (+0.28%) lagging.

Source: Finviz.com + Canva

And here are the closing prices:

S&P 500 | 5,635 | +1.15% |

Nasdaq | 17,878 | +1.47% |

Russell 2000 | 2,219 | +3.19% |

Dow Jones | 41,175 | +1.14% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $SSYS, $MNTS, $BKKT, $SQNS, $WDAY 📉 $GEV, $UI, $IESC, $UWMC, $CLEU*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Small-Caps Roar After Powell’s Push 📈

After setting the table for a September cut at the July meeting, Fed Chairman Jerome Powell confirmed, in no uncertain terms, that the pivot is complete.

In the early part of his speech, he said, “The time has come for policy to adjust. The direction of travel is clear and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.”

Some other noteworthy phrases include:

“The cooling in labor market conditions is unmistakable.”

“It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon.”

“We do not seek or welcome further cooling in labor market conditions.”

“We will do everything we can to support a strong labor market as we make further progress toward price stability.”

The paragraph below sums up his view on current conditions and how the Fed looks to navigate them going forward. 👇

We will do everything we can to support a strong labor market as we make further progress toward price stability. With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market. The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.

The question now is not whether the Fed will cut but how quickly it will need to cut based on the economy’s trajectory. Currently, the market is pricing in 125 bps in cuts before the end of the year, which is significantly more aggressive than the Fed’s June projections. 🔮

What they agree on, however, is that the long-term ‘neutral rate’ is likely in the mid-3% range. However, the market’s expected path to get there is likely to thrash around with the economic data as it comes in, while the Fed takes a more measured approach to its communication and policy moves.

Market participants expect rate cuts to benefit stocks across the board, but the lower rate environment continues to drive strength in small-cap stocks, which are more leveraged to the level and path of interest rates.

Bullish analysts expect the gap between large-cap and small-cap performance to continue closing, which it did today, as the Russell 2000 rose over 3%. And the Stocktwits community seems to agree, as sentiment pushed into ‘extremely bullish’ territory during today’s move. 🐂

Source: Koyfin.com

CHART OF THE DAY

No Longer “Just 7” Stocks… 🐂

One of the bears’ primary arguments over the last year (and a few years) has been that the stock market has depended on some combination of the “Magnificent Seven” mega-cap stocks to keep it going.

That argument was still being made despite the significant broadening of participation this year, with sectors ranging from industrials to financials to healthcare all breaking out to new all-time highs. 🤷

Today’s ‘Chart of The Day’ should officially put that argument to bed, especially when paired with the Russell 2000’s latest run discussed above.

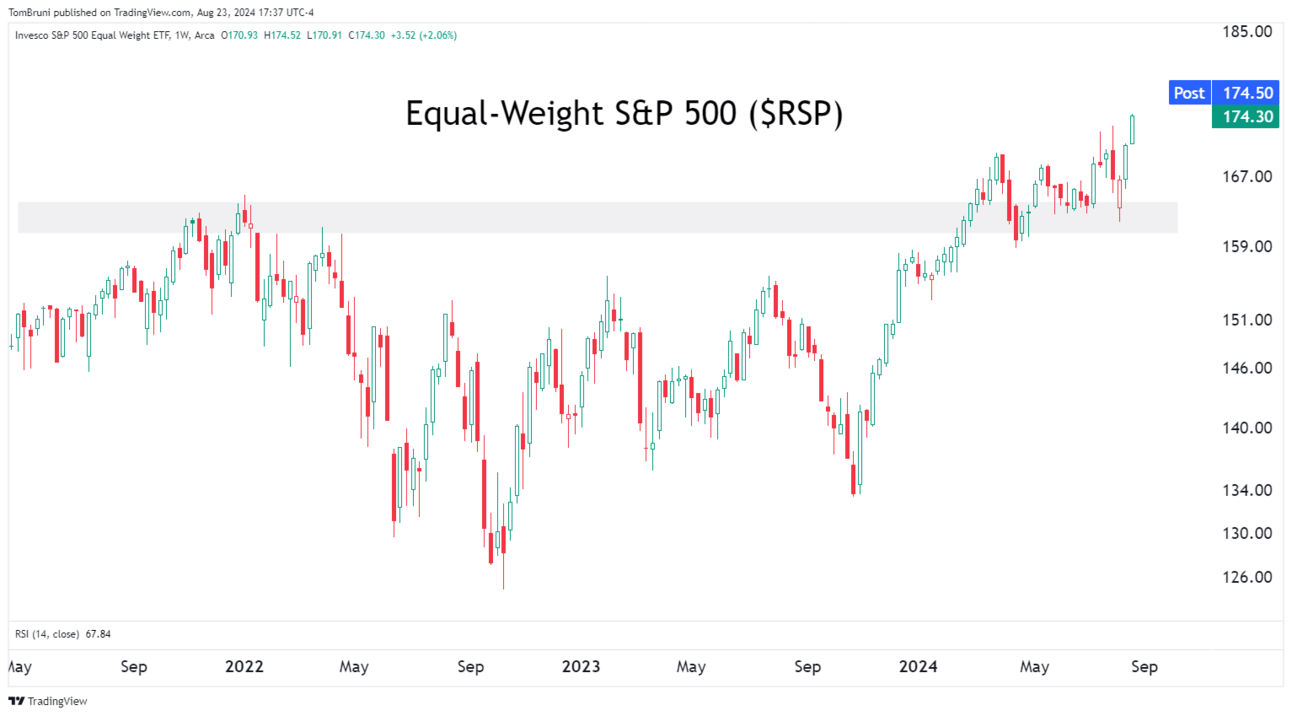

Below is a chart of the equal-weighted S&P 500 ETF ($RSP), which had broken above its 2021 highs earlier in the year but had been flirting with those levels consistently…leaving room for the bears to say it was bound to break down. 🙄

Source: Tradingview.com

With the index now firmly above resistance and closing at new all-time highs, the bears will need to spend this weekend devising a fresh narrative to support their thesis.

For now, stock market bulls are enjoying opportunities on the long side, many of which we feature daily in our Chart Art Newsletter. Check it out! 😉

STOCKTWITS “TRENDS WITH FRIENDS”

The Strange Sentiment Driving Healthcare’s Bull Market 🤔

STOCKS

Halliburton Hack Keeps Cyber On The Map 👀

Oilfield services giant Halliburton is the latest cyberattack victim. In a Securities & Exchange Commission (SEC) filing, the company revealed that it discovered an unauthorized party had gained access to some of its systems. 😬

It’s the latest in a series of headline-grabbing hacks, with global cyberattacks rising 30% YoY during the second quarter.

As a result, investors are also heavily focused on the sector, with many patiently waiting for industry-focused vehicles like ETF $HACK to break out to new all-time highs. The chart is testing resistance near $68 for the third time in four years, and many expect it to break out. 🤞

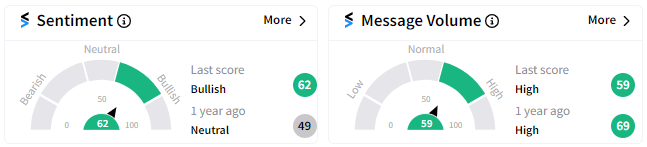

Stocktwits sentiment is currently in ‘bullish territory,’ with many watching CrowdStrike’s earnings on Wednesday as a potential catalyst to set the industry’s direction. 🧐

Source: Stocktwits.com

If the company can provide an upbeat outlook like Palo Alto Networks did, traders will be looking for $HACK and other vehicles to make new highs through the end of the year. Given CrowdStrike’s latest self-inflicted wounds, investors will focus primarily on its comments about the industry’s performance instead of the company’s own.

Time will tell. But for now, it’s clear $HACK is back on traders’ radars! 🕵️

WHAT’S ON DECK

Next Week’s Schedule 📝

Monday: Thinking about Nvidia earnings

Tuesday: Losing sleep over Nvidia earnings

Wednesday: Nvidia earnings

Thursday: Reviewing Nvidia earnings

Friday: Preparing for Nvidia’s next earnings

We’re joking, but not really. It’s that big of a deal, so we’re pulling out all the stops for “Nvidia Day" on Wednesday. 😆

Be sure to follow @Stocktwits on the platform and our socials (X, Instagram, YouTube) so you don’t miss out on all the action we’ve got planned ahead of the event! 🚨

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋