NEWS

The Trade War’s Latest Casualties

Source: Tenor.com

Stocks were slammed as the macro environment gave the bears more catalysts to press their downside bets. The largest names continue to weigh on the major indexes, with big tech names lacking a clear catalyst to head higher. Pockets of green in safe-haven parts of the market were the only source of solace for bulls. 👀

Today's issue covers what drove the market decline, the energy sector’s latest developments, a new “Daily Rip Live” co-host, and more from the day. 📰

Here’s the S&P 500 heatmap. 4 of 11 sectors closed green, with real estate (+0.86%) leading and energy (-3.49%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,850 | -1.76% |

Nasdaq | 18,350 | -2.64% |

Russell 2000 | 2,102 | -2.81% |

Dow Jones | 43,191 | -1.48% |

STOCKS

Today’s Downside Catalysts 📉

The time has come for tariffs, with Donald Trump saying that 25% taxes on imports from Mexico and Canada will begin on Tuesday. He also slapped another 10% tariff on imports from China, bringing the total rate to 20%. 📊

His tariffs are reportedly a tool to force our North American neighbors to improve their efforts to fight fentanyl trafficking and illegal immigration. However, he’s also indicated that he wants to eliminate America’s trade imbalances and push for more U.S. factories.

On top of that, Nvidia, Super Micro Computer, and Dell plunged, dragging down the semiconductor sector. Singapore said it’s investigating whether servers shipped to Malaysia containing chips barred from China ended up in the mainland. 🕵

Findings from the investigation could risk increasing U.S. scrutiny of equipment exports by the American companies, which would weigh on sales growth.

The tariff troubles and semiconductor scaries were paired with the Atlanta Fed’s GDP estimate tool falling deeply into negative territory. The real-time data tracker suggests that gross domestic product (GDP) could fall by 1.5% during the first quarter, sparking a growth scare among investors.

Driving this decline is a sharp rise in the U.S. trade imbalance, with companies front-loading purchases in order to avoid tariffs. 📦

While that explains some of today’s readings, many fear the continued uncertainty around the macro and global environment could impact companies’ decisions. More uncertainty typically means companies pull back, which could ultimately hurt growth, which has already slowed for the last several quarters.

Lastly, the crypto market added to the risk-off behavior. Over the weekend, the Trump administration announced plans for a strategic crypto reserve, naming Bitcoin, Solana, Ripple, and Cardano and sending the market higher. 🪙

However, the move was sold into throughout the day, with Bitcoin giving back all of its gains in the process. Investors say the “sell the news” reaction is not a positive sign for crypto bulls and that the near-term risk remains to the downside.

The combination of all these factors sent bulls running for the hills. As we’ve been talking about, bulls continue to lack a clear catalyst to counter the downside momentum that this market is experiencing almost daily.

Stocktwits sentiment remains in ‘bearish’ territory, while roughly 62% of poll respondents see the tariffs as a negative for the overall market. 🐻

SPONSORED

Smart Nora’s patented solution has already brought better sleep to more than 100,000 customers. The company is now bringing this technology to millions of people who can not tolerate CPAPs and other invasive snoring and sleep apnea solutions. Sleep apnea awareness and detection are at all times high. This is the perfect opportunity to join them.

Read the Offering information carefully before investing. It contains details of the issuer’s business, risks, charges, expenses, and other information, which should be considered before investing. Obtain a Form C and Offering Memorandum at invest.smartnora.com. This is a paid advertisement for Smart Nora, LLC's Reg CF campaign.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Sunnova Shares Plunge 🪫

Residential solar provider Sunnova Energy International fell over 63% after issuing a “going concern” warning. Management said its unrestricted cash, operating cash flows, and existing financing agreements were “not sufficient to meet obligations and fund operations.”

The company hired a financial advisor to help with debt management and refinancing efforts. However, slow revenue growth remains a key concern, and it has forced the company to cut 15% of its workforce to conserve cash. ✂

Higher interest rates and lower state incentives continue to crush the residential solar industry by making it more expensive for consumers to get set up. Concerns about federal solar tax credit cuts are another headwind.

Shares fell to new all-time lows on the news, with investors concerned that with shares falling below $1, delisting could be around the corner. 😨

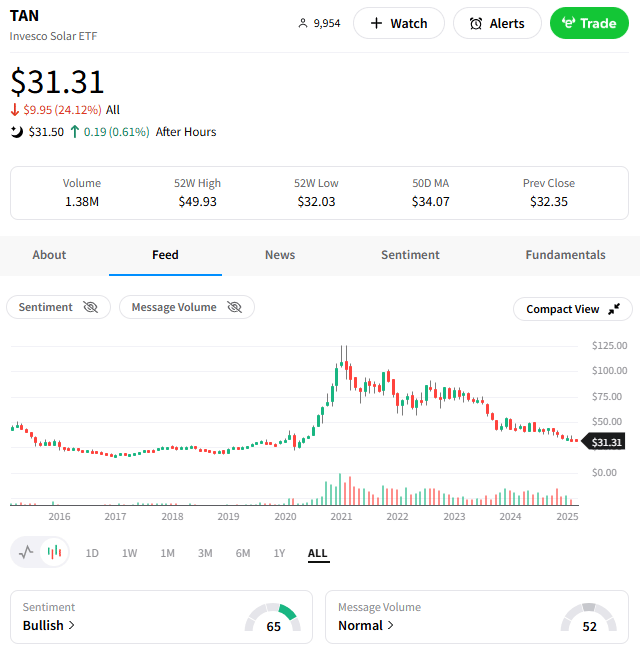

The news dragged down all solar energy stocks, with the ETF $TAN falling 3% to roughly 5-year lows on the day. Despite the plunge, Stocktwits sentiment remained in ‘bullish’ territory, though most acknowledge the sector as a contrarian bet given all the ‘obvious’ headwinds and an unclear upside catalyst. ⛈

STOCKS

Other Noteworthy Pops & Drops 📋

California Resources Corp. ($CRC -13%): The oil and gas giant’s earnings and revenue fell short of estimates as its quarterly oil production fell.

Occidential Petroleum Corp. ($OXY -5%): Announced an offer to exercise its outstanding publicly traded warrants at a temporary reduced price. Occidental said it intends to use the proceeds for general corporate purposes, which may include the redemption or repayment of certain of its outstanding indebtedness.

FTAI Aviation ($FTAI -7%): Muddy Waters Research said an Iranian engine shop appears to have acquired an FTAI Engine Module, violating U.S. sanctions. The report cited evidence published on LinkedIn in January and February 2025 by an Iranian airline executive of Sorena Turbine, an aircraft MRO based in Iran.

Argo Blockchain ($ARBK -23%): The Bitcoin miner announced it had entered into a non-binding term sheet for up to $40 million in senior secured convertible loans.

Hut 8 Mining ($HUT -3%): The Bitcoin miner posted a sharp rise in net income during 2024 but noted weaker revenue during the fourth quarter. Gains on digital assets and a steep drop in energy costs drove the net income jump.

FedEx Corp ($FDX -2%): The logistics giant was dinged by several analysts ahead of its third-quarter report. Macro uncertainty led to the cautious stance.

EARNINGS

OPEC+ Has Oil Bulls Saying Ouchie 😬

Crude oil prices fell to fresh 2025 lows following Bloomberg reports that OPEC+ will restart some halted production, a surprise decision adding to an already projected global surplus of inventory. 🛢

The market largely expected OPEC+ to push back the timeline for its production restarts given an already supply surplus and a dim outlook for energy in the world’s two largest economies (the U.S. and China).

On top of this, Trump’s tariff impacts and potential trade war escalations have furthered the gloom in the market, with hedge funds cutting their net-long positions in U.S. crude oil to their lowest since 2010. ✂

Ultimately, analysts suggest this dynamic could result in the U.S. losing market share to top foreign oil suppliers, which is why U.S. oil stocks were hit hard today.

Popular energy ETF $XLE was down 3.5% and remains stuck in a multi-year range as the overall market lacks direction. Why the Stocktwits community remains ‘extremely bullish’ is unclear, but some are clearly "buying the dip.” 🤷

PRESENTED BY STOCKTWITS

Daily Rip Live: Reacting To A Wild Weekend 🤯

New co-host Katie Perry joins Daily Rip Live’s Shay Boloor to discuss Trump’s crypto reserve announcement, the stock market’s rotation continuing, the setup heading into retail earnings, and a deep-value pick with massive risk-reward potential.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: JOLTs Job Data (9:00 am ET), RCM/TIPP Economic Optimism (10:00 am ET), Fed Williams Speech (2:20 pm ET). 📊

Pre-Market Earnings: Target ($TGT), Best Buy ($BBY), PaySafe ($PSFE), Sea ($SE), EVgo ($EVGO), Plug Power ($PLUG), On Holdings ($ONON), Autozone ($AZO). 🛏️

After-Hour Earnings: CrowdStrike ($CRWD), AeroVironment ($AVAV), ChargePoint Holdings ($CHPT), Nordstrom ($JWN), Ross Stores ($ROSS), Box ($BOX). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋