NEWS

The Trend Is The Bulls’ Friend

Source: Tenor.com

The tech-heavy Nasdaq 100 and S&P 500 made new all-time closing highs, with Nvidia and semiconductors helping drive the latest bull run. A lack of Trump tariff comments or other surprises helped investors feel comfortable staying long into the three-day weekend. Time will tell if this weekend is restful or if the pot is stirred. 👀

Today's issue covers the bullish trend continuing, Michael Burry’s buying spree, a brand new “Weekend Rip” episode, and other noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 4 of 11 sectors closed green, with communication services (+0.61%) leading and healthcare (-1.09%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,115 | -0.01% |

Nasdaq | 20,027 | +0.41% |

Russell 2000 | 2,280 | -0.10% |

Dow Jones | 44,546 | -0.37% |

STOCKS

When In Doubt, Zoom Out 🔍

Bulls continue to climb the “wall of worry,” and long-term investors are rewarded for sticking with the trend despite all the reasons to sell. Sometimes simplicity pays, so let’s view how some market participants attempt to keep it simple.

Below is a chart of Nasdaq 100 futures showing prices continually staying above their primary trendline and long-term (200-day) moving average. Whether using higher highs and higher lows, trendlines, moving averages, momentum indicators, or some other trend-following method, the path of least resistance remains higher. 📈

Source: TradingView

Looking ahead, one catalyst that could propel or derail stocks’ recent move is the U.S. Dollar Index. There’s been a negative correlation with stocks, as investors “rushed for safety” via the U.S. Dollar and treasuries during periods of uncertainty.

However, the Dollar's breakdown from its recent range could suggest some of that fear is leaving the market, and investors are taking a more aggressive approach toward risk assets like stocks, crypto, etc. The chart below shows prices retesting their former highs, and how prices react here will tell investors a lot about what’s next. 🕵

Source: TradingView

SPONSORED

Join Top Investors Before This “Unlisted” Stock Price Changes

When the team that created Zillow and grew it into a $16B real estate leader starts a new company, investors take note. That’s why top firms like SoftBank and Maveron already invested in Pacaso.

Pacaso’s disruptive co-ownership model took America by storm, earning $100M+ in gross profits in just four years. Now, they’re turning their focus to expanding internationally – which is why their share price is changing February 27.

Pacaso has already sold out two Paris homes in record time, with another on its way. In London, they just finalized the purchase of their most expensive European home yet. Meanwhile, in Cabo, they’ve added seven homes. And this is just the start. That’s why they formed a new partnership with a private UK lender to aid further growth.

Soon, Pacaso will become a globally known brand – which means the current $2.70/share price won’t last long. Lock in your stake before 2/27.*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com.

STOCKS

Michael Burry’s Buying Spree 🤑

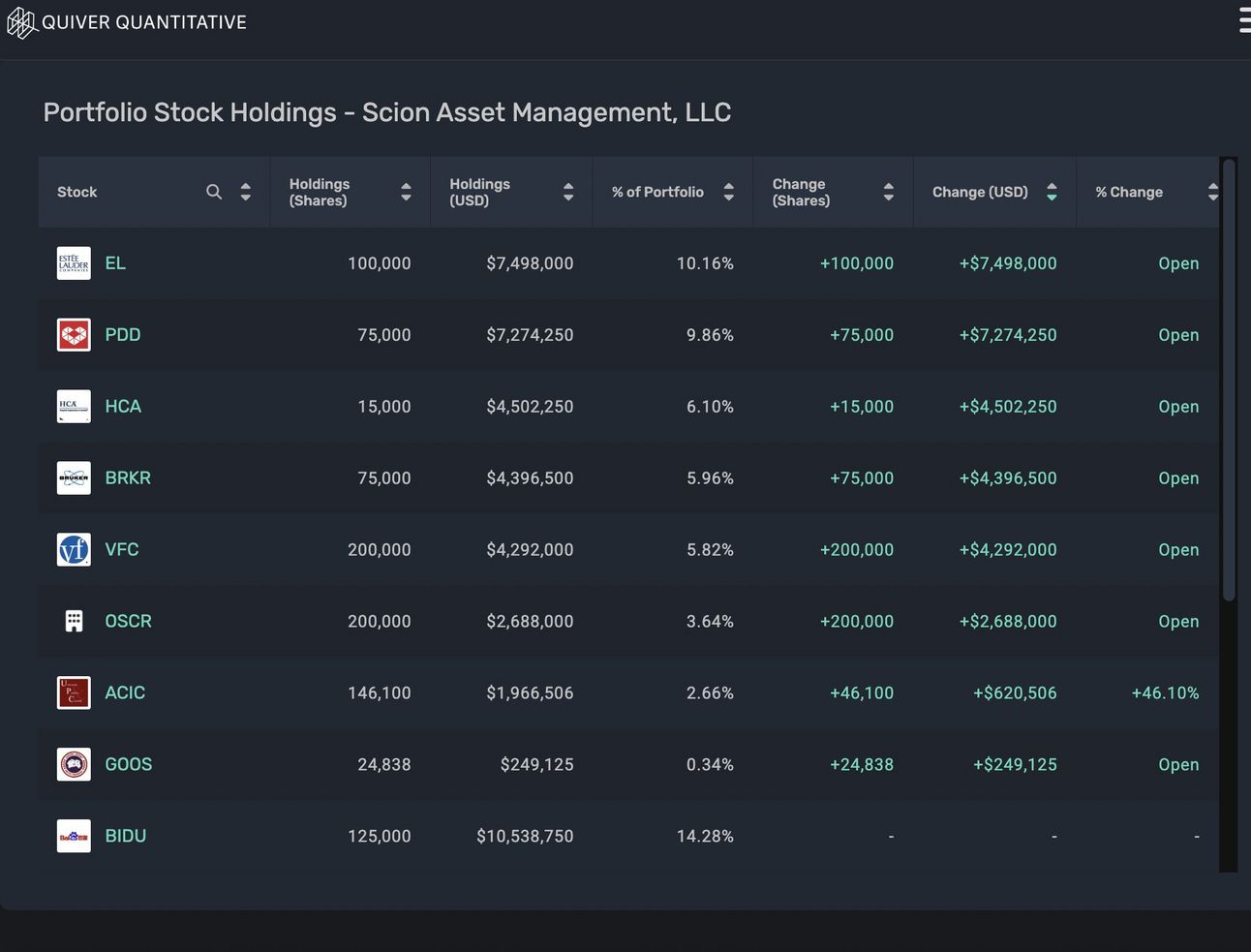

It’s that time of the quarter when major investors and institutions file with regulators to share their portfolio moves. The Big Short’s Michael Burry of Scion Asset Management is the investor getting the most attention.

Unlike January 2023, when he infamously tweeted “Sell,” last quarter, Burry went on a buying spree…adding positions in Estee Lauder, PDD Holdings, HCA Healthcare, Bruker Corp., VF Corp., Oscar Health, and Canada Goose. Notably, people pointed out he’s no longer in Alibaba, diversifying his China exposure via PDD. 💰

Source: QuiverQuant via X.

Meanwhile, Warren Buffett caused a major pop in Constellation Brands after buying a $1.2 billion stake in the struggling alcohol company amid its recent rout. He also reduced his stake in several financial stocks and other smaller core positions. 🍻

David Tepper, however, added to his Alibaba position during the quarter, making it the top position in his portfolio at roughly 15%. Appaloosa Management was among some of the most active funds this quarter, making moves across most holdings.

There’s a solid X thread from Evan (aka @StockMKTNewz) outlining other major moves, so check that out if you’re interested! 👀

STOCKS

Other Noteworthy Pops & Drops 📋

Moderna ($MRNA +3%): Bounced back despite a wider-than-expected quarterly loss and lackluster 2025 revenue forecast. Covid-19 vaccine sales fell 66% YoY.

Mind Medicine ($MNMD +15%): Retail traders viewed Robert F. Kennedy Jr.’s confirmation as U.S. Health and Human Services secretary as a major catalyst.

Informatica ($INFA -22%): The AI-powered enterprise cloud data management platform’s fourth-quarter revenue and guidance missed expectations.

Ingersoll-Rand ($IR -7%): The industrial products firm’s revenue missed estimates, with a decline in power tools and lifting equipment orders driving weakness.

Enbridge (ENB -4%): Fourth-quarter earnings topped estimates, with hedging activities and mainline pipeline volume declines contributing to the weakness.

Howmet Aerospace ($HWM +4%): Received several price target updates following upbeat fourth-quarter earnings and outlook.

Air Lease ($AL +7%): Fourth-quarter earnings and revenue topped estimates.

Arm Holdings ($ARM -4%): Nvidia reduced its stake in the chip designer by 44% while fully exiting its positions in Serve Robotics and SoundHound AI.

WeRide ($WRD +85%): Nvidia revealed a 1.7 million share stake in the autonomous driving startup, sparking a retail frenzy.

Mullen Automotive ($MULN -11%): Announced a 1-for-60 reverse split.

CAE Inc. ($CAE +13%): Third-quarter revenue topped estimates and the company added the co-founder of activist investor Browning West to its board.

Applied Digital ($APLD +15%): Secured $375 million in financing Sumitomo Mitsui Banking Corporation (SMBC) for its Ellendale high-performance computing (HPC) campus in North Dakota. Hood River Capital Management acquired a 7.17% stake.

PRESENTED BY STOCKTWITS

“The Weekend Rip” With Ben & Emil 🤩

Hosts Ben and Emil are back for another Weekend Rip, discussing Bill Ackman’s hypocritical Pepsi rant, Elon Musk’s political impact on Tesla, Robinhood’s blowout earnings, AppLovin’s amazing run, GameStop’s Bitcoin bet, and a big Teladoc buy.

COMMUNITY VIBES

One Tweet To Sum Up The Week 🥵

Links That Don’t Suck 🌐

💳 Credit card debt hit a record $1.21 trillion — here’s why ‘no one should be surprised,’ expert says

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋