NEWS

The Trillion Dollar Club’s New Member

Source: Tenor.com

Broadcom’s strength buoyed the Nasdaq 100, but the rest of the major indexes had a tougher time as inflation fears mounted and year-end profit-taking continued. Next week the Fed is expected to cut rates again, but its economic projections and commentary will take center stage as investors look ahead to 2025. 👀

Today's issue covers the tale of two markets, the rising risk to Nvidia bulls, and other noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 3 of 11 sectors closed green, with technology (+0.43%) leading and communication services (-1.19%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,051 | -0.00% |

Nasdaq | 19,927 | +0.12% |

Russell 2000 | 2,347 | -0.60% |

Dow Jones | 43,828 | -0.20% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $ATIF, $LW, $WKEY, $RPTX, $LEDS 📉 $GOEV, $ABBV, $VKTX, $RH, $BETR*

*If you’re a business and want to access this data via our API, email us.

STOCKS

The Tale Of Two Stock Markets 🤔

It was another disjointed week in the markets, with the small-cap Russell 2000 and price-weighted Dow Jones Industrial Average closing well in the red. Meanwhile, the Nasdaq 100 closed in the green as mega-cap tech stocks soared to new highs.

Broadcom was the latest tech giant to flex its muscles, jumping 25% on the back of a strong AI outlook and topping the $1 trillion market cap threshold for the first time. It adds to the already wild year-to-date performance of the 10 largest stocks in the U.S., nine of which are technology names. 💪

Source: Koyfin.com

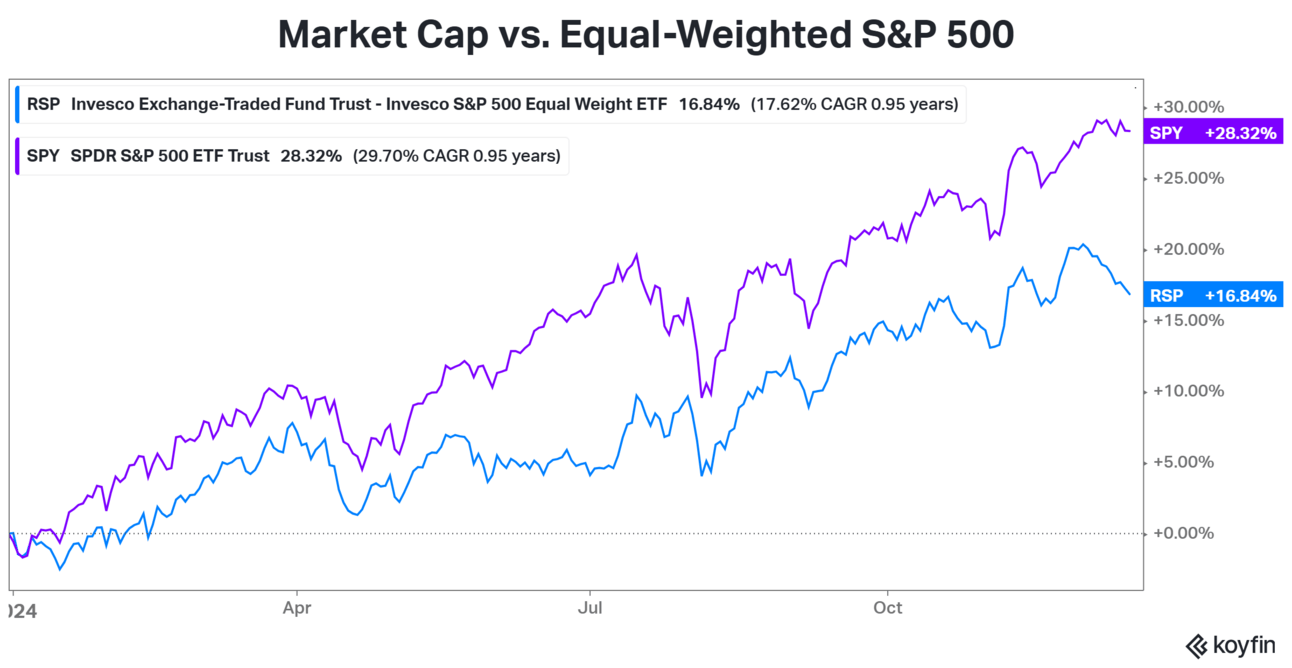

Strength in the market’s largest stocks has helped drive the market-cap indexes to record highs. However, technical analysts are flagging a growing divergence in the equal-weighted version of these indexes.

Below is the S&P 500 vs. its equal-weighted counterpart, which has fallen eight of the last ten days. The two indexes generally trade in lockstep, so this growing divergence is a notable change of character into 2025. 🤔

Source: Koyfin.com

Despite the recent weakness under the surface, investors and traders continue to bet that the biggest winners will continue to win. As we’ve noted, sentiment is extremely bullish across many measures, but the lack of a clear catalyst for bears to take control has the market continuing to climb its “wall of worry.” 🤷

SPONSORED

$11M Raised — 6 Days Left to Invest in the AI Company Everyone’s Buzzing About.

It’s not just another buzzword-filled startup… Meet Atombeam, the AI-driven disruptor aiming to change how data moves — faster, safer, and smarter. Investors are taking note, with over a $3M waitlist from their last round and $11M+ raised in this round — but the offering is closing soon.

Up to 4X Faster, $2.4M+ Defense Contracts. Atombeam’s patented AI software can send up to 4x more data over existing networks — without expensive hardware upgrades. That’s why names like the U.S. Space Force, U.S. Air Force are already customers. In 2023, Atombeam secured $2.4M in defense contracts.

Building industry relationships within a $200B market… Atombeam’s partnerships span NVIDIA, Intel, Ericsson, and HPE.1 Atombeam has a projected $200B global data center market by 2025. Now, you can invest in Atombeam.

$3M+ waitlist in last round, and only 6 Days to Invest…before Atombeam’s current funding round is closed. Over 7,500 investors have already invested across offerings, and one previous offering sold out. Invest now before the round closes on 12/18.**

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. **This is a paid advertisement for Atombeam’s Regulation A+ Offering. This Reg. A+ offering is made available through StartEngine Primary, LLC, member FINRA/SIPC. Please read the Offering Circular and related risks at Atombeam’s webpage on StartEngine before investing. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

CHART OF THE DAY

Rising Trendline Under Pressure For Nvidia 🛑

Since the end of 2022, Nvidia has consistently followed a strong and reliable trendline—until now. With earnings behind us and the stock priced to perfection, cracks are beginning to appear for the first time in years, signaling a potential shift.

Stocktwits user @badcharts points out that this could mark the start of a significant trend reversal for Nvidia.

STOCKS

Other Noteworthy Pops & Drops 📋

Trevi Therapeutics (+17%): Announced that its phase 2b study of Haduvio, an investigational therapy for idiopathic pulmonary fibrosis (IPF) with chronic cough, has achieved 75% of its enrollment target of 160 patients.

Ayro Inc. (+18%): The electric fleet solutions provider was named a tier-one supplier for General Motors (GM) through its collaboration with GLV Ventures.

ZenaTech (-4%): The Canada-based provider of AI drone solutions and enterprise SaaS solutions launched a quantum computing project using its drones for traffic optimization and weather forecasting.

RingCentral (-6%): The cloud-based communications software and services provider was downgraded by Mizuho Securities from ‘Outperform’ to ‘Neutral,’ citing downside risks to its 2025 estimates.

Super Micro Computer (-5%): The embattled server maker has hired Evercore Inc. to help it raise capital and strengthen its finances.

Western Digital (-1%): The provider of data storage devices and solutions’ CEO, David Goeckeler, hinted at more pricing headwinds than expected this quarter.

Nano Nuclear Energy (+7%): The company announced a collaboration with Digihost Technology Inc. to establish Microreactor Technology at its 60 megawatts (MW) power plant in upstate New York.

Charles Schwab (-4%): The financial services firm’s November activity report and full-year net revenue guidance raised retail sentiment despite shares falling 4%.

Upstart Holdings (+10%): Needham upgraded the AI-lending platform from ‘Hold’ to ‘Buy,’ with a price target of $100, implying a 15% upside.

Affirm (+3%): The buy-now-pay-later firm announced a long-term capital partnership with Sixth Street, its largest capital commitment to date ($4 billion).

SEALSQ Corp. (-4%): The vertical digital security solutions provider fell after announcing a public offering of 7.69 million shares at $1.30 each ($10 million total).

SPONSORED

Share your views on Investing & Trading! 🧠

Answer a short survey by 12/20/24 for a chance to win a $100 Amazon gift card.

Privacy: Your responses are confidential and will only ever be shown in aggregate after being combined with those of other survey respondents. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMMUNITY VIBES

One Tweet To Sum Up The Week 🤪

Links That Don’t Suck 🌐

💊 McKinsey & Company to pay $650 million to settle opioid consulting probe, ex-partner to plead guilty

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋