NEWS

The Worst Day Of 2025 (So Far)

Source: Tenor

U.S. stocks tumbled, ignoring Trump’s turnaround on Canada and Mexico tariffs. Risk-off behavior was a global theme, with China bucking the trend after stimulus hopes took hold. Tomorrow’s nonfarm payrolls data will help the market assess recession risks, either emboldening bears or letting the bulls battle back. 👀

Today's issue covers stocks ignoring a ‘pause-itive’ development, China surging on stimulus hopes, Intuitive Machines’ hard landing, private equity’s dumpster dive, and the “Stocktwits Cashtag Awards Presented by eToro.” 📰

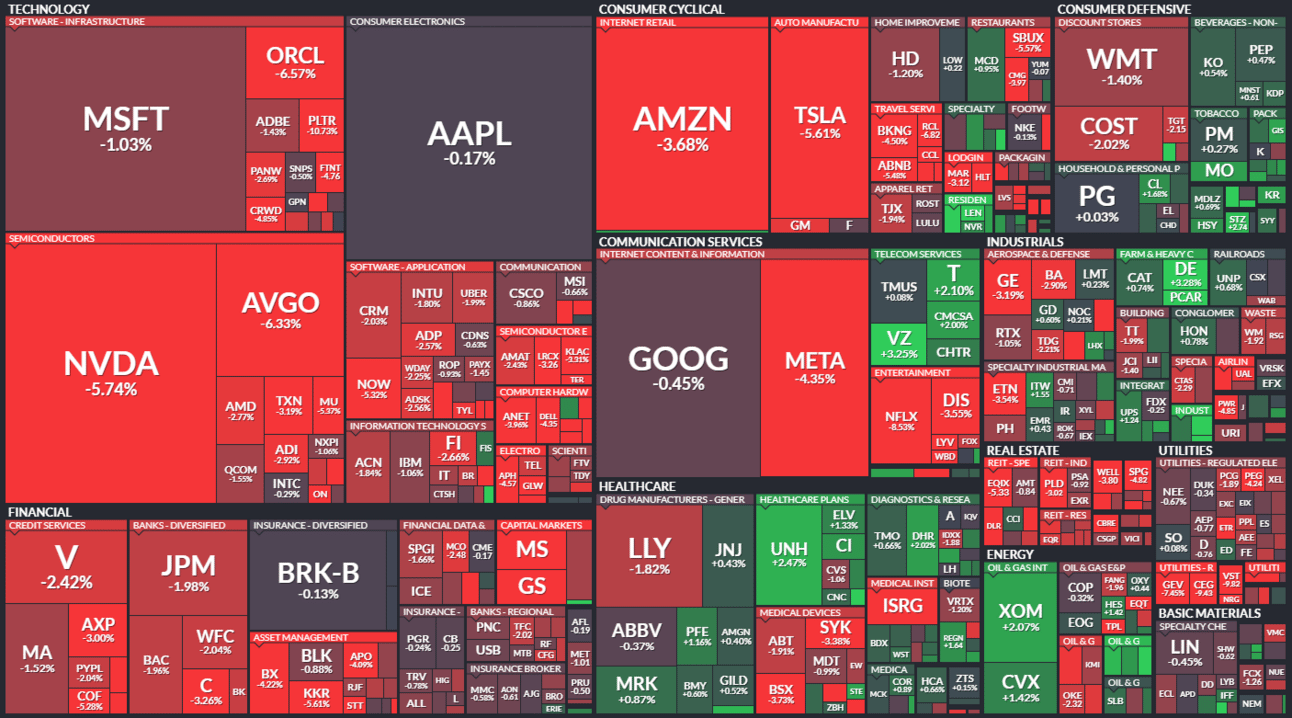

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with energy (+0.30%) leading and technology (-2.78%) lagging.

Source: Finviz

And here are the closing prices:

S&P 500 | 5,739 | -1.78% |

Nasdaq | 18,069 | -2.61% |

Russell 2000 | 2,067 | -1.63% |

Dow Jones | 42,579 | -0.99% |

STOCKS

Stocks Ignore A “Pause-itive” Development 🤔

Besides Chinese stocks, which we cover in our next story, the rest of the globe’s stocks had a rough day today. President Donald Trump postponed Mexico’s tariffs for a month early in the day and added Canada to the list later. ◀

Still, it appeared the damage was done because the stock market could not erase its losses but at least stopped going down.

Adding to global growth concerns was the European Central Bank cutting rates for the sixth time in nine months, hoping to buoy economic growth in the eurozone. The central bank reduced its growth projections again, reacting partially to Germany’s move to increase military and infrastructure spending. ✂

Many negative factors are still swirling in the market, but a big earnings beat by Broadcom may help boost the semiconductor industry and overall tech sector. The company offered strong guidance for its current quarter, citing a boom in its artificial intelligence (AI) business.

$AVGO ( ▲ 1.72% ) shares are up 12% after the bell, and Stocktwits community sentiment pushed into ‘extremely bullish’ territory. 🤩

With that said, not every tech firm is experiencing the same AI boost. Hewlett Packard Enterprise $HPE ( ▲ 1.33% ) is plummeting 25% after the bell. Heavy discounts helped it beat revenue expectations, but its forward guidance was weak, and management said it would trim its headcount by 5% (2,500 people) to cut costs.

All eyes turn to tomorrow’s nonfarm payroll numbers, where investors will look to gauge U.S. recession risk. If it’s positive, the Broadcom boost could help give the bulls power to battle back before markets close for the weekend. Time will tell. 🤷

SPONSORED

Top homebuilder invests in industry disruptor

You must be doing something right if the biggest names in your industry take an interest.

That’s the story with BOXABL. The company has gained the attention of investors like D.R. Horton with a business model that brings assembly lines to new home construction. Where traditional homes take over 7 months to build, BOXABL factories can mass produce their signature Casita home in nearly four hours – plumbing, electrical, HVAC, and all. No wonder 190,000+ potential buyers already reserved one*. And they’re just getting started.

Now, everyday investors can join them too. When BOXABL last opened a Reg A investment opportunity, they maxed out the $75M limit. Invest today for $0.80/share.**

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. * Reservations represents a non-binding indication of interest to purchase as Casita. A reservation does not require purchase of a Casita and there is no assurance of how many will result in actual purchases. **This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://www.boxabl.com/invest/

POLICY

China Stimulus Hopes Boost Stocks 💸

Global stocks were down today, but China bucked the trend after the country’s ambitious target of around 5% growth in 2025 sparked more stimulus hopes. Investors say that the geopolitical tensions and consumer slowdown in China will push the 5% growth target out of reach without government measures. 💰

Meanwhile, two of the company’s largest stocks saw positive developments, helping buoy the broader market. JD.com beat quarterly estimates and posted its best revenue growth since 2022, citing “rebounding consumption” domestically.

Also, Alibaba shares hit more than three-year highs after it unveiled QeW-32B, which it says “rivals cutting-edge reasoning model” DeepSeek-R1. Given its rally and new position in the AI arms race, analysts raced to upgrade the stock. 🤖

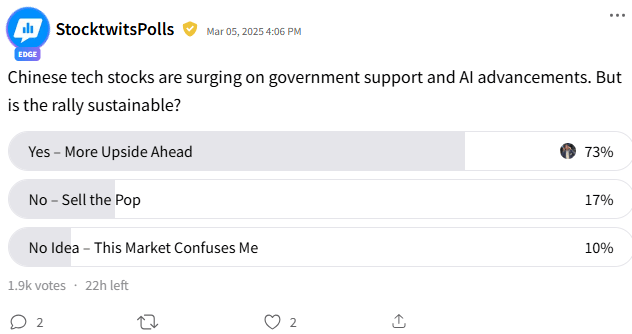

According to our Stocktwits poll, retail investors are finally starting to warm up to Chinese stocks and are looking for further upside. Roughly 73% of the 1,900 respondents are optimistic and see today’s news as a positive. 👍

COMPANY NEWS

Intuitive Machines’ Hard Landing 📉

One of the top trending stocks today was space exploration company Intuitive Machines. With the stock moving quickly, its unfortunate situation is a great opportunity for us to highlight a new feature on Stocktwits. 🤩

On certain symbols, you can now hover over the “Trending” button to receive an AI summary about what’s moving the stock. The “Why It’s Trending” feature is available on Stocktwits’ web version and is slowly rolling out to our app users over the coming week, but we know it’ll quickly become a must-have for active investors.

As the summary shows, the company’s IM-2 lunar lander did not stick to the landing, sparking a sharp selloff in the company’s shares. 😨

Stocktwits community sentiment is still ‘extremely bullish,’ but our active poll on the site shows a more mixed reaction. Until we have more clarity on the situation, investors and traders are “exploring” all possible scenarios. 😬

STOCKS

Other Noteworthy Pops & Drops 📋

Netflix ($NFLX -8%): The streaming giant slid after MoffettNathason analysts reiterated a ‘neutral’ rating on the stock with a $850 target, citing slowing growth.

Gap, Inc. ($GAP +16%): The apparel giant which owns Gap, Old Navy, Athleta, and Banana Republic posted its highest gross margin in over 20 years, and its revenue and earnings for the holiday quarter topped estimates.

Costco ($COST -3%): Earnings missed expectations as revenue beat, with its membership renewal rate ticking up 0.1% to 90.5%. Quarterly comparable sales rose 6.8%, topping estimates, but results could not satisfy sky-high expectations.

Alphabet ($GOOGL -0.2%): Announced a cheaper, ad-free subscription tier for its YouTube video hosting platform and is expanding its pilot to U.S. users.

BigBear AI Holdings ($BBAI -26%): Its quarterly loss and revenues missed estimates by a wide margin, with its fiscal 2025 revenue range also disappointing.

Core Scientific ($CORZ -17%): The Bitcoin miner reported mining productivity and revenue declines for February, and Microsoft spending concerns hit the stock.

Cooper Cos ($COO -7%): The medical device company’s fiscal first-quarter revenue missed analyst estimates, offsetting its earnings beat.

Samsara ($IOT -5%): Earnings and revenue topped expectations, adding 203 customers with over $100,000 in annual recurring revenue (ARR). However, its current quarter revenue outlook matched estimates, weighing on shares.

Sui’s Native Token ($SUI +5%): Trump-affiliated decentralized finance (DeFi) protocol World Liberty Financial (WLFI) announced a “strategic reserve deal” with the layer-1 blockchain project. As part of the agreement, WLFI will add Sui assets to its ‘Macro Strategy’ token reserve and explore potential product development opportunities with the blockchain.

STOCKTWITS COMMUNITY

The Stocktwits Cashtag Awards Presented By eToro

We are thrilled to welcome eToro as our Official Title Partner for the Stocktwits Cashtag Awards Presented by eToro, where the most talked-about stocks, trends, and personalities in the markets take center stage! 📈 https://bit.ly/41MRpqM

The Cashtag Awards celebrate the innovators, game-changers, and boldest minds shaping the future of trading, investing, and finance. From trailblazing products to the voices driving market conversations, it’s all about the creators who build community, share insights, and help everyday investors level up. 🚀

Powered by real traders and investors, the winners are chosen by YOU, the community! Cast your vote before March 21st and decide who takes home the top honors. 🏆

COMPANY NEWS

Private Equity Goes Dumpster Diving 🗑

Private equity firms and other asset managers continue to search far and wide for yield, with the industry finding its latest target in a struggling retail pharmacy. 🏬

Walgreens’ streak as a public company since 1927 will end in a transaction with Sycamore Partners, which will take it private for $11.45 per share in cash (equity value of around $10 billion). However, the total value of the transaction could be up to $23.7 billion when including debt and possible future payouts.

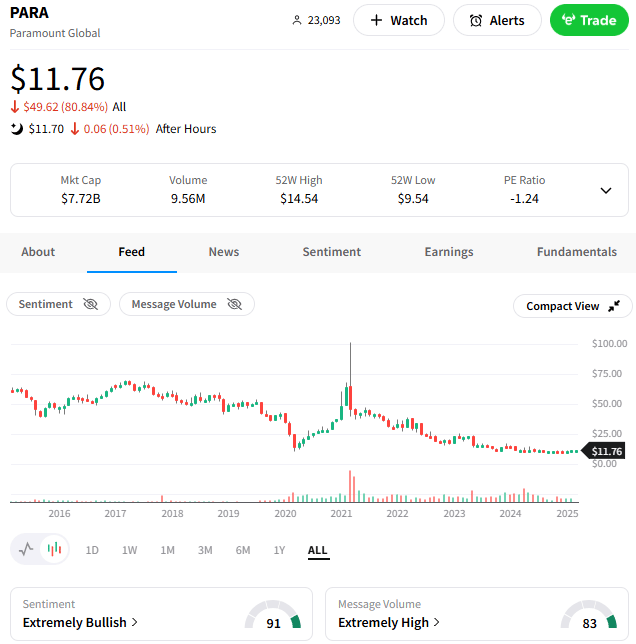

The move left little room for investors to buy Walgreens shares, causing investors to look at other beaten-down legacy brands that could be next on the buyout list. Paramount Global is one of them, with shares rising to nearly 8-month highs as Stocktwits sentiment rose into ‘extremely bullish’ territory. 🛍

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Non Farm Payrolls (8:30 am ET), Fed Bowman Speech (10:15 am ET), Fed Williams Speech (10:45 am ET), Fed Chair Powell Speech (12:30 pm ET), Fed Kugler Speech (1:00 pm ET). 📊

Pre-Market Earnings: Rewalk Robotics ($LFWD), Oncolytics Biotech ($ONCY), Algonquin Power ($AQN). 🛏️

After-Hour Earnings: None — enjoy your weekend. 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter holds a position in $PARA. 📋