Presented by

CLOSING BELL

Time For Bulls To Earn Their Keep

Source: Tenor

Today was the official start of earnings season, which means between Trump tweets and geopolitical headlines, we may have to analyze some numbers again. 😢

In today’s Daily Rip, we break down JPMorgan and Delta numbers, why software stocks got slammed, the U.S. government expanding its stock portfolio, and more from a busy day on Wall Street. 📝

STOCKS

Earnings Season Arrives Via Delta & JPMorgan 🛬

Markets at all-time highs bring major expectations, which investors fear could cause a bumpy earnings season ahead. JPMorgan Chase and Delta kicked off the next round of results, and although both beat expectations, their stocks fell on the day.

On the banking front, the largest U.S. bank topped earnings and revenue expectations overall, but its investment banking revenue fell short of expectations. Additionally, it announced a $0.60-per-share charge related to its takeover of the Apple Card loan portfolio from Goldman Sachs. 💳

CEO Jamie Dimon struck a cautiously optimistic tone, as he typically does, saying: "While labor markets have softened, conditions do not appear to be worsening. Consumers continue to spend, & businesses generally remain healthy. We remain vigilant, & markets seem to underappreciate the potential hazards like complex geopolitical conditions, the risk of sticky inflation and elevated asset prices.”

Meanwhile, Delta reported record earnings, driven by premium sector spending. Much like American Express, the airline has focused on the higher-end consumer, and those efforts are paying dividends. 🤑

CEO Ed Bastian said, “We are looking at our seat growth in the coming year. ... Effectively, none of our growth in seats will be in the main cabin; virtually all will be in the premium sector.”

Main cabin ticket prices fell 7% YoY in Q4, while premium ticket revenue rose 9% YoY to $5.7 billion, topping main cabin ticket revenues for the first time ever. And the company expects all of its 5-7% YoY revenue growth forecast in 2026 will come from its premium segment.

Optimism from two of the world’s largest consumer-linked companies is what investors like to hear, but as usual, expectations remain far more important than past results. These two stocks were punished today, so investors will be watching closely for the reaction as more earnings roll in. 🧐

SPONSORED BY STARFIGHTERS SPACE, INC.

Front-running Elon Musk in the Race to $1 Trillion

The space economy has exploded to $613 billion and is barreling toward $1 trillion.

And with the public chasing headlines about the SpaceX IPO, insiders like Musk and Thiel are close to locking up the next wave of space profits.

However, this time, there’s a narrow opening to get in front of the billionaires.

Starfighters Space (NASDAQ: FJET) is a little-known U.S. space company using the world’s largest private fleet of F-104s to slash payload-to-orbit costs — and investors can get in now.

Starfighters has flown real missions, operates literally next door to SpaceX, and has worked with NASA, Lockheed Martin, GE Aerospace, and the U.S. Air Force.

While Reuters keeps retail investors focused on SpaceX, early capital is quietly positioning in $FJET.

This is the unfair phase before institutions arrive… before the billionaires lock up the profits before the early advantage door closes.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POLICY

U.S. Government Expands Its Stock Portfolio 💰

The U.S. government has recently taken stakes in Intel, rare earth miners, and other companies in industries seen as vital to national security/interests. Trump hinted that defense companies could be next on the list, and he wasted no time. Today, the Department of War (DoW) announced a first-of-its-kind $1 billion direct-to-supplier investment. 💸

The DoW will make a $1 billion convertible preferred equity investment in L3Harris’ Missile Solutions business, which will become a separate company as part of the transaction. For the U.S., this helps to secure the U.S. solid rocket motor supply chain via multi-year procurement framework agreements.

L3Harris jumped, driving the aerospace and defense sector to all-time highs. 📈

While today’s consumer price index (CPI) report indicated that core inflation continues to trend slowly in the right direction (or at least stagnate), affordability remains a key issue for the Trump Administration ahead of the midterm elections. That’s why today he added to his latest “policy moves” by flagging electricity prices and promising to bring them down. ⚡

How he plans to do that is by targeting tech giants, saying they must bear the cost of data centers so average Americans don’t pay more for energy. Microsoft responded within 24 hours, promising that consumers won’t pay more when data centers are set up near their communities. It also pledged to replenish more water than it uses. But this is clearly a developing issue that we’ll need to keep an eye on.

STOCKS

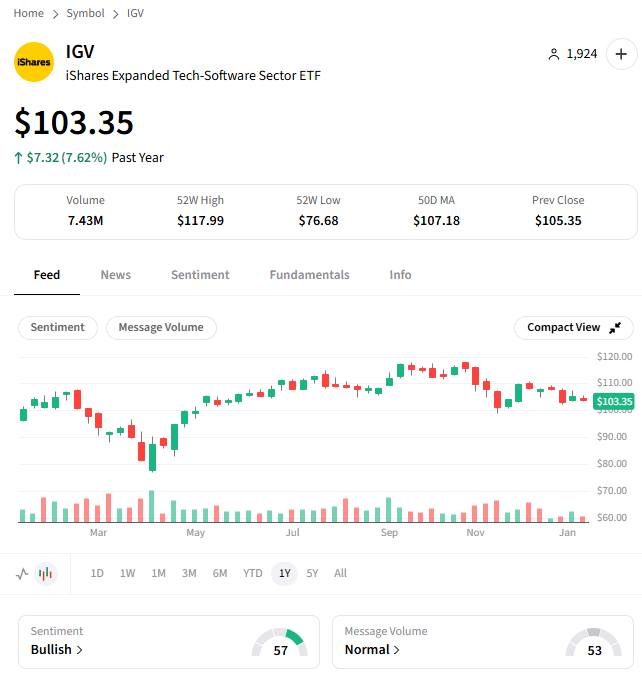

Software Taken To The Woodshed 🩸

The artificial intelligence trade continues to put pressure on software stocks, with some of the largest players like Adobe, Salesforce, and UiPath falling 5%+ on the day. While there isn’t a particular reason for the pressure today, some are blaming Oppenheimer’s downgrade of Adobe as the culprit. 👎

Although the sector is under pressure, Stocktwits sentiment remains in “bullish” territory for the main ETF and many of its core components. Bulls see the threat of AI to these companies as meaningfully overstated, and are looking to “buy the dip” as valuations come down.

Time will tell who’s right. But for now, we’ll keep monitoring retail investors’ dip buying as traders look for more downside. 🧭

POPS & DROPS

Top Stocktwits News Stories 🗞

Kraken-Linked SPAC files for $250 million Nasdaq IPO.

VanEck says first quarter could mark “risk-on” phase for crypto.

Intel surges to new highs after KeyBanc upgrade targets $60.

US Bancorp acquires BTIG, in trading & investment banking push.

OpenAI continues its acquisition spree with health-tech startup Torch.

Wharton’s Jeremy Siegel says to stay overweight U.S. equities.

Red Cat soars after a strong Q4 and full-year revenue outlook.

Boeing’s rebound continues as full-year deliveries jump 435%.

AstraZeneca buys Boston-based startup to bolster cancer pipeline.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

What’s On Retail’s Radar After Wild Weekend 🤔

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Oct/Nov Producer Price Index (8:30 am ET), Nov Retail Sales (8:30 am ET), Dec Existing Home Sales (10:00 am ET), Oct Business Inventories (10:00 am ET), EIA Energy Inventories (10:30 am ET), South Korea Rate Decision (8:00 pm ET). 📊

Pre-Market Earnings: Bank of America ($BAC), Wells Fargo ($WFC), Citigroup ($C), Aduro Clean Tech ($ADUR), Republic Airways ($RJET). 🛏️

After-Market Earnings: NextTrip ($NTRP), RF Industries ($RFIL). 🌕

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋