NEWS

Traders Pick Their Spots As Indexes Churn

It was a mixed day in the market as traders and investors searched for their next opportunity more selectively. Earnings and individual stock news continue to set the tone in an economic-data-light week. Let’s see what you missed. 👀

Today's issue covers Fisker pondering its final move, Palantir’s CEO taunting short sellers, Dr. Copper’s commodity prediction, and the continued strength in energy. 📰

Here's today's heat map:

7 of 11 sectors closed green. Energy (+1.60%) led, & technology (-1.08%) lagged. 💚

Under Armour shares popped then dropped after hours on news that CEO Stephanie Linnartz is stepping down after less than a year, with founder and former CEO Kevin Plank returning. Famed economist and businessman Mohamed El-Erian will also become the company’s next board chair. 👨💼

Dollar Tree shares plummeted 14% after its earnings and revenue missed expectations. The company acquired Family Dollar for more than $8 billion a decade ago but has had difficulting integrating the operations. As a result, it’s closing about 1,000 total stores as part of its broader turnaround plan. 💵

Robinhood shares continued their rebound after hours, rising 9% after the retail brokerage said that trading volumes surged during February: equities (+41% YoY), crypto (+86% YoY), and options (+33% YoY). 💸

Michael Saylor’s MicroStrategy is taking advantage of the company’s massive premium by issuing $500 million more in convertible notes in order to buy more Bitcoin. Also, if you thought the current cycle couldn’t get any sillier, we’re just getting started, apparently. The latest goof is that someone created a Dave “Portnoy Coin” on the Solana blockchain. 🤦

Other symbols active on the streams: $TSLA (-4.54%), $S (-11.88%), $DUO (+10.41%), $BA (-1.03%), $SWIN (-46.42%), $RUM (+7.34%), $HOLO (+37.01%), $SOUN (+37.12%), $ICU (-11.88%), & $SOL.X (+11.10%). 🔥

Here are the closing prices:

S&P 500 | 5,165 | -0.19% |

Nasdaq | 16,178 | -0.54% |

Russell 2000 | 2,072 | +0.30% |

Dow Jones | 39,043 | +0.10% |

COMPANY NEWS

Fisker Ponders Final Move As Vroom Tries To Zoom

Electric vehicle startup Fisker has had a cult-like following for years. But as we’ve seen with other “meme stocks,” simply having a large and dedicated retail investor base is not enough to guarantee success. 🫨

The stock has been falling slowly and steadily over the last six months, with the decline accelerating as shares broke below $5 and the company kept delivering bad news about its operations like a “going-concern” warning.

Well, today, management added insult to injury with reports that the company has hired advisors to guide it through a possible bankruptcy filing. Clearly, that’s not the outcome investors had been hoping for, as $FSR shares have been cut in half again in after-hours trading. 😬

Despite the news, sentiment readings on Stocktwits are still in bullish territory. Maybe the new bull thesis is that Tesla or some other electric vehicle maker will buy the company and leave a bit for common shareholders. Or maybe it can be restructured in a way to continue operating?

Time will tell, but for now, our data suggests the cult-like community hasn’t fully abandoned ship. 🙏

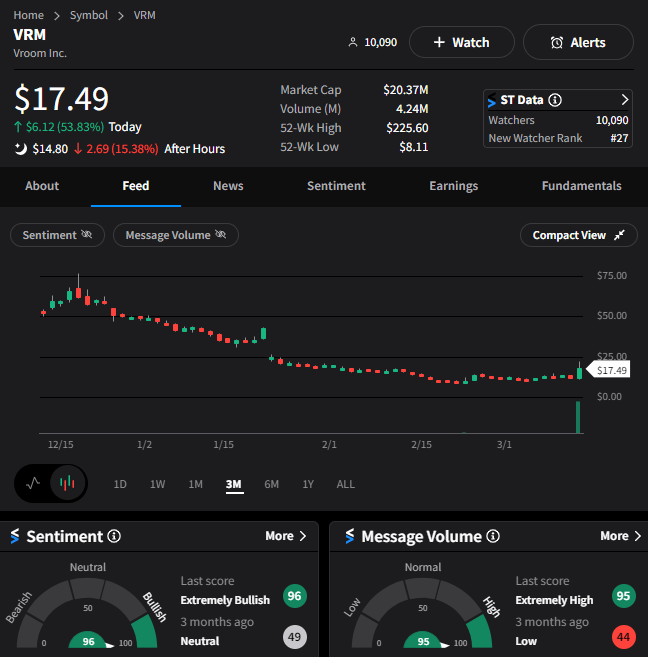

Speaking of beaten-down stocks, Vroom Inc. surged 54% on news that management has made significant progress on its “value maximization plan.” 📝

It’s winding down its automotive e-commerce business but will continue to operate its two businesses focused on automotive finance and AI-powered analytics/digital services for automotive retail. 🤖

How the company will look after it completes this transition remains to be seen, but investors seem to think it’ll be in much better shape than it currently is. With Root Inc, Carvana, and others in the space recently roaring back, this name will likely be on traders’ radars in the coming days and weeks. 👀

COMMODITIES

Dr. Copper Breaks Out Again

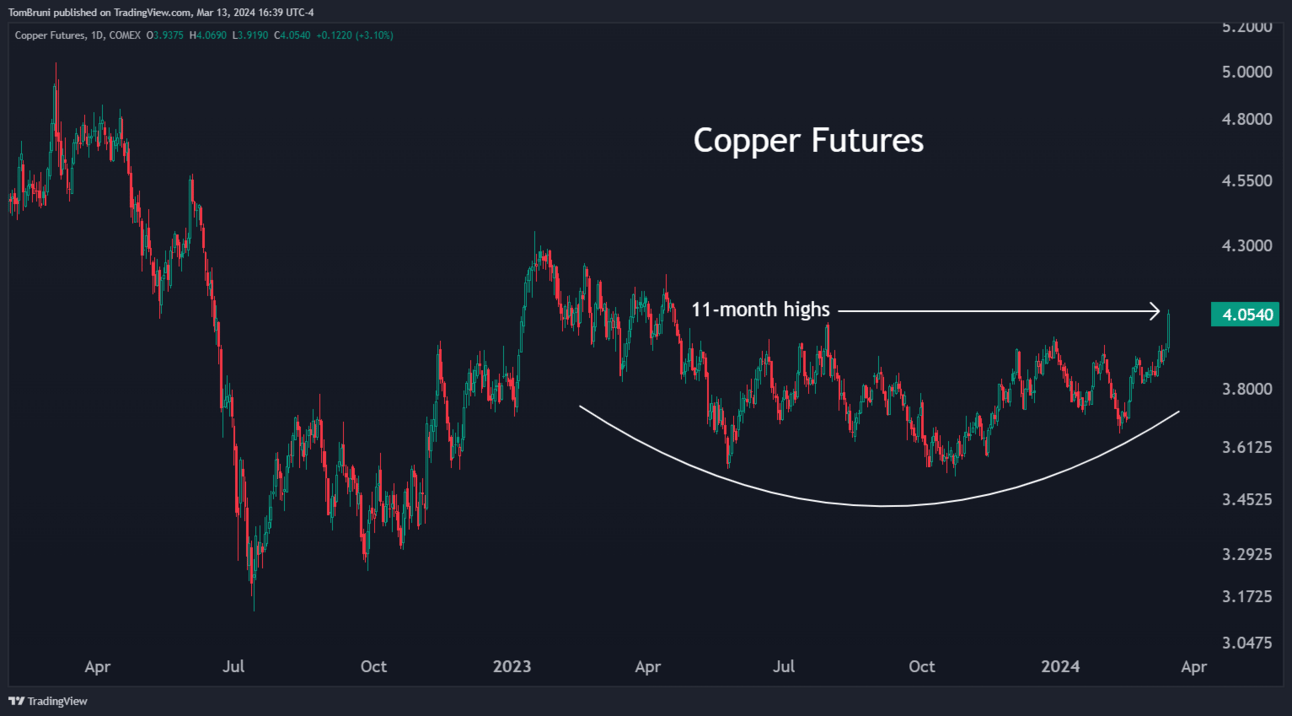

Given copper’s various uses in industrial activity, the base metal is often used as a proxy for assessing the health of the global economy. In essence, higher copper prices are seen as a positive sign for global growth, while falling prices are a negative omen. 🧭

Unfortunately for bears, another leg of their macroeconomic-driven thesis is falling flat. That’s because copper prices are hitting 11-month highs while global economic data continues to deliver positive surprises. 👎

The chart below shows prices still well off their 2022 highs but forming a strong base over the last eighteen months that it’s now emerging from. Based on the price and momentum readings, several technical analysts believe this could be the start of a more sustained move to the upside. 📈

We’ve recently highlighted a number of commodities regaining traction after long corrections, adding copper to that list today. Given the focus on inflation and economic activity, a lot of attention is being paid to the broad commodity ETF ($DBC).

The chart below shows that the commodity-futures vehicle rallied 200% in about two years and has spent the last eighteen months correcting 30%. With prices stabilizing over the last few weeks, some analysts suggest the recent uptick could be the start of commodities’ next major leg higher. 🤔

We’ll have to wait and see if they’re correct, but we know the Fed is certainly rooting against that happening. Its battle against inflation is already tough enough without the risk of commodity prices roaring back. 😬

COMPANY NEWS

Palantir CEO Targets Short Sellers

“In finding a good company to invest in, I always looked for a management team that spent its time engaging with short sellers and obsessing over the stock price.” - famed investor Warren Buffett (we’re kidding, obviously). 😂

Of course, we’re just poking a bit of fun at what turned out to be a great soundbite from Palantir CEO Alex Karp’s interview on CNBC today.

In it, he held nothing back and told short sellers exactly what he thought of them, saying, “Short sellers love pulling down great American companies so that they can pay for their coke…” And no, he doesn’t mean the soft drink… 👃

While some shareholders have taken the sentiment and cheerleading behind the stocks' recent runup as positive, others were quick to point out the bit of irony behind these statements. 😐

That’s because, as Diogenes pointed out on X, the company’s insiders have been significant net sellers of stock since it went public. 🤑

The most recent example was one of its founders filing a seven million share sale just yesterday. After all, if you’re so confident in the stock price rising, then why sell so much of it on a regular basis?

In general, companies going after short sellers are often focused on the wrong thing. Maybe this is a one-off victory lap due to recent results. But over the long term, focusing on building a great business that’s hard to bet against is usually a better course of action.

We’ll have to wait and see if Palantir can continue to execute that vision. But for now, its CEO is having a laugh of it. 🤷

STOCKTWITS AD-FREE

Enjoy An Ad-Free Stocktwits Experience 👀

Stay focused on your trading with Stocktwits Ad-Free. The streamlined experience fully immerses you in real-time discussions, breaking news, and expert insights.

Stocktwits Spotlight

While we’ve already spoken about copper and commodities as an asset class above, we wanted to quickly touch again on the energy sector after a few weeks since our last mention. ⏰

As we’ve discussed, oil and related commodities have been quietly picking up steam, rising further today after Ukraine struck Russian oil refineries. 🔥

The news put energy stocks back on the radar for many traders and investors, including Stocktwits user chessNwine, who shared the chart above. The gasoline futures ETF ($UGA) is a popular trading vehicle for those who want exposure to the price of gasoline without trading the futures directly.

As the chart above shows, prices of this ETF are emerging from a period of sideways trading, closing at their highest level in about 5 months. That has traders looking for opportunities on the long side in other energy-related ETFs and individual stocks as crude oil pushes into the low 80s once again. 🛢️

If you want to follow along with this thesis and see more analysis like this, follow chessNwine on Stocktwits! 👀

Bullets From The Day

👍 Disney CEO Bob Iger gains another big backer. Jamie Dimon is the latest heavy-hitter to endorse the media CEO in his proxy fight with Nelson Peltz’s Trian Partners. The activist hedge fund wrote a 133-page white paper earlier this month, outlining demands for a restructuring of leadership and an overhaul of Disney’s traditional TV channels. However, Disney’s quarterly results threw more weight behind current management’s efforts to streamline operations and drive profitable growth. CNBC has more.

💳 Stripe’s total payment volume tops $1 trillion. The payments infrastructure giant said it’s ‘robustly cash flow positive’ as its payment volumes rose 25% YoY in 2023. Two other data points in its investor update stood out. The first is that 100 companies process $1 billion or more annually with Stripe, while the second is that offerings in its “revenue and finance automation” segment are expected to reach a $500 million annual run rate this year. Still, with the company valued at $65 billion, most expect it won’t attempt a public offering until at least 2025. More from TechCrunch.

📦 Eli Lilly partners with Amazon to deliver its drugs. The pharmaceutical giant has partnered with Amazon’s pharmacy unit to deliver drug prescriptions sent to its direct-to-consumer service, LillyDirect. It launched the platform in January to enable patients to obtain certain medications directly from the company via delivery from the online pharmacy Truepill. However, to scale the operations and distribution, it’s expanding its offering to include Amazon Pharmacy, and potentially others in the future. Reuters has more.

Links That Don’t Suck

🤑 MarketSmith is now MarketSurge--check out the new features today and get 80% off the regular price*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍