NEWS

Trading Market Waves For Beach Waves

As expected, it was a lighter day in the markets as traders and investors looked to get a jump on the long weekend. The S&P 500 had its smallest weekly close in about three years as the index trades leadership spots back and forth with the Nasdaq 100. Let’s see what else you missed. 👀

Today's issue covers two retailers running despite industry challenges, Booz Allen Hamilton’s new all-time highs, and another solar stock that looks ready to shine. 📰

Here's today's heat map:

10 of 11 sectors closed green. Communications (+1.28%) led, & healthcare (-0.34%) lagged. 💚

Consumer sentiment fell in May as economic expectations deteriorated and inflation fears ticked higher. 🙁

U.S. durable goods orders rose 0.70% MoM in April, notching its third straight monthly gain. However, defense sector orders were responsible for all of the gain, as orders were flat if excluded. 🏭

Federal Reserve Governor Christopher Waller said he thinks the neutral interest rate is relatively low but warned that unsustainable fiscal spending could raise it over the long term. 🤔

Meme stock GameStop popped 10% after the bell on the news that it raised $933 million from its “at-the-market” program that was announced earlier this month. The company has once again used its good fortune to shore up its balance sheet, but shareholders are still waiting to hear how it intends to use that cash to grow its core business. 🎮

Alibaba shares were up marginally as the market digested its record sale of convertible bonds ($4.50 billion). It intends to use the money to buy back its shares and invest in growth opportunities like artificial intelligence (AI). The e-commerce giant’s notes due in 2031 have a coupon of 0.50%, a conversion premium of 30%, and was about six times oversubscribed. 💰

TurboTax parent company Intuit fell 8% after its fourth-quarter earnings guidance missed expectations. Enterprise management company Workday also slipped 12% after its second-quarter revenue guidance fell short of estimates. 📉

Guardant Health shares popped 13% after the U.S. Food and Drug Administration (FDA) determined its colorectal cancer blood test’s benefits outweighed the risks. On the other hand, Verastem plummeted 65% after its latest pancreatic cancer clinical trial safety data disappointed. 💉

Electric vehicle maker Lucid Group is cutting its U.S. workforce by 6% (400 employees) as it grapples with the slower-growth environments. The cuts will impact all levels but not hourly manufacturing and logistics workers. 🪫

Other active symbols: $CAVA (+6.87%), $SWIN (-25.97%), $AKAN (+71.97%), $AGBA (+22.12%), $ONMD (+56.46%), and $CADL (-27.04%). 🔥

Here are the closing prices:

S&P 500 | 5,305 | +0.70% |

Nasdaq | 16,921 | +1.10% |

Russell 2000 | 2,070 | +1.04% |

Dow Jones | 39,070 | +0.01% |

EARNINGS

Two Retailers Making A Run For It

On Wednesday, we discussed several retailers, such as Lululemon, Target, and Williams-Sonoma, struggling in the current environment. Today, we’re flipping the script to highlight two that are thriving despite the industry’s headwinds. 😍

First we’ll start with Hoka sneaker maker Deckers Outdoor’s. The company reported adjusted earnings per share of $4.95 on revenues of $959.80 million, easily topping estimates of $2.97 and $791.60 million.

With demand the key concern for all brands in this space, let’s see how its individual brand sales panned out:

Hoka $533 million (+34% YoY)

UGG $361.30 million (+14.90% YoY)

Teva $53 million (-15.60% YoY)

Sanuk $6.5 million (-39.10% YoY)

Other brands $6 million (flat YoY)

Clearly the company’s Hoka brand is doing a lot of the heavy lifting along with the UGG brand, helping deliver 21.20% YoY net sales growth. However, that’s expected to slow as net sales for fiscal 2025 are anticipated to rise 10% YoY while gross margin comes in at 53.50%. 🔻

For now, the company has the right product mix and sales channel diversification to help it maintain its performance. Once we start to see a slowdown in Hoka and UGGs, investors will start to ask questions about the company’s next growth opportunity.

That is another day’s problem, though, with investors loving what they’re seeing for the time being. Shares rose 14% on the day to new all-time highs, and Stocktwits sentiment remains “extremely bullish.” 👟

Next up is discount retailer Ross Stores, which reported adjusted earnings per share of $1.46 on revenues of $4.86 billion. Both numbers beat estimates of $1.35 and $4.83 billion, respectively, and same-store sales rose 3%. 🔺

CEO Barbara Rentelr said that the company was able to deliver performance in-line with guidance despite continued macroeconomic headwinds on discretionary spending. Ross’s adjustment to lower expenses for the period was the primary driver of the earnings beat, as demand is expected to remain tepid.

With same-store sales growth guidance of 2%-3% for fiscal 2024, the company will maintain its cost-centric focus and use promotions to help drive consumers back into its stores. Given its discounted nature, it already has a leg up with customers who are looking for a deal (which is most people these days). 🛒

The bull case is that if the company can maintain its momentum during a period of significant headwinds, once the macroeconomic picture clears up, it’ll be positioned to do really well.

Time will tell if that’s true. But for now, Ross shares are up 8% and trading just below all-time highs as sentiment sits in “extremely bullish” territory. 🐂

EARNINGS

The Booz Just Can’t Lose

Management consultants get a lot of hate for not creating value for their clients. But one thing is for sure, they do know how to create value for their shareholders. 😐

Booz Allen Hamilton’s latest quarterly report reminded us of that, with the high-tech defense contractor earning $1.33 per share on $2.77 billion in revenues. Both numbers topped estimates of $1.23 and $2.72 billion.

Certainly, the company looks well-positioned to continue capitalizing on the uptick in geopolitical turbulence. Executives said overall performance benefited from double-digit organic revenue growth in its federal defense and civil markets. Its quarterly backlog also grew 8.40% to $33.80 billion. 🔺

Looking ahead, they expect the strength to continue as long as the world stays crazy. The company is forecasting 8% to 11% revenue growth and adjusted earnings per share in line with expectations for fiscal 2025.

With expected net cash from operating activities of $825 to $925 million, some shareholders are speculating that a dividend increase could be around the corner…though that is not the case today. 📊

Booz Allen Hamilton shares rose 4% to new all-time highs on the news, with the Stocktwits community remaining “extremely bullish” on the stock’s prospects going forward. Time will tell if they’re right, but for now, it remains the standout in an otherwise mixed consulting market. 👍

STOCKTWITS “CHART ART”

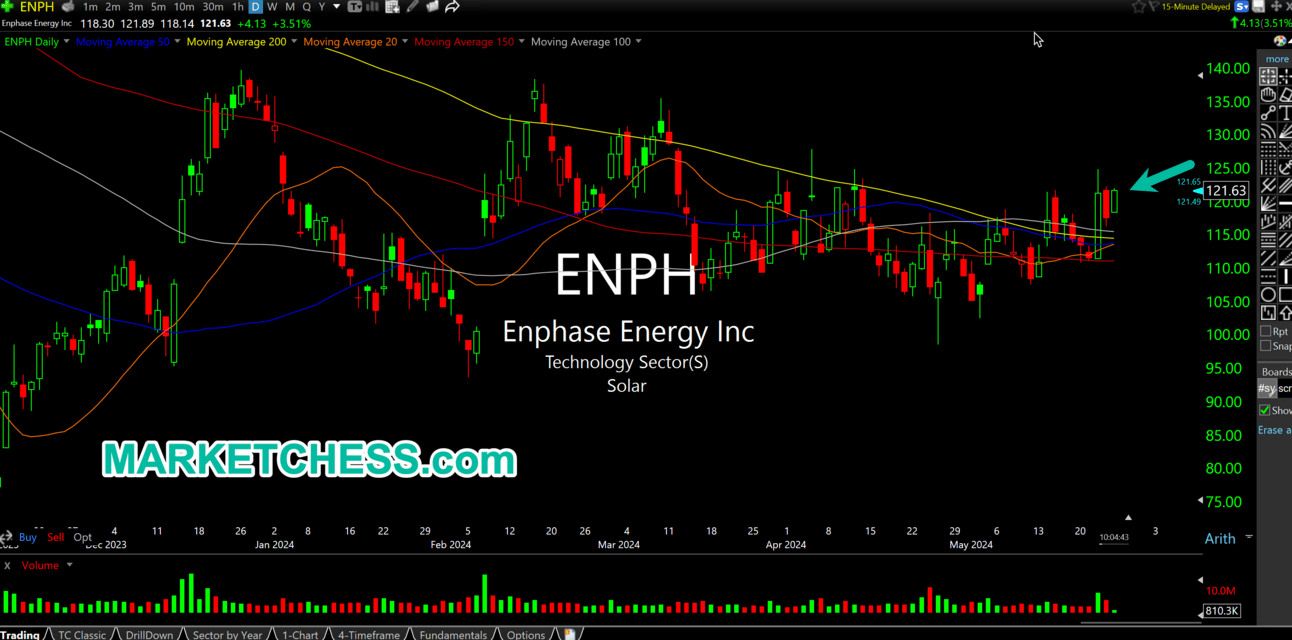

Domestic Solar Stock May Have Its Time In The Sun 🌞

If you weren’t paying attention this week, solar stocks became one of the hottest trades on the block, with First Solar leading the charge. Several Wall Street analysts upgraded the stock (and sector) on the thesis that AI will fuel significant demand for renewable energy sources like solar. 🤯

Since First Solar has already seen a massive runup, Stocktwits users like @chessNwine are looking to other names in the sector to catch a bid too. He shared his trade idea around Enphase Energy down below. 👇

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Bullets From The Day

🛒 Advertisers are boosting spending at retailers to offset TV losses. New data shows advertisers are increasing their spending on retail media networks, which show ads in stores, apps, and websites. The growth channel has become far more popular lately as traditional TV advertising continues its secular decline, and tech privacy regulations have made digital ad spending more difficult. Experts see global retail media ad spending doubling from 2023’s annual $115 billion by 2027. CNBC has more.

☀️ China has the opposite problem of the world: too much solar energy. While the rest of the world is rapidly trying to build out its renewable energy capabilities, including solar, nuclear, wind, and more, China is sitting on a major excess of solar panels. The country’s efforts to mass-produce solar panels as part of its clean-energy transition have dramatically lowered prices domestically but caused a glut of supply globally. That’s because China’s solar industry produces more power than its power grid can handle, leaving it no choice but to export. More from MSN.com.

📱 T-Mobile is imposing a price hike on older plans to encourage switch to latest offering. The telecom giant notified customers this week that they will see a $2 or $5 per month, per line increase to their phone bill if they stay on their older smartphone plan. The company is preparing for some pushback from customers, telling its customer service reps to tell users that “costs are rising, and we haven’t touched plan prices in nearly a decade.” Executives are hoping the company’s reliable 5G network and other perks will keep people interested in sticking with the carrier, potentially even upgrading to their newer Go5G plans to unlock more benefits. ArsTechnica has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍