NEWS

A True Turnaround Tuesday

Turnaround Tuesday lived up to its name, with today’s market action essentially being the reverse of yesterday’s. We saw big tech bounce while the rest of the market (and assets like commodities) sold off. Let’s see what you missed. 👀

Today's issue covers FedEx flagging improving revenues, the cruise boom continuing, and a beaten-down EV maker receiving a lifeline. 📰

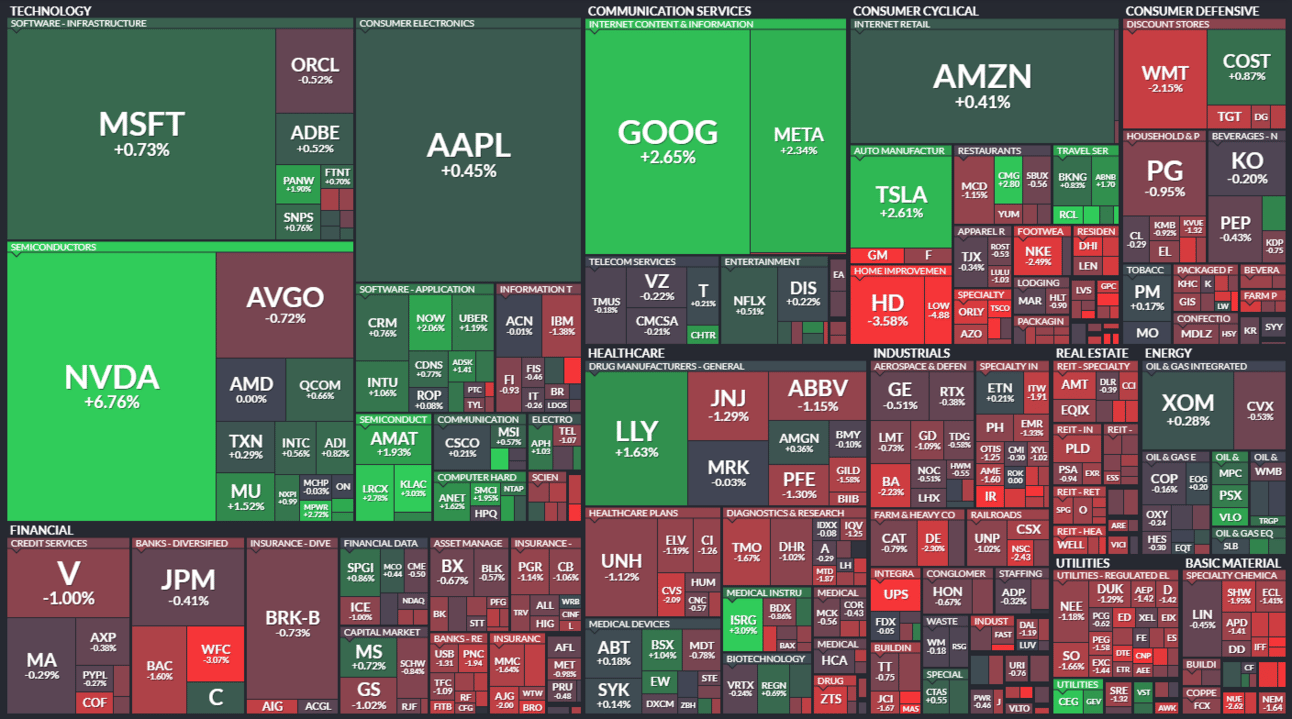

Here's today's heat map:

3 of 11 sectors closed green. Technology (+1.83%) led, & real estate (-1.41%) lagged. 💚

Lisa Cook was the latest Fed Member to reiterate that rate cuts will be appropriate “at some point” but that the timing remains uncertain given inflation’s slow(er) downward progress. Meanwhile, Michelle Bowman said rate cuts are inappropriate given inflation risk and that she’s willing to raise rates if inflation’s progress stalls. ⏯️

U.S. consumer confidence fell in May, with expectations for business conditions and incomes falling amid weariness around inflation. Still, activity measures remain mixed, with the Chicago Fed’s data indicating growth through a marginal uptick in the index to 0.18. 🔻

The S&P CoreLogic Case-Shiller Index indicated that housing prices rose to a new all-time high in April, up 0.4% MoM and 7.2% YoY. While that annual increase is less than the previous month’s 7.5% reading, it shows that the lack of supply continues to place upward pressure on prices. 📈

Boeing’s $35 per share bid for troubled supplier Spirit Aero hit a snag today, with the aerospace and defense giant switching from a cash to a stock offer after months of negotiations. ✈️

Aerospace manufacturer Airbus fell 11% in European trading after cutting its 2024 financial targets due to supply chain issues. ✂️

Wholesale pool supplies distributor Pool Corp. fell 8% after revising its full-year earnings guidance. And Industrial supplies company Enerpac Tool Group fell as much as 9% after reducing its guidance due to recent sales declines. 📉

Advanced silicon battery company Enovix jumped 35% on the news it will deliver silicon batteries and packs for a mixed-reality headset. It’ll receive a one-time payment for production tooling, with more payments later. 🔋

Other active symbols: $CHWY (+11.28%), $SNAP (+6.64%), $IEP (+5.17%), $GME (+5.41%), $MLGO (-2.07%), and $VKTX (-8.29%). 🔥

Here are the closing prices:

S&P 500 | 5,469 | +0.39% |

Nasdaq | 17,718 | +1.26% |

Russell 2000 | 2,022 | -0.42% |

Dow Jones | 39,112 | -0.76% |

EARNINGS

FedEx Flags Improving Revenue Picture

The transportation giant is hitting three-year highs on news that revenues may finally be picking up again (or at least enough to beat expectations). 🙂

FedEx, UPS, and others in the space have been battling falling volumes for the better part of two years and have recently been unable to raise prices enough to offset the weak demand. As a result, they’ve been focused primarily on cost-cutting to preserve earnings until things pick back up.

And so far it seems to be working, with adjusted earnings per share of $5.41 beating the $5.35 expected. Meanwhile, revenues rose about 1% YoY to $22.10 billion, stemming previous declines. 🔺

Looking ahead, management expects low- to mid-single-digit revenue growth, driven primarily by e-commerce and low-inventory levels.

Meanwhile, it’ll continue executing its DRIVE initiative, consolidating its delivery companies, Express, Ground, and Services, into one unified FedEx brand. Its Freight segment will remain separate, but it expects the combined delivery business to handle all packages as of June 2024. 📦

To help keep investors on board with the turnaround story, the company raised its quarterly dividend by 10% earlier this month. It’ll also need to figure out how to compensate for losing its U.S. Postal Service contract to UPS earlier this year.

Still, shares are popping nearly 15% on the news, and sentiment has pushed into bullish territory. Time will tell if these revenue improvements can continue, but for now, things are looking like the company can deliver. 👍

SPONSORED

Maximize your options profits (and minimize your losses) at Public.com

Heads up, options traders: investing platform Public.com has a rebate that allows you to buy contracts for less and sell contracts for more. As a member, you'll earn rebates on every options contract traded with no commissions or per-contract fees.

"My options trading platform is free, though. How is this better?" While some platforms seem to allow free trades, many charge fees of $1 or more per contract traded. On the other hand, Public offers rebates for trading options—and they can add up fast. If you trade 500 contracts each month, you'll earn $350-$1,000+ in rebates by the end of the year. In other words, you don't pay money to place options trades; you earn it.

Discover why NerdWallet awarded Public five stars for options trading and 4.6/5 stars overall, and earn rebates on every options contract traded with no commissions or per-contract fees.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Carnival Says The Consumer Ain’t Stopping

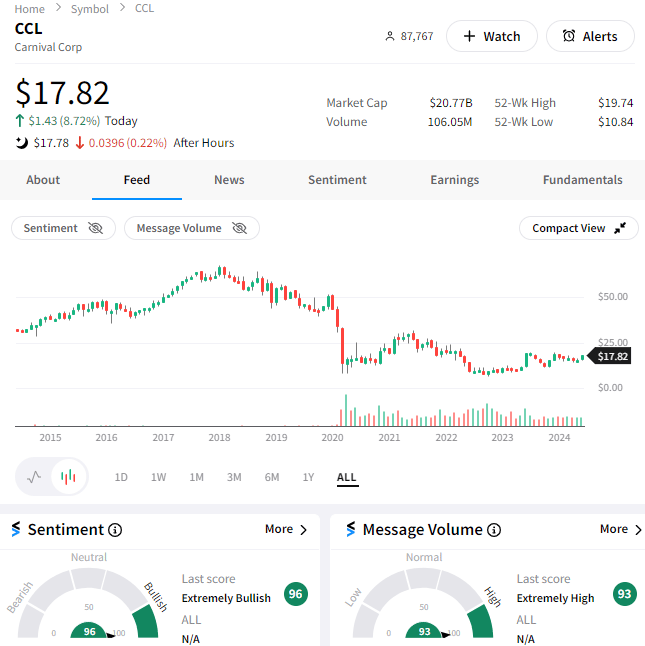

Travel-linked companies have been telling us consumers continue spending on experiences after binging on goods throughout the pandemic. And while many expected the revenge-travel trend to end by now, stocks like Carnival Cruise Lines indicate otherwise.

The cruise giant’s adjusted earnings of $0.11 per share were up from a $0.31 per share loss last year. Revenue growth slowed for the eighth consecutive quarter but was still up 17.70% YoY to $5.78 billion, marking a record for the second quarter. 🔺

Despite many looking for a slowdown, Carnival says booking momentum remains strong. Record volumes are expected for 2025, and early signs point to higher prices and occupancy than in 2024. 🥳

The company raised its full-year adjusted income guidance by $275 million, topping estimates. Still, some analysts remain concerned about the company’s high debt levels, which sit near $28 billion.

Despite the many positive tailwinds, the stock and its peer, Norweigan Cruise Lines, have struggled to keep pace with Royal Caribbean, which is trading at all-time highs. Still, the Stocktwits community is betting on Carnival to play catchup, as sentiment sits in “extremely bullish” territory. 🐂

EARNINGS

Beaten-Down EV Maker Gets A Boost

Rivian Automotive, a maker of premium electric vehicles (EVs), has been trading near all-time lows as industry rivals like Fisker, Faraday Future Intelligent Electric, and others face potential bankruptcy and restructuring. 😨

However, fears it may face the same fate were quelled today after German automaker Volkswagen Group announced a $5 billion investment in a new, equally-controlled joint venture to share EV architecture and software.

The funding will allow Rivian to develop its less expensive and smaller R2 SUVs, which are set to roll out in 2026, as well as its planned R3 crossovers. It could also help the company turn cash flow positive by licensing its existing intellectual property rights to the joint venture. 💰

Volkswagen sees this as a cost-effective way to address issues in its software division, Cariad, which has exceeded its budget and failed to meet goals. Solving the software problem will be a major part of achieving Volkswagen's goal of launching 25 EV models in North America by 2030.

Rivian shares rallied nearly 50% after the bell, with sentiment obviously shifting into extremely bullish territory as investors digested the news. 👍

Another stock facing similar issues in its own way is SolarEdge Technologies, which fell further on news that one of its largest customers is filing for bankruptcy. As a result, it may not be able to collect $11.40 million it’s owed. 💸

Then, it added salt to the wound by announcing a $300 million convertible senior note offering that it will use to refinance debt and fund general expenses.

The solar industry remains as difficult as the electric vehicle space for many of the same reasons. As a result, domestic players like SolarEdge are feeling the heat…and not in a good way. 🥵

Bullets From The Day

🕵️ European Union (EU) charges Microsoft with breaching antitrust rules. Regulators are targeting the tech giant for the bundling of its Teams and Office products. The move shows that Microsoft’s attempt to quell regulator concerns by unbundling Teams from Microsoft 365 last year was insufficient to address the broader antitrust concerns. CNBC has more.

🚫 Reddit tries to safeguard its data from AI scrapers. With artificial intelligence (AI) transforming data into one of the most valuable forms of currency, social media giant Reddit and its peers are taking steps to stop people from accessing it for free. They’re using updated robots.txt files, rate-limiting, and blocking unknown bots and crawlers from accessing their platform. Still, it’s a moving target, and many companies are having difficulty protecting their data long enough to monetize it properly. More from TechCrunch.

🚕 Waymo opens up its robotaxis to everyone in San Francisco. Anyone with the app can now use the company’s robotaxi service in the city, ending the “waitlist” that’s been intact since tests began in 2021. Roughly 300,000 people had been on the waitlist at one time or another, but the latest move to open services up to all customers is Waymo’s attempt to cement its lead in what’s becoming a more crowded industry by the day. The Verge has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: Paid endorsement for Public Investing, member FINRA/SIPC. Rebate rates vary from $0.06-$0.18 per contract depending on time of enrollment and number of referrals you make. Rates are subject to change. See terms & conditions of the Options Rebate Program. Investors must review the Options Disclosure Document (ODD). Options are risky and not suitable for everyone. See Fee Schedule and Options Rebate & Referral T&Cs: https://public.com/disclosures. Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.