NEWS

Trump Win Takes Risk Assets To New Highs

Source: Tenor.com

Markets hate uncertainty, and expectations were for a close and contested election. Instead, we saw a clear victory for Donald Trump and the Republicans in the Senate and likely the House of Representatives. While what’s said on the campaign trail and what’s done in office often differs, the market is betting big that the Trump administration’s policies will be pro-business and pro-markets, leading to a red-hot rally in risk assets. 👀

Today's issue covers the market’s biggest Trump trades, noteworthy earnings movers, and more from a wild day on Wall Street. 📰

Here’s the S&P 500 heatmap. 8 of 11 sectors closed green, with financials (+6.08%) leading and real estate (-2.67%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,929 | +2.53% |

Nasdaq | 18,983 | +2.95% |

Russell 2000 | 2,393 | +5.84% |

Dow Jones | 43,730 | +3.57% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $BOLT, $DXYZ, $FOXO, $CXW, $SONN 📉 $SMG, $CPS, $APPS, $OSCR, $SPR*

*If you’re a business and want to access this data via our API, email us.

STOCKS

Attitude Shifts From Fear To FOMO 🤯

It was a wild day in the markets, with many assets moving sharply in both directions.

While what’s promised on the campaign trail and what comes to reality is often different, that didn’t stop investors and traders from speculating on the most prevalent and profitable themes under the new administration. So, let’s summarize what moved and the current narrative around why. 👇

Small-caps soar: U.S. stocks rocketed to the upside, led by the small-cap Russell 2000. Trump’s focus on “America first” puts domestically-focused companies in the spotlight. Plus, an overall positive backdrop for risk assets has investors and traders willing to venture out on the risk spectrum to make bullish bets. 🥳

Regional banks ramp: Remember how the regional banking sector was set to go down the tubes 18 months ago? Well, it’s roaring back on hopes that deregulation and a focus on the domestic economy will be good for business. Reduced capital requirements could set them up to drive additional profitability and free up capital for buybacks and dividends. The regional bank ETF $KRE was up 13% on the day, with other financials also soaring today for similar reasons. 🤑

Bitcoin and crypto-linked stocks roar: An expectation for softer cryptocurrency regulations (and deregulation in general) drove the market. With many high-profile donors from the crypto and tech industry, what was once a major headwind for the industry may become a tailwind. Bitcoin hit new all-time highs, while crypto-related stocks like Coinbase and Robinhood rose 31% and 19%, respectively. Miners like Marathon Digital and hodlers like MicroStrategy surged by double digits, too. 🪙

Trump-linked stocks pump, then dump: Trump Media and Technology, Phunware, and Rumble all rose sharply as the election winner became clear, but they did not participate in today’s massive rally. While these were great public-market proxies for betting on Trump’s election odds, now business fundamentals will begin to matter. Most of these companies lack profitability (or operations) to support the shares. 🙃

Solar stocks extinguished: The regulatory and overall fiscal support for renewable energy will likely be softer than it was under the Biden administration, weighing on the sector. Additionally, tariffs could impact the China-linked industry. And higher rates keeping housing activity low and financing costs high for new projects will hurt demand. SolarEdge slumped 22% in regular trading and fell another 21% after hours on earnings. And solar ETF $TAN fell 11% on the day. ⛈

Electric Vehicle (EV) stocks slump (except Tesla): With regulatory support for electric vehicles likely to lessen under the Trump administration, many view this industry headwind as a positive for Tesla because of its massive head start in the space. Additionally, Elon Musk’s close relationship with Trump and Trump’s focus on ‘beating’ China are seen as major tailwinds for the next several years. ⚡

Marijuana stocks were smoked: With Kamala Harris and the democratic party seen as more pro-marijuana, much of the optimism around reclassification at the federal level was taken out of the market. Additionally, with states like Florida voting against recreational marijuana (albeit by a small margin), the regulatory environment will likely remain challenging for these companies. Popular ETFs like $MSOS, $MJ, $YOLO, and others were down between 15% and 20% on the day. 😶🌫️

Chinese stocks failed to fly: One foreign market that didn’t participate in today’s rally was China, for obvious reasons. With Trump expected to take a hard-line approach to China and other economic adversaries, many investors see risk in owning stocks listed in the country as geopolitical tensions heat up. 🌏

U.S. Dollar and rates soar, weighing on commodities: Today was all about the U.S. Dollar in the foreign currency world. Putting America first means our currency will be all that more important for global commerce. If the U.S. economy continues to grow at a faster pace than the rest of the world, rates will likely stay high on a relative basis, too, keeping demand for the U.S. Dollar high. 💲

Housing and real-estate stocks slump: Higher rates are the story here. Mortgage rates above 7% have already choked housing market activity and frozen commercial real estate transactions, but if Trump’s policies keep rates higher for longer, then the pain in these sectors could persist. 🏘

Consumer staples go stale: Consumer-brand-focused conglomerates like Pepsi and Mondelez fell on fears that Tariffs would drive higher prices and hurt demand among their U.S. customers. Transaction volumes have already struggled amid “shrinkflation” and changing consumer trends, so higher prices would pressure sales further. 🍪

These were some of the biggest themes in markets today. As we noted, some of these moves are knee-jerk reactions to what investors think is ahead for U.S. government policy and the economy. Eventually, the actual fundamentals will matter, but for now, the market’s trading on expectations (aka vibes), which remain bullish. 🐂

For more on how the Stocktwits community is taking advantage of the current bull run, you can find the top trade ideas and analysis in today’s Chart Art newsletter. 👈

SPONSORED

This Trading Bot Copies Congress, and has Outperformed the Market

Quiver Quantitative has built a trading bot that mimics stock trading by U.S. politicians, bringing a data-driven approach to copying the trading of Nancy Pelosi, Tommy Tuberville, and other members of Congress.

Quiver’s strategy, called the Congress Buys Strategy, tracks the performance of stocks that have been recently purchased by members of U.S. Congress (or their family). The holdings are weighted based on the reported size of the purchases, with weekly rebalancing.

This strategy has been doing well, and the methodology has had annualized returns of over 37% since 2020, outperforming the market on both an absolute and risk-adjusted basis.

To start copytrading the Congress Buys Strategy, along with dozens of other data-driven trading strategies published by Quiver Quantitative, you can visit www.quiverquant.com/strategies.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Other Noteworthy Pops & Drops 📋

SolarEdge Technologies: Shares fell more than 40% today after it reported a third-quarter loss and missed revenue estimates. Its fourth-quarter revenue estimate of $180 to $200 million was well below the $309.20 million anticipated by analysts. ⛈

AppLovin: Shares jumped 31% after the app marketing platform beat earnings and revenue expectations by a wide margin. Additionally, its current-quarter revenue forecast topped analyst estimates. 📱

Lyft: Shares rose 25% despite earnings missing expectations. Better-than-expected revenue and an upbeat outlook drove the stock higher. 🚘

Dutch Bros: Shares added 20% after earnings and revenue topped estimates. The drive-thru coffee chain continues to capitalize on Starbucks’ missteps, taking market share each quarter and management expects the momentum to continue. ☕

AMC Entertainment: Shares fell 5% despite earnings and revenue topping expectations. YoY revenue and attendance declines continue, even as CEO Adam Aron says he is “almost euphoric about the vital improvements lodged at AMC Entertainment during the third quarter…” Until the company can turn its core operations profitable, there’s not much to see here fundamentally. 🍿

POLICY

Market Preps For Another Powell Presser 📝

While the world reacted to the U.S. election results and data, Jerome Powell and the Federal Open Market Committee (FOMC) began their two-day meeting where they’ll decide the latest interest rate move and outlook. 🧑💼

Heading into tomorrow’s event, the markets are pricing in a roughly 98% chance of a 25 bp cut, expecting another in December and more in early 2025.

While another 25 bp cut looks to be in the bag tomorrow, some say this red-hot move in markets and a “softening, but not too soft” labor market will keep the Fed a bit more cautious about future cuts. ⚠

After all, if Trump is about to unleash major fiscal stimulus on the economy, that could stoke inflation at a time when it is nearing the Fed’s 2% long-term target.

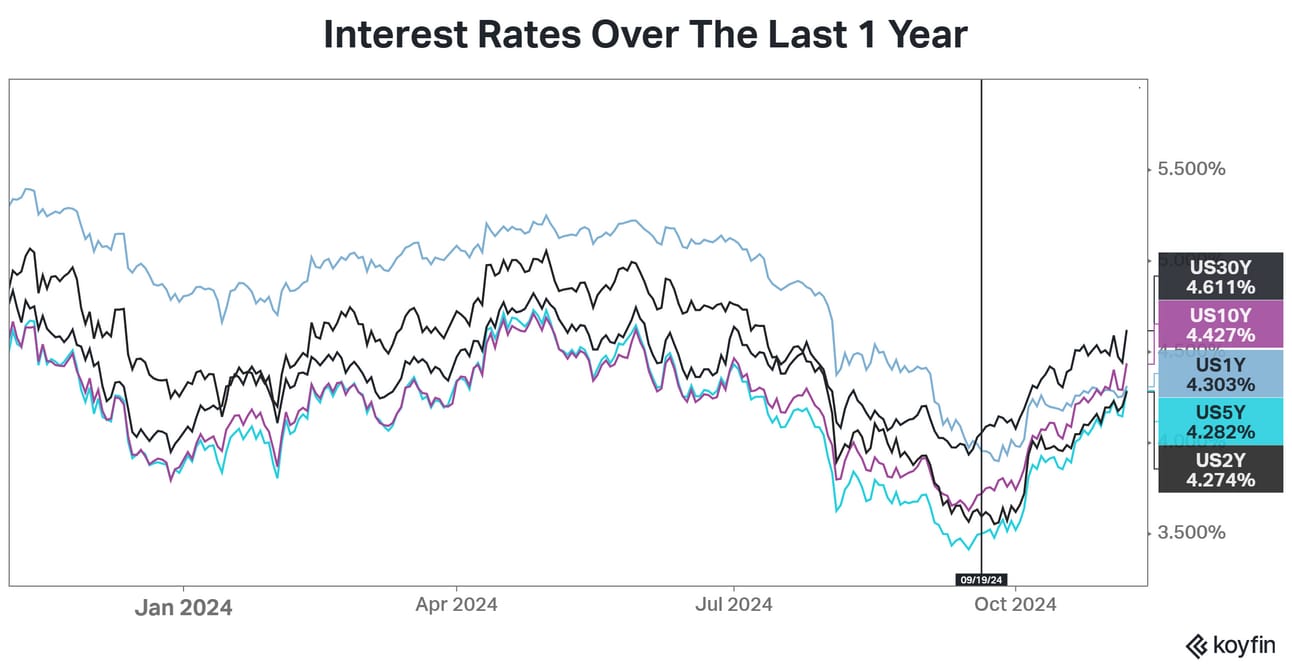

Plus, the bond market is seemingly pricing in that risk, given interest rates have done nothing but go up since the Fed cut rates by 50 bps on September 18th. 🙃

Tomorrow’s decision is less important than the actual commentary. That’s why we’ll be streaming Jerome Powell’s press conference live on the $SPY stream tomorrow at 2:30 pm ET. Join us here for the market’s real-time reaction. 👀

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: England Rate Decision (7:00 am ET), Initial Jobless Claims (8:30 am ET), Fed Rate Decision (2:00 pm ET), Fed Press Conference (2:30 pm ET). 📊

Pre-Market Earnings: Cassava Sciences ($SAVA), Village Farms International ($VFF), Moderna ($MRNA), Under Armour ($UAA), Aurinia Pharma ($AUPH), Jumia Technologies ($JMIA), Penn Entertainment ($PENN), Barrick Gold ($GOLD), Datadog ($DDOG), Haliburton ($HAL), Cameco ($CCJ). 🛏️

After-Hour Earnings: Lucid Group ($LCID), Rivian Automotive ($RIVN), Square ($SQ), DraftKings ($DKNG), Airbnb ($ABNB), Pinterest ($PINS), UpStart Holdings ($UPST), MannKind ($MNKD), Affirm Holdings ($AFRM), The Trade Desk ($TTD), Opendoor ($OPEN), Cloudflare ($NET), Unity Software ($U), SunRun ($RUN), Turtle Beach ($HEAR), Redfin ($RDFN), SIGA Technologies ($SIGA). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋