NEWS

U.S. Stocks Brought Home The Gold

Source: Tenor.com

U.S. stocks closed out a strong week of gains, while gold and precious metals shined. With two weeks left before the summer slump in trading volumes officially ends, many investors and traders are looking for the bulls to continue riding this momentum to new highs. Let’s see what you missed. 👀

Today's issue covers housing’s latest hot-button items, what’s driving gold’s global breakout, and MSG Entertainment approaching all-time highs. 📰

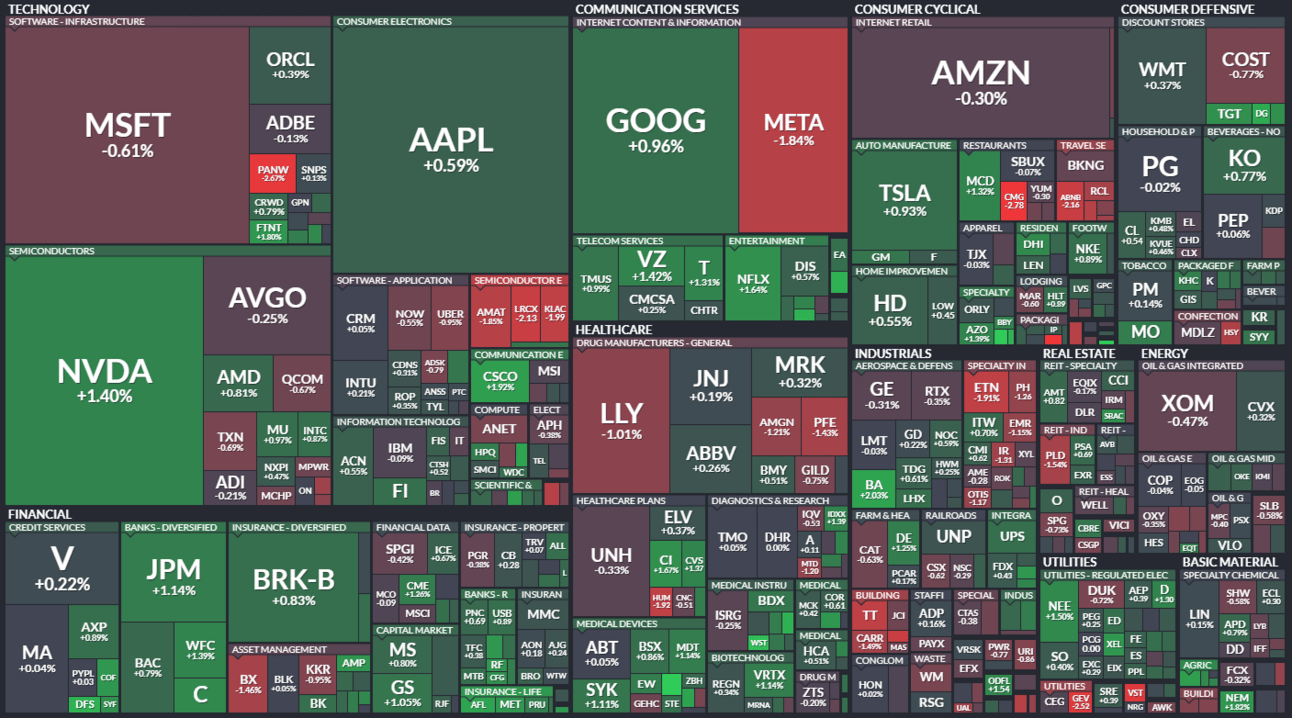

Here’s the S&P 500 heatmap. 8 of 11 sectors closed green, with financials (+0.69%) leading and industrials (-0.12%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,554 | +0.20% |

Nasdaq | 17,632 | +0.21% |

Russell 2000 | 2,142 | +0.30% |

Dow Jones | 40,660 | +0.24% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $SLXN, $MRVI, $ZCAR, $ONCO, $APDN 📉 $HRB, $IEP, $SEDG, $TPST, $SCLX*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

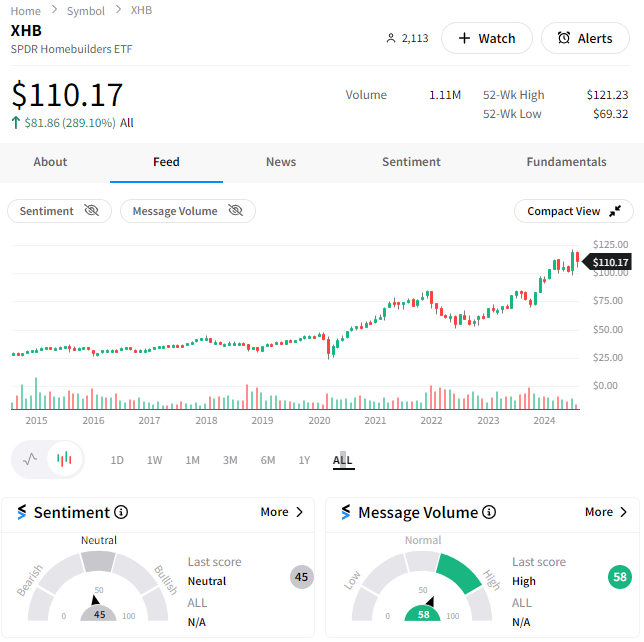

Housing Remains A Hot-Button Issue 🏡

Whether you’re a stock market investors, a homeowner yourself, or just anyone interested in the U.S. economy, you know how many things impact the all-important housing market.

This week we received some key data showing U.S. housing starts sliding to a four-year low, with single family units falling being partially offset by an uptick multi-family starts. Overall starts were down 16% YoY in July, June’s numbers were revised down, and residential permits dipped 4%. 🔻

These numbers come in just a day after the NAHB Housing Market Index signaled homebuilder confidence hitting its lowest level of the year. Buyers remain hesitant due to record prices and high interest rates, with both present sales and traffic readings showing weakness. 😟

Meanwhile, with the Presidential election coming up, both candidates are ramping up their messaging around the country’s housing crisis.

Vice-President and democratic candidate Kamala Harris announced a plan that builds on proposals President Joe Biden has already announced.

Of the many key initiatives included, the parts that got people talking were:

Up to $25,000 in down-payment assistance for first-time homebuyers

Tax incentives for building starter homes sold to first-time homebuyers

Removing tax benefits for investors who buy large numbers of single-family rental homes

With a record share of U.S. homes worth more than $1 million, U.S. residents are desperately awaiting relief from the massive supply/demand imbalance that’s existed for the last decade. 🤯

Time will tell which public/private solutions eventually make a dent, but for now, homebuilding stocks continue to hover near all-time highs as investors bet this structural imbalance will only benefit them going forward. 👷

SPONSORED

Invest In The AI Future Of Marketing

Meet the high-growth AI startup with backers including Adobe and execs from Google, Meta, Amazon, and Snap.

It’s developed groundbreaking artificial intelligence that helps brands identify new audiences and boost content ROI, servicing Fortune 500s and delivering as much as 3.50X ROI. Round closes on 8/16. Open to accredited investors only.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

MSG Entertainment Eyes New Highs 🎉

The owner of Madison Square Garden arena and Radio City Music Hall is approaching new all-time highs after posting a surprise profit. Revenues rose 26% YoY to $186.10 million, driving adjusted earnings per share of $1.41. 📊

Revenue from its entertainment offerings rose 20% YoY, buoyed by additional concerts performed. Food, beverage, and merchandise revenue rose 48% YoY to $34.70 million, driven by more games at Madison Square Garden, helped by the Knicks and Rangers making the playoffs. 🏟️

CEO James Dolan said the company is “well positioned to generate robust adjusted operating income growth in fiscal 2025” after delivering a solid first full year as a standalone company.

Shareholders were certainly entertained by the news, with shares rising 5% and approaching a new high. Stocktwits users’ believe there’s more fun to be had ahead, with sentiment hitting ‘extremely bullish’ territory. 👏

STOCKTWITS “TRENDS WITH FRIENDS”

What’s Driving Gold’s Global Breakout 👑

COMMUNITY VIBES

One Tweet To Sum Up The Week 😂

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋