NEWS

Volume Whiffs As Traders Watch Eclipse

It was a mixed day in the market, with S&P 500 and Nasdaq 100 trading volumes hitting their lowest levels since Thanksgiving 2023. Without a clear market catalyst until Friday’s bank earnings, traders’ and investors’ interest in the sun’s shenanigans eclipsed that of making money. Let’s see what you missed. 👀

Today's issue covers Blackstone’s biggest bet yet on multifamily housing, Taiwan Semiconductor securing major U.S. funding, and a look at the energy ETF eclipsing its 2022 highs. 📰

P.S. Want the best charts and trade ideas delivered straight to your inbox? Starting today, we’re doing just that with our new “Chart Art” newsletter. See a sneak peek of the first published issue and subscribe for a free gift toward the end of today’s newsletter. 🎁

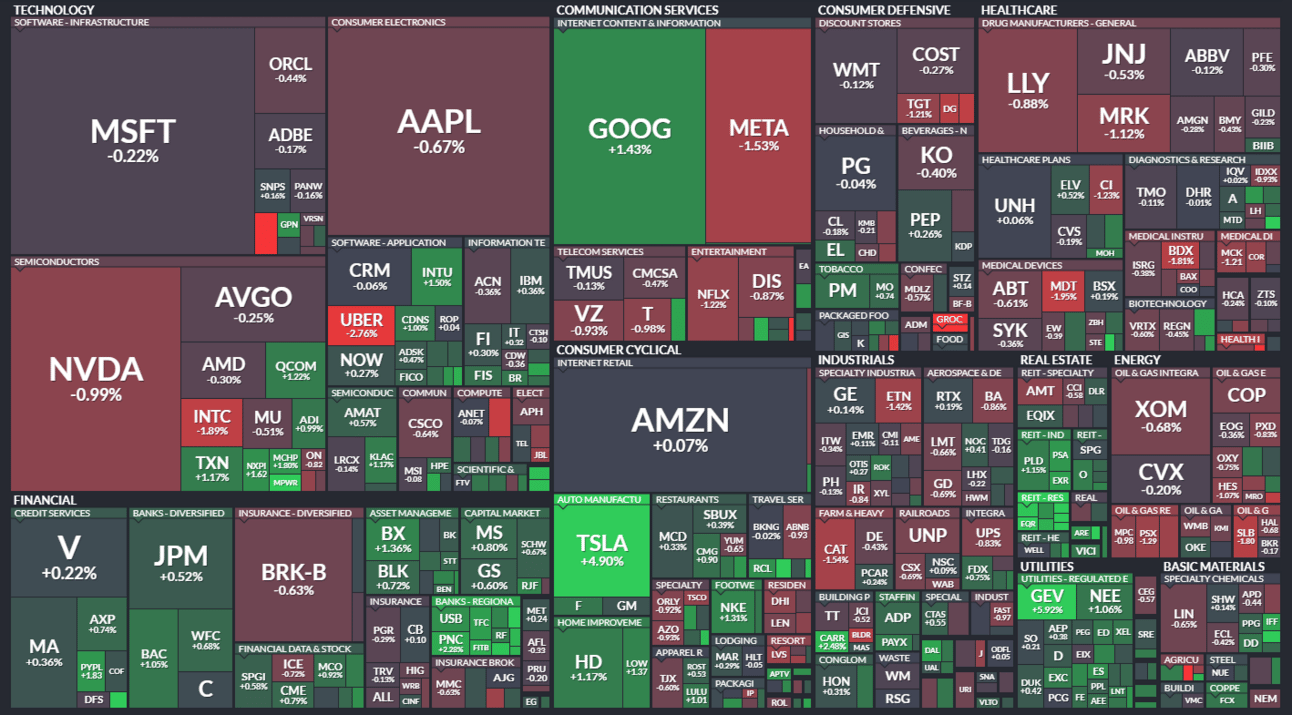

Here's today's heat map:

6 of 11 sectors closed green. Consumer discretionary (+0.95%) led, & energy (-0.63%) lagged. 💚

The Bank of Israel held rates steady at 4.50% for the second straight meeting after cutting in January, saying further rate cuts may be possible if regional tensions ease. Ultimately, it’s trying to balance the risks of inflation accelerating and supporting an economy that’s facing significant headwinds. ⏯️

SoFi Technologies jumped 5% after Citi resumed coverage of the stock with a buy rating, citing its moves to diversify the business and ability to attract deposits. 🏦

Shares cloud company Fastly jumped 8% after Piper Sandler upgraded it to overweight, citing a strong valuation and steady fundamentals. ⛅

Lithium producers were back in focus today after U.S. shares of Latin American producer Sociedad Quimica y Minera rose 5%. Jeffries upgraded the stock from neutral to buy, saying it’s an attractive value play in the commodities space. ⚒️

Other active symbols: $TSLA (+4.90%), $PARA (-7.60%), $DXYZ (+68.56%), $LUNR (-7.25%), $PERI (-40.79%), $SHOT (+7.44%), & $ALCC (+22.52%). 🔥

Here are the closing prices:

S&P 500 | 5,202 | -0.04% |

Nasdaq | 16,254 | +0.03% |

Russell 2000 | 2,074 | +0.50% |

Dow Jones | 38,893 | -0.03% |

COMPANY NEWS

Taiwan Semi Secures A Major Subsidy

With countries around the globe offering major incentives to bring chip manufacturing to their shores, companies have been shopping their expansion plans around to secure the best offer possible. 🕵️

And it looks like Taiwan Semiconductor, the world’s largest chip manufacturer, has reached a deal with the U.S. that suits its fancy. Let’s take a quick look.

This morning, it was announced that TSMC will increase its total investment from $40 billion to $65 billion by adding a third chip factory to the manufacturing complex it began building in 2021 in Phoenix, Arizona. 🏭

Under the 2022 Chips Act, the U.S. will grant the company up to $6.60 billion in grants and $5 billion in government loans to support Its expansion efforts.

With projects like TSMC’s, the U.S. is on track to make about 20% of the world’s cutting-edge chips by 2030, with the project marking the largest foreign direct investment in a new project in U.S. history. 💰

Still, even as Intel, TSMC, GlobalFoundries, and other chipmakers expand in the U.S., worries remain about whether there is enough skilled labor to support these facilities. Some projects have already pushed back their timelines, citing this exact issue. ⚠️

However, the recent earthquake in Taiwan has strengthened the case for TSMC's diversification of its footprint globally, adding to the obvious geopolitical and financial reasons for doing so.

With the number of chips needed to support global technology ambitions ranging from AI to self-driving cars, retail investors remain bullish on the overall sector and major players like TSMC.

$TSM shares rose 1% on the news today, with Stocktwits sentiment score hitting “extremely bullish” territory once again. We’ll have to see if the optimism continues to pay off as we head into earnings season. 👍

COMPANY NEWS

Blackstone’s Biggest Multifamily Bet Yet

The only person/entity who cares about family more than Vin Diesel in the “Fast And Furious” series is an investment fund with capital to put to work. The only difference is that while Vin Diesel is trying to protect his family, firms like Blackstone are looking to profit from yours.

Okay, we’re being a bit dramatic for drama’s sake. But seriously, the world’s largest alternative asset manager is taking Apartment Income REIT (aka AIR Communities) private in a $10 billion deal. 🤑

After many quarters of caution in the real estate market, Blackstone is getting back in on the action by purchasing 76 rental housing communities primarily located in coastal markets. It’s then planning to invest $400 million to further improve the properties. 🏗️

It’s the company’s largest transaction in the multifamily housing market, reiterating its bullishness on rental housing and its belief that commercial real estate as an asset class is bottoming out.

With such a large amount of capital to manage, Blackstone can’t wait for an “all-clear” sign and is instead looking to take advantage of the market’s uncertainty to position itself for the next upturn.

This acquisition adds to its $3.50 billion purchase of Tricon Residential, which operates a portfolio of ~38,000 single-family rental homes in the U.S. 🏘️

Ultimately, Blackstone considers rental housing and multi-family properties one of the best commercial property segments to invest in. And it’s putting its money where its mouth is despite concerns about new supply and higher interest rates.

Investors appeared to like the deal, as $BX shares rose 1% towards their all-time highs and Stocktwits sentiment hit “extremely bullish” territory. Investors will also receive more info about the company’s plans and prospects on April 18th, when it reports quarterly results before the bell. 📝

As for the rest of us who may be looking to buy a home or rent an affordable apartment, it doesn’t seem the market’s going to improve meaningfully anytime soon with these behemoths lurking no-so-quietly on the sidelines. 🙃

STOCKTWITS “CHART ART”

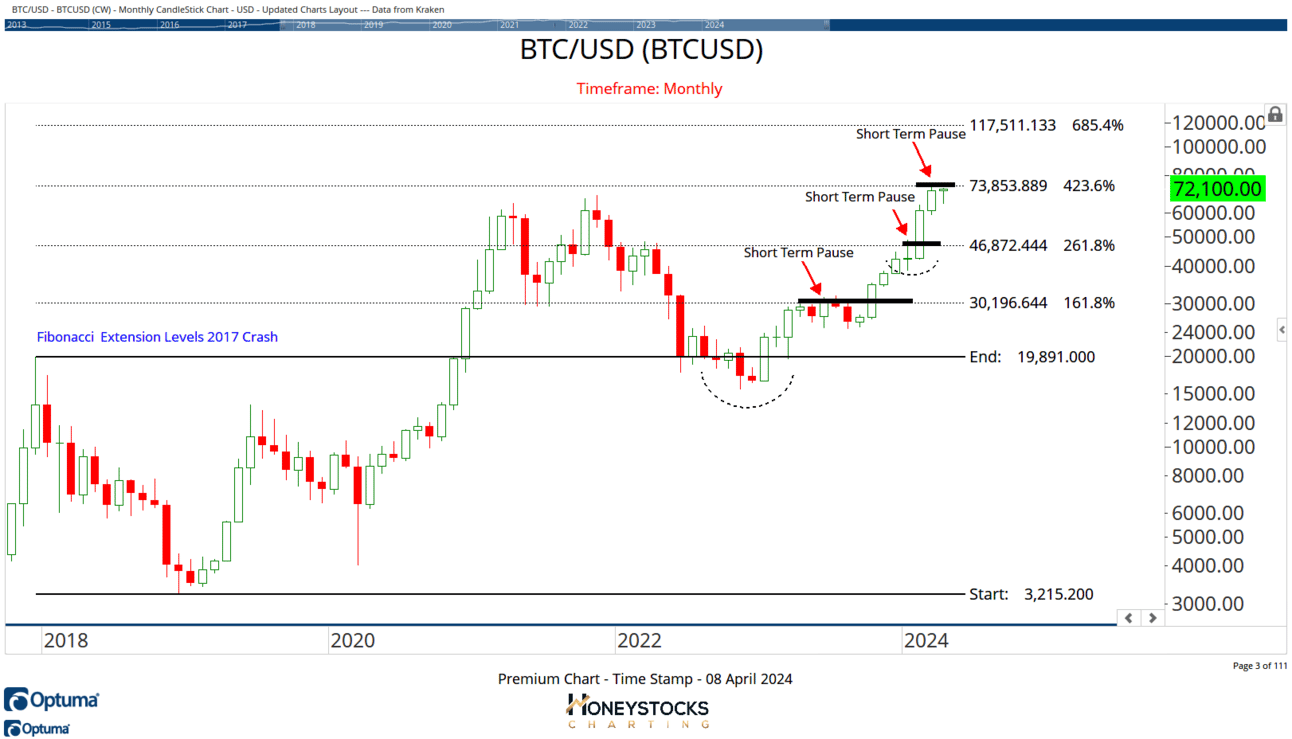

Could Bitcoin Blast To $117k? 👀

If you liked this chart and commentary, you’ll love our new “Chart Art” newsletter, which officially launched today. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

To sweeten the deal for early subscribers, we’ve got two bonuses. 🎁

Receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Subscribe during April to be entered to win 1 of 5 Stocktwits Edge annual subscriptions.

Bullets From The Day

💵 Spirit Airlines makes tough choices to preserve its cash position. The struggling low-cost airline has reached a deal with Airbus to delay all aircraft deliveries scheduled from the second quarter of 2025 through 2026, also intending to furlough 260 pilots. After failing to merge with JetBlue, the company needs to face the fact that it’s lost money in the past six quarters despite travel demand booming. As a result, it has to make drastic changes to the way it operates if it’s going to survive as a standalone carrier. Reuters has more.

📍 Android finally upgrades its “Find My Device” network. Google’s long-anticipated answer to Apple’s “Find My” network feature has arrived. The crowdsourced network helps Android device owners find their stuff by seeing where their phone is, even if it’s offline. In May, the network will also support new Bluetooth tracker tags from Chipolo and Pebblebee so you can use the network to track other personal items, with additional tags to be made compatible later this year. More from The Verge.

🪪 Government consulting firm leaks 340,000 social security numbers. U.S. consulting firm Greylock McKinnon Associates disclosed a data breach from May 2023, telling victims about a year later that their personal and Medicare information was likely affected in the incident. It’s unclear why it took so long to recognize the breach and notify victims, but it’s another high-profile data breach that’s putting a spotlight on companies’ cybersecurity efforts (or lack thereof). TechCrunch has more.

Links That Don’t Suck

🔋 China says innovations, not subsidies, are powering EV edge as Yellen raises ‘overcapacity’ concerns

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍