NEWS

Welcome Back to Correction Territory

What a time to start writing the Daily Rip. The market pulled back in the worst day for the S&P 500 since 2020, officially sending equities back into correction territory, as investors priced in tumultuous tariffs from President Trump. Among the few winners, traders flocked to staples and U.S.-based dividend stocks like Coca-Cola, United Health, and McDonald’s own french fry provider, Lamb Weston.

Sounds like a great recipe for getting and treating heart disease. 💘

Meanwhile, the Magificient Seven collapsed more than 6% as a whole, wiping out $1 trillion in market cap. 👀

Today's issue covers tariff fallout, Restoration Hardware’s hard landing, and other pops and (mostly) drops. 📰

Here’s the S&P 500 heatmap. 1 of 11 sectors closed green, with consumer staples (+0.44%) leading and energy (-7.35%) lagging.

And here are the closing prices:

S&P 500 | 5,396 | -4.84% |

Nasdaq | 16,550 | -5.97% |

Russell 2000 | 1,910 | -6.59% |

Dow Jones | 40,545 | -3.98% |

STOCKS

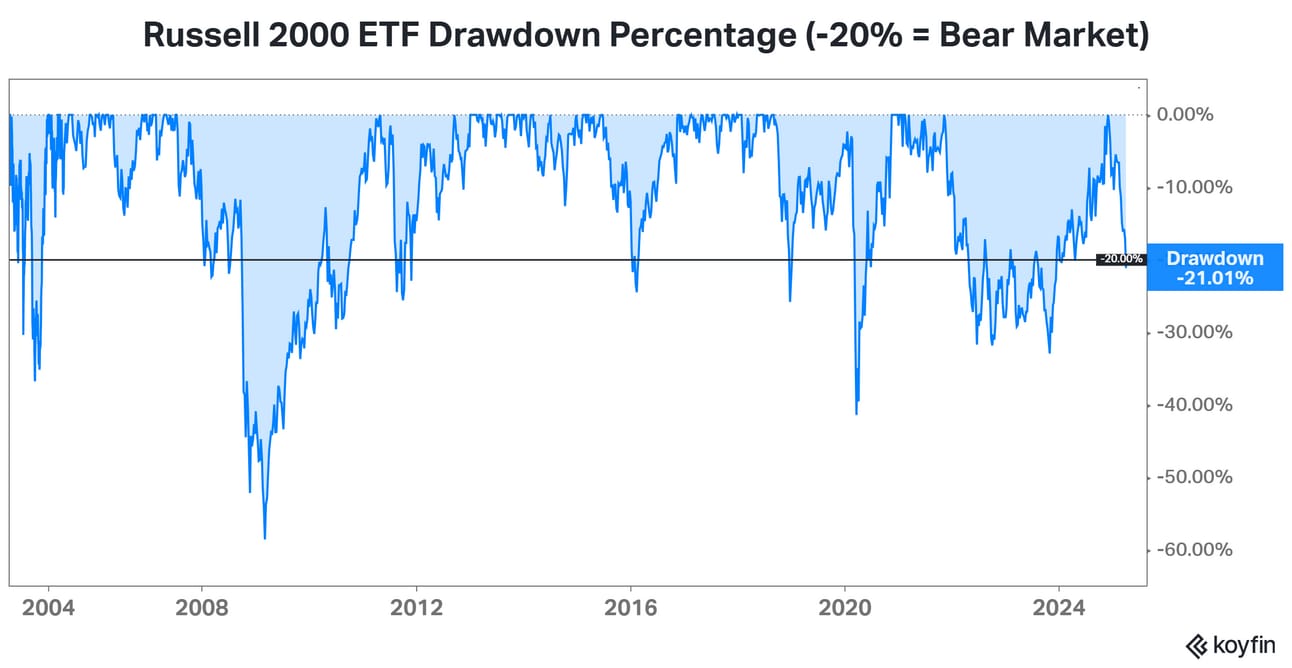

Russell 2000 Enters Bear Market Territory 🐻

The largest major index whipped out by tariff worries was the Russell 2000, falling nearly 7% to reach bear market territory. The index has been here before- many times, in fact, for the past 25 years. 😅

Source: Koyfin

According to CNBC, small-cap stocks have been the primary winners since election day, but on Thursday, they were turning into the biggest losers. Keith Lerner, co-chief investment officer at Truist, told CNBC that smaller firms on the Russell were suffering from the prospect of a softening economy and hurt by their higher interest payments and debt.

The sell-off was concentrated on tech and consumer-heavy stocks: information tech like Upstart, healthcare stocks like RxSight, and retail stocks like Designer Brands and Victoria’s Secret, each fell over 18%.

Less than 80 were in the green, led by international tire seller Goodyear. 🛞

If anything, Thursday was a day for analysts, who spoke across the financial media and handed out warning notes that the market had further to go.

Professor Jeremy Siegle, Professor at UPenn Wharton, went nearly nuts on Bloomberg Business’s closing show, claiming it might be the worst economic policy decision in one hundred years.

JPMorgan global economist Nora Szentivanyi warned the move could lead to a worldwide recession. UBS Chief U.S. Economist Jonathan Pingle said in a note Wednesday that he expects two quarters of negative GDP growth.

Right on cue, the Atlanta Federal Reserves GDPNow prediction, recently a barer of bad news, came out Thursday afternoon with the same warning: the Fed sees this quarter's GDP growing at a negative rate of -2.8%. 📉

SPONSORED

Today’s Fastest Growing Company Might Surprise You

🚨 No, it's not the publicly traded tech giant you might expect… Meet $MODE, the disruptor turning phones into potential income generators.

Mode saw 32,481% revenue growth, ranking them the #1 software company on Deloitte’s 2023 fastest-growing companies list.

📲 They’re pioneering "Privatized Universal Basic Income" powered by technology — not government, and their EarnPhone has already helped consumers earn over $325M!

Invest in their pre-IPO offering before their share price changes on May 1st.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

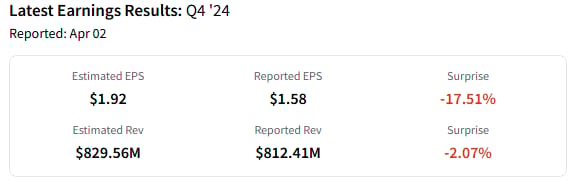

‘Oh Sh—’: Hard Times For Restoration Hardware 🫠

One major stock caught in the crossfire Wednesday night continued to tank Thursday. Restoration Hardware $RH fell 45% intraday after the firm made the cosmic mistake of reporting earnings while Trump had his big tariff graph out on stage.

The results were not exceptional either; RH posted revenue growth in their fourth quarter that trailed Wall Street estimates, but that doesn’t really capture the full picture in a post-Liberation Day world.

While President Trump showed off discount tariffs, investors sent RH to discount prices despite the earnings call arguments of CEO Gary Friedman. He said he did not think tariffs were going to “stick,” but the market was not buying it.

Friedman realized that fact himself halfway through his presentation:

Friedman said it was “not a secret” that Restoration Hardware sources much of its furniture inventory from Asia. That was par for the course on Wednesday, but on Thursday, it was grounds for a sell-off, and most retailers were stuck in the same boat. 🚣

Joining RH on the downside, brands like Nike hit their lowest days since 2017. Nike produces half of their shoes in Vietnam, a country slapped with 46% tariffs.

Dell Technologies led the S&P 500 lower, falling 18%, followed by Western Digital, a digital storage firm, and Best Buy, which derives 60% of its goods by cost from China.

Friedman ended his earnings call defending his firm and saying their results were hard fought in the face of what he called the “Worst housing market in 50 years.”

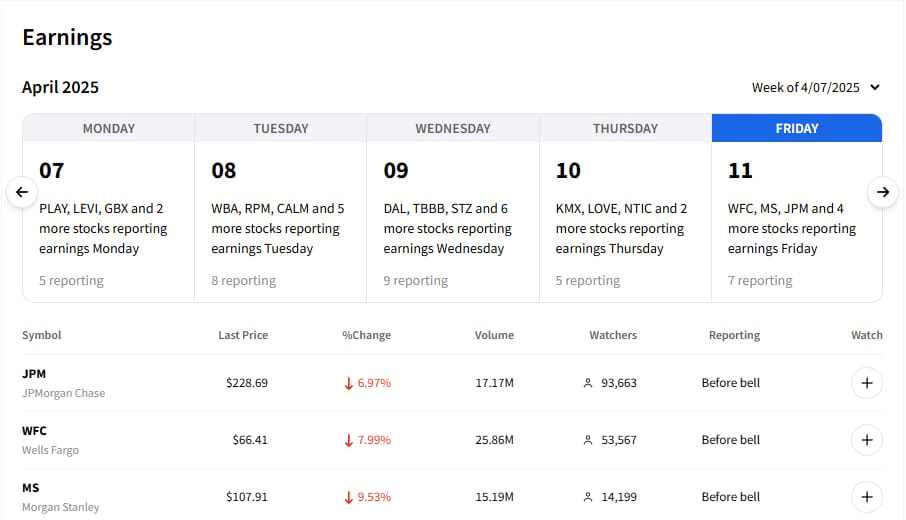

With low consumer demand and weak economic growth forecasted, next week begins the ‘true’ earnings season for the first quarter, with Walgreens, Delta Airlines, and the big banks JPMorgan and Morgan Stanley on Friday. If this is the new trend for earnings results in the recently post-tariff era, it will be wild. 🐻 🐂

STOCKS

Other Noteworthy Pops & Drops 📋

General Motors ($GM -4%): The U.S. carmaker said on Thursday that it delivered more than 442,000 vehicles in China and its joint ventures for the first quarter of 2025, marking a marginal growth of 0.23% from the corresponding quarter of 2024, when the company delivered over 441,000 vehicles.

Nvidia (NVDA -7%): The leading semiconductor stock dropped more than 6% in afternoon trade on Thursday, but tariffs were not the only concern. HSBC analyst Frank Lee downgraded Nvidia’s stock to ‘Hold’ from ‘Buy’ and cut his price target to $120 from $175.

Roundhill Mag Seven ETF (MAGS -6%): Magnificent Seven stocks tumbled toward a $1 trillion loss in market capitalization – the group's largest one-day loss of valuation on record, according to MarketWatch.

Pony AI (PONY -8%): The self-driving startup stock might have done well on a normal day after the company announced it had received a permit from Luxembourg authorities to begin Level 4 robotaxi testing.

CASI Pharma (CASI +1%): traded 5% higher Thursday afternoon before pulling back after the company announced that it has received a buyout proposal valuing the company’s operations in China at $20 million.

PRESENTED BY STOCKTWITS

An Exclusive With $IONQ CEO Niccolo De Masi 🤖

Daily Rip Live hosts Shay Boloor and Katie Perry break down the opportunities and risks for the quantum computing industry with IonQ’s CEO Niccolo De Masi, covering:

IonQ’s big-picture vision for itself and the broader quantum space

Why quantum computing is a bipartisan issue, and how IonQ is positioning

How IonQ’s next system could be its “ChatGPT moment”: The firm aims for its upcoming #AQ64 Tempo processor to be 240 million times more powerful than its last generation.

This hour-long exclusive is packed with insights, you won’t want to miss it! 🤯

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Nonfarm Payrolls and Unemployment Rate (8:30 am), Fed Chair Powell Speech (11:25 am), Fed Barr Speech (12 pm), Fed Waller Speech (12:45 pm). 📊

Pre-market movers: Catch the Daily Rip Live with Katie Perry, Shay Boloor, Jordan Lee, Michael Nauss, and special guest, Wedbush tech analyst Dan Ives. Watch the stream here at 9 am ET. 🤩

Jerome Powell will speak live at the Society for Advancing Business Editing and Writing (SABEW) conference tomorrow at 11:25 am ET.

You can find the live stream here on Vimeo, but we’ll do our best to get it up live on the Stocktwits platform like we have been for other major events! Keep an eye on the $SPY stream around then. 👀

Links That Don’t Suck 🌐

🧑🏫 Expert market insights await! Attend MoneyShow Masters Symposium Dallas, Apr 4-5. Sign up HERE!)*

🏠 Stellantis pauses some Mexico, Canada production, temporarily lays off 900 US workers due to tariffs

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Kevin Travers) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋