NEWS

We’re Going Back To The Future

If you woke up this morning thinking it felt like 2021 and not 2024, you were not alone. The meme stock mania is back, with GameStop, AMC, and other heavily-shorted stocks soaring, leaving traders hopeful for another pandemic-era squeeze to fill their bags with. Let’s see what else you missed. 👀

Today's issue covers Roaring Kitty reigniting the meme stock mania, orange juice continuing its jump, and more from the day. 📰

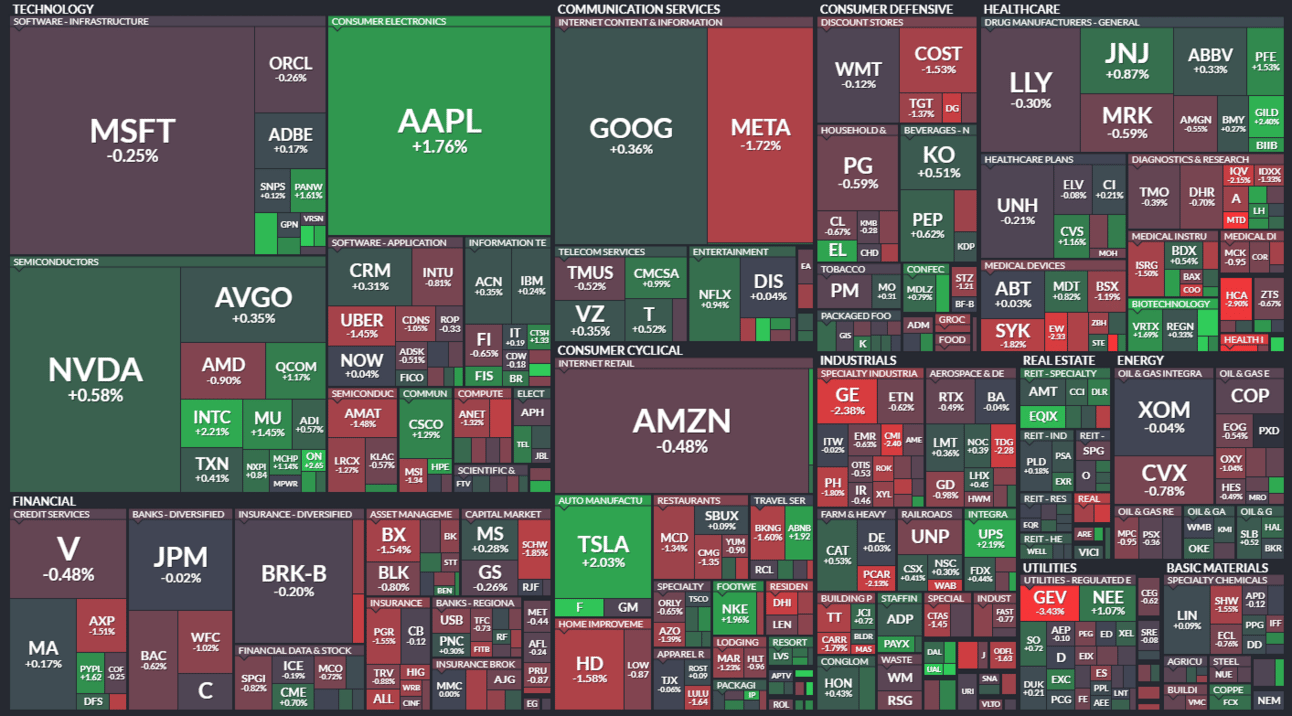

Here's today's heat map:

3 of 11 sectors closed green. Technology (+0.47%) led, & industrials (-0.42%) lagged. 💚

Internationally, China is launching a 1 trillion yuan stimulus bond issuance this week to raise the funds necessary to stimulate key sectors of its slowing economy. The bonds will have 20 to 50-year maturities. 🪙

In a sign of the times, SoftBank’s Vision Fund posted its first annual gain in three years, boosted by the rebounding tech sector and public market valuations. Founder Masayoshi Son shifted the firm back into “offense” mode last year as it looks to make up lost ground in the current environment. 💰

SoftBank’s Arm Holdings rose 8% today on reports that it’s looking to launch artificial intelligence (AI) chips by 2025 to capitalize on the sector’s explosive demand. Intel shares also gained 2% on reports that the conclusion of its $11 billion financing deal with Apollo Global Management is nearing. 🔺

Kraft Heinz jumped marginally on news that it’s exploring the sale of its Oscar Mayer business amid slow revenue growth and lackluster stock performance. 🌭

Vaccine maker Novavax soared 47% after partnering with French drugmaker Sanofi in a multibillion-dollar deal. The licensing agreement allows it to remove its “going concern” warning, which was first issued last year. 🤝

Other active symbols: $RILY (+8.84%), $IBRX (+6.28%), $OKLO (+15.62%), $HOLO (+17.65%), $KOSS (+36.66%), & $DATS (+14.20%). 🔥

Here are the closing prices:

S&P 500 | 5,221 | -0.02% |

Nasdaq | 16,388 | +0.29% |

Russell 2000 | 2,062 | +0.11% |

Dow Jones | 39,432 | -0.21% |

STOCKS

Old Leader Reignites The Meme Stock Mania

Back in 2020 and 2021, the face of the GameStop and “meme stock” rally was Keith Gill, also known as “Deep Fucking Value” and/or “Roaring Kitty.” The GameStop bull helped unite Main Street against the Wall Street machine before riding off into the sunset in mid-2021 with his profits in hand (though not without his share of headaches).

That is, until yesterday…when he posted for the first time in three years. 🤯

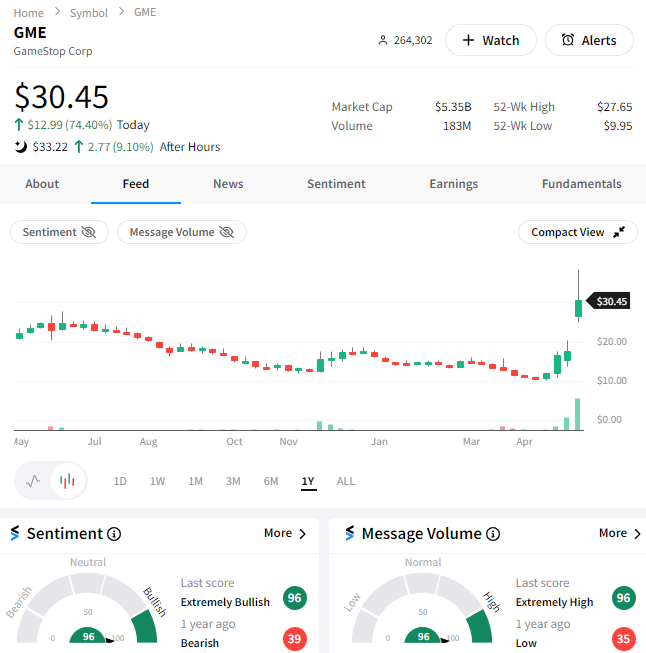

While not explicitly saying anything, traders took the image above as a signal that he’s getting back into the game…more specifically, GameStop.

That caused GameStop shares to pop over 50% in pre-market trading, adding to their gains at the open as Roaring Kitty posted more cryptic tweets throughout the day, saying nothing…but everything, all at once. 😳

His appearance on the interwebs was enough to get the retail investor and trading crowd going again, throwing their weight behind an already hot GameStop stock. Traders in our community have been flagging unusual call buying and upward momentum in $GME shares since late April, with activity on our site picking up significantly alongside sentiment.

In addition to GameStop gaining ground, shares of other “meme stocks” like AMC Entertainment, Tupperware Brands, and others soared signfiicantly on the day too. Everyone’s favorite scan for stocks is once again beaten-down names with high short interest.

Because if you missed the meme stock rally in 2020/2021, there’s no way you’re missing out on a second attempt at it… 🙅♂️

As for management teams, it’s likely GameStop, AMC, and others are looking to use this good fortune to issue more equity and raise capital to extend the lives of their struggling businesses. They did it last time and they’ll certainly do it again, it’s just a matter of how long they wait to pull the trigger. 🤑

For now, though, traders are taking advantage of the momentum as well. GameStop shares rose 75% on the day, with sentiment pushing to “extremely bullish” territory as message volume and visits to the $GME Stocktwits stream soared to their highest levels since 2021. 🐂

Nobody knows how long this will last, but it’s clear the animal spirits are once again alive and well. And retail is ready to play… 🎮

So, “game on” traders, speculate responsibly. 😉

SPONSORED

Earn a rebate of up to $0.18 per options contract traded at Public.com

Are you an options trader? At Public.com, you could earn up to $0.18 per contract traded with no commissions or per-contract fees. That's because Public offers a rebate on every contract you buy or sell. Joining Public is easy, and your rebates can add up fast. If you trade 1,000 option contracts on Public, you could earn up to $180 in rebates. If you trade 10,000 contracts, you could earn almost $2,000.

So, don’t change your strategy; change your platform—and start earning a rebate of up to $0.18 per options contract traded. Plus, get up to $10,000 when you transfer your existing portfolio to Public. There are no fees, and Public will cover any fees from your current brokerage on the way out.

Discover why NerdWallet recently awarded Public five stars for options trading, and earn rebates on your options trades with no commissions or per-contract fees.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMMODITIES

Orange Juice Continues Its Jump

While Cocoa futures posted another historical down day today, another agricultural commodity is awaking from its slumber once again. 🚨

Orange Juice futures have been one of the best-performing assets over the last few years and, according to traders, look poised to head even higher.

Technical analysts say the market broke out of its year-to-date consolidation with its sights set on all-time highs. 📈

While many retail investors do not trade this asset, it’s important to track it, given that several commodities are placing upward pressure on inflation expectations. The Fed’s number one fight remains against inflation, so you can be sure they’re watching these developments, too. 👀

And for now, it looks like the path of least resistance remains higher. 🍊

Bullets From The Day

❌ NRF rejects Shein membership as it pursues U.S. IPO. The National Retail Federation (NRF) has once again rejected the Chinese fast fashion company, with its failure to get approval from the industry’s largest trade association providing another reason for U.S. regulators and investors to remain skeptical of its initial public offering (IPO) potential. It’s unclear why the company continues to be rejected, but sources say someone with significant influence is strongly against Shein’s admittance. CNBC has more.

⚒️ Anglo American rejects BHP’s $43 billion proposal as commodity consolidation heats up. The London-listed miner rejected the raised takeover offer from BHP Group, saying the world’s largest listed miner continues to undervalue the company significantly. While the bid was about 10% higher than the original, it would require Anglo to sell its shares in iron ore and platinum assets in South Africa, which executives say is an unattractive deal structure. More from Reuters.

🤦 SquareSpace is the latest bull market IPO to go private at a massive discount. U.K.-based private equity firm Permira is taking the website builder private in a $6.60 billion all-cash deal. While a win for recent shareholders, it represents a downtick from the $10 billion private valuation it sported in 2021 and its $8 billion market cap peak in public markets. However, in a seemingly large vote of confidence, Permira will keep Casalena on as CEO and board Chairman, leaving him as one of the largest Squarespace shareholders after the acquisition. TechCrunch has more.

Links That Don’t Suck

🧑🏫 Join IBD’s Swing Trading webinar on May 14 to learn strategies for growing your portfolio faster*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: Paid endorsement for Public Investing, member FINRA/SIPC. Rebate rates vary from $0.06-$0.18 per contract depending on time of enrollment and number of referrals you make. Rates are subject to change. See terms & conditions of the Options Rebate Program. Investors must review the Options Disclosure Document (ODD). Options are risky and not suitable for everyone. See Fee Schedule and Options Rebate & Referral T&Cs: https://public.com/disclosures. Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.