Presented by

CLOSING BELL

100 Years of AI

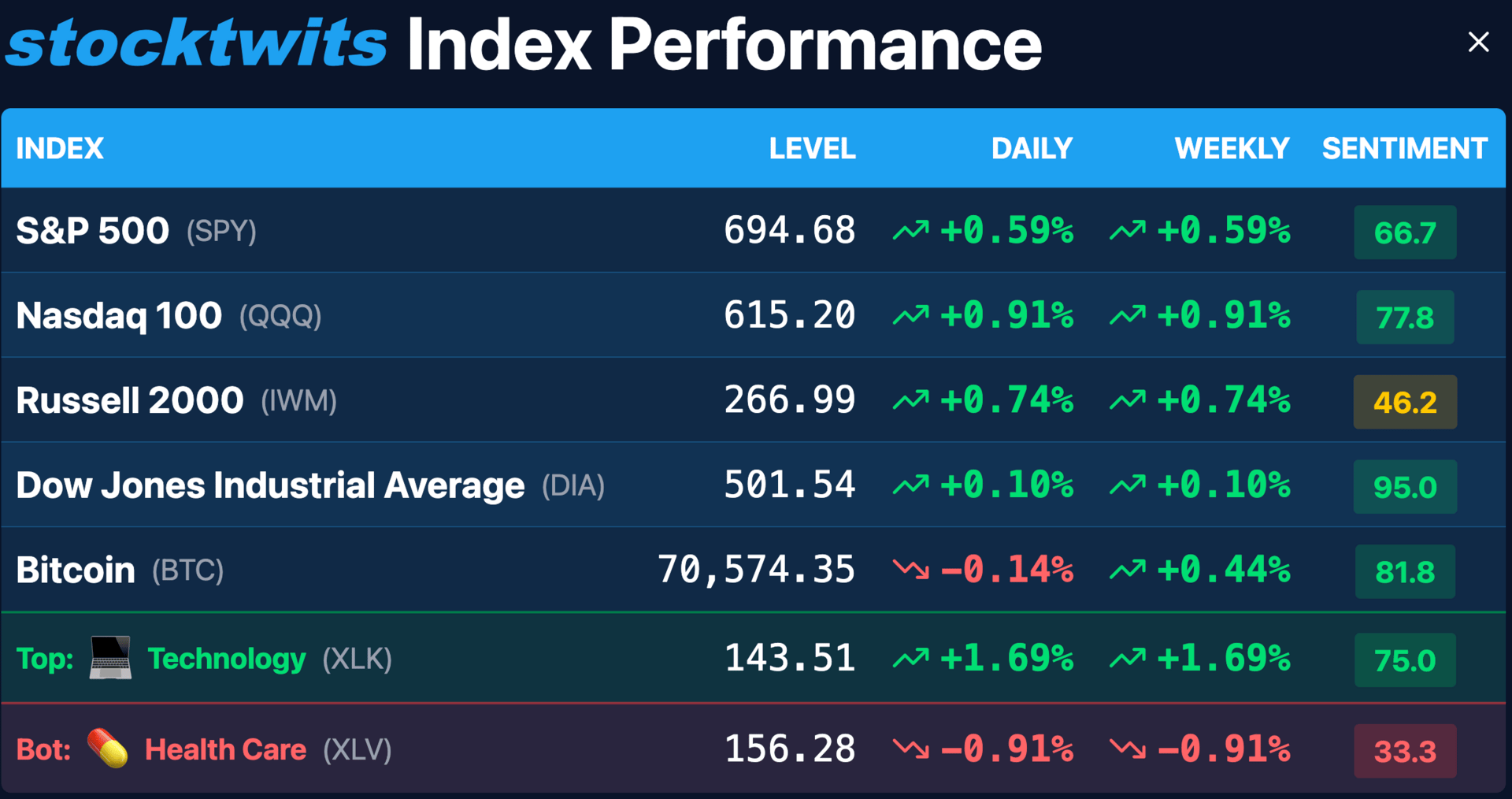

The markets climbed Monday as a most likely hungover population dragged itself away from leftover chicken wings and back to the working world following the Superbowl. The Seahawks won, Bad Bunny put on quite a party celebrating Puerto Rican, Latin American, and general western hemisphere pride, while AI ads confused people everywhere.

Thankfully, the Daily Rip readership already knew all about the weird claw-themed chat bots and huge AI spending sprees that are hitting 2026 like a storm, but still, Amazon making light of fears with basically “2001: A Space Odyssey but in your suburban home” was wild. It almost makes me want to unplug my Alexa.

In markets, prices turned green as Google priced out 100-year bonds to fund its AI campaigns, Japan’s economy sparked up after the right-wing growth-at-any-cost party won a landslide, and Mr. Beast bought a bank.

This week we should see updated unemployment numbers, and even White House Economic Council Director Kevin Hassett had to admit there could be way lower numbers due to ‘AI productivity.’

AI agent models this year, if not widely used, at the very least established a scary premise for labor numbers: even as software stocks go back up, it’s cheaper to download a coworker than hire one.

AFTER THE BELL

Alphabet "Century Bonds" Capture $20 Billion AI Debt Binge 🛰️

Alphabet is issuing 100-year pound sterling bonds, a rare "century bond" move not seen in tech since the 1990s, to fund a massive $185 billion AI capex plan. Bloomberg Intelligence’s Robert Schiffman notes this "flood of issuance" signals a fundamental releveraging of Big Tech balance sheets to support generational infrastructure growth.

The bond auction saw massive volume, the debt sale raised $20 billion on Monday, crushing initial targets of $15 billion as orders surpassed $100 billion in global demand. It turns out the scary concept of not knowing if the bond will ever be paid back is not that scary if it’s Google issuing the debt.

Insurance companies and pension funds, the likely buyers of such long date paper fully intend to finance debt until the sun dies, as Gorden Kerr, European macro expert at KBRA said, “The guy who underwrites it is probably not going to be the guy who’s there when it gets repaid.”

Alphabet’s 100-year tranche marks the first ultra-long-dated tech bond since Motorola in 1997, pricing as part of a multi-currency deal across USD, GBP, and CHF markets.

The capital blitz is fueled by a projected $400 billion borrowing needsfor cloud giants this year as they race to build out AI data centers. Despite the leverage, Alphabet’s $95 billion cash balance and $300 billion projected free cash flow over three years provide a robust cushion against widening corporate bond spreads. The numbers are becoming impossibly large.

BANKING WITH THE BEAST

Beast Industries Acquires Step to Launch "MrBeast Bank" 🏦

YouTube titan MrBeast has acquired the fintech startup Step via his holding company, Beast Industries, effectively pivoting his 466 million subscribers toward a classic fintech ‘democratize finance’ playbook focused at his young viewer base. Step describes itself as an ‘all-in-one’ finance app, designed to help Beasts exact target audience with building their financial future. It offers savings accounts, credit building cards, and cash advance.

Like it or not, Beast is the Walt Disney of our time in terms of viewers, and what better way to warm fans hearts, then by reaching into their wallets? 💳 The terms of the merger were not disclosed, but Chief of Beast Industries, a multiple-time strategic investor and wealth advisor named Jeff Housenbold, said Step’s goal to help young people build financial security helps build wellbeing.

"This acquisition positions us to meet our audiences where they are, with practical, technology-driven solutions that can transform their financial futures for the better."

The acquisition of Step, which previously raised $491 million from backers like $V and Stephen Curry, gives MrBeast immediate access to a regulated banking partner in Evolve Bank & Trust. For the $400 million revenue/year, $5B valuation Beast Industries, it shows the YouTube creator and hunger games founder is trying to expand out from consumer products like Feastables into higher-margin financial services.

The roadmap for 2026 includes the potential launch of "Beast Mobile" and an integrated crypto exchange, as suggested by recent trademark filings.

SPONSORED BY JAMES CRESS FLORIST & EVENTS

Don’t Paper-Hand Valentine’s Day 💎🙌 | 25% Off Sitewide!

Save 25% Sitewide on Flowers - BIGGEST Deal Yet!

Use Code STOCKTWITS at checkout or click here for nationwide local flower delivery.

Valentine’s Day is February 14th, and the best delivery slots go fast. Don’t wait to panic buy! Make the smart move now and let flowers do the talking.

Use code STOCKTWITS at checkout online for 25% off orders $85+.

James Cress Florist, trusted since 1903, serves over 350,000 customers. We hand-deliver nationwide through local shops, backed by our 100% Satisfaction Guarantee.

Impress them beyond words this Valentine's Day with the #1 trusted florist.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

WORLD NEWS

Landslide in Japan Politics Sends Yen Flying

Japan's Nikkei 225 breached the historic 57,000 mark as Prime Minister Sanae Takaichi’s LDP secured a 316-seat supermajority on Sunday. It was the largest landslide victory for a parliamentary majority since WWII. The victory cements a mandate for "Sanaenomics," an aggressive expansionary agenda centered on massive state-led investment and fiscal stimulus.

The Nikkei 225 surged over 5% intraday to a record 57,337.07, fueled by the win. Small-cap favorite $UOKA ( ▼ 61.91% ) skyrocketed alongside a 3.89% daily gain for the benchmark, as the tape reacted to a "supermajority" mandate that eliminates parliamentary gridlock.

The rally is underpinned by a pledged 10 trillion yen injection into AI and semiconductors, alongside a broader 21 trillion yen stimulus package for the world’s third-largest economy. Traders are rotating into defense and tech, viewing the "Sanaenomics" three-arrow approach: monetary easing, fiscal expansion, and strategic industrial policy. Winning the majority, even if it means government stimulus, at least gives international investors the confidence that there will be fewer surprises, Charu Channa, Chief Investment Strategist at Saxo Bank told Barron’s.

WORLD NEWS

Novo Nordisk Sues Hims & Hers Over Wegovy "Knockoff" Pill 💊

Novo Nordisk filed a patent infringement lawsuit against Hims on Monday, just days after the smaller telehealth firm launched, and then abruptly pulled, a $49 compounded version of the weight-loss pill Wegovy. The legal strike aims to protect the official January launch of $NVOS ( ▼ 11.43% ) ’s own oral semaglutide.

Novo shares jumped 7% on the news, recovering from a 17% crash last week, while $HIMS ( ▼ 6.92% ) fell. The lawsuit seeks trebled damages in the "hundreds of millions" and a permanent ban on Hims marketing unapproved oral semaglutide versions that bypass Novo’s intellectual property.

The legal battle intensified after the FDA and HHS signaled a crackdown on mass-marketed compounded GLP-1s, referring the matter to the DOJ for criminal investigation. The news dropped this morning after Novo advertised a new Wegovy pill during the Superbowl, but the letter of intent sent to Novo was dated Feb 5 according to CNBC.

Talk about your Superbowl hangovers, the Novo legal team will feel ragged all week. 🤒

WORLD NEWS

Federal Reserve Warsh Nomination Sparks Market Regime Shift 🦅

President Trump nominated former Fed Governor Kevin Warsh to succeed Jerome Powell, a move markets interpreted as a push for closer coordination between the White House and the central bank.

This week, the tone shifted from "Will he cut rates,” to "Will he be best friends with Treasury Secretary Scott Bessent?”

Bloomberg and WSJ reports examined Warsh’s past ideas of a Fed-Treasury Department partnership. The worry is if the Treasury becomes included in Fed decisions, such as through clarity on what the Fed would buy and hold with its balance sheet, it would also grant a type of soft veto power to a force outside the independent FOMC.

Bloomberg reported the Fed and Treasury used to collude plenty, but split in 1951 after post war bond purchases drove up inflation, settling with an agreement for the FOMC to set its own rates. Warsh said in April that those principles went out the window during the money-printing Covid era. Bond buyers are worried too much collusion between the Treasury, such as counting on the Fed to buy up debt to keep rates in line, would undermine the U.S. dollar.

Deutsche Bank strategists modeled a scenario where the Fed becomes a major buyer of Treasuries, raising its holdings to more than half of its $6T portfolio, from a current 5%. If the Treasury and Fed work together to lower real rates by tasting their own supply, it might work, but then the global market may look elsewhere for debt.

The fear is not completely unfounded, treasuries opened this week in a choppy session after a rumor that Chinese regulators told Chinese banks to avoid holding so much U.S. debt over fears of volatility.

TRENDING STOCKS

Market Movers

$APP ( ▼ 2.28% ) AppLovin Corp : Jumped as the adtech leader rebounded from January's short-seller pressure, with investors reassessing its monetization potential in an AI-heavy gaming landscape.

$ORCL ( ▼ 3.27% ) Oracle Corp : Climbed after detailing a $45–$50 billion 2026 financing plan to aggressively expand its Oracle Cloud Infrastructure (OCI) to meet massive AI demand.

$PLTR ( ▲ 0.92% ) Palantir Technologies : The stock gained as momentum continued following a blowout Q4 earnings report and Citi raising its 2026 price target to $235 on strong AI-driven demand.

$MSFT ( ▼ 2.24% ) Microsoft Corp : Increased as megacap tech names led a broader market rally ahead of key inflation data, outperforming the Dow's modest gains.

$SHOP ( ▼ 4.14% ) Shopify Inc : Surged as investors positioned ahead of upcoming earnings Wednesday.

$WAT ( ▼ 1.07% ) Waters Corp : Plunged after the lab equipment maker issued a Q1 profit forecast of $2.25 to $2.35 per share, missing the $2.51 consensus estimate due to weak performance in its newly acquired bioscience unit.

$WTW ( ▼ 1.01% ) Willis Towers Watson : as the market reacted to integration concerns and a valuation gap compared to peers, despite some analysts raising price targets on restructuring hopes.

$AON ( ▲ 1.57% ) Aon plc : Declined in sympathy with peers as the insurance sector faced broad selling pressure following mixed guidance updates.

$WDAY ( ▼ 3.85% ) Workday Inc : Dropped -4.20% as the software name faced profit-taking following a strong recent run, underperforming the broader tech rally.

ST MEDIA

Top Stocktwits Stories 🗞

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Macro: Wholesale Trade, 2-Year Note Auction, Fed Chair Speaks. 📊

Pre-Market Earnings: $KO, $SPOT, $DDOG, $OSCR, $FISV, $MAR, $DUK, $INCY, $HAS, $DD, $DGX, $ECL, $SPGI. ☀️

After-Market Earnings: $F, $HOOD, $GILD, $LYFT, $Z, $MAT, $AIG, $EW, $WELL, $ALAB. 🌙

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The content is to be used for informational and entertainment purposes only and the service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published on the service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋